Joint Tenant/joint Tenancy With/ Right Of Survivorship

Description

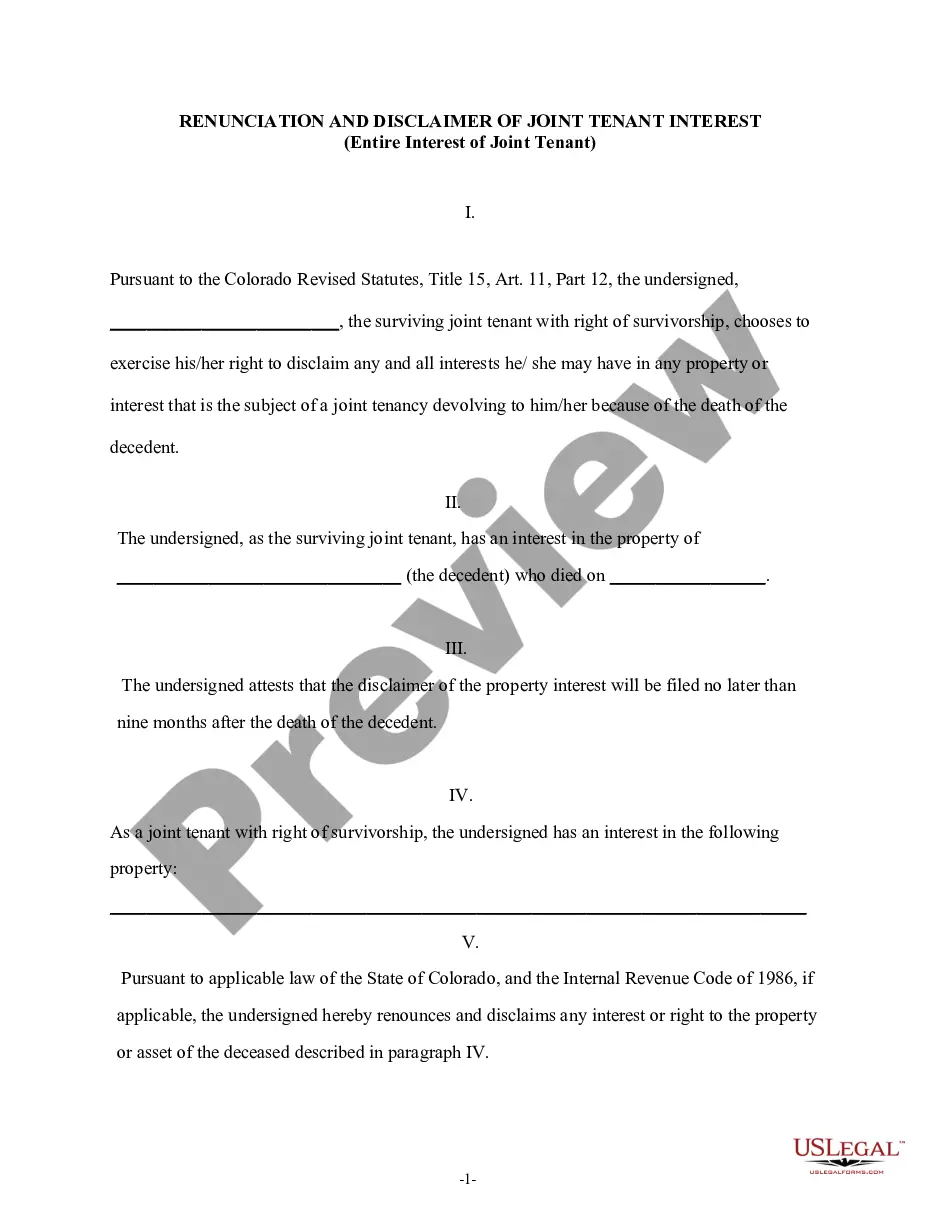

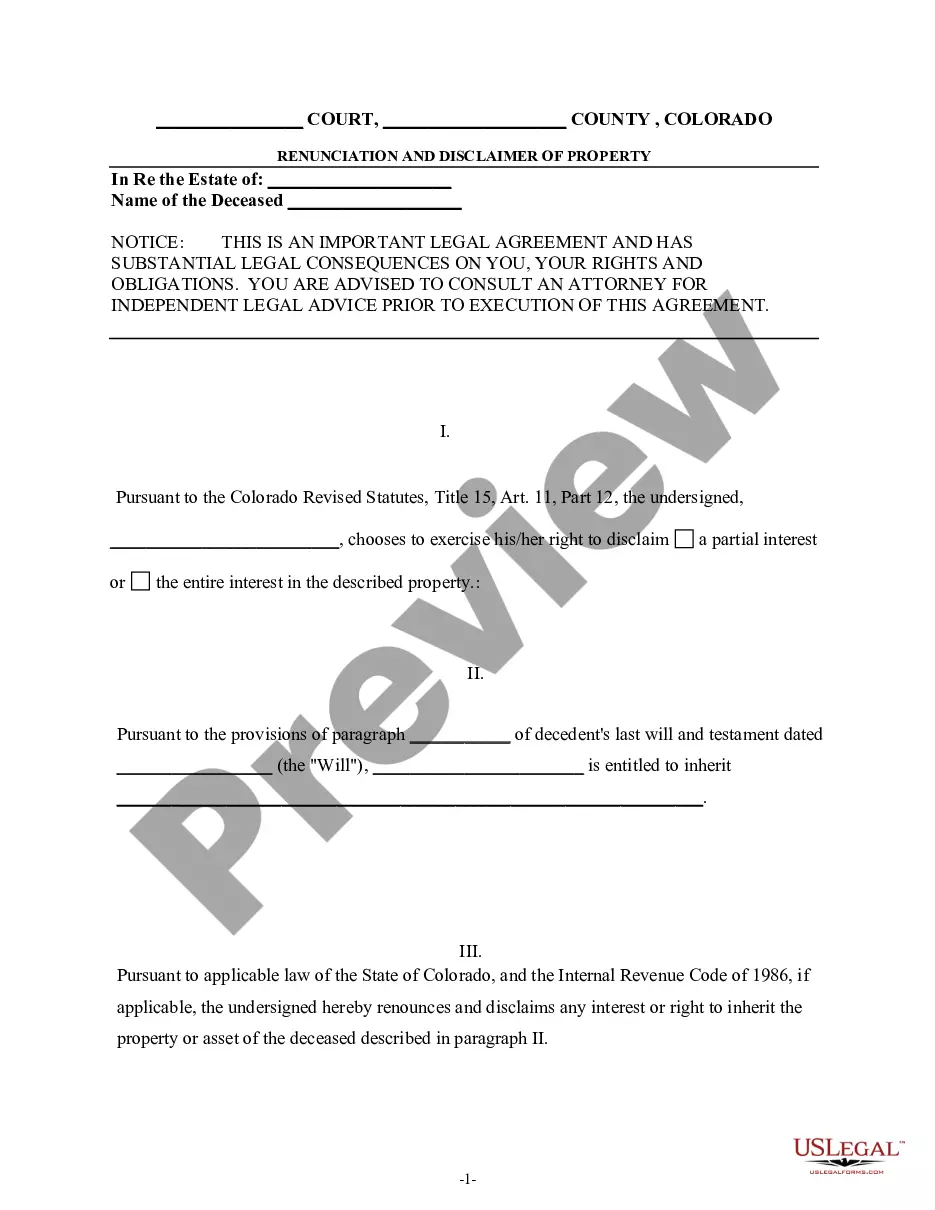

How to fill out Colorado Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- Log in to your US Legal Forms account if you're a returning user and ensure your subscription is active. Access your needed form template by clicking the Download button.

- If you're new to the service, begin by checking the Preview mode and description of your desired form. Validate that it aligns with your local jurisdiction requirements.

- In case of discrepancies, utilize the Search feature to find the correct template that meets your needs.

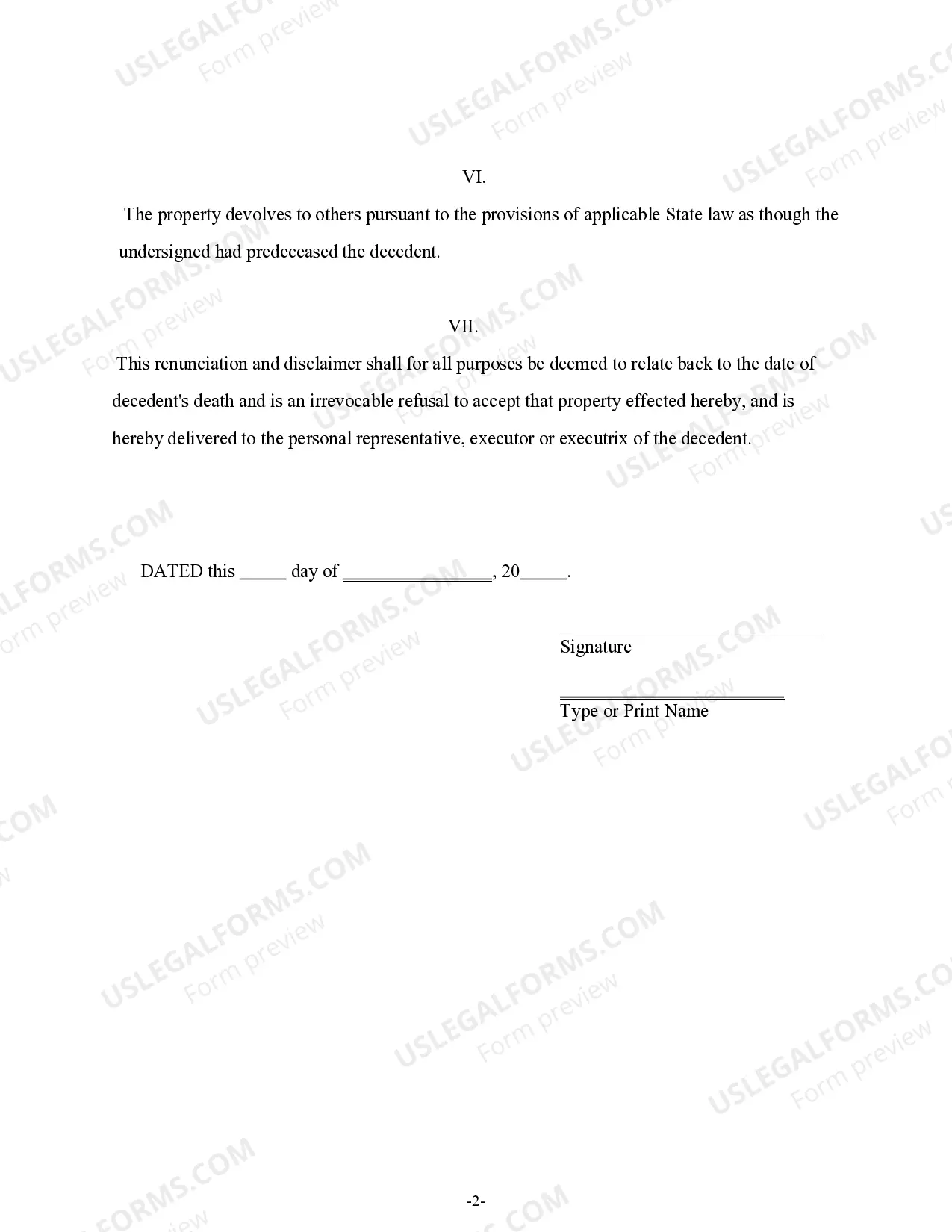

- Proceed to purchase the document by clicking the Buy Now button and selecting a suitable subscription plan. You'll be required to create an account for library access.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download the completed form and save it on your device for ease of access. You can find it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms offers individuals and attorneys a streamlined process to obtain essential legal documents like those for joint tenancy with right of survivorship. Their extensive library and expert support ensure that the documents are accurate and legally sound.

Start your experience today by visiting US Legal Forms and take the first step toward protecting your property interests.

Form popularity

FAQ

Certain individuals cannot take title as joint tenants with right of survivorship, including minors and some individuals under legal guardianship. Additionally, entities like corporations or limited liability companies generally cannot hold property in this manner. It's essential to understand these restrictions to avoid complications in your estate planning and property ownership. For more tailored guidance, considering expert platforms like USLegalForms can facilitate a smoother experience.

Setting up joint tenancy with right of survivorship involves drafting a deed that outlines the ownership details. You will need to clearly indicate that both parties will hold equal shares in the property. After completing the deed, it should be signed, notarized, and recorded with the appropriate local government office. This process helps protect your rights as joint tenants and ensures that your intentions are legally recognized.

To establish joint tenancy with right of survivorship, you must first ensure that the property title specifies this arrangement. Both parties typically need to sign a deed that clearly states their intention for joint tenancy. It's advisable to consult legal resources, such as USLegalForms, to ensure all documents meet state requirements and effectively reflect your wishes. Doing this can help secure your joint ownership and the benefits that come with it.

The step-up basis for joint tenants with right of survivorship refers to how property value is adjusted when one tenant passes away. Under this rule, the deceased's share of the property receives a fair market value adjustment to the date of death, which can reduce capital gains tax if the surviving tenant sells the property. This tax benefit is significant for joint tenants because it can lead to significant savings when executing a sale or transfer. Understanding this can guide you in making informed financial decisions regarding estate planning.

Creating joint tenancy with rights of survivorship requires a few straightforward steps. First, you must acquire the property and then draft a deed that specifies the joint tenancy arrangement. It is essential to state that the property is held by multiple parties as joint tenants with rights of survivorship. Many people find it helpful to utilize services like USLegalForms to ensure all legal requirements are met correctly; this saves time and provides peace of mind.

To set up joint tenancy with the right of survivorship, you need to include specific language in the title of the property, indicating your intent for joint ownership. This generally involves drafting a deed that clearly states the joint tenants and their shares in the property. Using a platform like USLegalForms can simplify this process, as they offer resources and templates to assist you. Once the deed is recorded with the county, the joint tenancy is established, ensuring that the right of survivorship is in effect.

The step-up basis for joint tenancy with right of survivorship refers to the increase in the value of an asset that occurs upon the death of one joint tenant. Essentially, when a joint tenant passes away, the surviving tenant receives a new basis in the property equal to its fair market value at the time of death. This adjustment can lead to significant tax savings, as it reduces capital gains tax when the property is sold. Understanding this concept is crucial, especially when assessing the financial implications of joint tenancy.

The tax implications of joint tenancy with right of survivorship can be complex. For instance, the property may receive a step-up in basis upon the death of the first owner, potentially reducing capital gains taxes for the surviving tenant. It is advisable to consult with a tax professional to understand how this arrangement may affect your specific financial situation.

Joint tenants with rights of survivorship face several disadvantages, including exposure to each other's debts and financial liabilities. Furthermore, all owners must agree to any sale or mortgage of the property, which can lead to complications. This arrangement can also impact tax implications differently than if individuals held property separately.

One key disadvantage of the right of survivorship is that it eliminates the possibility of passing your share of the property through your will. Thus, you may inadvertently disinherit your heirs if you intended to bequeath that property. This lack of control can create complications and disputes among family members after death.