Intent To File Lien Form Colorado

Description

Form popularity

FAQ

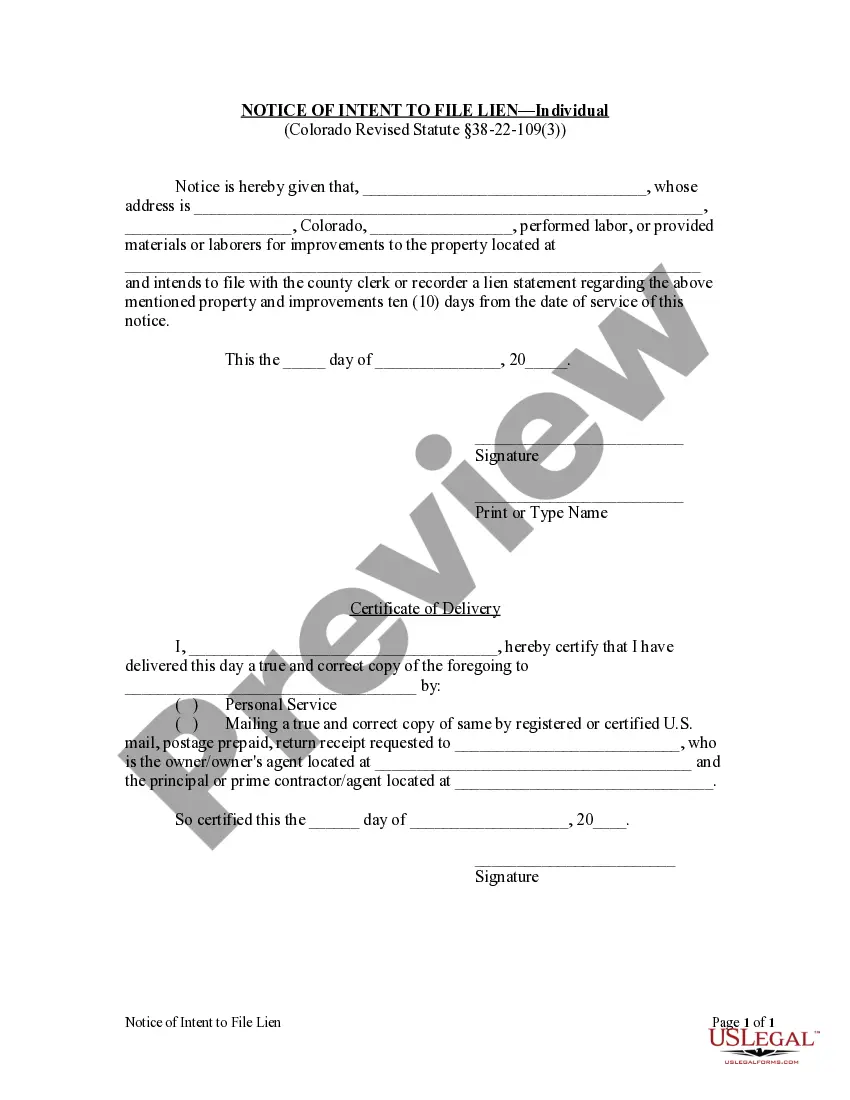

Yes, Colorado is considered a lien state. This means that individuals and businesses have the legal right to place a lien against a property to secure payment for services rendered or materials supplied. Understanding this can help you navigate your rights effectively. For detailed forms and resources, explore the intent to file lien form Colorado on US Legal Forms.

To file an intent to lien in Colorado, you must complete an intent to file lien form Colorado and submit it to the appropriate county clerk. The form requires specific details about the debt and the parties involved. Additionally, make sure to file it within the specified timeframe to protect your legal rights. US Legal Forms offers templates and guidance to help streamline this process.

In Colorado, a lien is generally valid for six years from the date it is recorded. However, if the lien relates to a specific payment obligation, it may expire sooner if that obligation is fulfilled. It is crucial to know the duration of a lien to maintain your rights. You can find more information and resources on the intent to file lien form Colorado through US Legal Forms.

To put a lien on someone's property in Colorado, begin by preparing your intent to file lien form. This document should specify the details of your claim and the amount owed. After you complete this form, file it with the county clerk’s office where the property is located. This step is essential for formally asserting your claim and securing your rights.

In Colorado, you generally have six months from the date of work completion to file a lien against a property. Understanding this timeline is critical to protecting your financial interests. Ensure that you prepare and file your intent to file lien form during this window. Taking prompt action helps solidify your claim.

To put a lien on a Colorado title, you must complete and submit an intent to file lien form. This form should clearly outline your claim and the amount owed. Once you have completed the form, file it with the Colorado Department of Revenue. This action will ensure your lien is recorded officially and protected under state law.

No, both parties do not have to be present to transfer a car title in Colorado. However, it's essential for the seller to complete the necessary paperwork, including signing the title over to the buyer. If one party cannot attend, a notarized signature may be required. Make sure to check local requirements to ensure a smooth transaction.

To file a lien with intent in Colorado, start by drafting the intent to file lien form. This document must clearly outline the nature of your claim, the amount owed, and the property involved. After preparing this form, submit it to your local county clerk's office. Always keep a copy for your records to avoid any confusion later.

Filing a lien in Colorado requires a formal process. First, you must prepare your notice of intent to file lien form, detailing your claim. Once completed, you will file this document with the appropriate county clerk and recorder's office. It's vital to follow the exact legal requirements to ensure that your lien is enforceable.

In Colorado, you have a specific timeframe to file an intent to lien form. Generally, the notice must be filed within 90 days of the last work performed or materials supplied. This ensures that your claim is recognized and protected under Colorado law. Be diligent about this deadline to secure your rights efficiently.