Connecticut Gift Form Withholding

Description

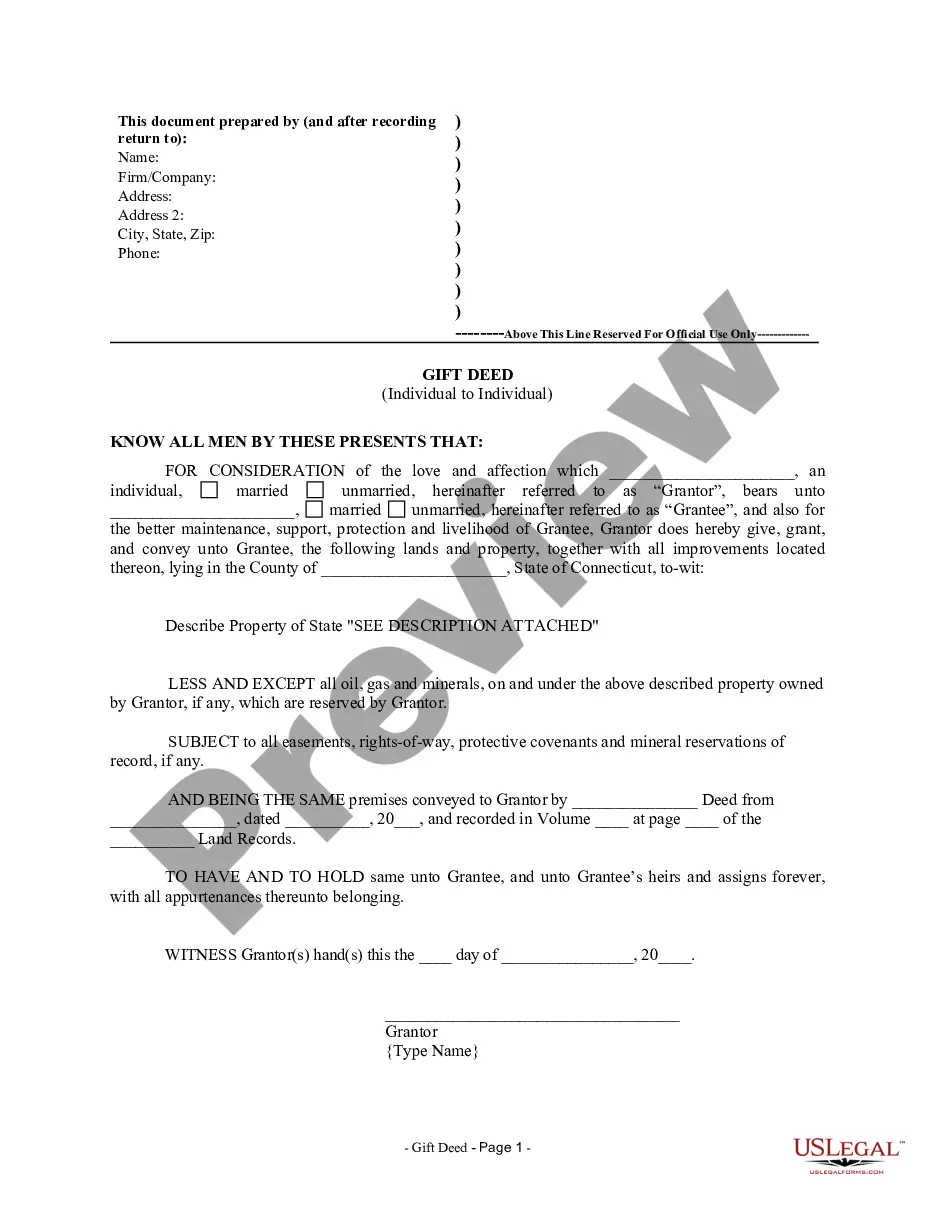

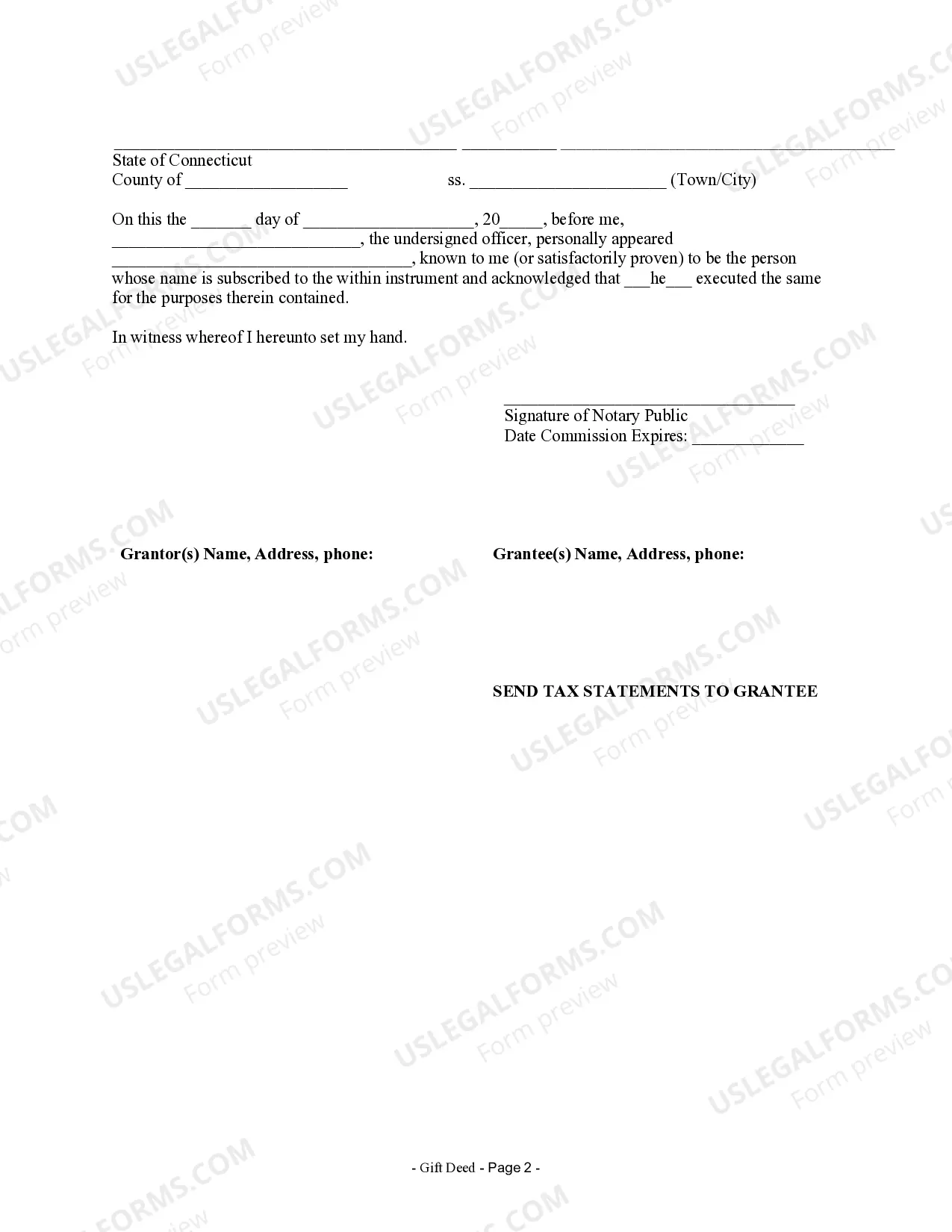

How to fill out Connecticut Gift Deed For Individual To Individual?

Acquiring legal document samples that adhere to federal and local regulations is crucial, and the internet provides many choices to select from.

However, what’s the use of spending time searching for the correct Connecticut Gift Form Withholding template online if the US Legal Forms digital library already has such documents gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by lawyers for any professional and personal situation.

Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

- They are simple to navigate with all documents organized by state and intended use.

- Our specialists stay updated with legal changes, ensuring your documents are current and compliant when obtaining a Connecticut Gift Form Withholding from our platform.

- Acquiring a Connecticut Gift Form Withholding is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you require in the appropriate format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

Connecticut Gift Tax: Connecticut State Gift Tax Rate: 11.6% (if the value of the taxable estate/gift is $9.1 to $10.1 million) or 12% (if the value is greater than $10.1 million)

Starting in 2023, the Connecticut lifetime gift and estate tax exemption amount will match the federal gift and estate tax exemption amount, meaning that the Connecticut exemption will increase from $9.1 million to $12.92 million on January 1, 2023.

Annual Gift Tax Exclusion You can make annual exclusion gifts of $17,000 per year starting in 2023 (up from $16,000) to as many people as you wish, free of federal and Connecticut gift tax, without using up any of your estate and gift tax exemption.

Connecticut increased its lifetime gift tax exemption to $9.1 million for the tax year 2022, with the plan to rise in subsequent years. This means you won't owe a Connecticut gift tax unless the gifts you provide in those years exceed their corresponding exemption levels.

You can give up to the annual exclusion amount ($17,000 in 2023) to any number of people every year, without facing any gift taxes or filing a gift tax return. If you give more than $17,000 in 2023 to someone in one year, you do not automatically have to pay a gift tax on the overage.