Child Support Worksheet B Colorado For Rent

Description

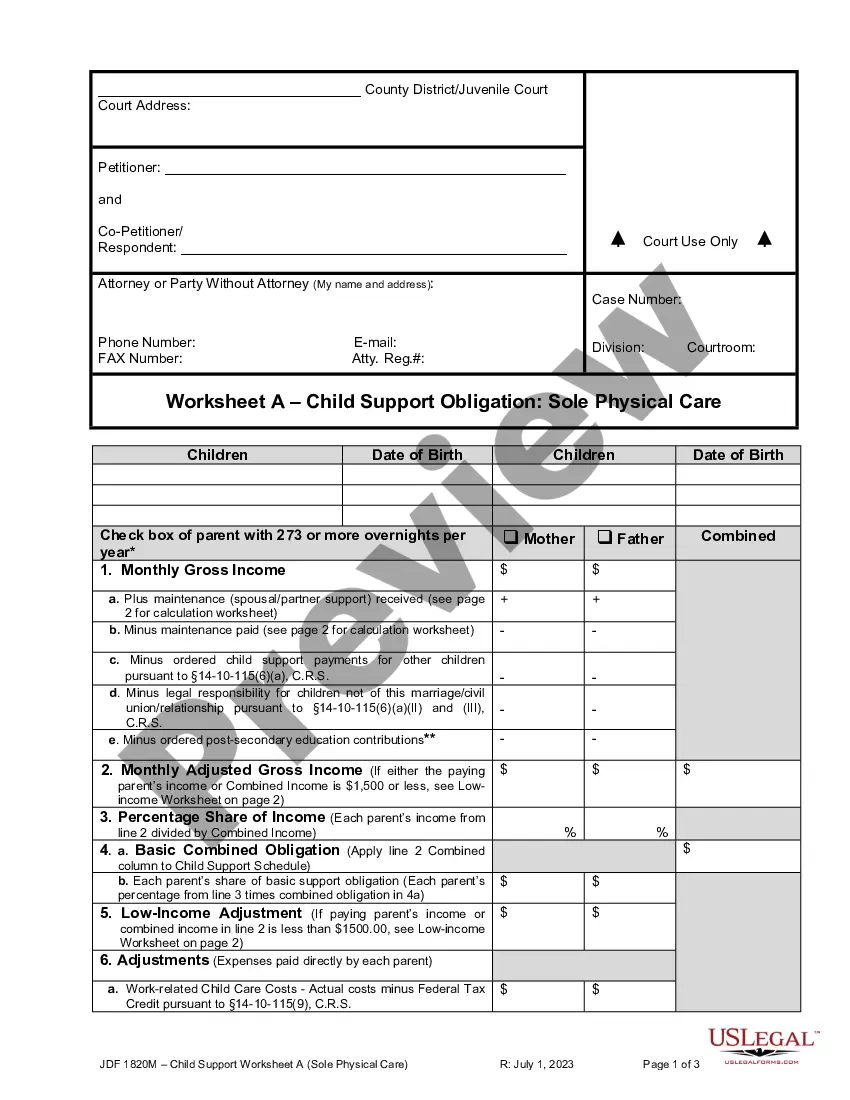

How to fill out Colorado Child Support Worksheet B?

The Child Support Worksheet B Colorado For Rent displayed on this page is a reusable legal document created by expert attorneys in compliance with national and state laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers more than 85,000 confirmed, state-specific templates for various business and personal needs. It's the fastest, simplest, and most dependable method to procure the paperwork you require, as the service ensures the utmost level of data security and anti-malware measures.

Register for US Legal Forms to have verified legal templates for all of life's circumstances at your fingertips.

- Search for the document you require and review it.

- Scan through the sample you looked for and preview it or review the form description to confirm it meets your requirements. If it doesn't, utilize the search bar to find the correct one. Click Buy Now when you have found the document you need.

- Enroll and Log In.

- Choose the pricing option that fits you and create an account. Utilize PayPal or a credit card for a quick checkout. If you hold an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

- Select the format you desire for your Child Support Worksheet B Colorado For Rent (PDF, Word, RTF) and download the document onto your device.

- Complete and endorse the document.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to rapidly and precisely complete and sign your form with a valid signature.

- Download your documents again.

- Utilize the same document again whenever needed. Access the My documents tab in your profile to redownload any previously downloaded forms.

Form popularity

FAQ

Extraordinary medical expenses must be addressed in child support orders. These expenses are any uninsured medical/dental/mental health expenses over $250 per year per child (the first $250 is considered in the basic child support) and may include the costs of: Dental work (e.g., braces) Physical therapy.

Gross income (before taxes) of both parents. The child's income (if any) Number of overnights the child spends with each parent. Expenses, including health insurance and daycare.

Adjusted gross income, the child support obligation must be capped at twenty percent of the obligor's adjusted gross income. The minimum guideline amount for obligors earning less than $1,500 per month shall not apply when each parent keeps the children more than ninety-two overnights each year.

Under Colorado Revised Statutes Section 14-10-115, a parent's adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. Income can refer to more than just the wages you earn at your place of employment, however. Income can refer to: Wages.

A: The standard child support percentage is 20% of the parents' combined gross income. An additional 10% is added for each additional child. If there are extenuating circumstances, the court may call for a higher or lower percentage to reflect your situation.