Connecticut Divorce Law For Non-muslim

Description

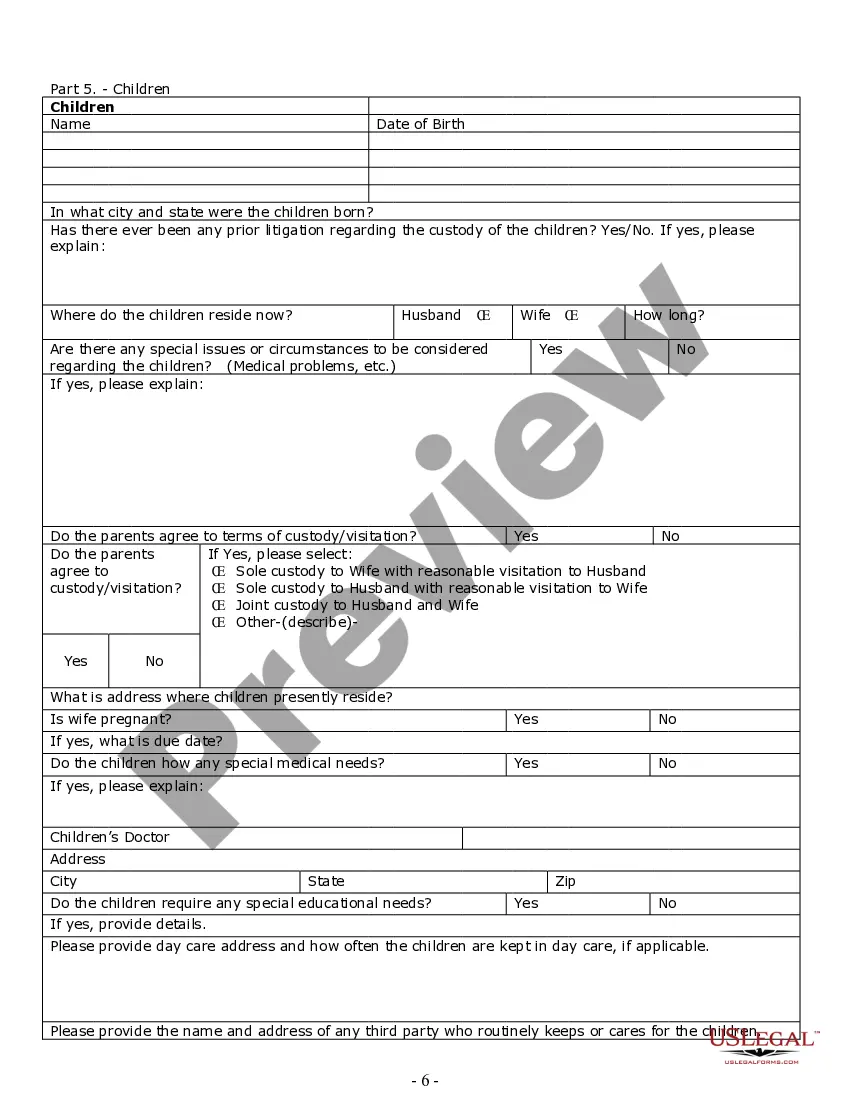

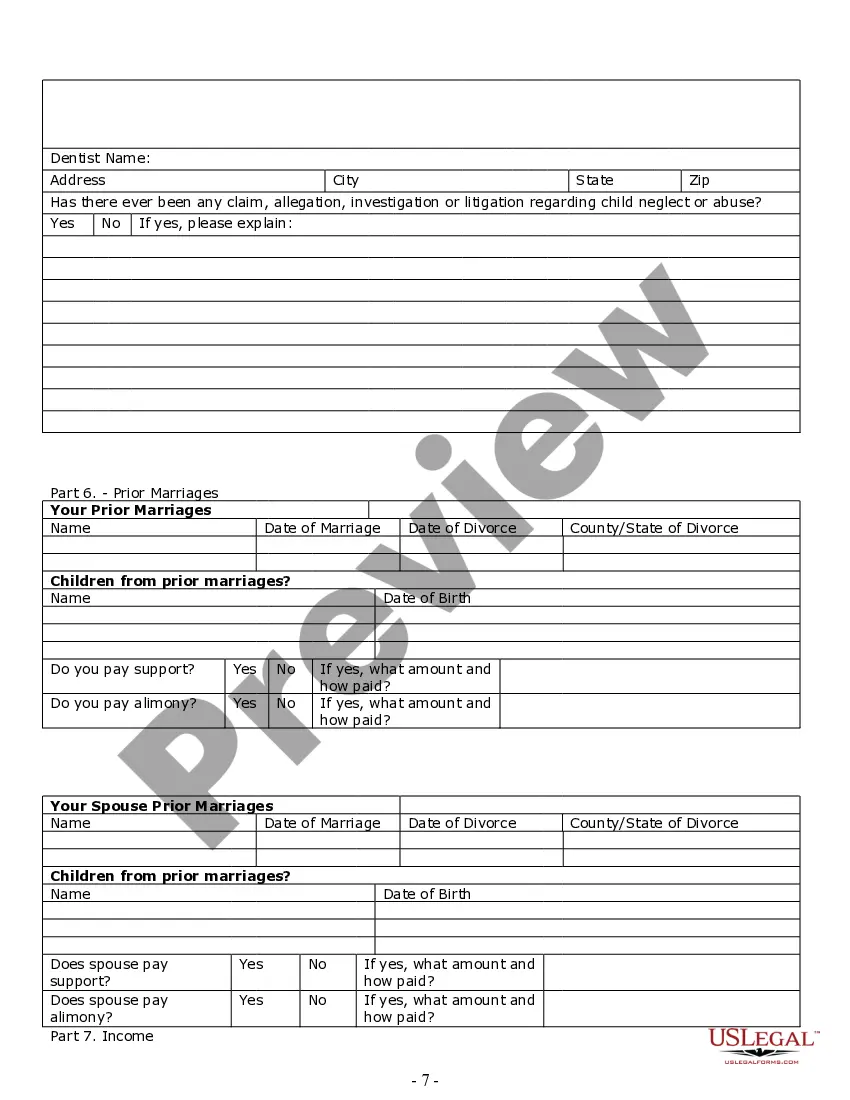

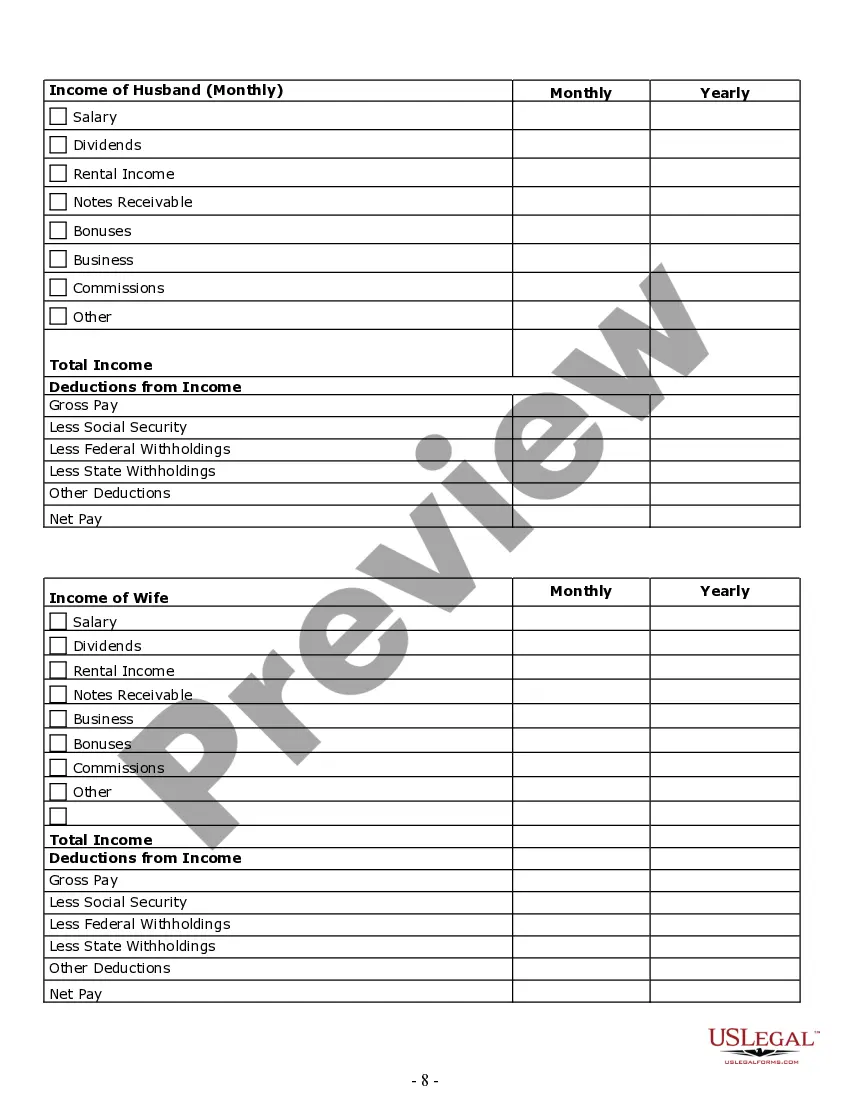

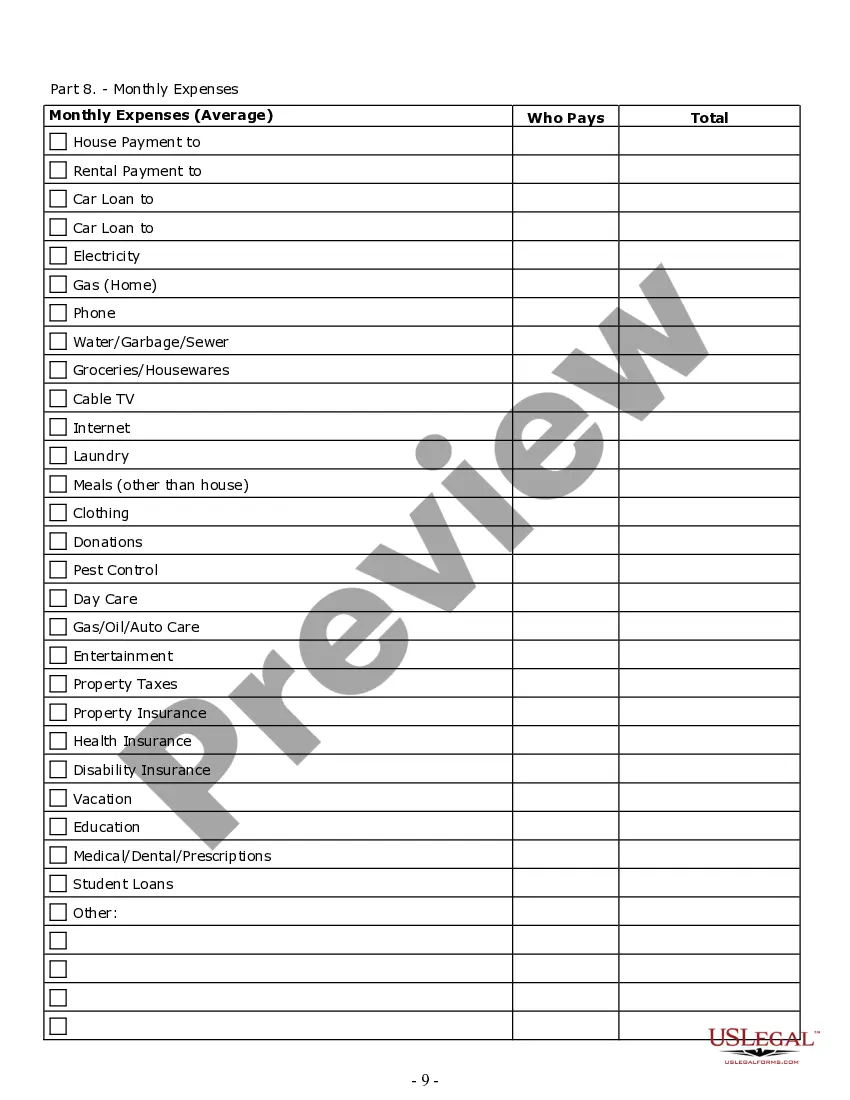

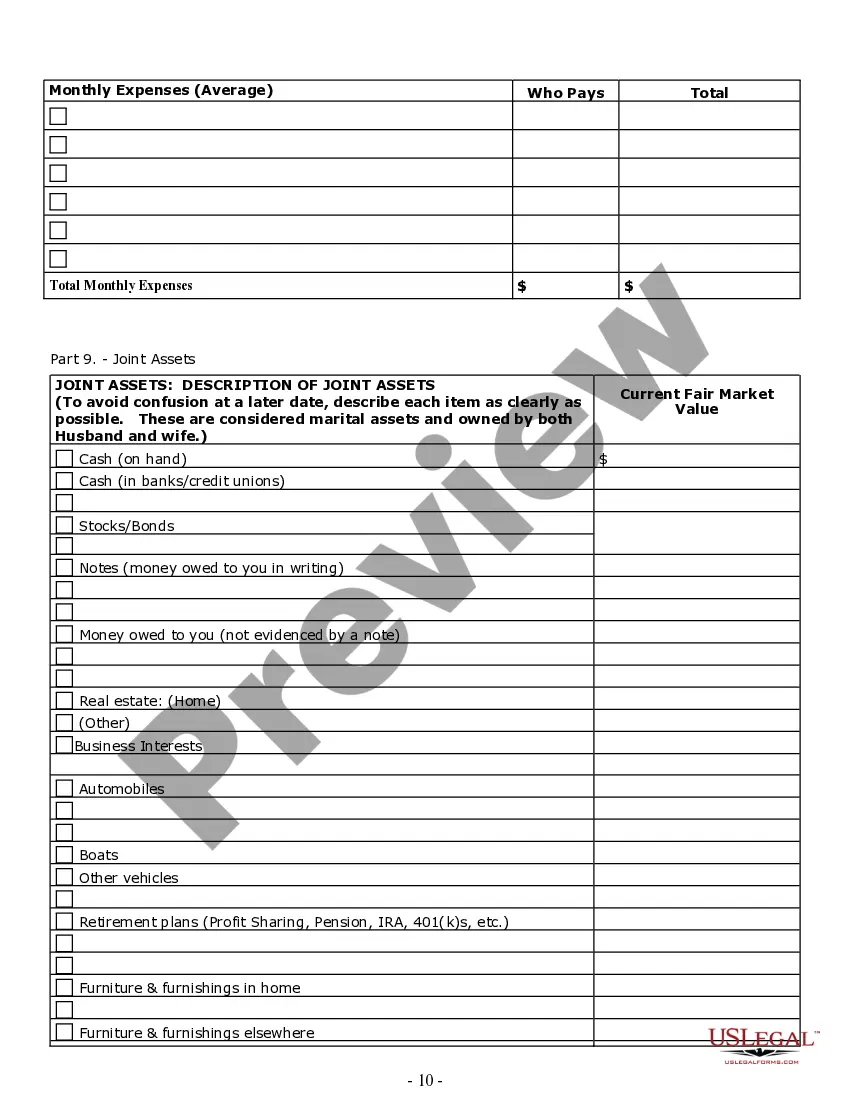

How to fill out Connecticut Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Crafting legal documents from the ground up can at times be intimidating.

Certain situations may require hours of investigation and substantial financial investment.

If you’re looking for a simpler and more economical method of preparing Connecticut Divorce Law For Non-muslim or any other documents without unnecessary obstacles, US Legal Forms is consistently accessible.

Our online collection of more than 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

However, before jumping straight into downloading Connecticut Divorce Law For Non-muslim, consider these pointers: Review the document preview and descriptions to confirm you are looking at the document you need. Ensure that the form you select adheres to the statutes and regulations of your state and county. Choose the most appropriate subscription plan to obtain the Connecticut Divorce Law For Non-muslim. Download the file, then complete, authenticate, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us now and make form completion easier and more streamlined!

- With just a couple of clicks, you can swiftly obtain state- and county-specific templates carefully assembled for you by our legal experts.

- Utilize our platform anytime you require reliable and dependable services through which you can promptly find and download the Connecticut Divorce Law For Non-muslim.

- If you’re familiar with our website and have established an account with us previously, simply Log In to your account, find the template, and download it or re-download it anytime in the My documents section.

- Not registered yet? No problem. It only takes a few minutes to sign up and browse the catalog.

Form popularity

FAQ

An Iowa tax power of attorney form allows residents to select a professional accountant to file taxes with the Department of Revenue on their behalf.

To be effective, the power of attorney must be signed before a notary public. If it affects real estate, it should include the legal description of the real estate and it should be filed with the county recorder in the county where the real estate is located.

Many people will only need to file Form 1040 and no schedules." State of Iowa Tax Website (including forms , instructions, etc.) ? Note from the Iowa Dept.

We have provided a link to the calculating version of the 2022 Iowa tax form on the Iowa Tax Information page. (Please note: This form must be downloaded and opened in Adobe.) The filing deadline for 2022 Iowa tax returns is .

The POA document must: Name the person authorized to act as your agent. Be signed by you, the principal, or another person in your presence and at your direction. Be acknowledged before a notary public or other individual authorized to take acknowledgements.

An Iowa power of attorney lets an individual (?principal?) delegate financial, medical, or other related matters to someone else (the ?agent?) while they are alive. The most common purpose is to prepare for a time when the principal can no longer handle their financial or medical responsibilities themselves.

An IA 2848 form must be signed by the individual. Joint or combined returns. If a tax matter concerns a joint or combined individual income tax return, each taxpayer must complete and submit their own IA 2848 even if they are represented by the same representative(s). signing as a Power of Attorney.

The current franchise tax is imposed at a rate of 5% on income apportioned to Iowa. Senate File 2367 provides for a schedule of annual rate reductions beginning in Jan. 1, 2023, culminating in a rate of 3.5% applying for tax years beginning Jan. 1, 2027 and after.