Power Of Attorney Form For Bank Account

Description

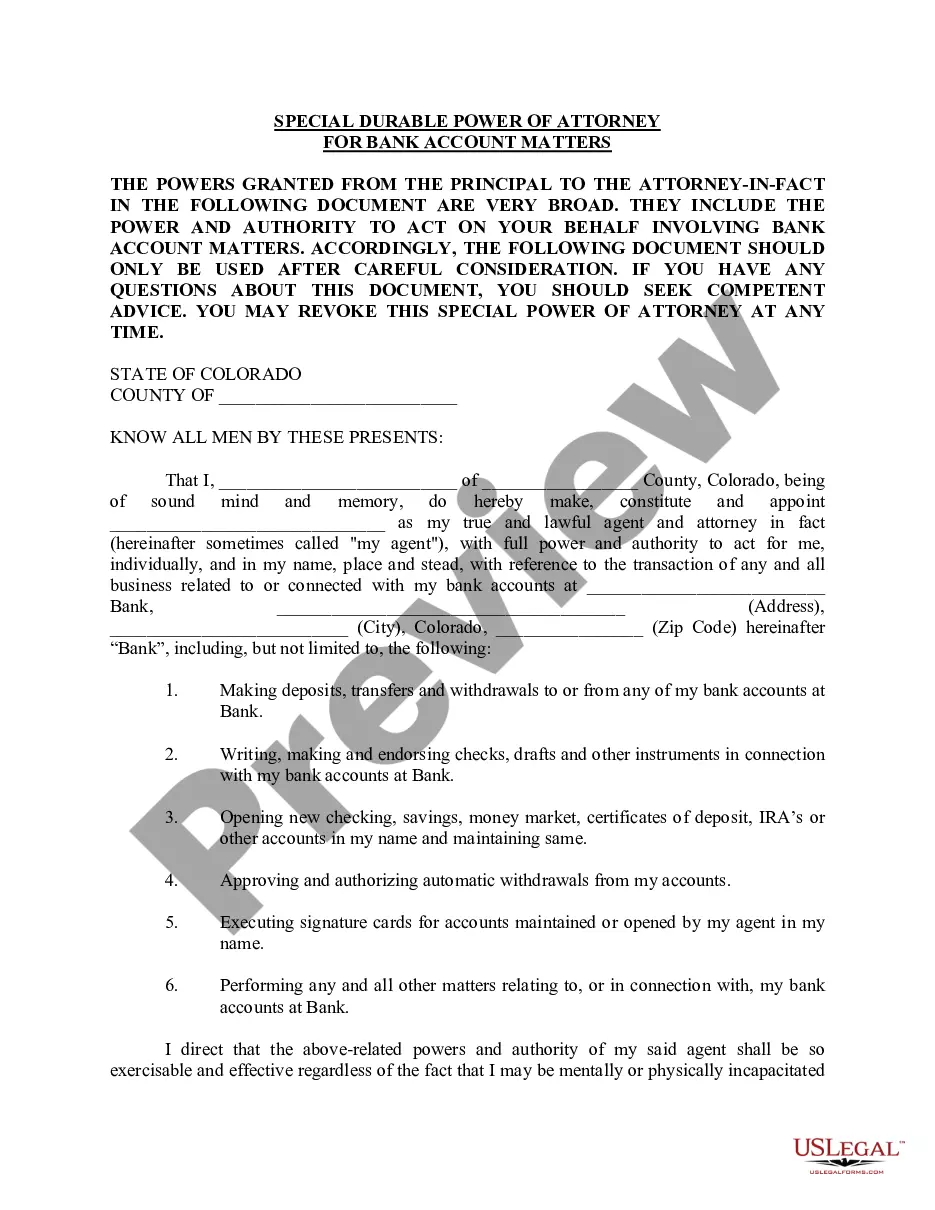

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your US Legal Forms account if you're an existing user. Make sure your subscription is active to access the required form template.

- If you're a new user, start by exploring the available documents. Use the Preview mode to check the form description and ensure you've selected the correct document that meets local jurisdiction requirements.

- In case of inconsistency, utilize the Search feature to find another suitable template. Once you find the right one, proceed to the next step.

- Select your preferred subscription plan by clicking the Buy Now button. You will need to create an account to access the document library.

- Complete your purchase by entering your payment details, either using a credit card or PayPal. Ensure that your payment processes successfully.

- Download the power of attorney form directly to your device and complete it as needed. You can always access your downloaded documents in the My Forms section of your profile.

With US Legal Forms, you gain access to more than 85,000 legal templates, ensuring you find exactly what you need. Their robust collection offers more forms than competitors, which means you are more likely to find the right document at a competitive cost.

In conclusion, utilizing US Legal Forms streamlines the process of obtaining essential legal documents like a power of attorney form for bank account. Don't hesitate—start your journey today and empower your legal endeavors!

Form popularity

FAQ

A legal power of attorney typically does not allow for decisions regarding certain personal matters, such as creating or altering a will, making medical decisions, or changing a partnership agreement. It is essential to understand the limitations of a power of attorney form for bank account and consult legal resources if you have further questions. For comprehensive information, consider visiting uslegalforms, which can guide you through the specific limitations of a power of attorney.

A power of attorney for bank accounts allows you to act on someone else's behalf regarding financial transactions. This could include paying bills, making deposits, and navigating bank services. To ensure seamless transactions, it’s important to present the power of attorney form whenever necessary and confirm the bank’s requirements.

Yes, a power of attorney form for bank account does apply to managing bank accounts. When you have this authority, you can access, deposit, withdraw, or manage funds on behalf of the person who granted you power of attorney. This legal tool is crucial for handling financial matters effectively.

A power of attorney does not override the terms of a joint bank account. Both account holders generally maintain equal rights to the account. Therefore, if one account holder grants power of attorney to another, the authority granted does not negate the rights of the other account holder.

Yes, if you hold the power of attorney form for bank account, you can add your name to the bank account of the person who granted you that authority. However, it is crucial to review the specific bank's policies, as some may require additional documentation. Always ensure that the power of attorney is properly executed to avoid complications.

Yes, a power of attorney form for bank account can be used to grant access to a checking account. By properly executing this document, you allow your designated agent to manage transactions, deposits, and withdrawals on your behalf. Ensure that your bank accepts this arrangement by confirming their specific rules and procedures.

A bank may deny a power of attorney form for bank account if it does not meet their criteria or if there are doubts about its authenticity. Issues can arise if the document lacks required signatures or is outdated. It's essential to ensure that your power of attorney is properly filled out and meets the bank's standards.

Yes, most banks honor durable power of attorney forms for bank account as long as they are properly executed and comply with state laws. A durable power of attorney remains effective even if you become incapacitated. Always check with your bank to confirm their specific requirements for accepting such a document.

Banks are cautious about power of attorney forms for bank account to prevent fraud and ensure the legitimacy of transactions. Each institution has specific policies that require clear, legal documentation to protect both the account holder and the bank. Therefore, ensuring your power of attorney form meets the bank’s criteria is essential.

While having a power of attorney form for bank account provides convenience, there are disadvantages to consider. For instance, if the agent mismanages your funds or does not act in your best interest, it can lead to financial issues. Moreover, once you grant power of attorney, you might have limited ability to change it without proper legal processes.