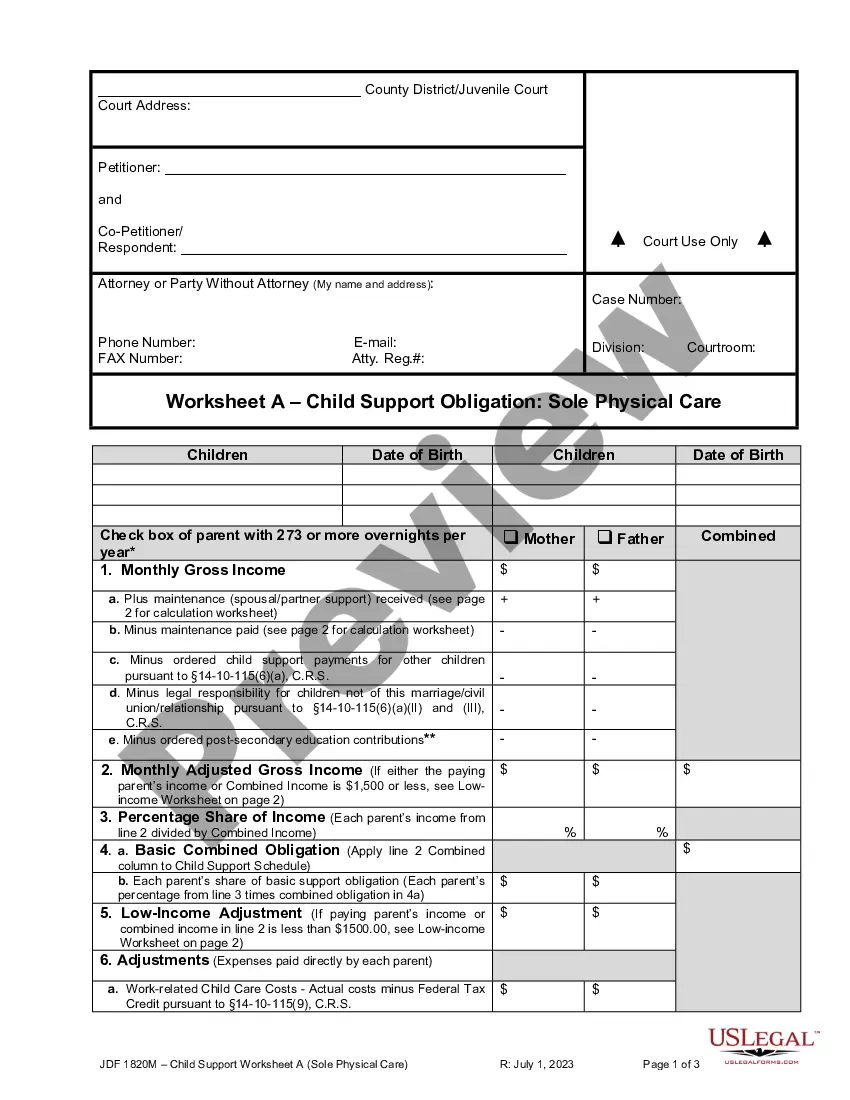

Child Support Worksheet B Colorado Withholding

Description

How to fill out Colorado Child Support Worksheet B?

It’s well-known that you cannot transform into a legal professional in a short period, nor can you swiftly learn to accurately create the Child Support Worksheet B Colorado Withholding without a specialized background.

Assembling legal documents is a lengthy process that requires particular training and expertise. So why not entrust the creation of the Child Support Worksheet B Colorado Withholding to the experts.

With US Legal Forms, which boasts one of the most comprehensive legal document repositories, you can find everything from court forms to templates for internal communication.

You can regain access to your forms from the My documents section at any time. If you are a current client, you can simply Log In and locate and download the template from the same section.

No matter the reason for your documents—whether they are for financial, legal, or personal use—our platform has you covered. Give US Legal Forms a try today!

- Find the document you require using the search function at the top of the webpage.

- View a preview (if available) and read the accompanying description to ascertain if the Child Support Worksheet B Colorado Withholding meets your needs.

- If you require any other template, restart your search.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. After the payment is finalized, you can acquire the Child Support Worksheet B Colorado Withholding, fill it out, print it, and send or mail it to the involved parties or organizations.

Form popularity

FAQ

Adjusted gross income, the child support obligation must be capped at twenty percent of the obligor's adjusted gross income. The minimum guideline amount for obligors earning less than $1,500 per month shall not apply when each parent keeps the children more than ninety-two overnights each year.

Under Colorado Revised Statutes Section 14-10-115, a parent's adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. Income can refer to more than just the wages you earn at your place of employment, however. Income can refer to: Wages.

A: The standard child support percentage is 20% of the parents' combined gross income. An additional 10% is added for each additional child. If there are extenuating circumstances, the court may call for a higher or lower percentage to reflect your situation.

From Disposable Earnings, child support either takes the full amount for the Frequency or up to 65%. For child support with court ordered health insurance, Disposable Earnings excludes the amount of the employee's health insurance.

Gross income (before taxes) of both parents. The child's income (if any) Number of overnights the child spends with each parent. Expenses, including health insurance and daycare.