Connecticut Attorney Ct Withholding Code

Description

How to fill out Connecticut Durable Springing Power Of Attorney?

Acquiring legal documents that adhere to federal and local laws is crucial, and the web provides countless alternatives to choose from.

However, what’s the benefit of expending time looking for the appropriate Connecticut Attorney Ct Withholding Code example online if the US Legal Forms digital library already has such documents compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable documents created by lawyers for any professional and personal circumstance.

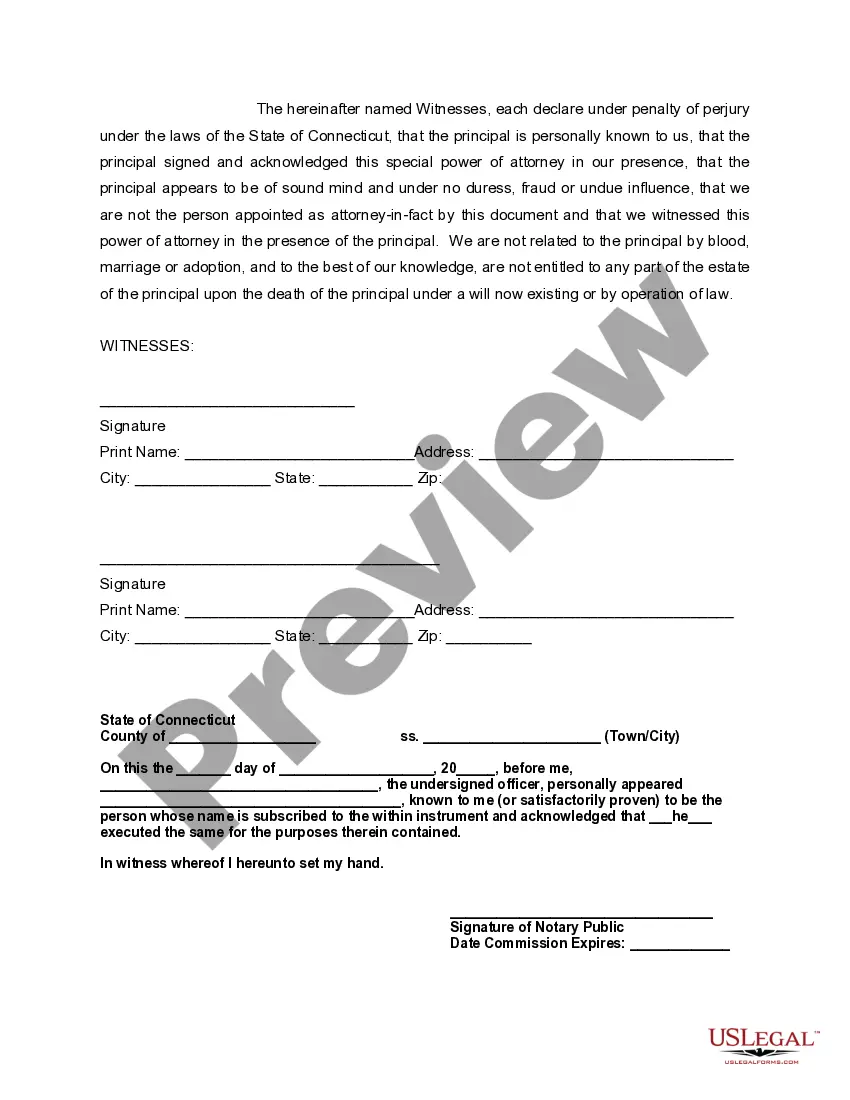

Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

- They are simple to navigate with all files organized by state and intended use.

- Our experts keep pace with legal amendments, so you can always trust your form is current and compliant when acquiring a Connecticut Attorney Ct Withholding Code from our site.

- Obtaining a Connecticut Attorney Ct Withholding Code is straightforward and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you need in the appropriate format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

For most filers, the ideal withholding amount is as close as possible to their total tax bill; that way, they're receiving as much money in their paychecks as possible, and they're not going to face an unpleasant surprise in the form of a huge tax bill when they file.

Employer Instructions For any employee who does not complete Form CT-W4, you are required to withhold at the highest marginal rate of 6.99% without allowance for exemption. You are required to keep Form CT?W4 in your files for each employee.

You must begin withholding at the highest marginal rate of 6.99%, from each employee who claimed exempt status from Connecticut income tax withholding in the prior year and who did not provide a new Form CT-W4 on or before February 15 of the current year. See Employees Claiming Exemption on Page 10.

Connecticut State Income Tax Withholding Information Filing StatusDescriptionBHead of HouseholdCMarried - Filing Jointly, Spouse Not WorkingDMarried - Filing Jointly, Both Spouses Working (combined income greater than $100,500)FSingle1 more row

If you are exempt, complete Line 4, but do not complete Lines 2 and 3. Sign the form and return it to your employer. Connecticut income tax will not be withheld from your pay. However, the Department of Revenue Services may review any Form CT-W4 claiming exemption from withholding.