Joint Tenant Tenancy For Tenant

Description

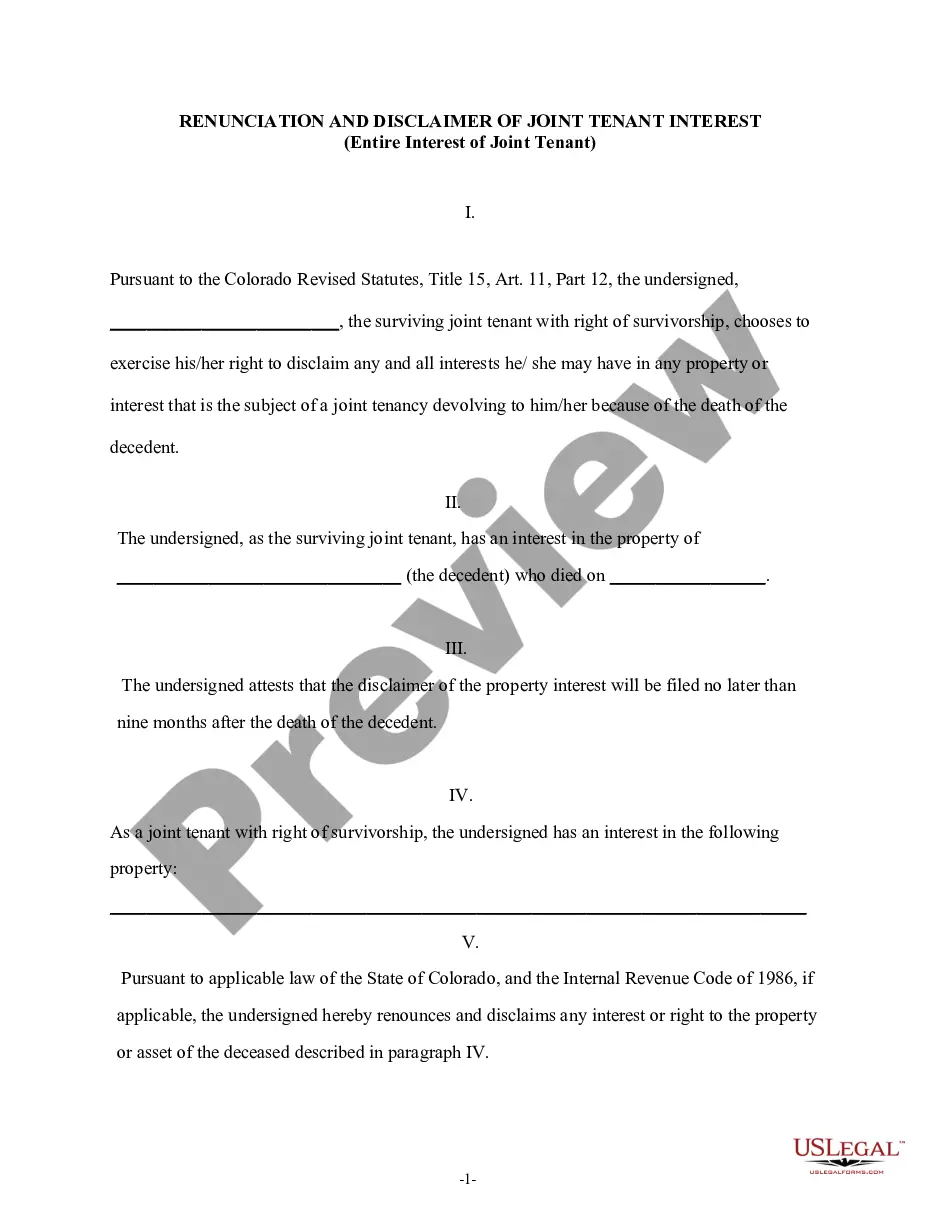

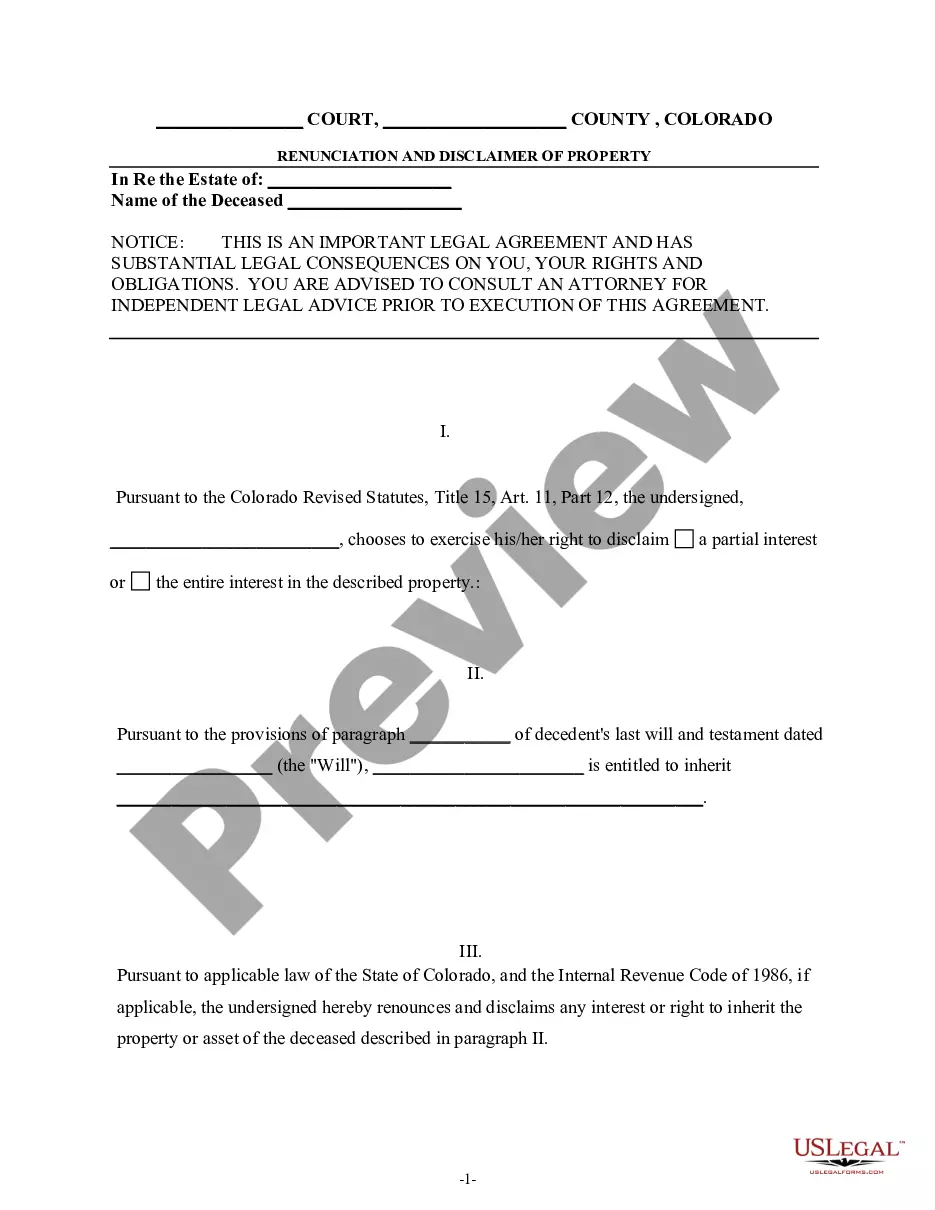

How to fill out Colorado Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- If you're a returning user, log in to your account and check the status of your subscription. Ensure it's active, or renew it if necessary for uninterrupted access.

- For first-time users, begin by exploring the platform. Look through the preview mode to confirm that the form aligns with your requirements and jurisdiction specifics.

- Use the Search tool above if the initial form doesn’t meet your needs. Discover additional templates that are suitable for your situation.

- Once you find the right document, proceed to purchase it by clicking the Buy Now button. Select your desired subscription plan, which may require account registration.

- Complete your purchase by providing your payment information, either through a credit card or PayPal, to activate your subscription.

- Download your form to your device, ensuring easy access for completion. You can always revisit your document later in the My Forms section of your profile.

By leveraging US Legal Forms, you gain access to an extensive collection of over 85,000 fillable and editable legal documents, surpassing typical competitors in both quantity and quality.

Don’t wait to secure your legal documents. Start using US Legal Forms today to simplify your joint tenant tenancy needs!

Form popularity

FAQ

To convert from tenants in common to joint tenant tenancy for tenant, all involved parties must agree to change the ownership structure. This involves executing a new deed that clearly states the change in tenancy type. It's advisable to seek legal guidance during this process to ensure compliance with local laws. Platforms like uslegalforms can assist you in preparing the necessary documents for this transition smoothly.

Joint tenant tenancy for tenant in California functions by allowing two or more individuals to hold ownership of a property jointly. Each tenant has equal rights to the whole property and can use it without the permission of others. Upon the death of one tenant, their interest automatically transfers to the remaining tenants. It is essential to establish this type of tenancy through proper legal documentation to ensure clarity.

Yes, joint tenant tenancy for tenant in California includes an automatic right of survivorship. This means that when one tenant passes away, their ownership share transfers directly to the surviving tenant without going through probate. This benefit can simplify estate planning, but it also means that the deceased’s wishes regarding their share of the property might not be honored if they didn’t plan accordingly.

When one person wants to exit a joint tenant tenancy for tenant in California, they must formally transfer their ownership interest. This can be accomplished through a deed of severance, which creates a tenants-in-common arrangement instead. Remember, by doing this, the remaining tenants will not lose their rights, but the exiting tenant removes their stake from the joint tenancy, which may impact future decisions significantly.

In California, joint tenant tenancy for tenant requires all parties to acquire the property at the same time and through the same deed. Also, each tenant shares equal ownership of the property, meaning no one can claim a portion that exceeds their interest. Additionally, it is important to have explicit language in the deed that establishes the joint tenancy; simply co-owning property does not automatically create this tenancy.

Joint tenant tenancy for tenant can present some disadvantages, particularly regarding control and decision-making. In this arrangement, all parties must agree on significant actions, like selling the property. Furthermore, if one tenant passes away, the property automatically transfers to the surviving tenant, potentially excluding heirs from benefits. This setup may not suit everyone, especially those wanting to retain control over their share of the property.

Joint tenancy is often referred to as a poor man's will because it provides a simple method of transferring property upon death, similar to a will. While this arrangement may seem straightforward, it can lead to unintended consequences regarding estate distribution. Therefore, it’s crucial to grasp the concept of joint tenant tenancy for tenant thoroughly before relying on it as a primary estate planning tool.

While joint tenancy offers benefits such as avoidance of probate, it also carries significant downsides. For example, one co-owner can legally sell or mortgage the property without the consent of others, which can lead to disputes. Additionally, joint tenant tenancy for tenant may expose you to liability for another owner’s debts or legal issues. Understanding these risks is vital before proceeding.

Joint ownership can complicate matters in case of disagreements between co-owners. It may also create tax implications when one owner wants to sell their share. Moreover, joint tenant tenancy for tenant may limit inheritances for children or other family members. It’s wise to consider these factors before entering into such an agreement.

Joint tenancy is a legal arrangement where two or more individuals hold property together, with equal rights to the property. In joint tenant tenancy for tenant, if one owner dies, the remaining owners retain full ownership, bypassing probate. This arrangement can offer benefits, but it’s essential to understand the full implications beforehand.