Power Attorney For Property

Description

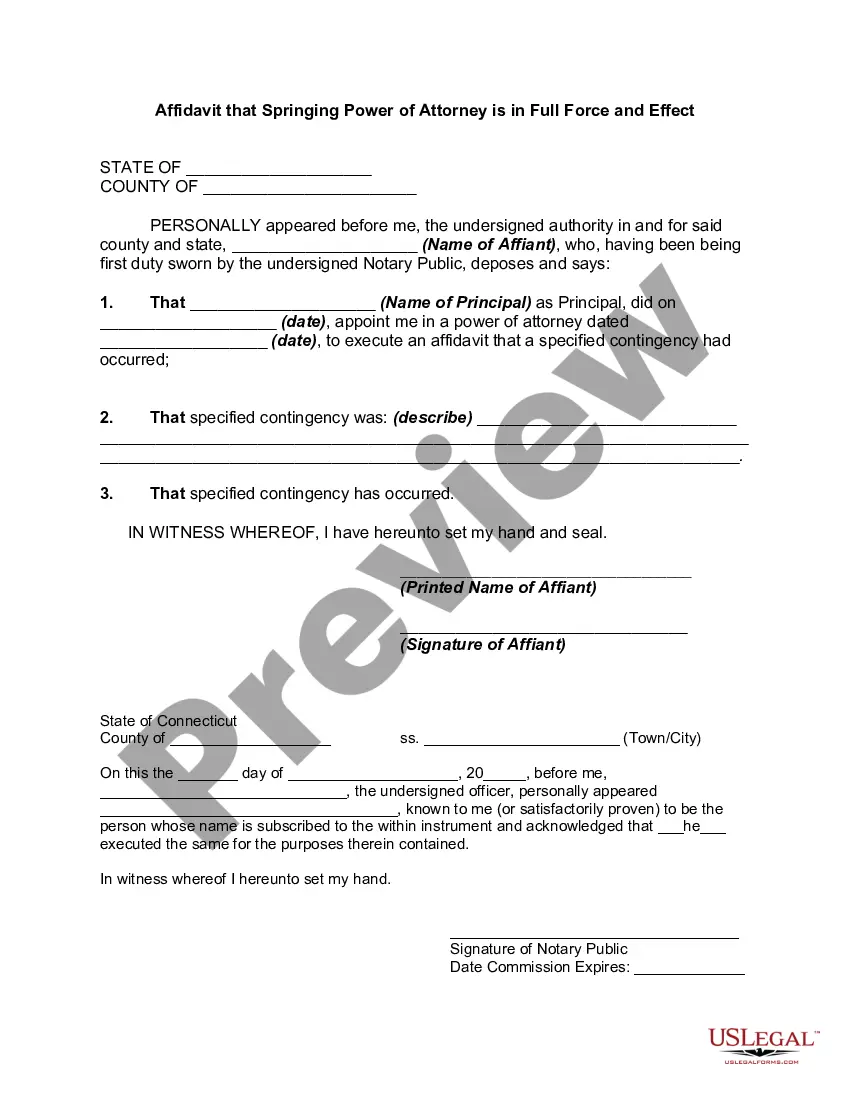

How to fill out Connecticut Affidavit That Springing Power Of Attorney Is In Full Force And Effect?

- Log into your US Legal Forms account if you are already a member. Check your subscription status and renew if necessary.

- If you're new to US Legal Forms, start by checking the Preview mode and form description to ensure that you choose the correct power attorney for property that fits your local jurisdiction.

- If the form doesn't meet your needs, use the Search tab to find another template that suits you better.

- Once you've found the appropriate document, click the Buy Now button and select your preferred subscription plan, registering for an account if required.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download the form directly to your device and access it anytime from the My Forms section of your profile.

Using US Legal Forms not only saves you time but also gives you access to a vast selection of over 85,000 customizable legal forms. Their platform ensures that your documents are precise and legally sound.

Empower yourself today by getting the right power attorney for property. Visit US Legal Forms now to start your journey!

Form popularity

FAQ

Choosing the best person for power of attorney is crucial and should involve someone you trust completely. Ideally, this individual should be responsible, organized, and able to manage financial or property matters effectively. It is often beneficial to appoint someone with whom you have a strong relationship, like a family member or close friend. This decision ultimately plays a vital role in ensuring your property is managed according to your wishes.

Yes, in Pennsylvania, a power attorney for property must be notarized to be legally effective. This requirement serves to verify the identity of the person granting power and ensures the document's authenticity. Notarization helps to prevent fraud and protects both parties involved. Keeping this step in mind can help you navigate the process smoothly.

In Pennsylvania, a power attorney for property must be in writing and signed by the principal. Additionally, it should be notarized to ensure its validity. The document should specify the agent's powers and may include specific instructions or limitations. Understanding these requirements can help streamline the process and ensure compliance with the law.

To give someone power of attorney in Pennsylvania, you need to create a legal document that outlines the specific powers you are granting. It’s crucial to clearly define the scope of authority, especially if it pertains to property matters. You can draft this document using templates or consult tools available on platforms like US Legal Forms, which provide guidance on crafting a power attorney for property effectively.

The new power of attorney law in Pennsylvania updates several provisions that affect how a power attorney for property is created and used. This law emphasizes the importance of clarity in the document, ensuring that individuals understand their rights and responsibilities. It is designed to protect the interests of both the principal and the agent. If you're looking to create a power attorney for property, it's essential to familiarize yourself with these changes.

A power of attorney for property grants you the authority to manage financial affairs on behalf of the principal. This includes handling bank accounts, real estate transactions, and other property-related matters. By using a power of attorney, you can make crucial decisions that ensure the principal's financial well-being and preserve their assets.

Being a power of attorney for property comes with significant responsibilities, which can be daunting. You need to act in the best interest of the principal, and any mismanagement can lead to legal consequences. Furthermore, you may face emotional burden, especially during challenging times, as you navigate financial decisions while ensuring compliance with the law.

A power of attorney for property is not allowed to make medical decisions on behalf of the principal unless specifically authorized. Additionally, it cannot make decisions that are contrary to the principal's wishes or engage in illegal activities. It is also important to note that the power of attorney does not allow for the transfer of assets in a way that defies the law or violates ethical standards.

A power of attorney for property can have disadvantages, such as the potential for misuse of authority by the agent. If the agent acts against the principal's interests, it can lead to financial loss. Additionally, the principal may lose some control over their property decisions, which can be concerning. It's essential to choose a trustworthy agent to mitigate these risks.

You can create a power of attorney for property without a lawyer by using online platforms like USLegalForms. These services offer templates and step-by-step instructions, simplifying the process significantly. Ensure you understand the powers you wish to grant and fill out the form carefully. Once completed, follow the necessary steps to sign and notarize the document.