Formato De Solicitud De Arrendamiento Minerva Withholding

Description

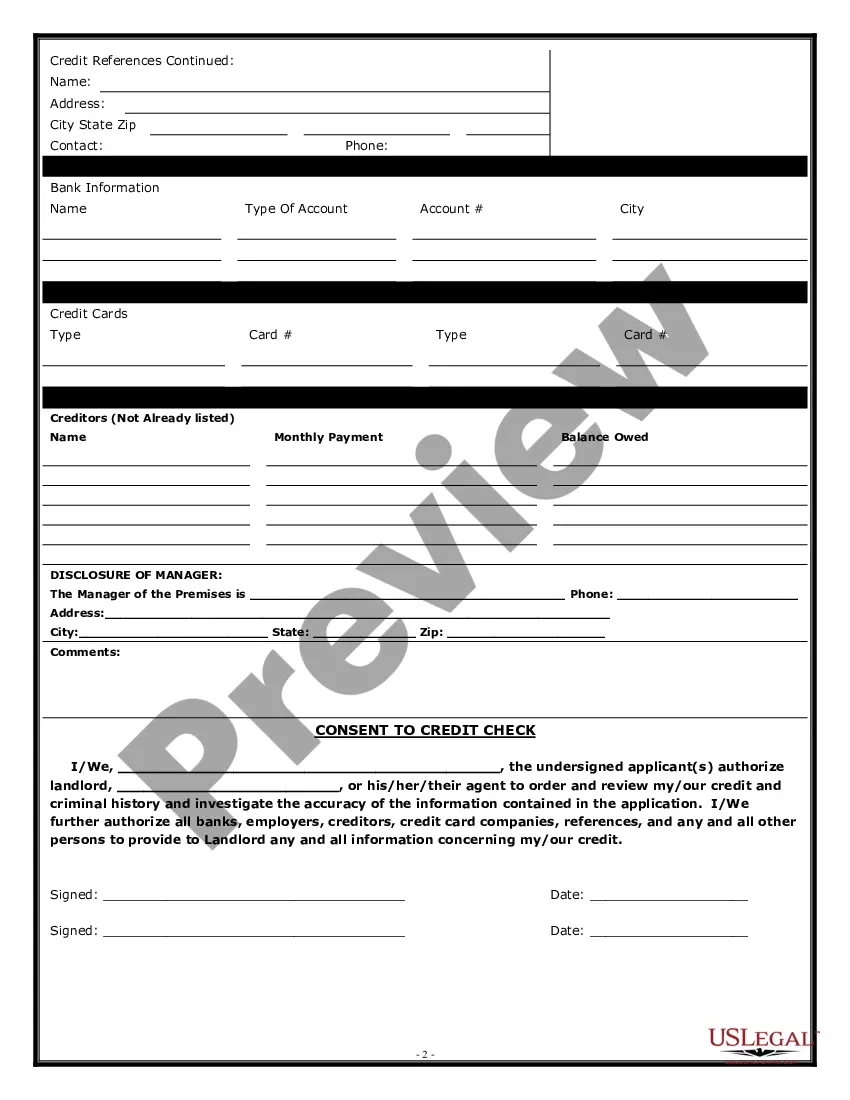

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

The Formato De Solicitud De Arrendamiento Minerva Withholding you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and regional regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Formato De Solicitud De Arrendamiento Minerva Withholding will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to confirm it fits your needs. If it does not, use the search bar to find the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Formato De Solicitud De Arrendamiento Minerva Withholding (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork again. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Permite conocer las existencias de un articulo y/o material y confrontar posteriormente en contabilidad la existencia en Libros. Disponible con numeracion pre impresa consecutiva para facilitar controles. El formato de un titulo valor con el que se suscribe una promesa de pagar una suma determinada de dinero.

El contrato de arrendamiento sencillo debe incluir la siguiente informacion: ¿Que y quien va rentar? Descripcion detallada del inmueble. Clausulas indispensables. Clausulas adicionales. Garantia para el cumplimiento de las obligaciones.

Como llenar un contrato de arrendamiento con fiador: Paso a paso Lugar y fecha. Debe definir cuando y donde se revisara el documento para su firma. Datos personales. ... Informacion sobre la propiedad. ... Responsabilidades del avalista. ... Duracion. ... Valor y revision del alquiler. ... Valor de la fianza. ... Firma.

Tambien llamado contrato de alquiler, estos formularios son prueba de que tanto el inquilino como el propietario llegaron a un acuerdo y estan de acuerdo. Un formulario de contrato de arrendamiento de alquiler sera util para obtener informacion para la proteccion de ambas partes.

Para ser fiador en un contrato de arrendamiento se necesita: Propiedad a su nombre ante el Registro Publico de la Propiedad en la ciudad en la que se celebra el contrato. Identificacion oficial. CURP. Comprobante de domicilio de la propiedad en garantia (no mayor a 3 meses de antiguedad) Comprobante de ingresos.