Promissory Note With Co-maker

Description

How to fill out Promissory Note With Co-maker?

Bureaucracy necessitates exactness and correctness.

Unless you handle paper completion like Promissory Note With Co-maker regularly, it might lead to some confusions.

Choosing the appropriate example from the outset will ensure that your document submission will proceed without issues and avert any hassles of re-sending a document or repeating the same task from the beginning.

If you are not a subscribed user, finding the needed sample would require a few additional steps: Locate the template by utilizing the search bar. Ensure the Promissory Note With Co-maker you’ve found is valid for your state or region. View the preview or check the description that includes the details on applying the sample. If the outcome meets your query, click the Buy Now button. Choose the appropriate option among the suggested subscription plans. Sign in to your account or register for a new one. Complete the acquisition using a credit card or PayPal payment method. Save the form in your preferred format. Obtaining the correct and current samples for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and streamline your form handling.

- Obtain the suitable example for your paperwork in US Legal Forms.

- US Legal Forms is the largest online repository of forms that provides over 85 thousand samples across various fields.

- You can access the latest and most relevant version of the Promissory Note With Co-maker by simply searching it on the site.

- Locate, preserve, and download templates in your profile or verify with the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can gather, keep in one location, and review the templates you save for easy access in just a few clicks.

- When you're on the site, click the Log In button to sign in.

- Then, navigate to the My documents page, where your document history is archived.

- Peruse the form descriptions and download the ones you need at any time.

Form popularity

FAQ

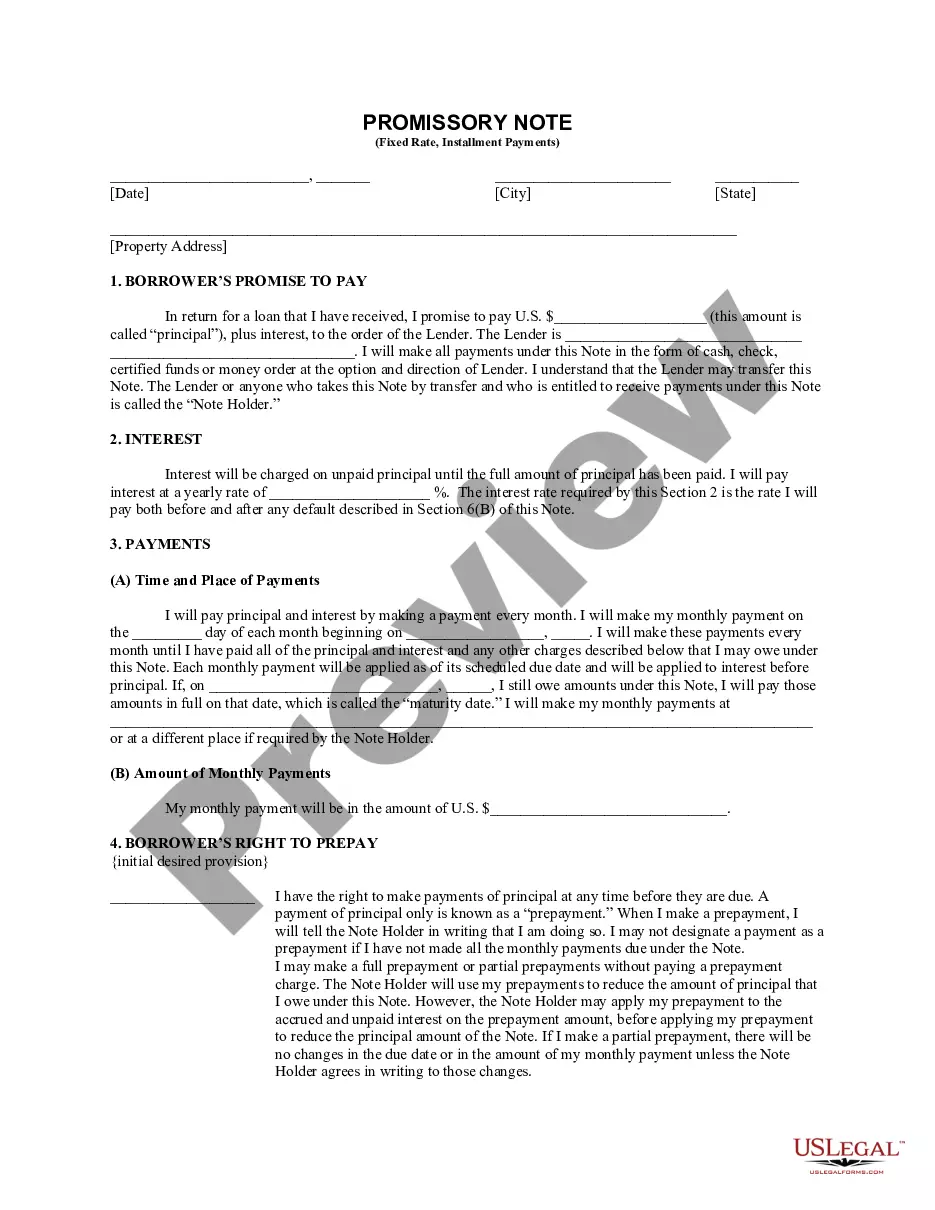

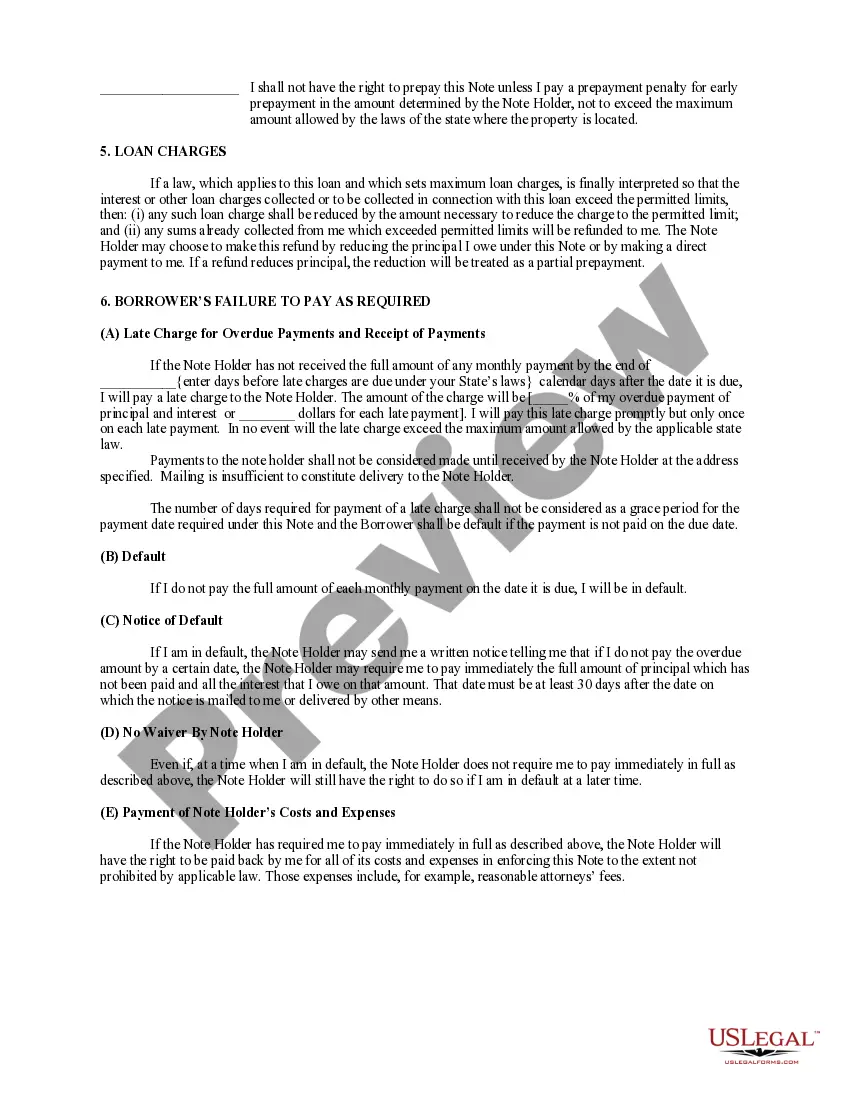

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A person who signs a promissory note along with the primary borrower. A co-maker's signature guarantees that the loan will be repaid, because the borrower and the co-maker are equally responsible for the repayment.