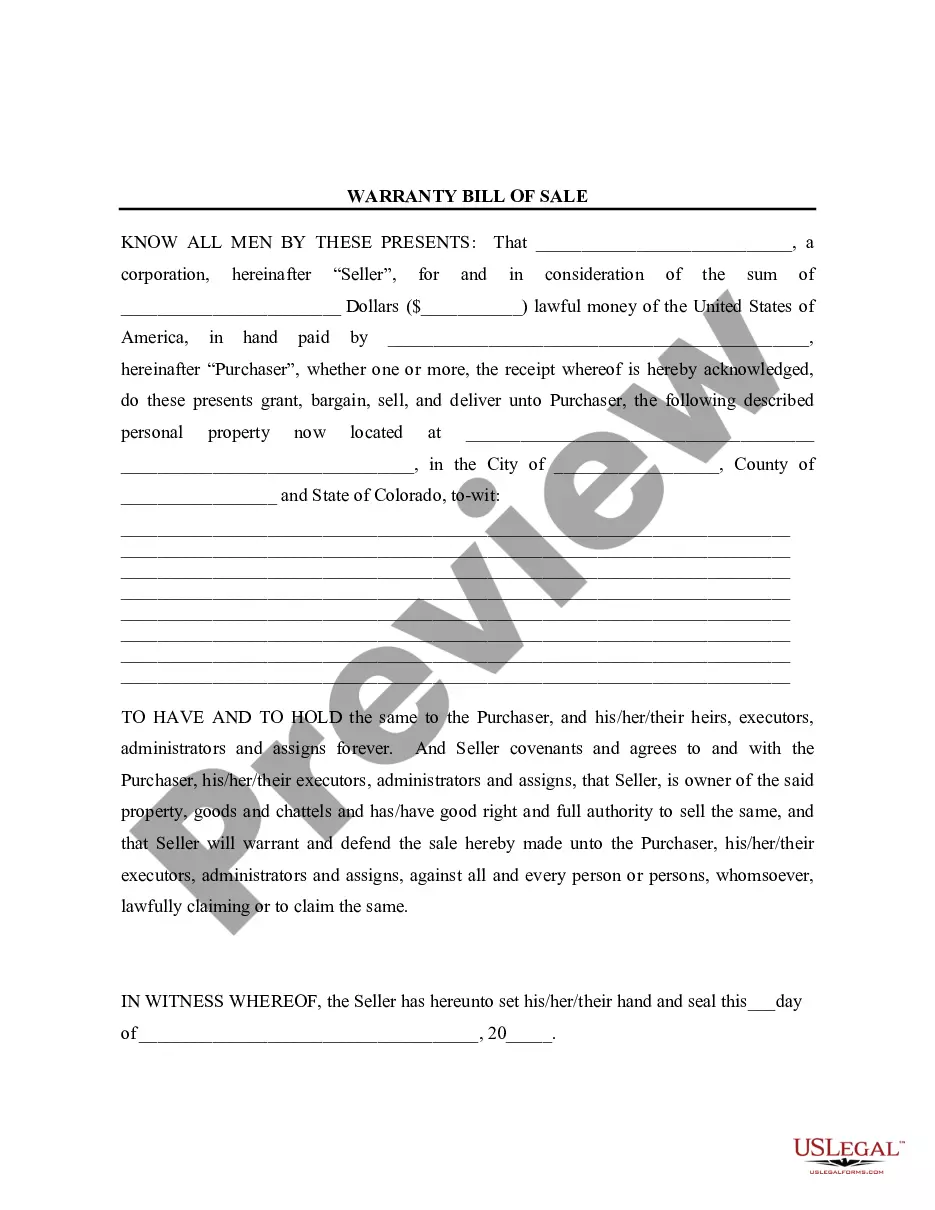

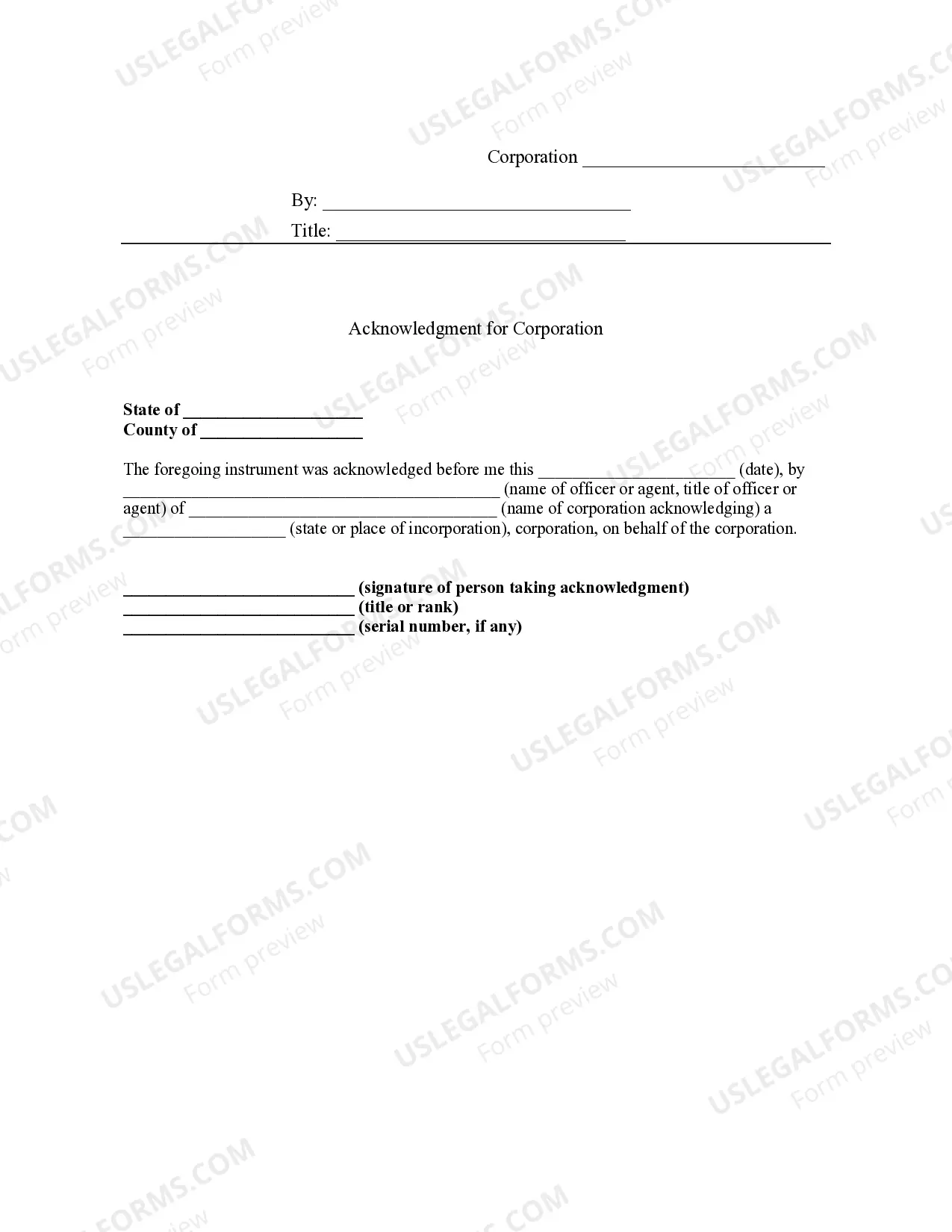

Corporate Bill Of Sale With Odometer Disclosure

Description

How to fill out Colorado Bill Of Sale With Warranty For Corporate Seller?

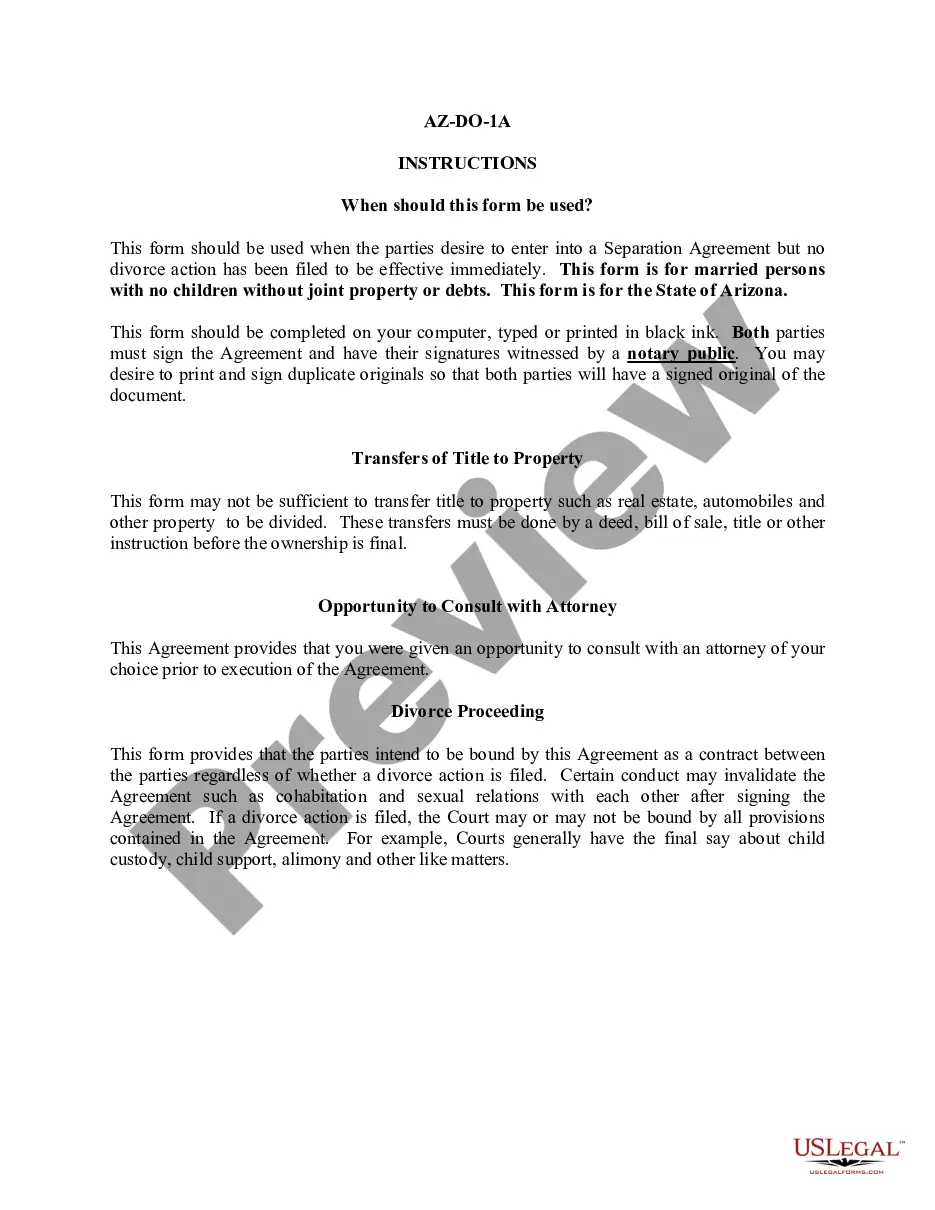

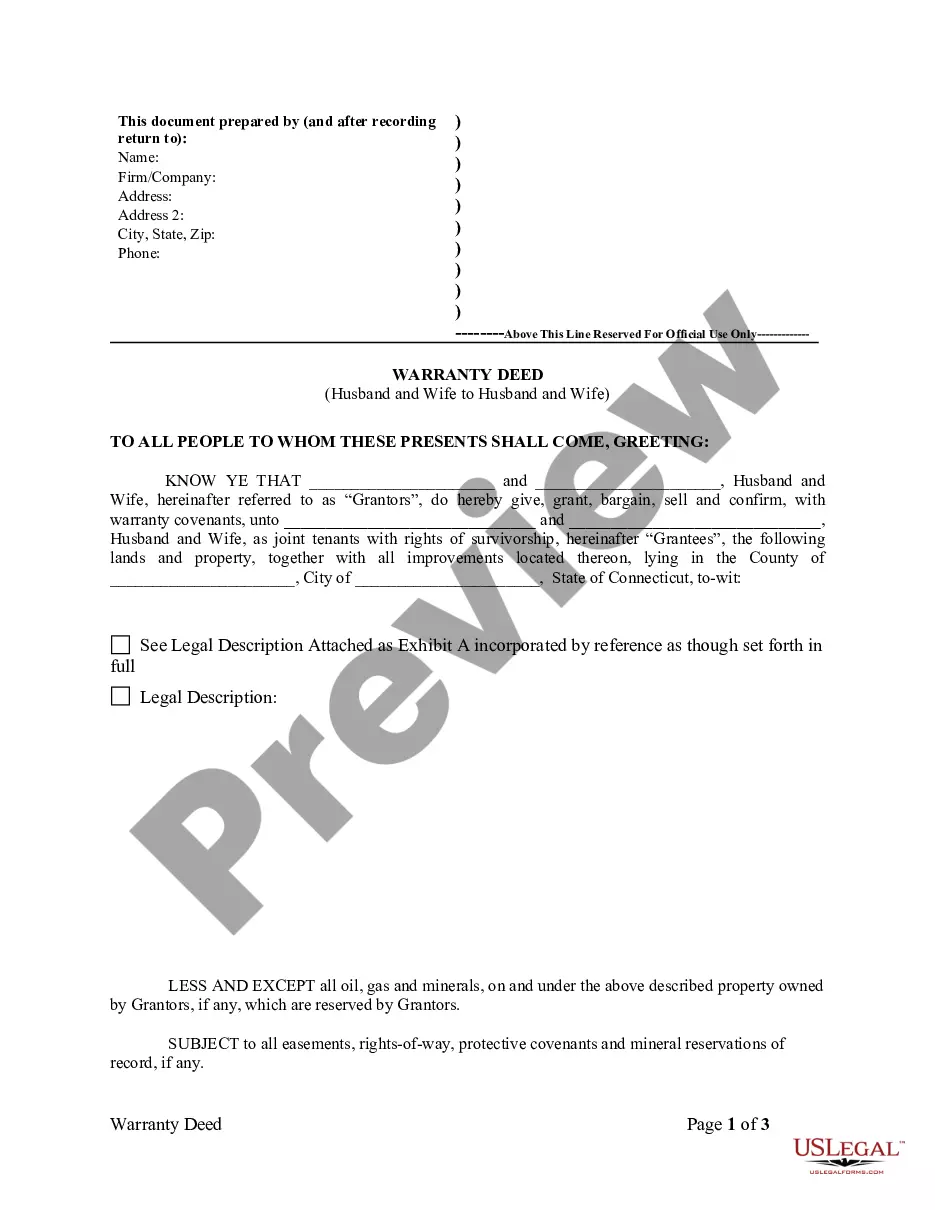

When you have to complete a Corporate Bill Of Sale With Odometer Disclosure that aligns with your local state’s statutes and rules, there can be many choices to select from.

There’s no reason to review each document to confirm it meets all the legal requirements if you're a US Legal Forms member.

It is a trustworthy resource that can assist you in acquiring a reusable and current template on any subject.

Acquiring appropriately drafted formal documents becomes effortless with US Legal Forms. Furthermore, Premium users can also utilize the powerful integrated tools for online document editing and signing. Try it out today!

- US Legal Forms is the largest online repository with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with the regulations of each state.

- Thus, when downloading Corporate Bill Of Sale With Odometer Disclosure from our platform, you can be assured that you possess a valid and contemporary document.

- Acquiring the necessary template from our platform is exceptionally simple.

- If you already hold an account, just Log In to the system, ensure your subscription is current, and save the selected file.

- In the future, you can access the My documents tab in your profile to retrieve the Corporate Bill Of Sale With Odometer Disclosure at any time.

- If it's your initial encounter with our library, please adhere to the instructions below.

- Browse through the suggested page and verify it meets your standards.

Form popularity

FAQ

A Texas Odometer Disclosure Statement should be filled out in the following way:State the seller's name and that the seller certifies that the information listed in this statement is true and accurate.Select the appropriate box to make it clear whether the mileage amount listed is one of the following:More items...

Effective January 1, 2021, the new 20-year exemption for odometer disclosure applies to 2011 and newer model-year vehicles. This means a 2011 model year vehicle will not become exempt from odometer disclosure until the vehicle is 20 years old, which will be January 1, 2031.

PURPOSE: Federal and state law require both seller (transferor) and buyer (transferee) to accurately state the mileage of any used motor vehicle, with a manufacture year of 2011 or newer, in connection with the transfer of ownership whether sale, trade-in or exchange.

An odometer disclosure statement declares the mileage on your vehicle. They are required when buying a new car or selling a used one. You'll typically need to fill out an odometer disclosure statement to declare mileage on any vehicle that's less than 10 years old.

It is not advisable to sell a car with mileage discrepancy as it is unethical. Even though it might seem reasonable for most people, there are those who would use this module for rollback purposes.