Sale Motor Vehicle With Lienholder

Description

How to fill out Colorado Power Of Attorney For Sale Of Motor Vehicle?

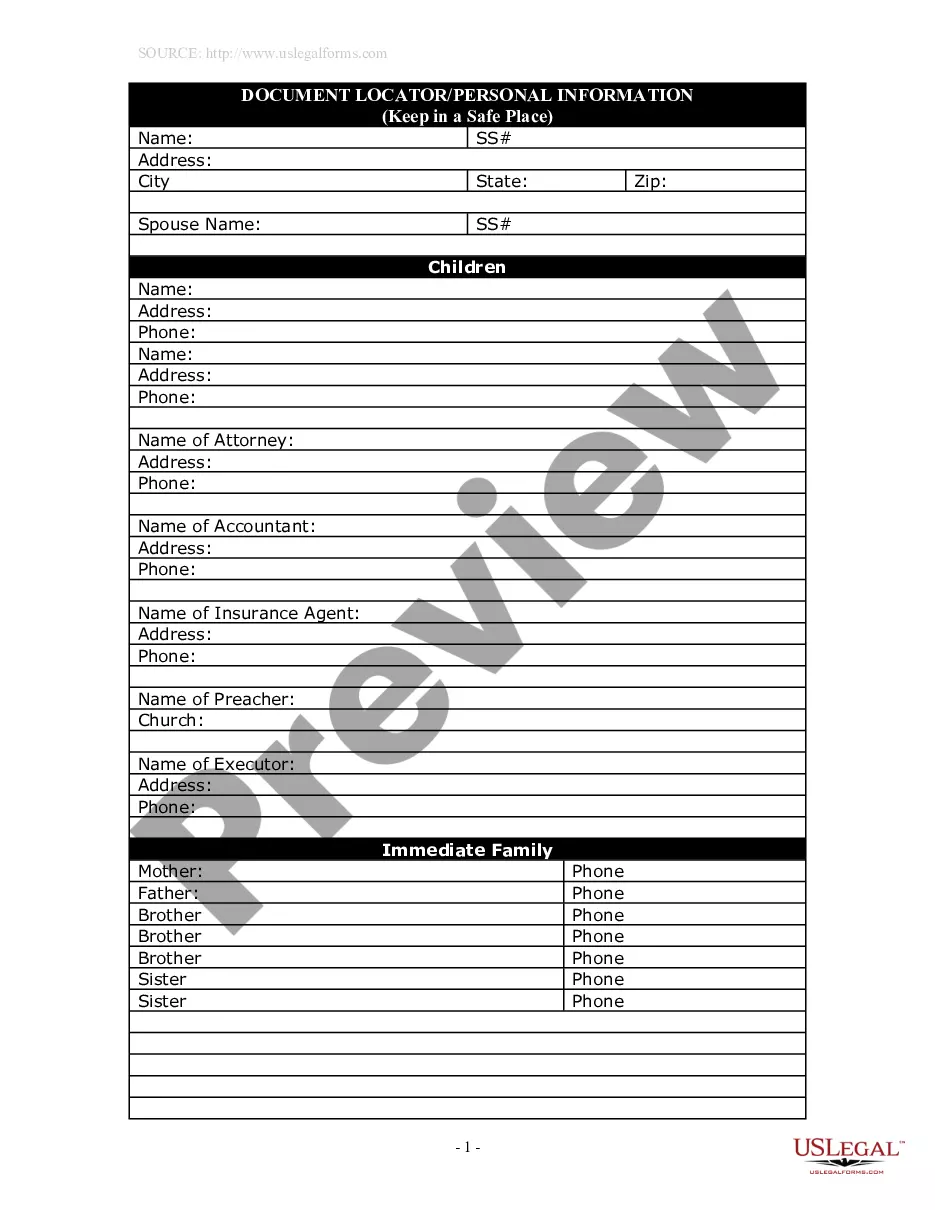

- Log into your US Legal Forms account. If you're a new user, start by creating an account for access.

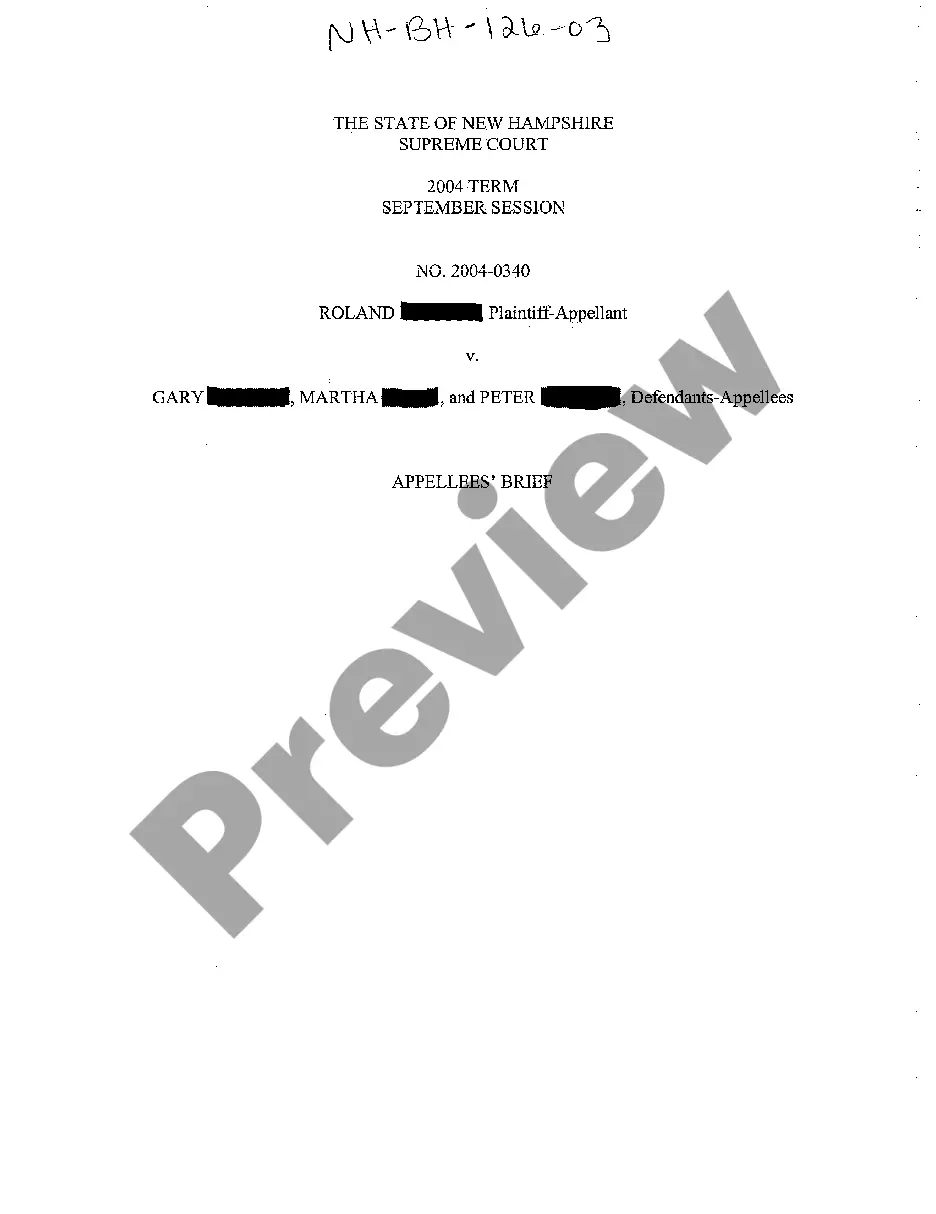

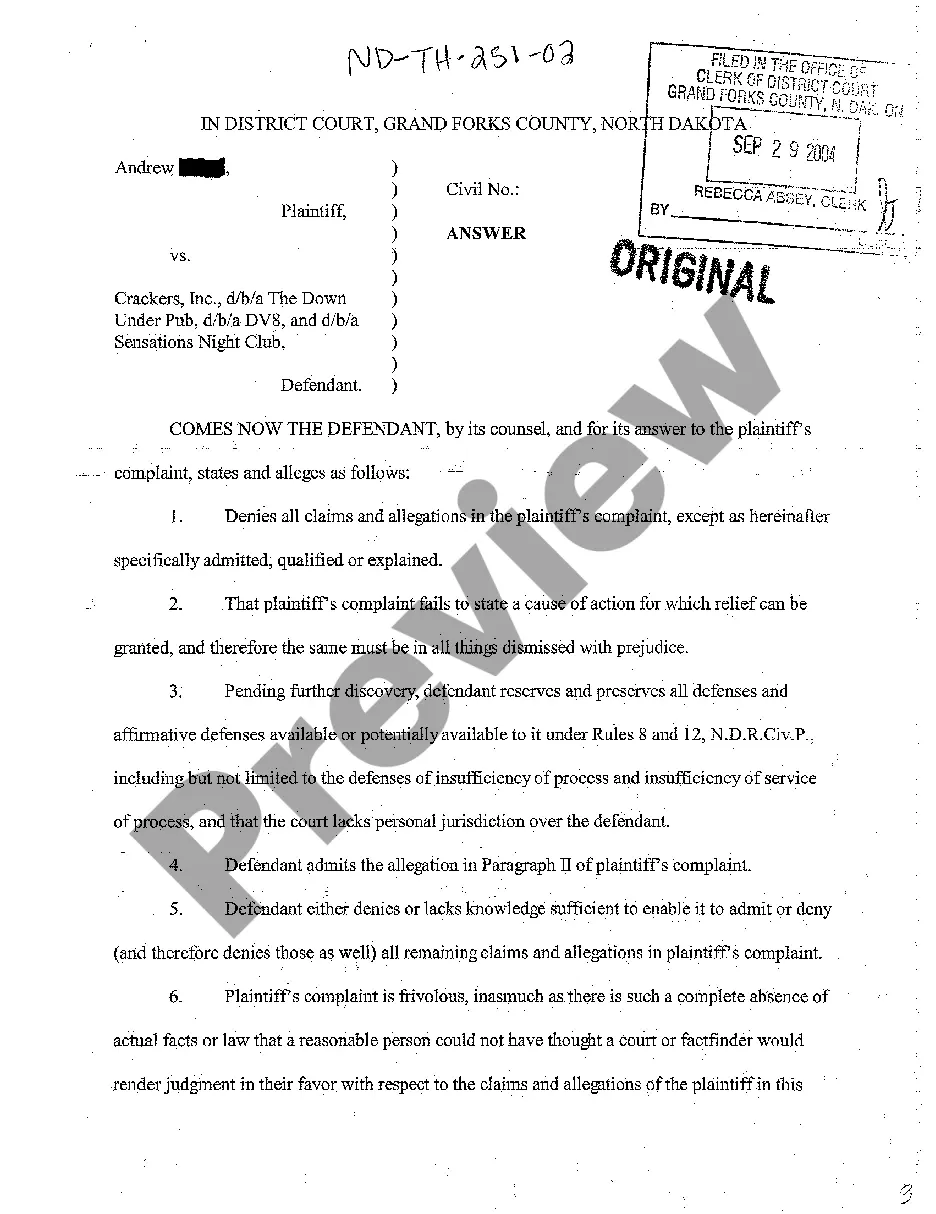

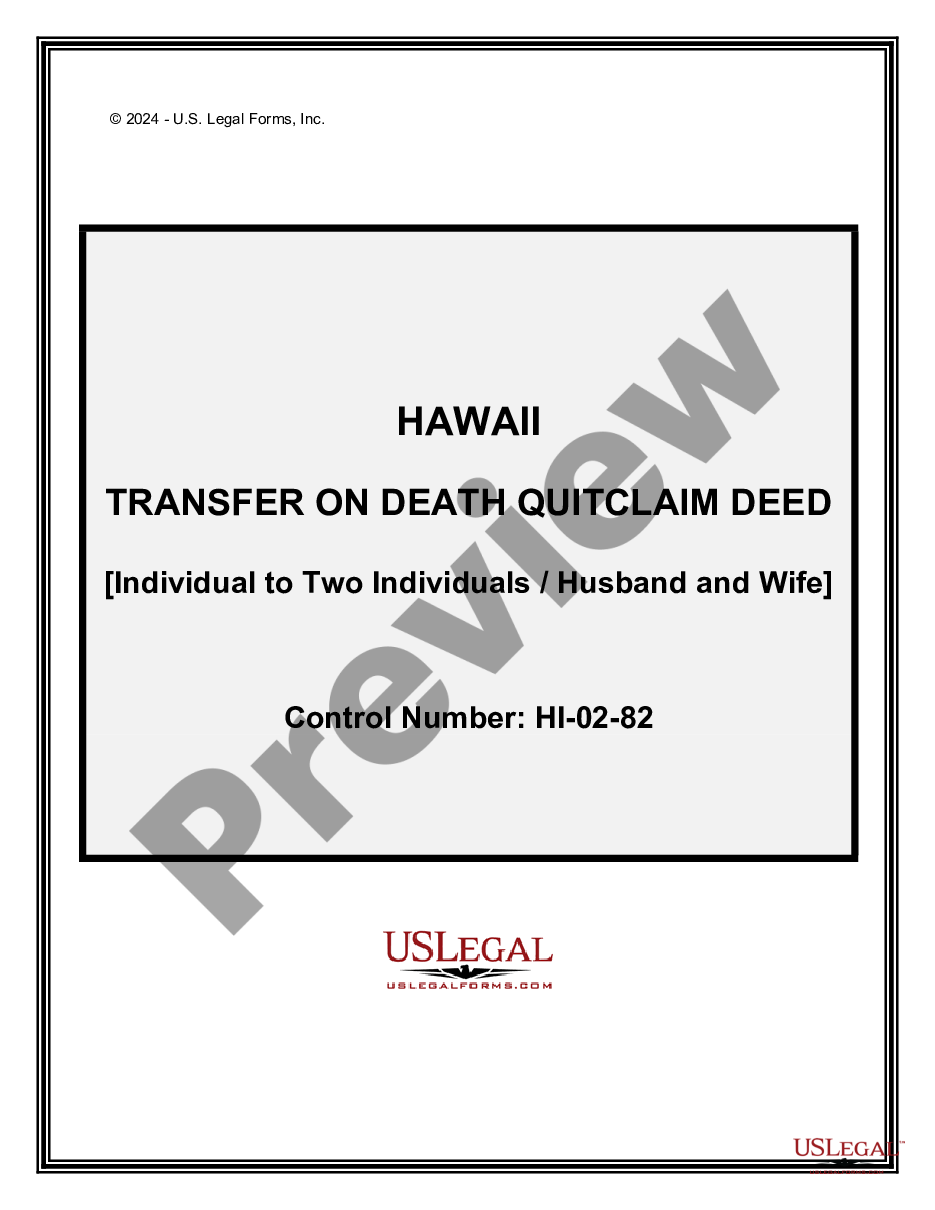

- Browse the preview mode and read the form description carefully to ensure you have the right document that meets your specific legal needs and jurisdiction.

- If the form isn't suitable, utilize the Search feature to find a more appropriate template for your requirements.

- Select the desired form and hit the Buy Now button. Choose a subscription plan that fits your needs and complete the registration process.

- Input your payment details, either through credit card or PayPal, to finalize your purchase.

- Once payment is confirmed, download your form to your device, where it will be available under My Forms in your profile for future reference.

In conclusion, utilizing US Legal Forms simplifies the process of selling a motor vehicle with a lienholder. Their extensive library and premium expert assistance ensure you can handle your legal documentation with ease and confidence.

Start your journey to a hassle-free sale today by exploring our collection of legal forms!

Form popularity

FAQ

A lien on a car signifies that a lender has a legal right to the vehicle until a debt is repaid. This means that if the borrower defaults, the lender can repossess the vehicle. For anyone considering a sale motor vehicle with lienholder, understanding how the lien works is vital to ensure you fulfill your financial responsibilities.

Selling a car with a lien is not illegal, but it requires proper handling of the lien once the sale occurs. The seller is responsible for disclosing the lien to the buyer and resolving it typically during the transaction. It’s essential to approach a sale motor vehicle with lienholder carefully to protect the interests of both the buyer and seller.

In Ohio, the seller must sign the title to complete the transfer of ownership, but their physical presence is not always necessary. If the seller cannot be present, they can authorize someone else to sign on their behalf with a notarized signature. However, for a sale motor vehicle with lienholder, it's best to ensure all parties are involved to meet legal requirements.

In California, a lien sale occurs when a lienholder reclaims a vehicle due to unpaid debts. The lienholder must follow specific procedures, including notification to the vehicle owner and published notice of the sale. After fulfilling the legal requirements, the lienholder can sell the vehicle to recover the owed amount. Understanding this process can assist in managing your own sale of a motor vehicle with lienholder.

To title a car with a lien, begin by contacting your lienholder for the necessary documents. They will often provide a lien release form, which you must obtain before the title transfer. Once you have the lien release, visit your local Department of Motor Vehicles (DMV) and submit the required paperwork. By doing this, you ensure a clear title when you decide to sell the motor vehicle with lienholder.

To transfer ownership of a car in Maryland, you must complete the title transfer by signing the back of the title and providing the buyer with a bill of sale if desired. If the vehicle has a lienholder, obtain a lien release document to show that any loans have been cleared. Finally, the buyer needs to visit the Motor Vehicle Administration (MVA) office with these documents to finalize the ownership transfer. For detailed forms and instructions, you can explore resources at US Legal Forms.

In Wisconsin, a bill of sale is not legally required for selling a car; however, it's a smart move. Creating a bill of sale can help verify the transfer of ownership, particularly when you sell a motor vehicle with a lienholder involved. This document can also help clarify the terms of sale, making the transaction smoother for both you and the buyer. You can find ready-to-use templates on US Legal Forms to simplify this step.

In Maryland, a bill of sale is not mandatory for most car transactions, but it is highly recommended. This document serves as a record of the sale when you sell a motor vehicle with a lienholder. It helps protect both parties by detailing the sale conditions and can be necessary for tax purposes. Consider using a bill of sale template from US Legal Forms to ensure you cover all the important details.