Connecticut Notice Of Intent To Lien Form Maryland

Description

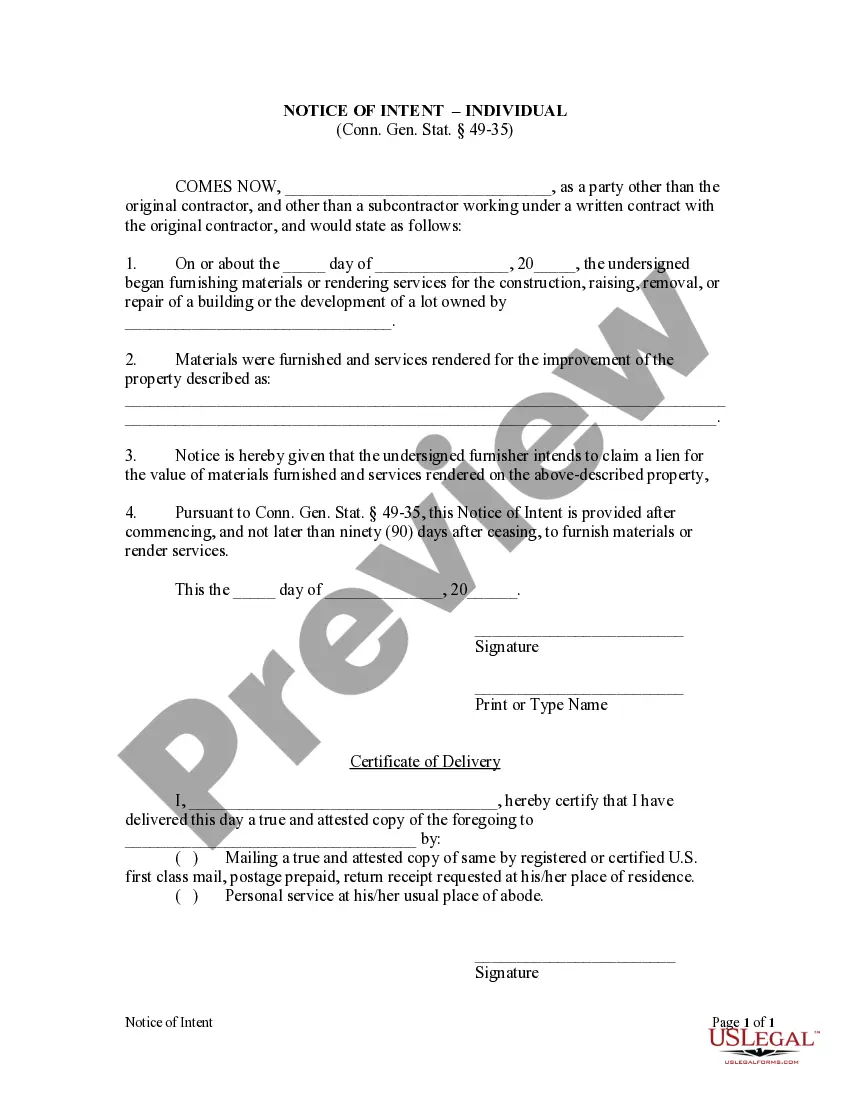

How to fill out Connecticut Notice Of Intent - Individual?

Regardless of whether for commercial objectives or personal affairs, everyone encounters the need to handle legal matters at some stage in their life. Completing legal documents requires meticulous consideration, starting from selecting the appropriate form template.

For example, if you choose an incorrect edition of the Connecticut Notice Of Intent To Lien Form Maryland, it will be rejected upon submission. Hence, it is crucial to have a reliable source of legal documents such as US Legal Forms.

With an extensive catalog of US Legal Forms available, you don’t have to waste time searching for the correct template on the internet. Utilize the library's straightforward navigation to find the appropriate form for any circumstance.

- Locate the template you require using the search bar or catalog browsing.

- Review the details of the form to ensure it aligns with your situation, state, and area.

- Click on the form’s preview to examine it.

- If it's the incorrect document, return to the search feature to find the Connecticut Notice Of Intent To Lien Form Maryland version you need.

- Obtain the file if it satisfies your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you don't have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill in the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Connecticut Notice Of Intent To Lien Form Maryland.

- Once saved, you can complete the form using editing software or print it and finish it by hand.

Form popularity

FAQ

How does the Restore Louisiana affect my Louisiana state income tax? Pursuant to IRC Section 139, qualified disaster relief payments are excluded from gross income.

All nonresident and part-year resident individuals must file Schedules NRPA-1 and NRPA-2 along with Form IT-540B electronically if he or she is a professional athlete who earned income as a result of services rendered within Louisiana and is required to file a federal individual income tax return.

The Restore Louisiana Homeowner Assistance Program provides grant funding to homeowners affected by 2020-21 Storms for home repairs, reconstruction and/or reimbursement for repairs already completed.

IHP includes grants for housing assistance for either temporary housing and/or home repairs, and other needs assistance (ONA). ONA can include assistance for personal property, medical, dental, transportation and other personal or special needs to help people recover from a disaster.

Restore Louisiana is funded through federal CDBG-DR funds that HUD allocated to Louisiana?a condition of this funding is that it may only be used to assist homeowners with repairing or replacing the structure of their damaged homes.

ALL FLOOD-IMPACTED HOMEOWNERS ARE STRONGLY ENCOURAGED TO COMPLETE THE SURVEY. EVEN IF HOMEOWNERS DO NOT QUALIFY FOR ONE OF THE SIX PHASES OF ASSISTANCE, THEY COULD QUALIFY AS MORE FUNDING BECOMES AVAILABLE.

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana.