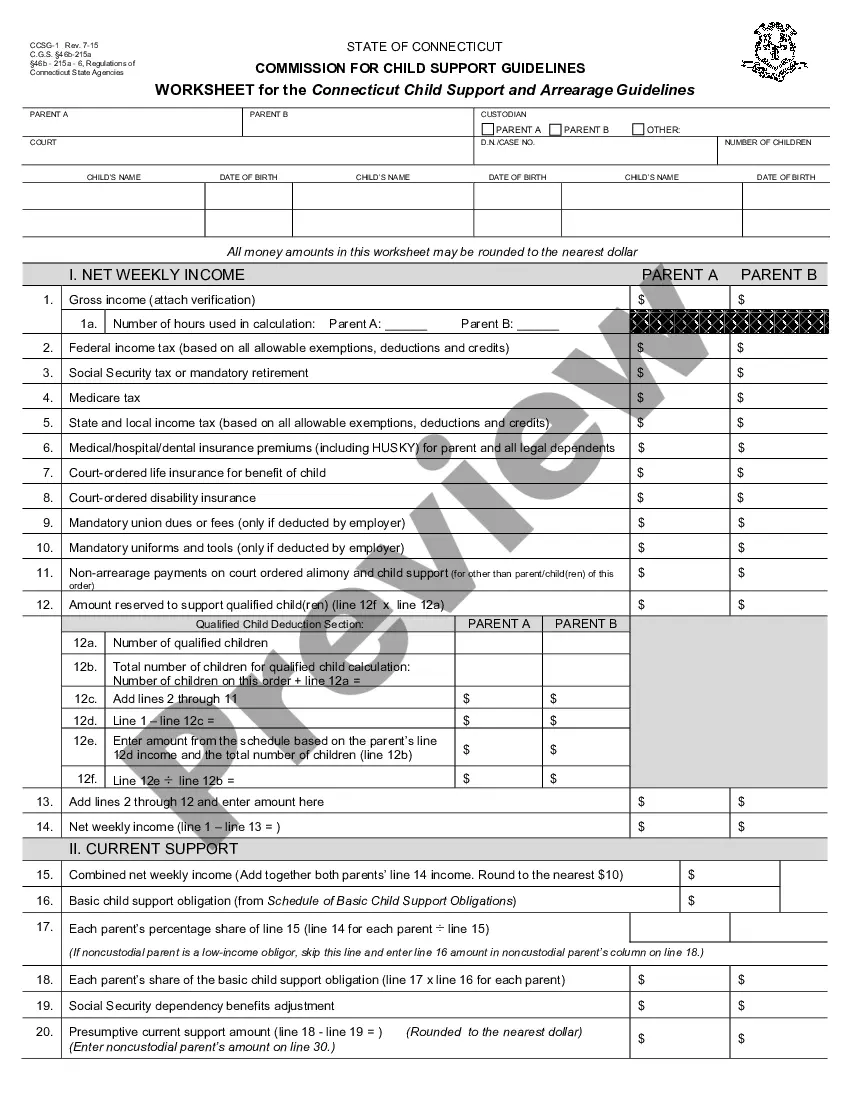

Contractor Withholding Tax

Description

How to fill out Colorado Painting Contractor Package?

Individuals often link legal documentation with complexity that only an expert can handle.

In a certain sense, this is accurate, as preparing Contractor Withholding Tax requires comprehensive understanding of subject matter standards, including state and local laws.

However, with US Legal Forms, the process has become simpler: pre-designed legal templates for various life and business circumstances relevant to state regulations are collated in one online catalog and are now accessible to all.

All templates in our collection are reusable: once obtained, they remain stored in your profile. You can access them whenever required through the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms features over 85,000 current forms categorized by state and area of application, allowing you to search for Contractor Withholding Tax or any other specific template in just a few minutes.

- Returning users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users will need to first create an account and subscribe before they can download any documents.

- Here is the detailed guide on how to obtain the Contractor Withholding Tax.

- Examine the page content thoroughly to ensure it meets your requirements.

- Review the form description or inspect it through the Preview option.

- Look for another template using the Search bar in the header if the previous one doesn't meet your expectations.

- Click Buy Now when you locate the appropriate Contractor Withholding Tax.

- Select a pricing plan that aligns with your needs and financial capacity.

- Create an account or Log In to continue to the payment page.

- Complete payment for your subscription via PayPal or with your credit card.

- Choose the format for your document and click Download.

- Print your document or import it into an online editor for faster completion.

Form popularity

FAQ

Corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents, generally at the rate of 25% in the case of payments to non-resident foreign corporations and for non-resident aliens not engaged in trade or business (see the Income determination section

You may have to pay provisional tax. Sometimes payments made under a contract are taxed at a flat rate, called a withholding payment or schedular payment tax is withheld from your fee.

The standard withholding rate is 20%, if the contractor is working through a labour-hire firm, or if there is a particular schedular rate set out in legislation, then this rate will apply (these are the old rates that apply to contractors such as entertainers, labourers, farm workers and so on).

The contractor needs to give you a completed Tax rate notification for contractors - IR330C. If the contractor does not give you an IR330C you need to deduct tax at either: the 45% non notified rate. 20% if the contractor is a non resident company.

4. The Income Tax Act require that withholding income tax be deducted at the appropriate resident or non-resident rate, as the case may be, on any payments made to contractors or other persons engaged in the implementation of OAFPs.