Power Of Attorney Form For Irs

Description

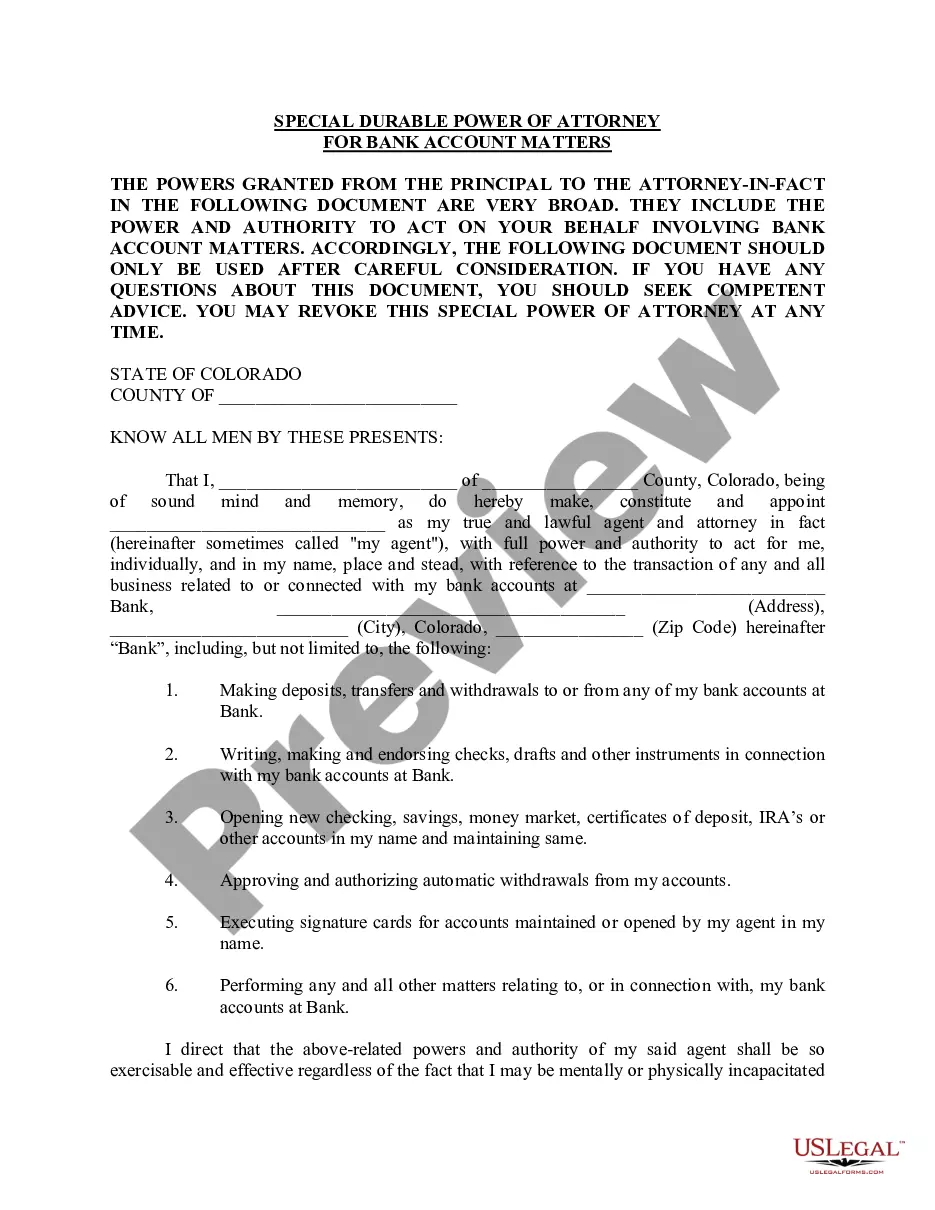

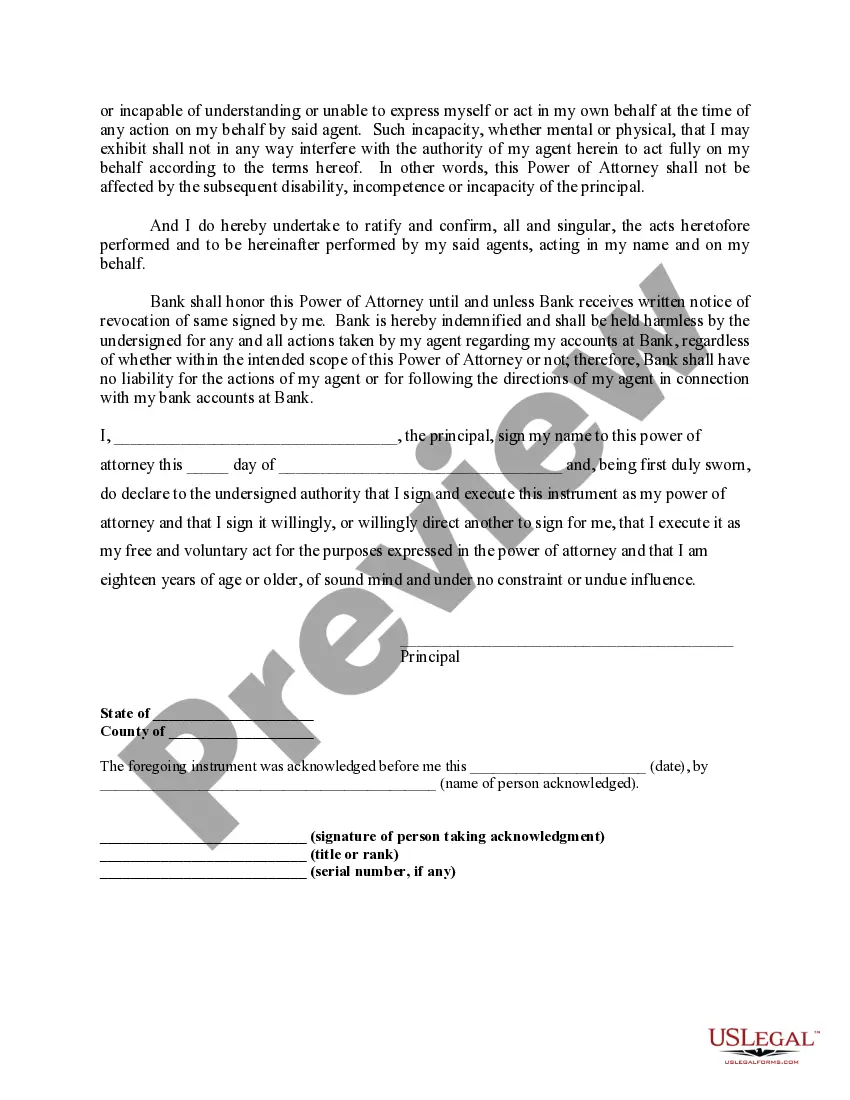

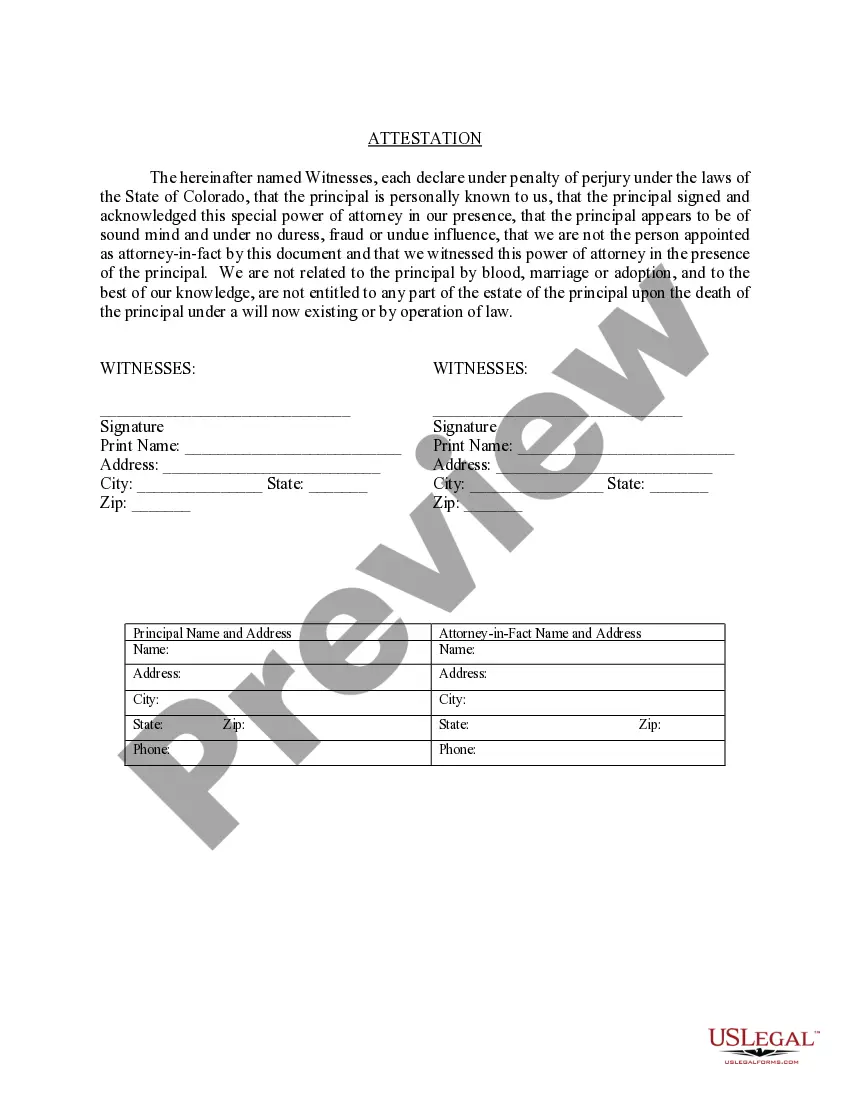

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

- If you're an existing user, log in and download your Power of Attorney form directly by selecting the Download button. Ensure your subscription remains valid; if it isn't, renew it according to your plan.

- For first-time users, start by reviewing the Preview mode and description of the Power of Attorney form. Confirm it aligns with your specific needs and complies with local jurisdiction requirements.

- If you need a different template, utilize the Search tab to locate an appropriate document that meets your requirements. If it aligns with your needs, proceed.

- Purchase the desired document by clicking the Buy Now button, selecting your preferred subscription, and registering for an account to unlock access to the legal library.

- Complete your transaction by entering your payment details or opting for PayPal to finalize your subscription.

- Download your Power of Attorney form, saving it on your device. You can also retrieve it anytime from the My Forms section of your profile.

US Legal Forms stands out with its extensive collection, offering over 85,000 customizable legal forms, empowering users with flexibility and precision in legal documentation.

Take the next step in managing your legal documents efficiently. Explore the vast resources at US Legal Forms today!

Form popularity

FAQ

To fill a power of attorney, begin with a blank form and carefully include the principal's information and any additional necessary details. Clearly outline the powers being granted, especially those pertinent to tax issues. Once the form is filled out, ensure both the principal and agent sign, and consider having it notarized for added assurance.

Filling out a power of attorney form requires careful attention to detail. Start by entering your name and the principal's information, including any specific powers granted to you regarding tax matters. After completing the form, both parties must sign it, and it may also need notarization depending on the state’s requirements.

The best person to serve as a power of attorney is someone you trust completely, as they will make important decisions on your behalf. This person should be reliable, organized, and knowledgeable about your financial matters, especially when dealing with a power of attorney form for IRS. Choosing a family member or close friend often works well.

New Jersey requires a power of attorney form for IRS to be in writing, signed by the principal, and witnessed. It is crucial that the form specifies the powers related to tax matters explicitly. Additionally, having the document notarized is a recommended practice to ensure its validity.

The IRS power of attorney form does not have a specified limit on the number of years it can cover. However, the authority granted through this form generally continues until revoked or until the principal's death. It's wise to check for updates or changes in tax law that may affect this status.

In Texas, creating a valid power of attorney form for IRS requires the document to be signed by the principal and notarized or witnessed. Additionally, it should clearly state the powers granted. It's important to ensure that the powers cover tax matters explicitly, particularly if you intend to file on behalf of the principal.

To file taxes as a power of attorney, you first need a completed power of attorney form for IRS. This form grants you the authority to handle tax matters on behalf of the taxpayer. After you submit the form, you can prepare and file the tax returns, ensuring you adhere to all IRS regulations.

Yes, the IRS recognizes a power of attorney. When you submit a power of attorney form for IRS to represent someone else, it allows the designated individual to act on behalf of the taxpayer. This delegation covers matters including tax returns and IRS correspondence, provided the form is properly completed and submitted.

Executing form 2848 grants the appointed representative the authority to act on your behalf in specific IRS matters. This means they can receive tax information, communicate with IRS agents, and even negotiate settlements for you. Essentially, the power of attorney form for IRS allows for streamlined communication and decision-making during tax proceedings.

Any taxpayer who wants to authorize someone else to represent them regarding their tax matters needs to file form 2848. This includes individuals, corporations, or partnerships seeking tax assistance or audit representation. If you require help navigating IRS inquiries or disputes, submitting the power of attorney form for IRS is essential.