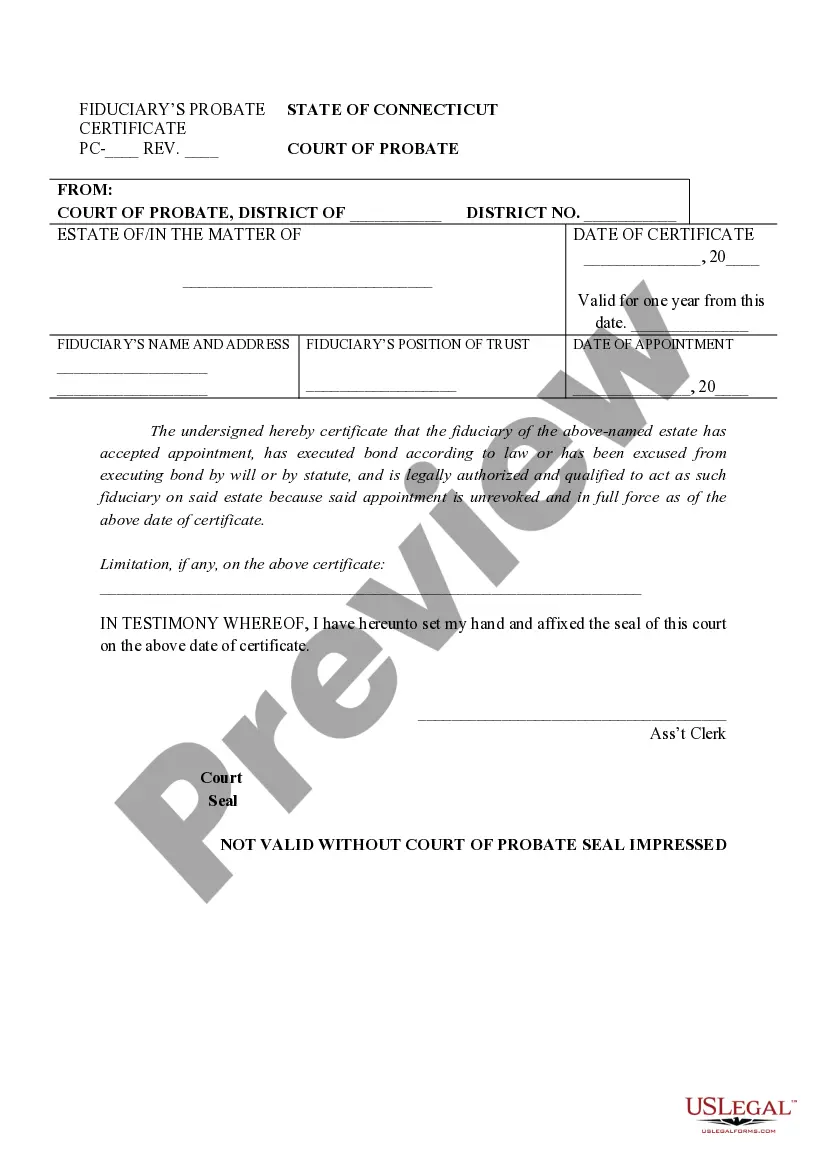

Fiduciary Probate Certificate Withdrawal

Description

How to fill out Fiduciary Probate Certificate Withdrawal?

Precisely composed formal documentation is one of the essential assurances for preventing issues and legal disputes, yet acquiring it without legal assistance may require time.

Whether you seek to swiftly locate a current Fiduciary Probate Certificate Withdrawal or various other forms for work, family, or business events, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is current, you merely need to Log In to your account and click the Download button adjacent to the chosen document. Additionally, you can access the Fiduciary Probate Certificate Withdrawal at any time in the future, since all documents ever retrieved on the platform are stored within the My documents tab of your profile. Save time and money on preparing official documents. Experience US Legal Forms today!

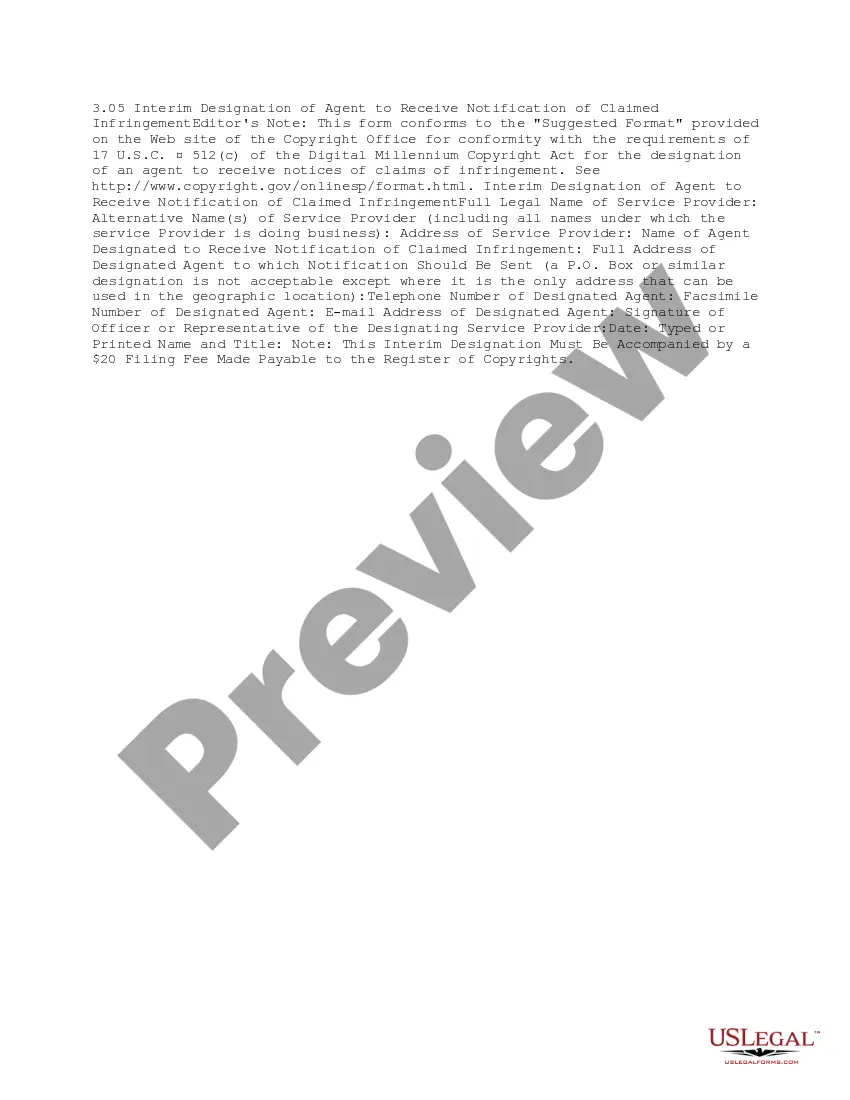

- Verify that the form is appropriate for your situation and region by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar in the page header.

- Click Buy Now once you find the correct template.

- Select the pricing option, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Fiduciary Probate Certificate Withdrawal.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Delays in probate can arise from disputes among heirs, missing documents, or court backlogs. Incomplete or incorrect filings can also stall the process. Using U.S. Legal Forms ensures you have the correct documents for fiduciary probate certificate withdrawal, helping to streamline your probate experience.

After the six-month period, the estate may distribute the remaining assets to heirs. Settling any claims or debts becomes essential during this time. If all goes well, you can proceed with fiduciary probate certificate withdrawal and complete the estate process efficiently.

The waiting period allows creditors to file claims against the estate. It provides time to ensure all debts are settled. This step is important to facilitate fiduciary probate certificate withdrawal, as it confirms no outstanding liabilities exist before the distribution of assets.

You must usually start the probate process within a few weeks after a person's death. However, laws vary by state, so check your local regulations. Remember, initiating the probate process sooner reduces complications, such as complications related to fiduciary probate certificate withdrawal.

To fill out the US Customs Declaration form, include your travel information and personal identification. List items that you are bringing into the country and their estimated value. This information can be essential if a fiduciary probate certificate withdrawal involves any estate goods that cross international borders.

Filling out a medical authorization form requires you to provide detailed information about the patient and the healthcare provider. It's vital to specify the extent of the authorization clearly. A proper authorization may be necessary during the fiduciary process in ensuring healthcare decisions align with the deceased's wishes.

To fill out the Employee Withholding Certificate form, start by entering your name, Social Security number, and filing status. Then, indicate the number of allowances you wish to claim. Completing this form correctly helps ensure that your withholdings align with any financial duties tied to fiduciary probate certificate withdrawal.

Again, when filling out form 350ES, focus on accuracy and completeness. Start with your personal details and carefully describe any transactions or obligations regarding the estate. Proper completion aids in the fiduciary probate certificate withdrawal, allowing you to move forward efficiently.

Filling out a probate inventory involves listing all assets owned by the deceased. Make sure to include real estate, bank accounts, and personal belongings. Accurately completing this inventory is essential for the fiduciary probate certificate withdrawal and ensures a transparent probate process.

In Arizona, the requirements for informal probate include being the named executor in the will and having a valid death certificate of the deceased. You must also submit the will and a petition to the probate court. Satisfying these criteria helps facilitate the fiduciary probate certificate withdrawal, making the process smoother.