Lady Bird Deed In Ct

Description

How to fill out Connecticut Enhanced Life Estate Or Lady Bird Quitclaim Deed - Individual To Individual?

The Lady Bird Deed in CT available on this site serves as a reusable legal template created by experienced attorneys, ensuring compliance with federal and state statutes. For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners access to more than 85,000 authenticated, state-specific documents for various personal and business needs. This is the fastest, simplest, and most dependable method to obtain the necessary documents, as the service guarantees optimal data protection and defenses against malware.

Obtaining this Lady Bird Deed in CT will require just a few straightforward steps.

Register with US Legal Forms to access verified legal templates for all of life’s situations.

- Search for the document you require and verify it. Browse through the file you looked for and preview or review the form description to confirm it meets your needs. If it doesn't, utilize the search bar to locate the correct one. Click Buy Now when you've found the template you need.

- Register and Log In. Choose the pricing plan that fits you and set up an account. Make a swift payment via PayPal or credit card. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template. Select the format you prefer for your Lady Bird Deed in CT (PDF, Word, RTF) and download the sample onto your device.

- Fill out and sign the documents. Print the template to manually complete it. Alternatively, use an online multifunctional PDF editor to swiftly and precisely fill out and sign your form with a legally-binding electronic signature.

- Download your documents once more. Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously purchased documents.

Form popularity

FAQ

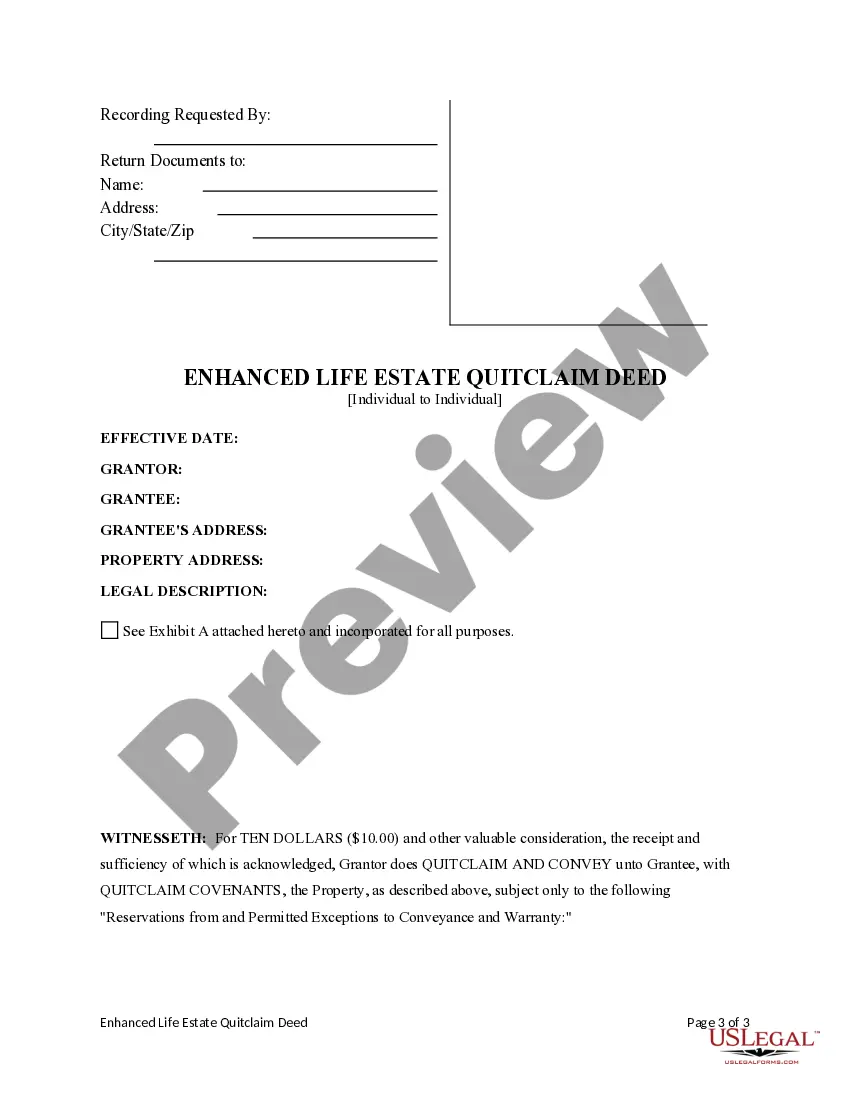

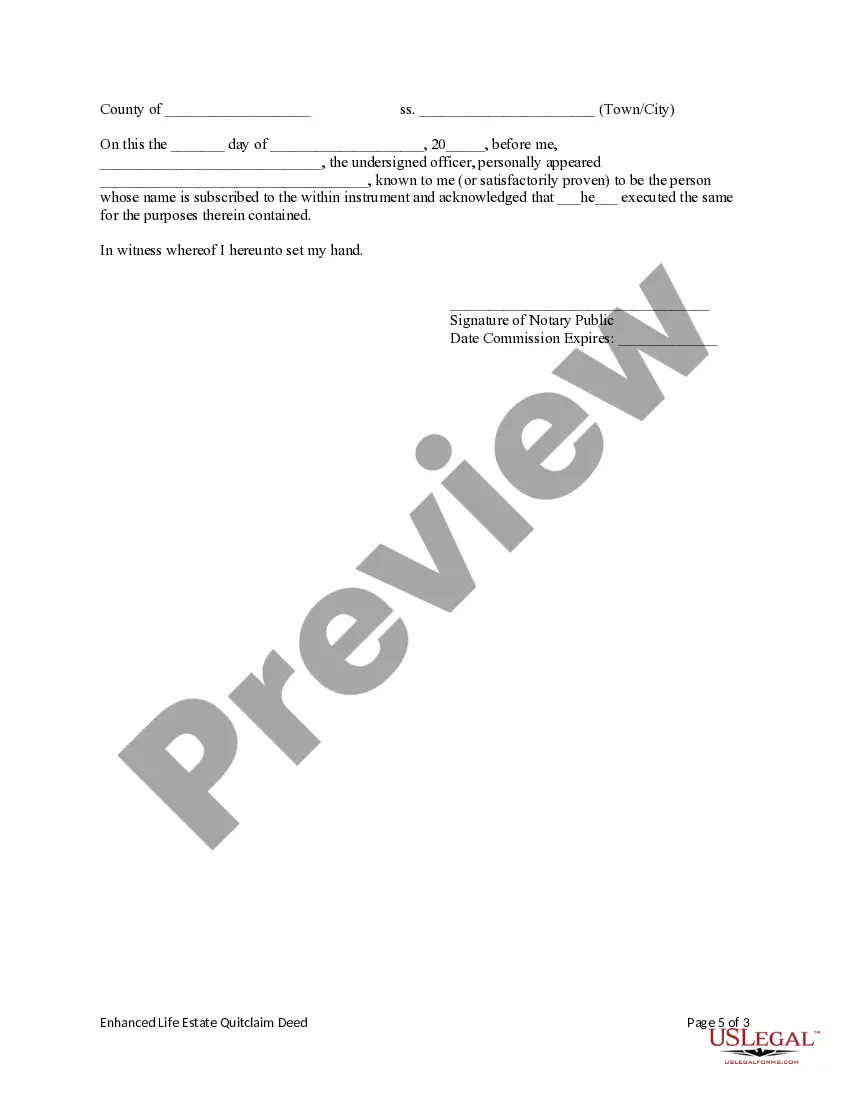

Laws. Recording ? A quit claim with the Registry of Deeds where the property is located. Signing ? The quit claim deed is required to be notarized AND signed with two (2) witnesses. If the notary public agrees, he or she may act as one (1) of the witnesses as well as the notary.

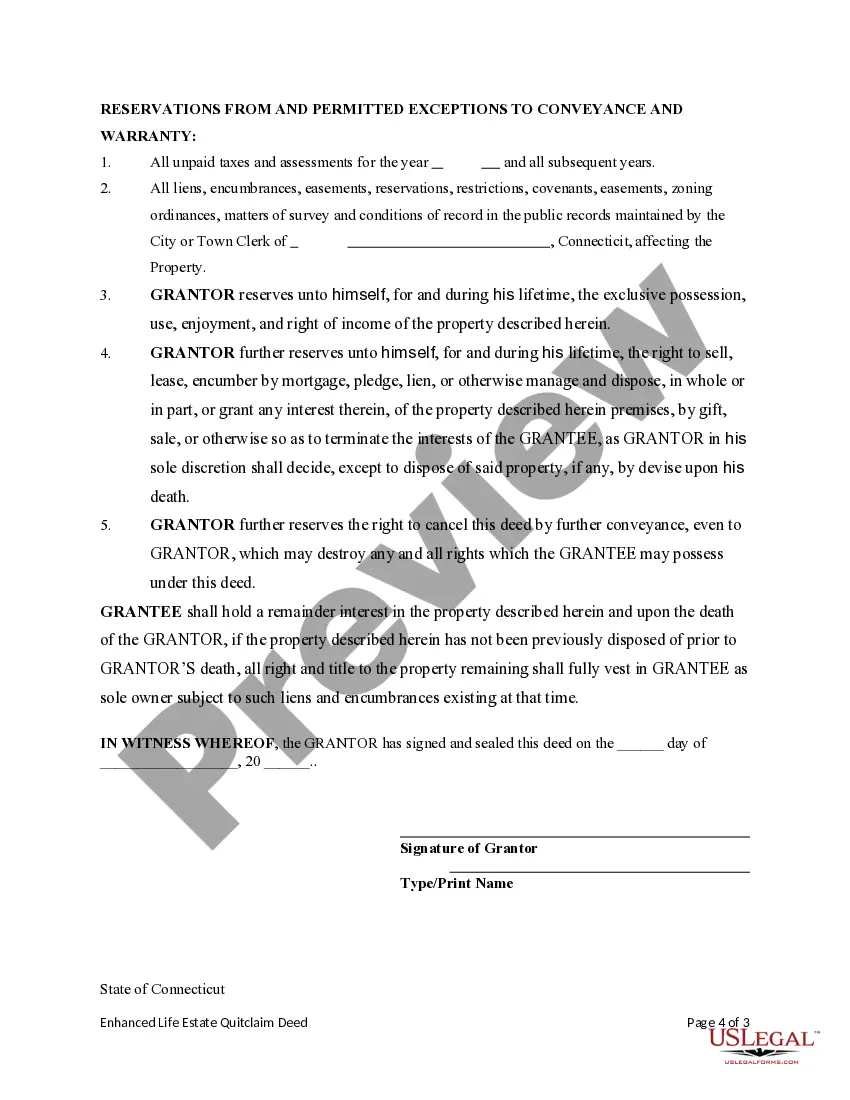

The original owner retains complete control over the property. Using a Lady Bird deed, the homeowner retains control over their property until they sell it, gift it, or die. The remainder beneficiary receives the property if the grantor owns the property at the owner's death.

Disadvantages. The downside is that property transferred via a lady bird deed will be subject to a new tax assessment that could (and often does) result in higher property taxes generally.

The Validity of Lady Bird Deeds in Connecticut A Lady Bird deed, also known as an enhanced life estate deed, is a legal document that allows an individual to pass property to beneficiaries while retaining a life estate in the property.

It must be signed before a notary and two witnesses. The notary may be a witness, but the person receiving the ownership right cannot be a witness. In addition to the Deed, you will need a conveyance tax form. Although no tax will be due, you still need to complete the form.