Connecticut Gift Form Withdrawal

Description

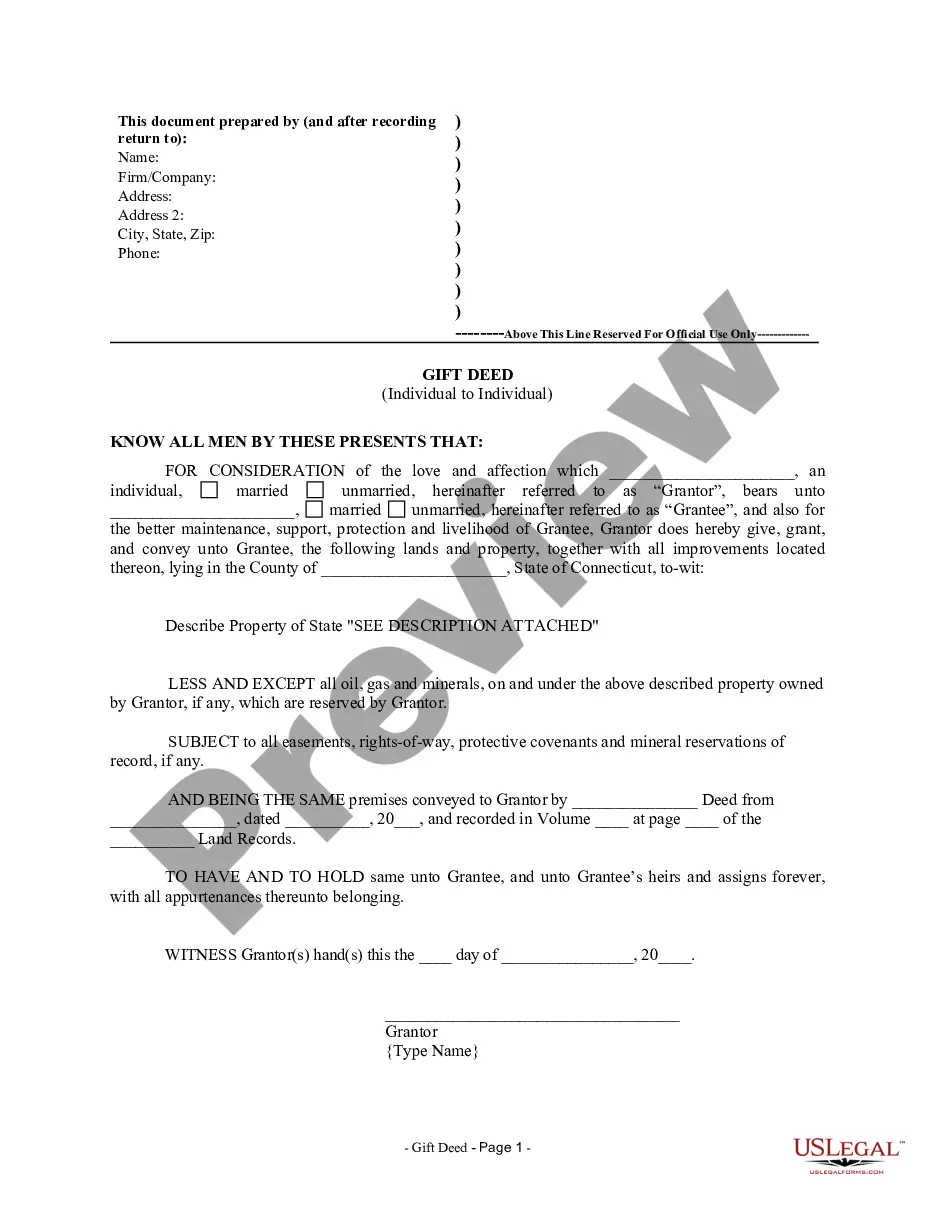

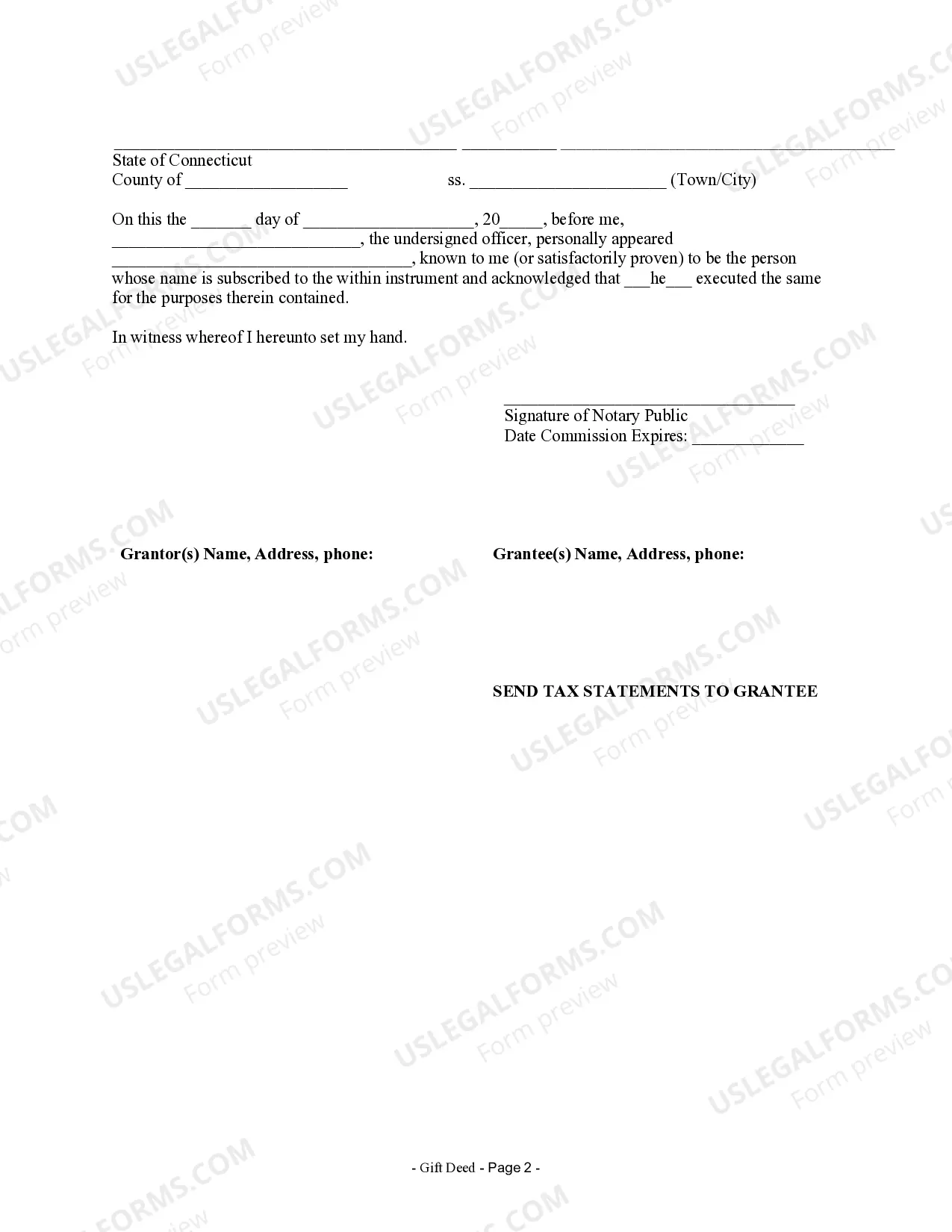

How to fill out Connecticut Gift Deed For Individual To Individual?

It’s clear that you can’t become a legal specialist instantly, nor can you understand how to swiftly prepare the Connecticut Gift Form Withdrawal without a specific skill set.

Drafting legal documents is a lengthy endeavor that necessitates particular training and expertise. So why not entrust the creation of the Connecticut Gift Form Withdrawal to the professionals.

With US Legal Forms, which boasts one of the most comprehensive legal document collections, you can obtain anything from court records to templates for internal communications.

If you're in need of any other form, you can restart your search.

Establish a free account and select a subscription plan to purchase the form. Then, click Buy now. Once the payment is finalized, you can download the Connecticut Gift Form Withdrawal, fill it out, print it, and send or mail it to the relevant individuals or organizations.

- We recognize the significance of compliance and adherence to federal and local laws and regulations.

- Consequently, on our platform, all templates are specific to locations and current.

- Here’s how you can initiate your journey with our platform and acquire the document you require in just a few minutes.

- Locate the document you seek using the search bar at the top of the page.

- Preview it (if this feature is available) and read the accompanying description to ascertain if the Connecticut Gift Form Withdrawal is what you need.

Form popularity

FAQ

You and the family member must complete and sign the AU-463. Once the paperwork is complete, you and your family member must visit a CT DMV office with paperwork and photo identification. Once this step is complete, the CT DMV will post the new certificate of title to your family member in a few days.

How to sell your vehicle without a title: Request and complete a Supplemental Assignment of Ownership Form (Form Q1). This form is also available at your local DMV office. Without this form, we are unable to transfer ownership.

Can you gift a vehicle in CT? In Connecticut, you can legally gift a car to an immediate family member, like your parents, spouse, child, or sibling. Gifting the vehicle allows you to avoid the Connecticut Gift Tax and other related fees.

Depending on the value of the car and the state where you reside, you may owe a gift tax on the vehicle. In some states, there is a nominal gift tax regardless of the value of the vehicle. ing to Kelly Blue Book: "As of January 2023, gift tax rules apply if the vehicle's fair market value is over $17,000.

How to Transfer a Car After a Death The Certificate of Title, assigned to the new owner by the Executor or Administrator of the estate, A certified copy of the Probate Court document authorizing the transfer of the vehicle (a list of acceptable probate documents can be found on the DMV's website at .ct.gov/dmv),