Connecticut Notice Of Intent To Lien Form Colorado

Description

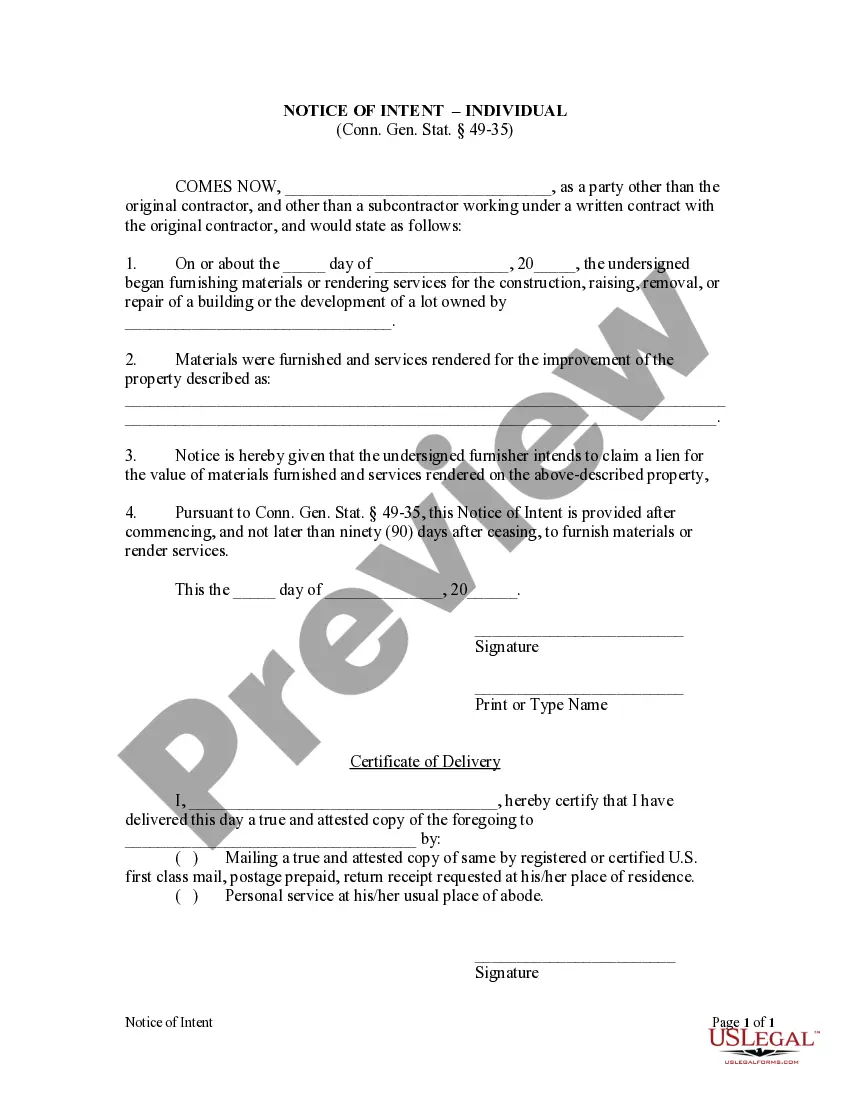

How to fill out Connecticut Notice Of Intent - Individual?

Legal supervision can be overwhelming, even for seasoned professionals.

When you are looking for a Connecticut Notice Of Intent To Lien Form Colorado and lack the time to spend searching for the accurate and updated version, the process can be stressful.

Gain entry to a collection of articles, manuals, and resources related to your situation and requirements.

Save time and effort locating the forms you need, and use US Legal Forms’ advanced search and Review feature to find the Connecticut Notice Of Intent To Lien Form Colorado and obtain it.

Select Buy Now when you are prepared.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to view the forms you have previously downloaded and organize your folders as desired.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's features.

- After downloading the desired form, ensure this is the correct form by previewing it and reading its details.

- Confirm that the template is approved in your state or county.

- Access state- or county-specific legal and corporate documents.

- US Legal Forms caters to any requirements you might have, from personal to business records, all in one location.

- Utilize sophisticated tools to complete and manage your Connecticut Notice Of Intent To Lien Form Colorado.

Form popularity

FAQ

Reinstatement / Revival for Limited Liability Companies: Reinstating a Louisiana LLC requires downloading a specific reinstatement form for your entity from the Louisiana Secretary of State's website. Submit that form, along with last year's annual report, to the Secretary of State.

UCC-1F and UCC-3F Central Registry Filings UCC and Crop filing$35*Crop filing$20*Amendments, Continuations, Assignments$20*

Louisiana Annual Report Service & Filing Instructions. All Louisiana corporations, LLCs, and nonprofits must file a Louisiana Annual Report each year. These reports must be filed with the Louisiana Secretary of State. On this page, you'll find instructions for how to file the Louisiana Annual Report yourself.

You can find your reinstatement application through an account with the SOS's geauxBIZ system (and if you live in a parish that requires online filing, geauxBIZ is the only way to file.) Otherwise, you can call the SOS at (225) 925-4704 to request your reinstatement application.

Late Fees: Louisiana doesn't assess late fees for failing to file an annual report. However, you will lose your good standing in the state. If you are delinquent for more than 3 years, your business will be administratively dissolved or revoked of its rights to conduct business within the state.

LLC ? Reinstating an administratively dissolved LLC in Louisiana requires you to pay $75. The filing fee for the annual report is $25. There is no late fee for past-due reports. Corporation ? The filing fee for a Louisiana reinstatement for a corporation is $60.

Reinstatement / Revival for Limited Liability Companies: Reinstating a Louisiana LLC requires downloading a specific reinstatement form for your entity from the Louisiana Secretary of State's website. Submit that form, along with last year's annual report, to the Secretary of State.

Business name and registration Register your business name with the county clerk where your business is located. If you are a corporation, you will also need to register with the Secretary of State.