Affidavit Of Due Diligence Within Acquisitions

Description

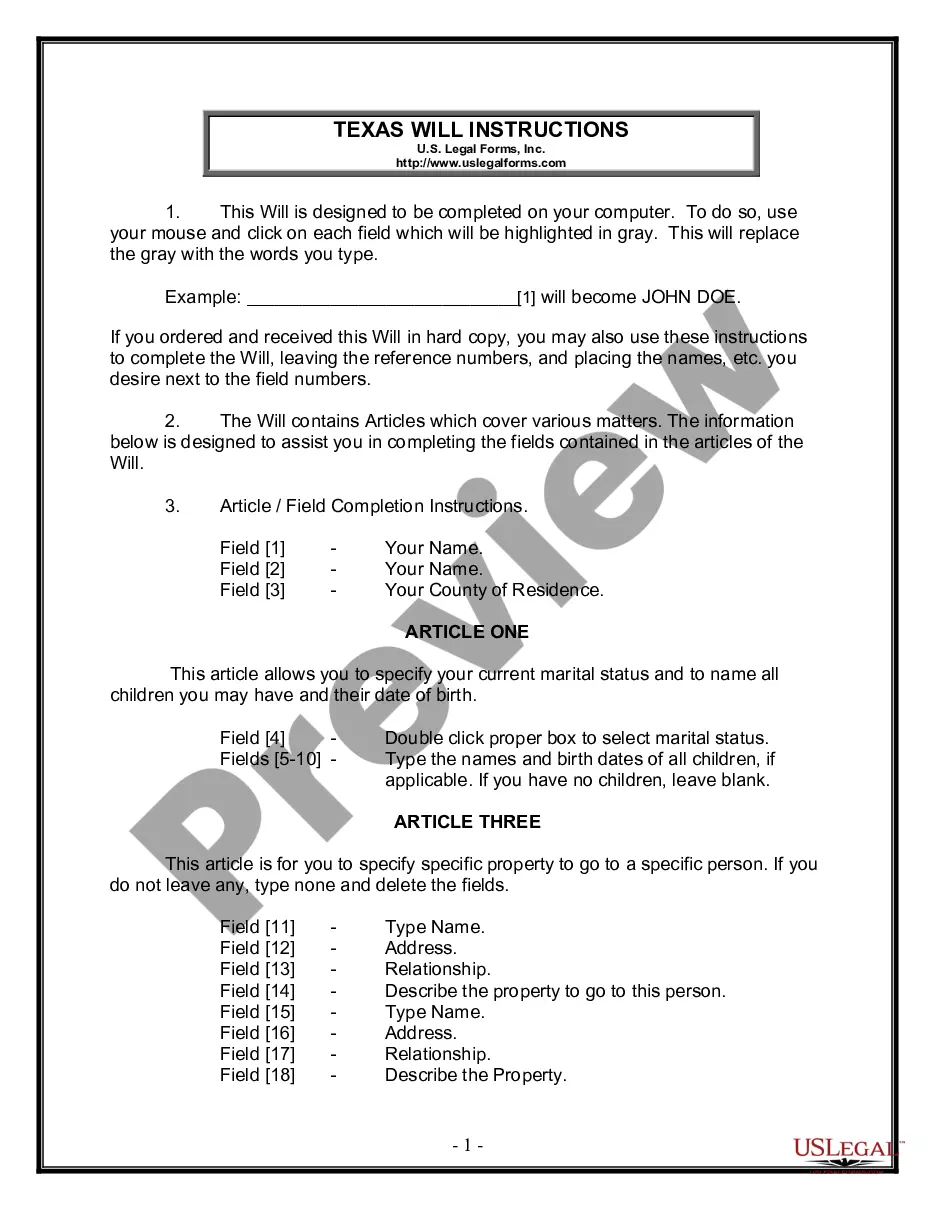

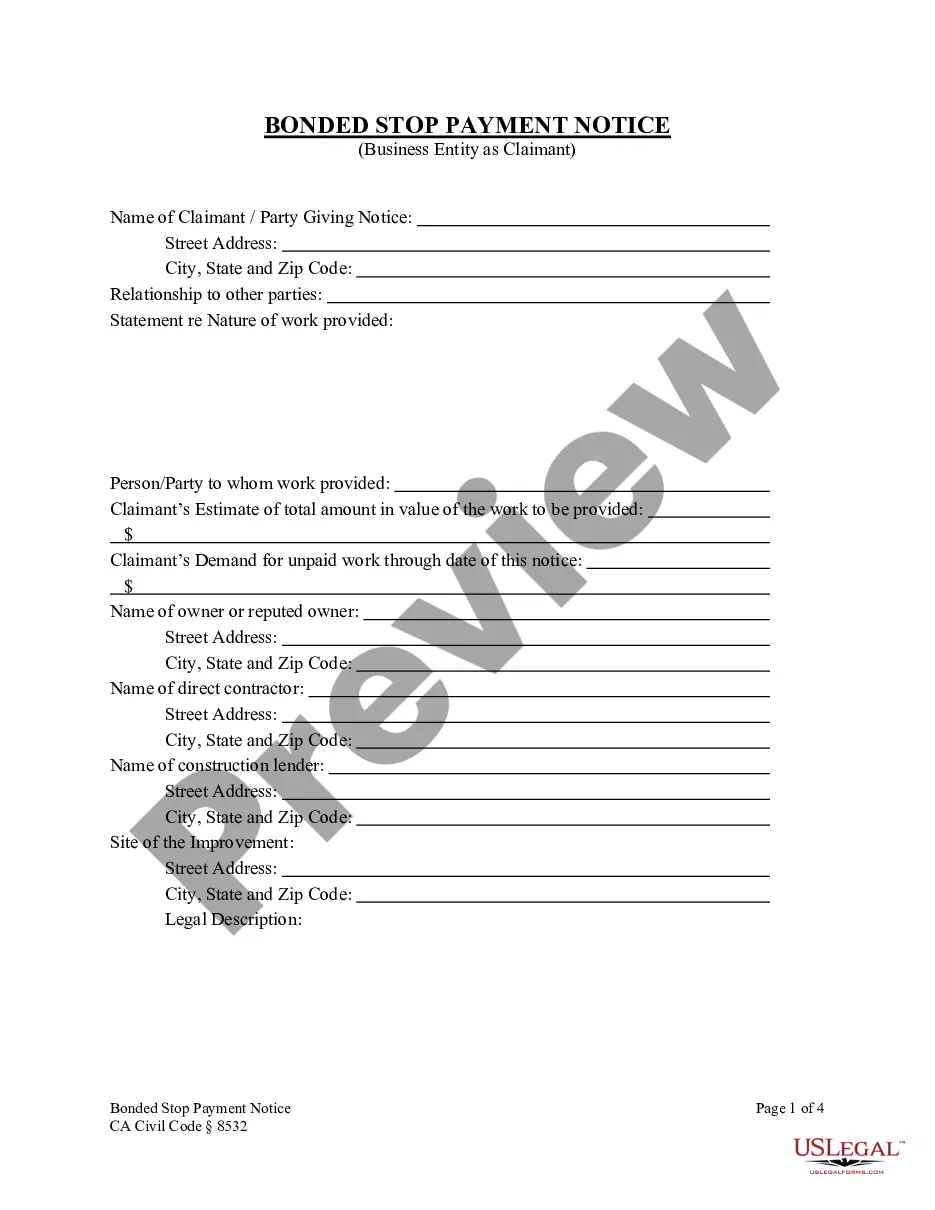

How to fill out Colorado Affidavit Regarding Due Diligence And Proof Of Publication?

There is no longer a necessity to invest countless hours searching for legal paperwork to fulfill your local jurisdiction requirements. US Legal Forms has gathered all of them in one location and eased their availability.

Our website presents over 85,000 templates for a variety of business and personal legal circumstances compiled by state and area of application. All documents are expertly written and verified for accuracy, allowing you to confidently obtain an up-to-date Affidavit Of Due Diligence Within Acquisitions.

If you are acquainted with our service and already possess an account, it is important to verify that your subscription is active before downloading any templates. Log In to your account, choose the document, and click Download. You can also access all previously acquired documents whenever necessary by selecting the My documents tab in your profile.

Print your form to fill it out in writing or upload the document if you prefer to complete it using an online editor. Organizing formal paperwork in compliance with federal and state laws and regulations is rapid and simple with our library. Try US Legal Forms today to maintain your documentation in order!

- If you haven't interacted with our service previously, the procedure will necessitate additional steps to finalize.

- Here's how new users can access the Affidavit Of Due Diligence Within Acquisitions from our collection.

- Review the page content thoroughly to ensure it includes the example you require.

- To do so, utilize the form description and preview options if available.

- Use the search field above to look for another template if the one currently displayed isn't suitable for you.

- Click Buy Now adjacent to the template title when you identify the right one.

- Select the most suitable pricing plan and create an account or Log In.

- Complete your subscription payment using a credit card or via PayPal to continue.

- Choose the file format for your Affidavit Of Due Diligence Within Acquisitions and download it to your device.

Form popularity

FAQ

Financial InformationReviewed financial statements.Description of accounting methods and treatments.Disclosure of any accounting issues.Historical cash flows.Monthly income statements and balance sheets.Detailed information on indebtedness and financial arrangements, to include all related documentation.More items...

In the M&A process, due diligence allows the buyer to confirm pertinent information about the seller, such as contracts, finances, and customers. By gathering this information, the buyer is better equipped to make an informed decision and close the deal with a sense of certainty.

Below are typical due diligence questions addressed in an M&A transaction:Target Company Overview. Understanding why the owners of the company are selling the business Financials.Technology/Patents.Strategic Fit.Target Base.Management/Workforce.Legal Issues.Information Technology.More items...

Step one: Collect documents for due diligence well in advanceCompany and legal structure.Trade register excerpts.Licences, approvals, permits and certificates.Shareholders' agreement.Corporate history.Articles of incorporation.By-laws.Lists of all current shareholders.More items...?08-Aug-2019

The due diligence business definition refers to organizations practicing prudence by carefully assessing associated costs and risks prior to completing transactions. Examples include purchasing new property or equipment, implementing new business information systems, or integrating with another firm.