Acting As A Power Of Attorney Poa For A Client

Description

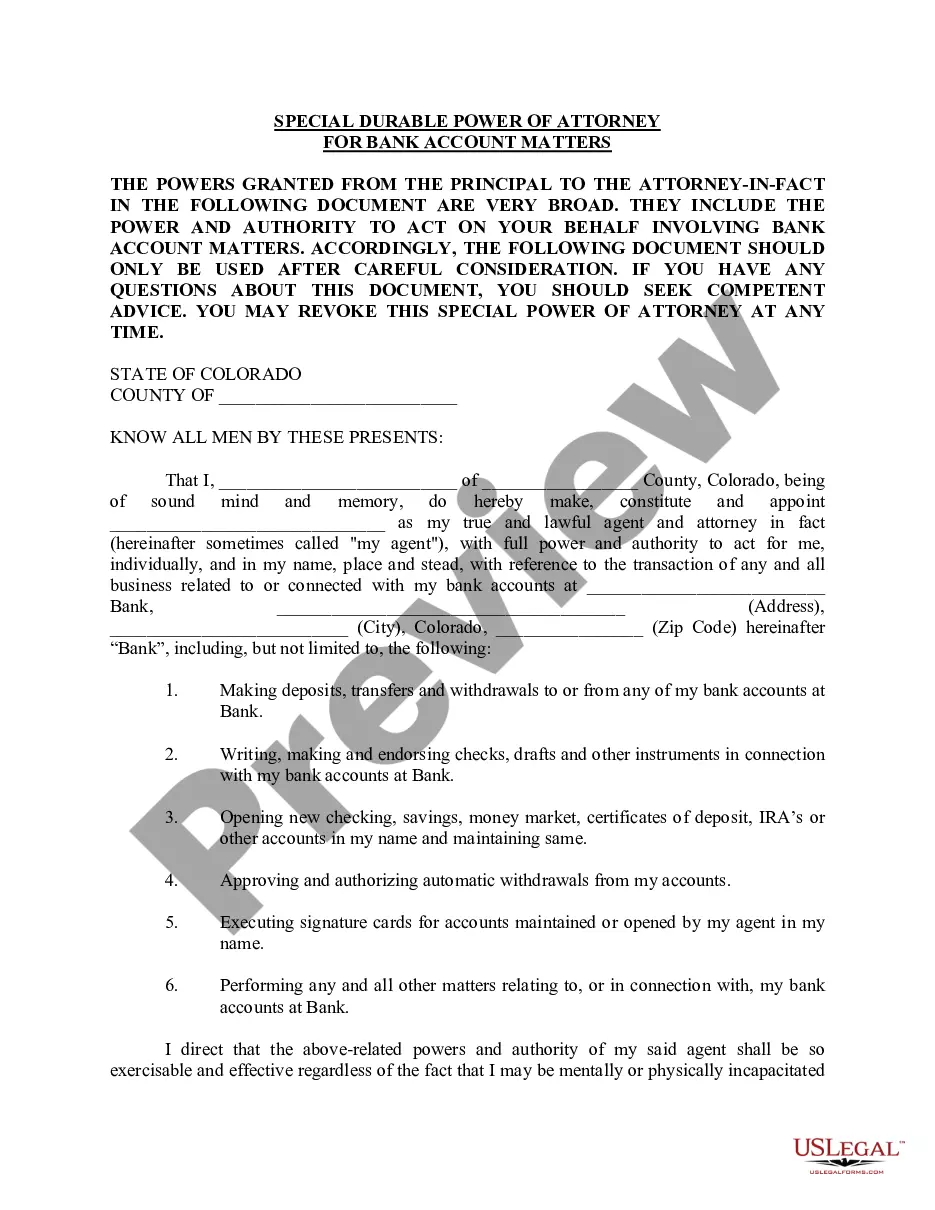

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your existing US Legal Forms account, ensuring your subscription is active. If it's expired, renew it before proceeding.

- Navigate to the form library and search for the specific power of attorney template relevant to your needs. Ensure it aligns with local jurisdictional requirements.

- If you need a different form, utilize the Search function to find alternatives that fit your criteria.

- Purchase the selected document by clicking on the Buy Now button, and choose a subscription plan that fits your needs.

- Complete your transaction by entering your payment information through credit card or PayPal.

- Download the completed form directly onto your device for easy access and future use, which will also be available in the 'My documents' section of your profile.

By following these steps, you can effectively act as a power of attorney for your client, ensuring all necessary documentation is in place.

For more guidance and to explore the extensive options available, visit US Legal Forms today.

Form popularity

FAQ

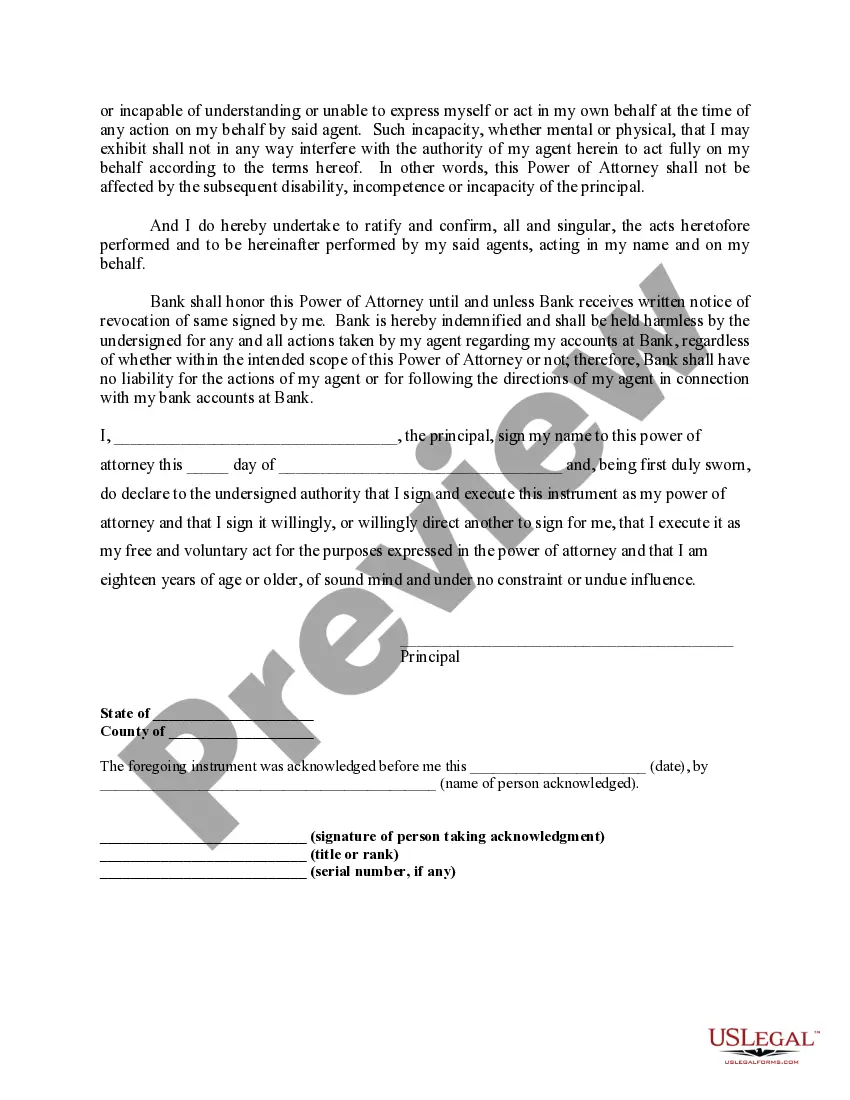

The four types of power of attorney include general, durable, special, and medical powers of attorney. Each type serves different purposes, from managing finances to making health care decisions. Understanding these types is essential when acting as a power of attorney POA for a client, as it allows for tailored solutions to meet specific needs.

When selecting someone as your power of attorney, consider their ability to handle financial and legal matters. It is prudent to appoint someone familiar with your wishes and capable of acting in your best interest. Acting as a power of attorney POA for a client means ensuring that the appointed person aligns with your goals and desires.

There are some decisions that a legal power of attorney cannot make, including decisions regarding your own medical treatment, if you have stated otherwise in advance. Additionally, a power of attorney cannot modify your will or make decisions about your inheritance. Acting as a power of attorney POA for a client means knowing these limitations to avoid legal issues.

In Georgia, to create a valid power of attorney, the document must be in writing and signed by you. You also need a notary public's seal and a witness signature. Acting as a power of attorney POA for a client requires adhering to these rules to ensure the document serves its intended purpose effectively.

The best person to appoint as your power of attorney is someone who is responsible, trustworthy, and understands your values. This could be a family member, close friend, or a professional. Remember, acting as a power of attorney POA for a client is a serious role, so choose someone who can make decisions wisely in your absence.

You can appoint almost anyone to be your power of attorney, but it is wise to choose someone you trust. That person will make significant decisions on your behalf. Acting as a power of attorney POA for a client means prioritizing the relationship with the appointed agent to ensure they represent your best interests.

In New Jersey, creating a power of attorney requires a written document that clearly states your intent to appoint someone as your agent. The document must be signed by you, the principal, and two witnesses or a notary public. Acting as a power of attorney POA for a client involves understanding these requirements to ensure a valid and effective appointment.

Attorney-client privilege can extend to communications made while acting as a power of attorney, depending on the circumstances. If a lawyer is designated as a POA, they typically can maintain confidentiality in their dealings. This privilege helps protect sensitive information and ensures that your client’s interests remain secure while you act on their behalf.

Filling out power of attorney paperwork requires understanding the specific powers you will hold as a POA for a client. Carefully fill in your client’s information, specify the powers granted, and detail any limitations. Using a service like USLegalForms can streamline the process and offer templates to ensure you complete the paperwork correctly.

An example of a signature on behalf of someone as power of attorney includes signing their name followed by a notation such as ‘by Your Name, POA’. This notation clarifies that you are authorized to make decisions for your client. It’s crucial to ensure that such signatures are only used in accordance with the powers given to you in the POA document.