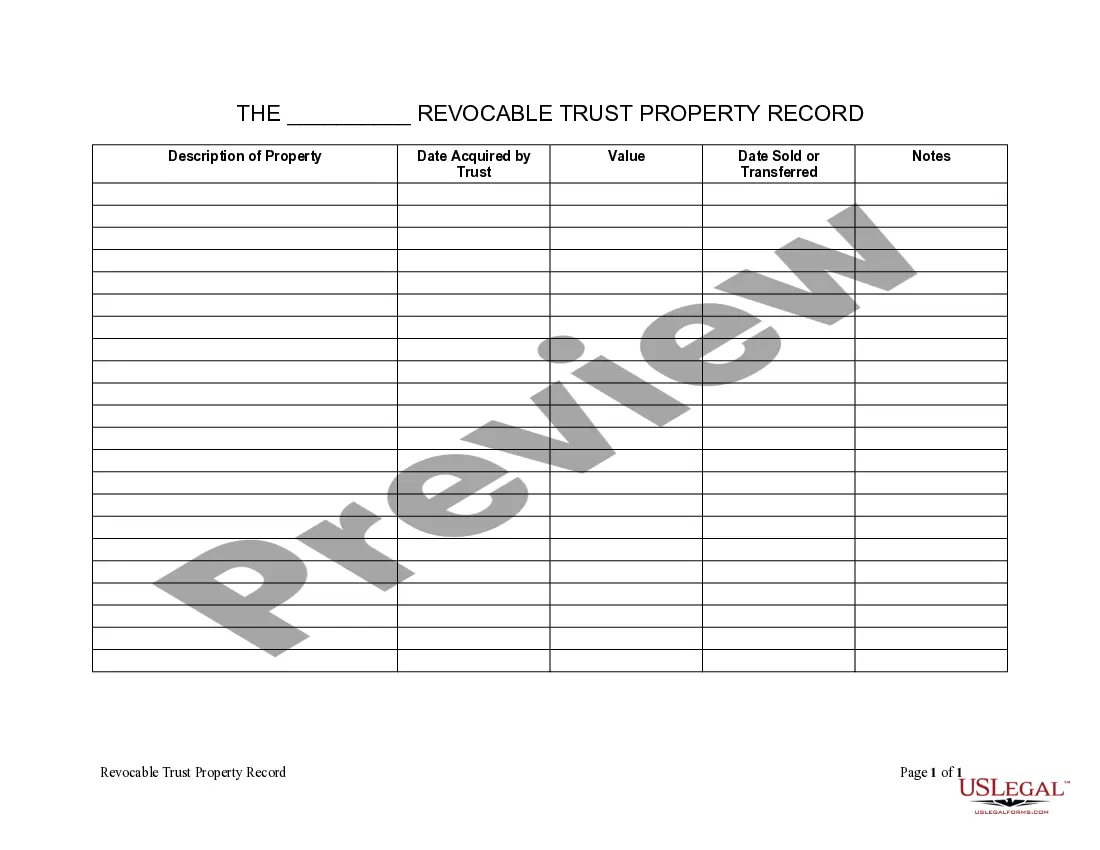

Living Trust Property With A Title

Description

How to fill out Colorado Living Trust Property Record?

- Visit the US Legal Forms website and log in to your account. If you're a new user, create an account to start accessing legal documents.

- Search for the living trust form that aligns with your local regulations. Use the Preview mode to review the document's details carefully.

- If necessary, find alternative forms using the Search tab to ensure you have the correct document for your situation.

- Select the form you want and click the Buy Now button. Choose your preferred subscription plan to access the entire library.

- Complete your transaction by entering your payment information, whether through credit card or PayPal.

- After your purchase, download the form to your device. You can access it anytime from the My Forms section in your profile.

By utilizing US Legal Forms, you empower yourself with a robust library of legal resources, ensuring that your living trust property and its title are handled accurately and legally.

Get started today and secure your financial future by visiting US Legal Forms!

Form popularity

FAQ

Deciding whether to put assets in a trust, particularly living trust property with a title, depends on your parents’ financial goals and circumstances. A trust can offer significant benefits such as avoiding probate and ensuring a smoother asset transfer after their passing. However, it's crucial for them to consult with an expert to make an informed decision that fits their individualized estate plan.

One disadvantage of a family trust is that it can limit flexibility in how living trust property with a title is managed and distributed. Depending on the trust's terms, family members may have limited access to funds or assets can be tied up for an extended period. Furthermore, without proper guidance, family dynamics can create tensions when managing the trust.

A significant drawback of having a trust is the ongoing administrative responsibility that comes with managing living trust property with a title. Trustees must maintain records, manage investments, and adhere to legal requirements, which can become burdensome. Additionally, if the trust is improperly set up, it may not provide the desired benefits, complicating the estate planning process.

Many parents overlook the importance of clear communication when setting up a trust fund involving living trust property with a title. This often leads to confusion among heirs, especially regarding their roles and expectations. By actively discussing your intentions and ensuring all parties understand the trust's workings, you can avoid significant future disagreements.

When you place living trust property with a title into a trust, you may face complexities such as administrative costs and potential tax implications. Additionally, if not properly managed, a trust can lead to misunderstandings among your beneficiaries about asset distribution. It's essential to evaluate these aspects to ensure your estate planning aligns with your goals.

Holding property in a trust offers several advantages, such as avoiding probate, providing privacy, and protecting assets from creditors. However, it can also involve costs for setup and ongoing management. While living trust property with a title can simplify your estate process, it's important to weigh these benefits against potential downsides. Considering a platform like USLegalForms can guide you through the process, helping you make informed decisions.

When something is held in trust, it means that an asset is managed by a trustee on behalf of beneficiaries. This includes making decisions about the asset according to the trust's rules. Properties like living trust property with a title can be safeguarded from creditors and facilitate smooth transitions of ownership. Overall, it allows you to specify how and when the benefits of your property will be distributed.

A title held in trust means that the trust company or naming trustee is the legal owner of the property title. This arrangement allows the trustee to administer the property based on your instructions outlined in the trust. Such a framework can provide good asset protection and streamline the process of passing on property to heirs. Essentially, it helps maintain control over your property even after you're gone.

When land is held in trust, it signifies that the property is legally owned by the trust rather than an individual. The trustee is responsible for managing the land and ensuring it benefits the beneficiaries according to the trust agreement. This arrangement can protect your assets from certain risks while providing clear guidelines for distribution. Moreover, it ensures that your wishes are honored in the management of the property.

When a title is held in a trust, it indicates that the trust now owns the property, not you as an individual. This means the trustee manages the property on behalf of beneficiaries according to the trust’s terms. By holding property in a trust, you can control how the assets are distributed after your passing, ensuring peace of mind. It also simplifies the transfer process, avoiding probate.