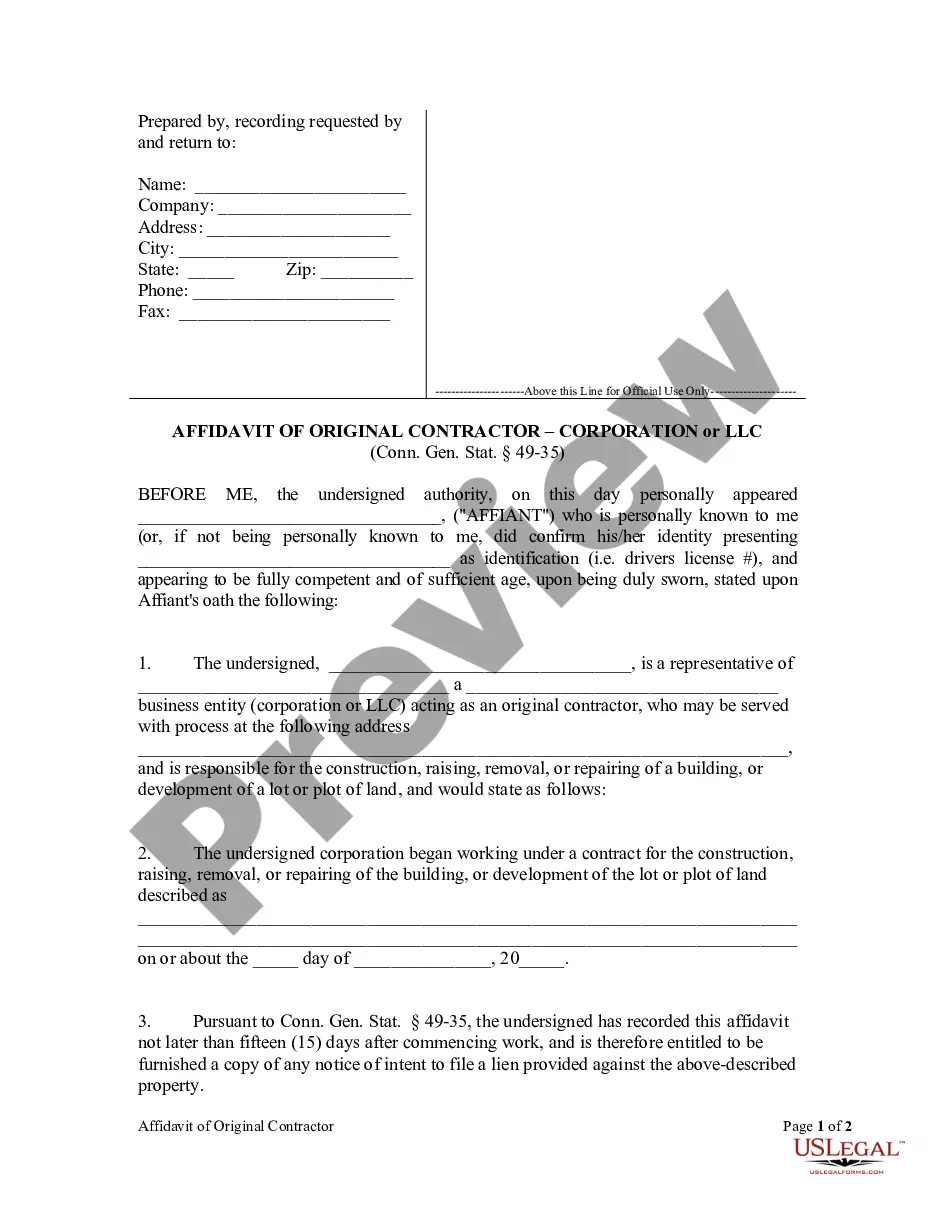

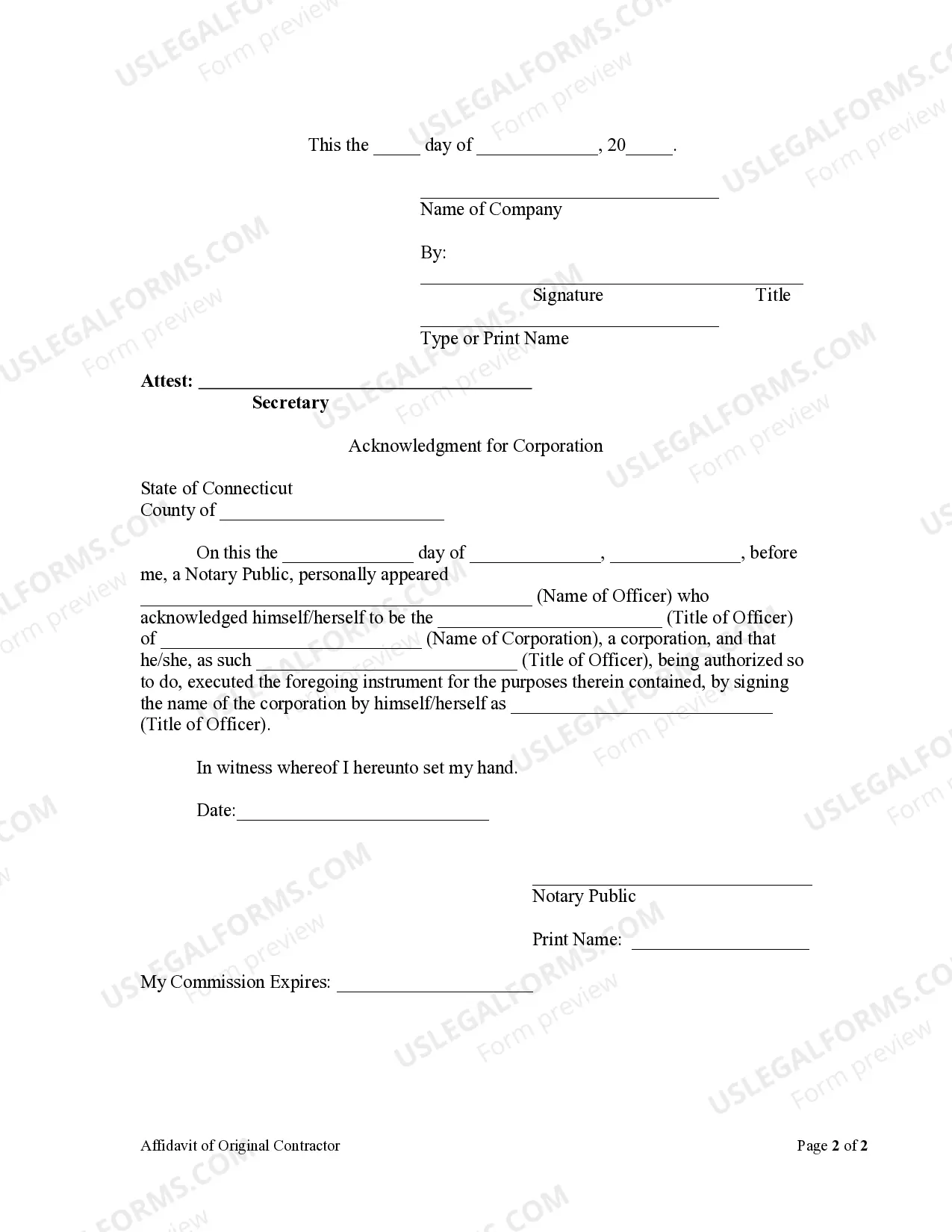

With one exception, Connecticut law only allows original contractors, and subcontractors whose contract with the original contractor is in writing and has been assented to in writing by the other party to the original contract, to claim a mechanic's lien. However, other parties may claim a lien if they provide a written notice to the property owner after commencing to furnish materials or render services but not later than ninety (90) days after ceasing to furnish materials or render services. This notice must be given to the property owner. Also, if the original contractor has recorded an affidavit stating the contractor's name, business address, and including a property description, a copy of the Notice of Intent must be served on the original contractor as well.

Connecticut Llc Limited Liability Company Formed By Quizlet

Description

Form popularity

FAQ

The primary beneficiaries of limited liability are the members or owners of a limited liability company. In the case of a Connecticut LLC limited liability company formed by Quizlet, these individuals enjoy protection against personal liability for business debts. This structure allows members to safeguard their personal assets while participating in business activities. It's noteworthy that this privilege is a significant reason many entrepreneurs choose the LLC format.

A limited liability company (LLC) is a separate legal entity that protects its owners from personal liability for its debts and obligations. This means that your personal assets are generally safe if the LLC faces legal issues or financial problems. Understanding the basics of a Connecticut LLC limited liability company formed by Quizlet helps you appreciate its advantages in combining features of both corporations and partnerships.

One key disadvantage of an LLC is that it may be subject to self-employment taxes on the owner's share of income. This tax can be higher than other corporate structures. Additionally, when forming a Connecticut LLC limited liability company formed by Quizlet, you might encounter limitations in raising funds through the sale of shares. Therefore, weigh these factors carefully before proceeding.

To form a limited liability company (LLC) in Connecticut, you must file the Articles of Organization with the Secretary of State. This document outlines the basic details of your LLC, including its name and principal office. After approval, you should create an operating agreement to detail how your LLC will be managed. Additionally, keep in mind that forming a Connecticut LLC limited liability company formed by Quizlet involves adhering to local regulations and possibly obtaining permits.

The Limited Liability Company (LLC) was first recognized in the United States in 1977, specifically in Wyoming. This innovative structure quickly gained popularity across the nation due to its tax benefits and asset protection features. Since then, many entrepreneurs have successfully formed Connecticut LLC limited liability companies, availing themselves of the advantages this business structure provides.

A limited liability company, or LLC, combines the benefits of a corporation and a partnership, offering personal asset protection while allowing for pass-through taxation. In a Connecticut LLC limited liability company formed by Quizlet, owners are known as members, who enjoy management flexibility and fewer formalities than a corporation requires. This makes LLCs an appealing choice for many entrepreneurs and small businesses.

When a business has limited liability, it means that the financial responsibilities of the company do not extend to its owners. In other words, if the business incurs debts or legal judgments, the owners' personal assets cannot typically be seized to satisfy those obligations. This crucial protection promotes financial security for individuals operating a Connecticut LLC limited liability company formed by Quizlet.

A company has limited liability primarily due to its legal structure, such as when it is registered as a corporation or limited liability company. This structure separates the business entity from its owners, ensuring that the owners' personal assets are protected from debts and legal claims against the business. By forming a Connecticut LLC limited liability company through platforms like USLegalForms, you can ensure that your business benefits from this vital protection.

The major advantages of a Connecticut LLC limited liability company formed by Quizlet include personal asset protection and operational flexibility. Owners benefit from simpler tax options and fewer regulatory burdens compared to corporations. However, disadvantages can include more complex formation processes and potential self-employment taxes, which must be carefully weighed before deciding on this business structure.

Various types of companies can have limited liability, including limited liability companies (LLCs), limited partnerships (LPs), and corporations. A Connecticut LLC limited liability company formed by Quizlet falls into this category, providing its members with a layer of protection. Businesses of all sizes, from startups to established firms, often choose this structure for enhanced security.