Joint Tenant Tenancy For Tenants

Description

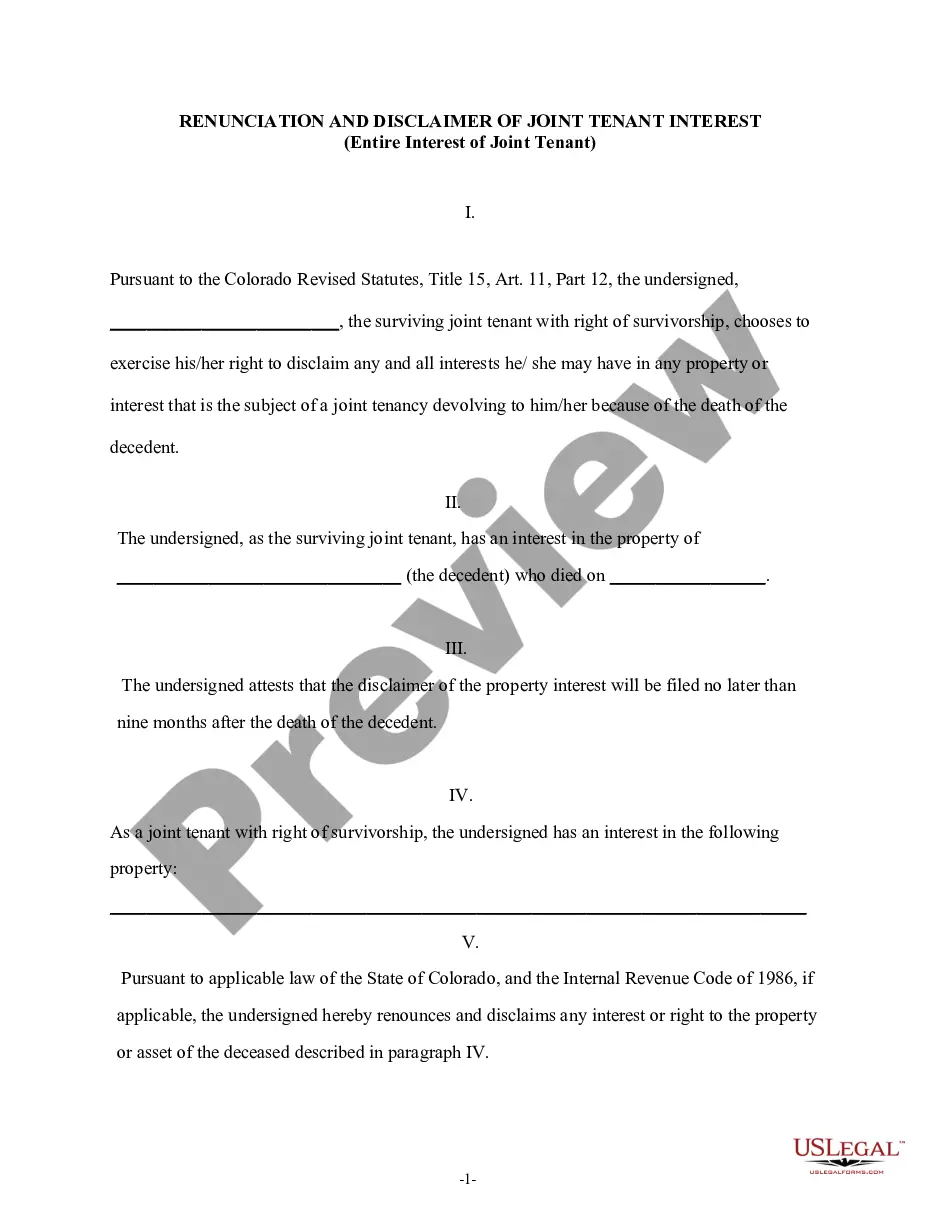

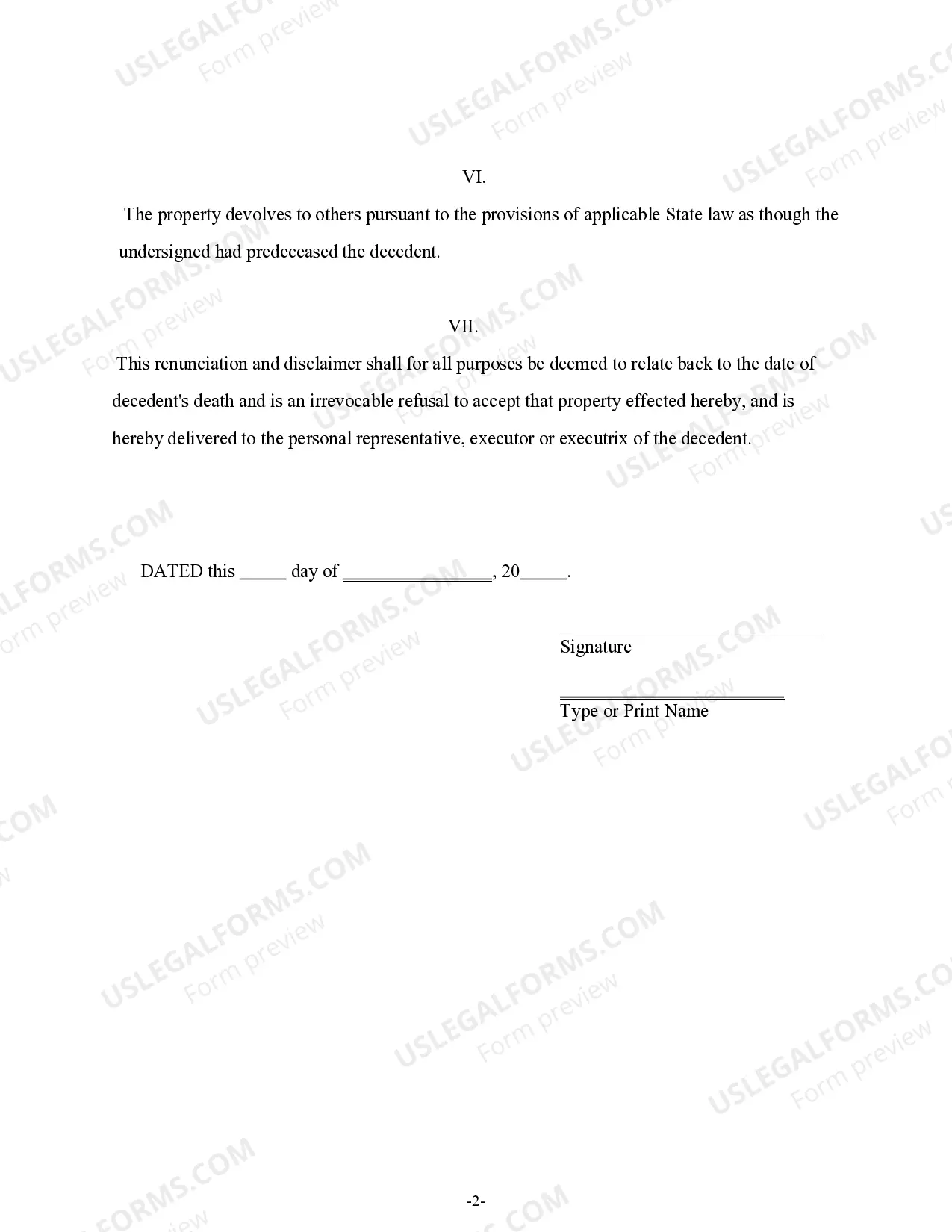

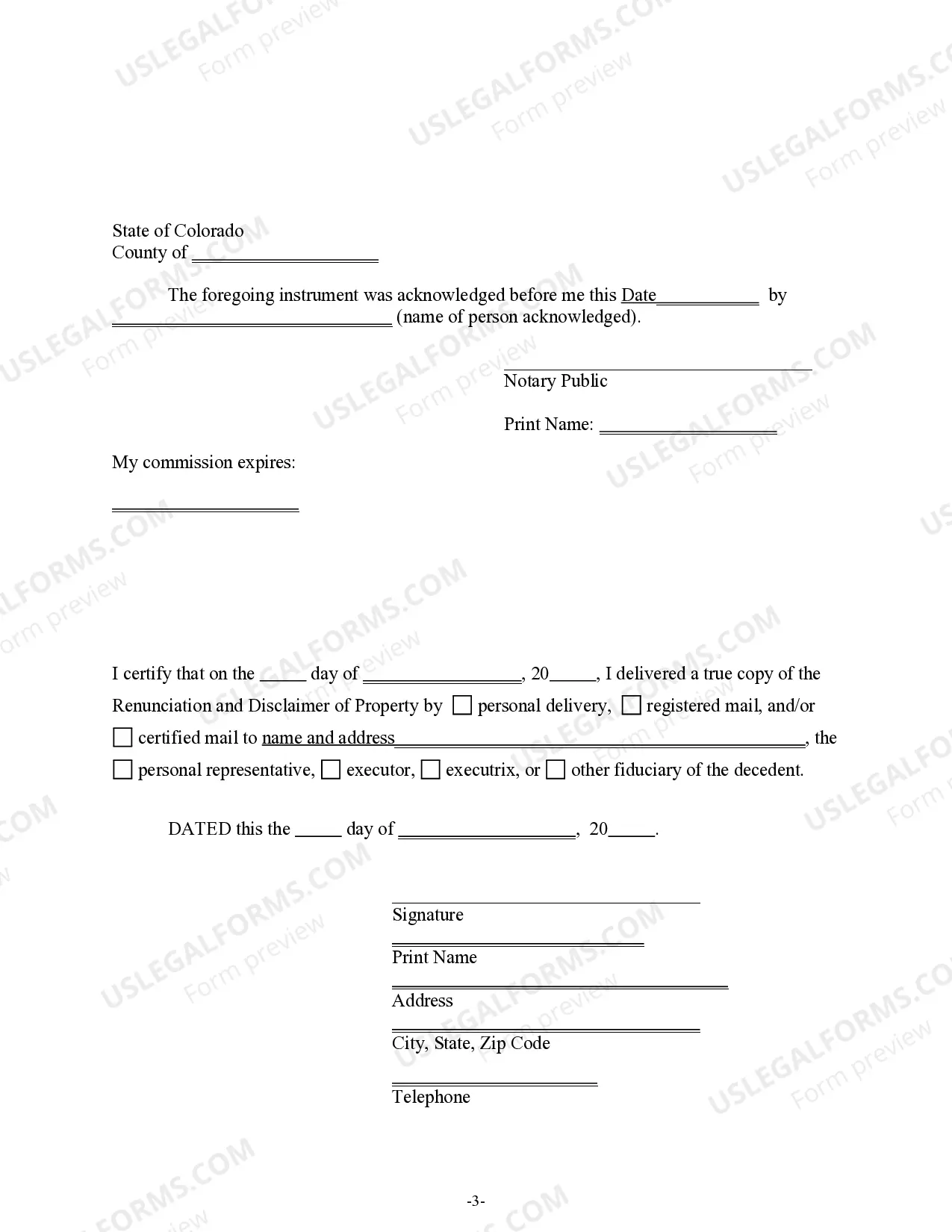

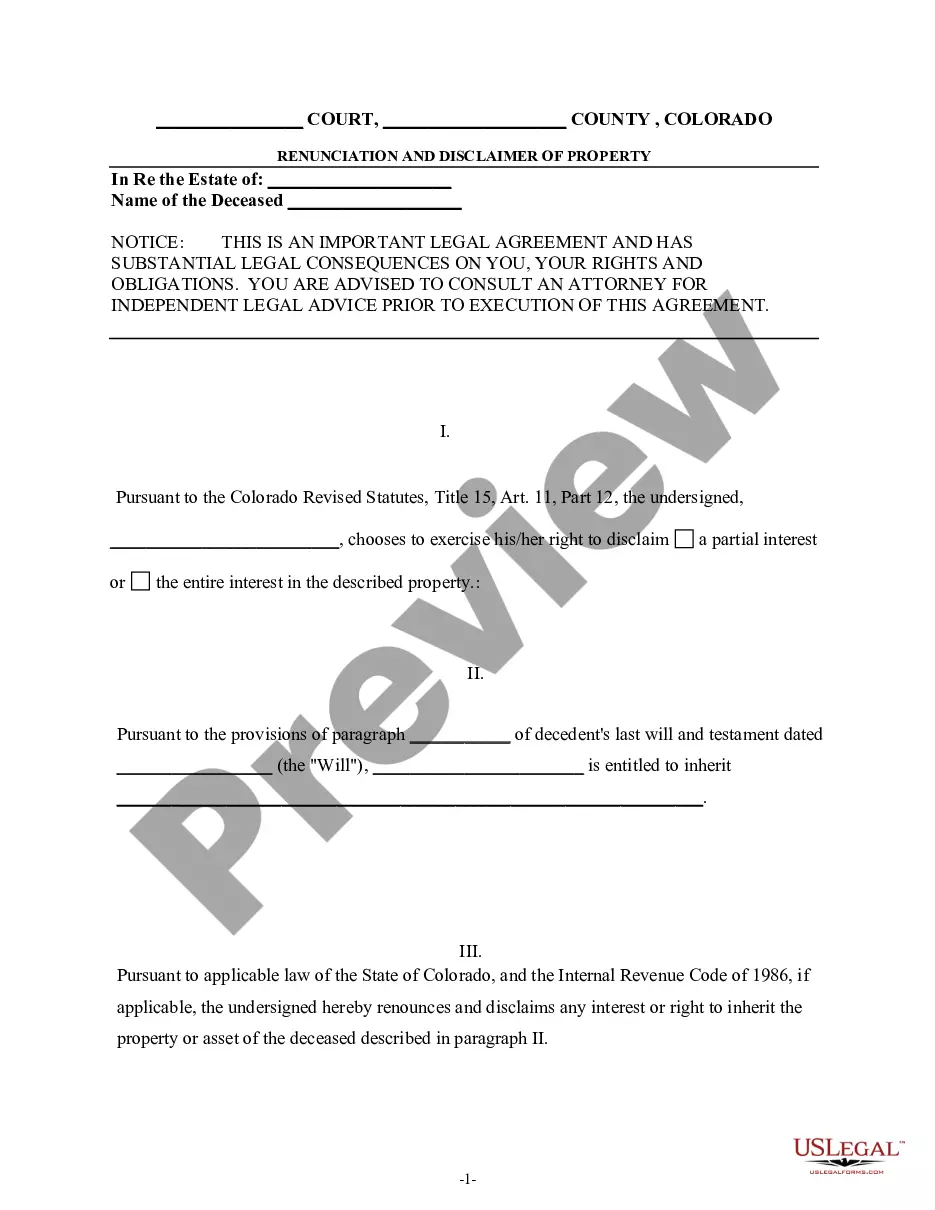

How to fill out Colorado Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- If you're a returning user, log in to your account and use the Download button to get your desired form. Ensure your subscription is active; otherwise, renew it under your payment plan.

- For first-time users, start by reviewing the Preview mode and description of the form to confirm it suits your inquiry and adheres to local jurisdiction requirements.

- If you need a different template, utilize the Search tab to find the correct one that matches your legal needs.

- Once you find the appropriate document, hit the Buy Now button and select the subscription plan that meets your needs. You’ll need to create an account to access the library.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download the form to your device, which you can find later in the My Forms section of your profile.

US Legal Forms stands out with its extensive collection, offering over 85,000 fillable templates, more than what competitors provide at similar prices. Additionally, users have access to premium experts who can assist in completing forms, ensuring accuracy and adherence to legal standards.

By leveraging US Legal Forms, you can simplify your legal documentation process. Start today to ensure you have the correct forms at your fingertips!

Form popularity

FAQ

A defining aspect of joint tenancy is that all joint tenants must acquire their ownership interests simultaneously, under the same deed. This principle reinforces the equality of ownership among the tenants, solidifying their collaborative relationship in managing the property. Additionally, in instances of co-ownership disputes, joint tenant tenancy for tenants provides a clear legal framework for resolution. Leveraging platforms like US Legal Forms can help clarify these aspects and streamline the documentation process.

Joint tenancy is best defined as a form of property ownership where two or more individuals hold equal interest in a property with a right of survivorship. This means that, upon the death of one owner, their portion of the property directly transfers to the remaining owners without going through probate. It offers a straightforward method for co-owners to manage property, ensuring that the essence of ownership remains intact. Embracing joint tenant tenancy for tenants can enhance cooperation among owners.

Both joint tenancy and tenancy by the entirety provide their owners with a right of survivorship, which allows remaining co-owners to inherit the deceased owner’s share. This feature simplifies the transfer of property upon death, avoiding the lengthy probate process. Additionally, both structures require all owners to have equal shares and equal rights in managing the property. This makes joint tenant tenancy for tenants a favorable option for those looking for a reliable ownership model.

Joint tenancy refers to a legal arrangement where two or more individuals hold equal shares in a property. This type of ownership includes a right of survivorship, meaning that if one owner passes away, their share automatically transfers to the surviving tenant(s). The structure of joint tenant tenancy for tenants allows for shared control and responsibility, making it a popular choice for partners or family members. Understanding this concept can make property co-ownership smoother and more secure.

Yes, New York allows joint tenancy as a form of property ownership where two or more individuals hold title to a property together. It is vital to specify joint tenant tenancy for tenants in the deed to clarify ownership rights. If you plan to establish joint tenancy in New York, consider using US Legal Forms to navigate the requirements and make the process easier.

Setting up a joint tenancy involves drafting a title deed that includes all joint tenants' names and stating that they hold the property together. You can accomplish this by using a legal service like US Legal Forms, which simplifies the process and helps ensure compliance with state laws. Once the deed is completed and filed with your local government, you create a solid joint tenant tenancy for tenants that protects everyone's interest in the property.

To get a joint tenancy agreement, you can start by drafting the agreement that clearly states the terms and conditions for all parties involved. It's advisable to consult with a legal professional or use a trusted platform like US Legal Forms to ensure that the agreement meets all legal requirements. Once drafted, all joint tenants must sign the agreement for it to be valid, establishing joint tenant tenancy for tenants to securely share ownership.

The step-up basis for joint tenancy right of survivorship is determined by the fair market value of the property at the time of a tenant's death. Essentially, this means only the deceased tenant’s share receives the step-up, while the surviving tenant’s basis remains unchanged. This adjustment provides a significant tax benefit by potentially lowering capital gains taxes upon a future sale. Knowing about the step-up basis is essential for anyone involved in joint tenant tenancy for tenants, as it impacts financial planning.

up basis in joint tenancy with right of survivorship refers to the tax adjustment that occurs when one joint tenant passes away. The surviving tenant's basis in the property adjusts to the current market value at the time of the first tenant's death. This is important because it minimizes potential capital gains taxes should the surviving tenant decide to sell the property. Understanding this aspect of joint tenant tenancy for tenants helps you make informed decisions regarding asset management.

Yes, a joint account that includes right of survivorship generally receives a step-up in basis upon the death of one tenant. This means the deceased's share of the property is revalued to its current market value at the time of death. Consequently, the surviving tenant benefits from a reduced capital gains tax if they decide to sell the property later. This fact highlights the importance of joint tenant tenancy for tenants as a beneficial estate planning tool.