Non-foreign Affidavit For Corporation

Description

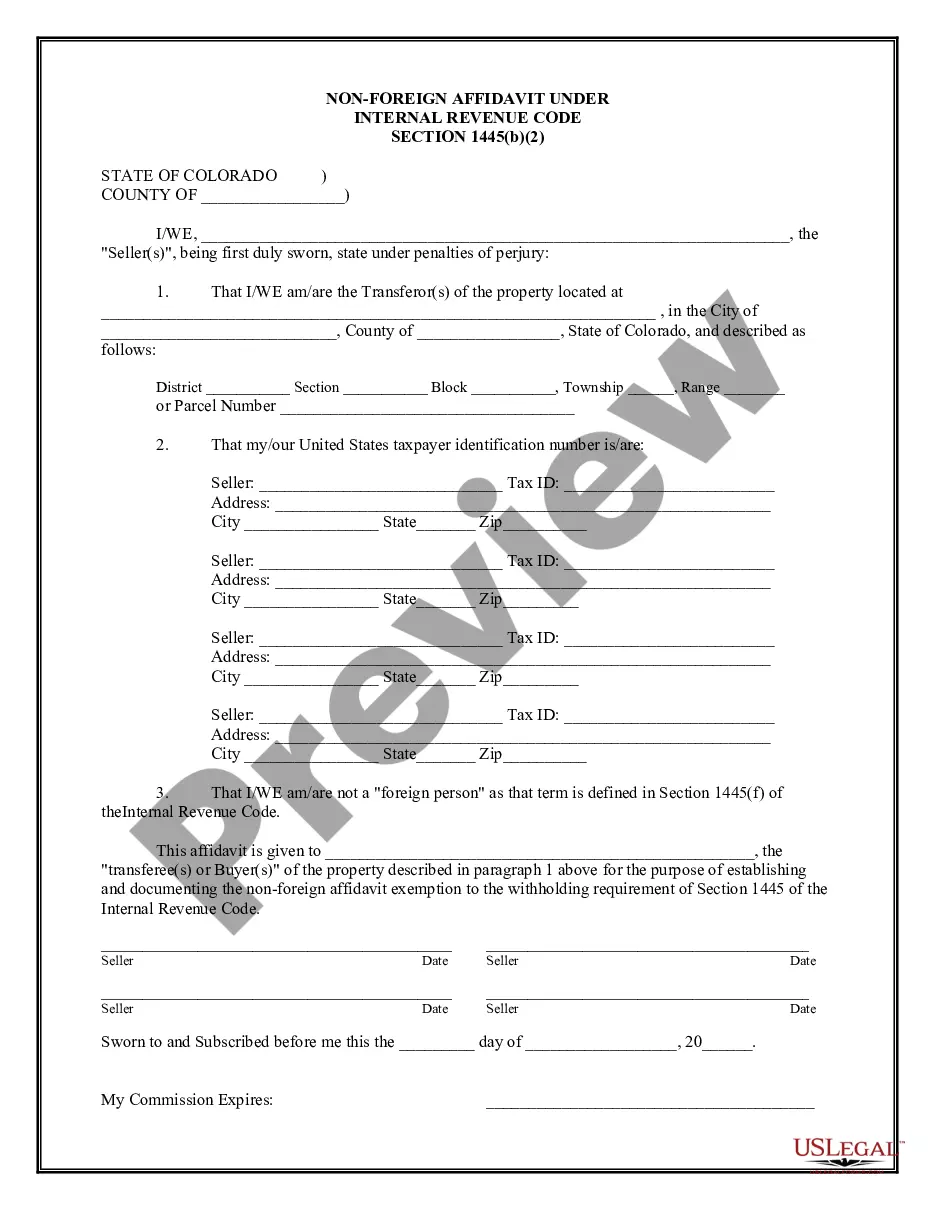

How to fill out Non-foreign Affidavit For Corporation?

Individuals typically link legal documentation with something intricate that only an expert can handle.

In a sense, this is accurate, as creating a Non-foreign Affidavit For Corporation requires substantial knowledge in subject matter, encompassing state and local laws.

Nonetheless, with US Legal Forms, everything has become simpler: pre-prepared legal forms for any personal and business situation specific to state regulations are gathered in a single online repository and are now open to everyone.

All templates in our collection are reusable: once obtained, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- Assess the page content thoroughly to confirm it aligns with your requirements.

- Review the form description or validate it through the Preview option.

- Find another example using the Search field in the header if the previous one isn't suitable for you.

- Click Buy Now once you locate the appropriate Non-foreign Affidavit For Corporation.

- Choose a subscription plan that suits your needs and budget.

- Establish an account or sign in to move forward to the payment page.

- Complete the payment for your subscription via PayPal or with your credit card.

- Choose the format for your sample and click Download.

- Print your document or upload it to an online editor for a faster fill-out.

Form popularity

FAQ

FIRPTA stands for Foreign Investment In Real Property Tax Act (26 USC §1445). It is a tax law designed to ensure payment of tax to the Internal Revenue Service (IRS), as may be due, when US property is sold by any foreign person.

Domestic corporations are not subject to the withholding rules under FIRPTA, so withholding will not be required in cases where entities otherwise subject to withholding have elected to be taxed as a domestic corporation.

foreign person affidavit is made by a seller of a real property stating that s/he is a nonforeign seller as defined by the Internal Revenue Code Section 26 USC 1445. The nonforeign affidavit is required to afford the buyer with guarantee that the seller is not a foreign person.

The FIRPTA affidavit is for all those local sellers who are not foreigners. This form certifies that the seller of the real estate property is a local seller, and a non-resident alien to provide income tax to the Internal Revenue Service. This form can help your seller in avoiding the FIRPTA withholding.

The FIRPTA law says that if the seller is a foreign person, the transferee i.e. the buyer, is the Withholding Agent3 that is legally responsible for collecting the tax and forwarding it to the IRS.