Connecticut Fiduciary Probate Certificate Pc 450 Withholding

Description

How to fill out Connecticut Fiduciary's Probate Certificate?

Navigating legal management can be exasperating, even for seasoned professionals.

When seeking a Connecticut Fiduciary Probate Certificate Pc 450 Withholding and lacking the time to dedicate to finding the correct and current version, the processes can be stressful.

With US Legal Forms, you can.

Access state- or county-specific legal and business documents. US Legal Forms addresses any needs you may have, from personal to business documentation, all in a single location.

For first-time users of US Legal Forms, create a free account and enjoy unlimited access to all library benefits. Here are the steps to follow after obtaining the form you desire.

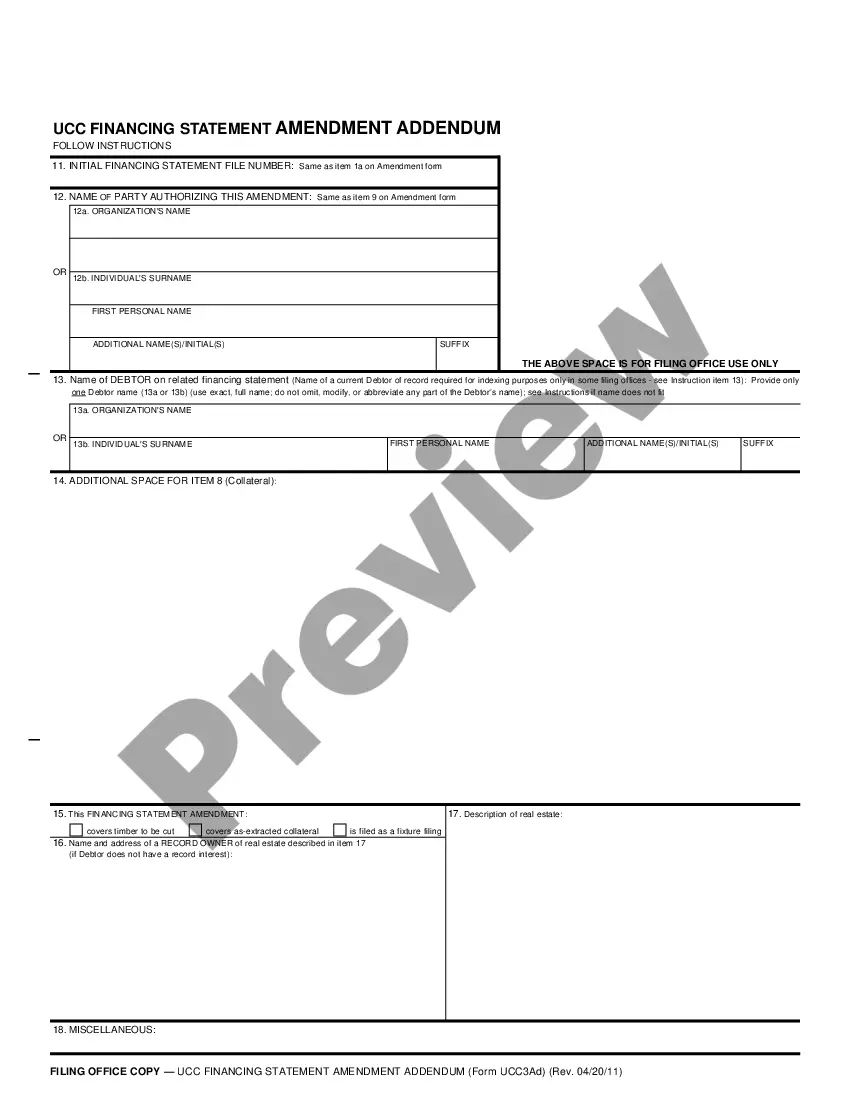

Verify that this is the proper form by previewing it and reviewing its description.

Confirm that the sample is recognized in your state or county.

- Utilize cutting-edge tools to fill out and manage your Connecticut Fiduciary Probate Certificate Pc 450 Withholding.

- Tap into a knowledge base of articles, guides, and handbooks relevant to your situation and needs.

- Save time and effort searching for the necessary documents by employing US Legal Forms’ advanced search and Preview feature to acquire the Connecticut Fiduciary Probate Certificate Pc 450 Withholding and download it.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to review the documents you've previously saved and manage your folders as desired.

Select Buy Now once you are ready.

Choose a monthly subscription plan.

Select the format you prefer and Download, complete, sign, print, and send your document.

Capitalize on the US Legal Forms online directory, backed by 25 years of experience and reliability.

Transform your routine document management into a seamless and user-friendly process today.

- An extensive online form directory could transform the experience for anyone aiming to handle these matters effectively.

- US Legal Forms stands out as a leader in online legal documents, boasting over 85,000 state-specific legal forms available to you at any moment.

Form popularity

FAQ

In Connecticut, the estate tax return must be filed by the executor or administrator of an estate when the gross estate exceeds a certain threshold. This requirement ensures compliance with Connecticut fiduciary probate certificate pc 450 withholding guidelines and helps the state collect any owed taxes. If you're unsure about the process, USLegalForms can assist you in determining whether an estate tax return is necessary and guide you through filing the correct forms.

If you neglect to file probate in Connecticut, the estate may face significant complications. The heirs may not receive their inheritance promptly, and legal disputes could arise among family members. Furthermore, failing to adhere to the state's laws can lead to financial penalties and complications related to the Connecticut fiduciary probate certificate pc 450 withholding. To navigate these challenges seamlessly, consider using USLegalForms to ensure all paperwork is completed correctly.

Filling out a probate form requires attention to detail and accuracy. You will need to gather all necessary information, including details about the deceased, their assets, and any beneficiaries. To streamline this process and ensure you meet the Connecticut fiduciary probate certificate PC 450 withholding requirements, consider using uslegalforms for user-friendly templates and clear instructions.

Completing a probate inventory in Connecticut involves listing all assets and liabilities of the deceased. You will need to identify each asset's value and provide documentation that backs up your valuations. Utilizing resources from uslegalforms can simplify this process by offering templates and guidance tailored to the Connecticut fiduciary probate certificate PC 450 withholding requirements.

If someone dies without a will in Connecticut, the probate process must begin within a specific timeframe. You generally have 30 days to file for probate after the death. This timeline is essential for managing the estate effectively and ensuring compliance with any necessary Connecticut fiduciary probate certificate PC 450 withholding requirements.

In Connecticut, certain assets often bypass the probate process. For example, assets held in a living trust, jointly owned property, and life insurance proceeds typically do not require a Connecticut fiduciary probate certificate PC 450 withholding. Additionally, bank accounts with payable-on-death designations and retirement accounts benefit from direct beneficiary designations, avoiding probate delays.

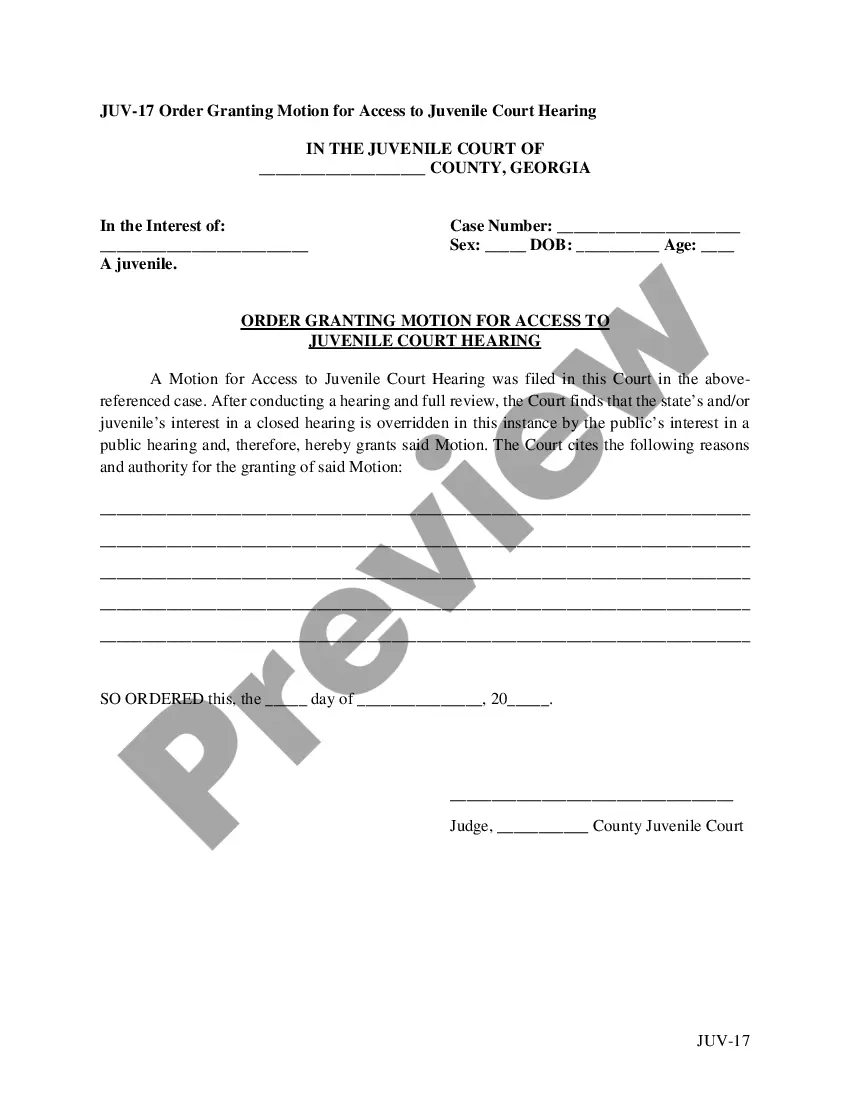

A probate certificate in Connecticut serves as a legal document that confirms the authority of a fiduciary to manage an estate. Specifically, the Connecticut fiduciary probate certificate PC 450 withholding is essential for financial institutions, and it verifies that the estate is properly managed according to state laws. Additionally, this certificate helps ensure that taxes and other obligations are met, facilitating a smooth probate process. By obtaining this certificate through US Legal Forms, you can streamline your estate management and ensure compliance.

After someone dies in Connecticut, you generally have six months to file for probate. Prompt filing is crucial, as delays can complicate the distribution of assets and settlement of debts. Besides, timely action can help prevent additional costs or potential legal challenges from arising. To navigate this process effectively, consider utilizing resources like US Legal Forms for guidance on necessary documentation.

In Connecticut, most wills typically need to go through probate to ensure they are validated and executed according to the deceased person's wishes. This process helps in resolving any disputes and managing the estate’s debts and assets. However, certain assets can be exempt from probate, depending on how they are titled. Consulting with a legal professional can help clarify whether your specific situation requires the completion of the Connecticut fiduciary probate certificate PC 450 withholding and other related forms.

Not all estates in Connecticut must go through probate, depending on the nature and value of the assets. For instance, assets held in a trust may not require probate. However, if the estate involves real property or significant assets, probate is usually necessary to settle debts and distribute property legally. Gaining a clear understanding of your estate’s needs can ensure compliance with Connecticut’s probate laws.