Joint Tenancy Joint Tenancy With Right Of Survivorship

Description

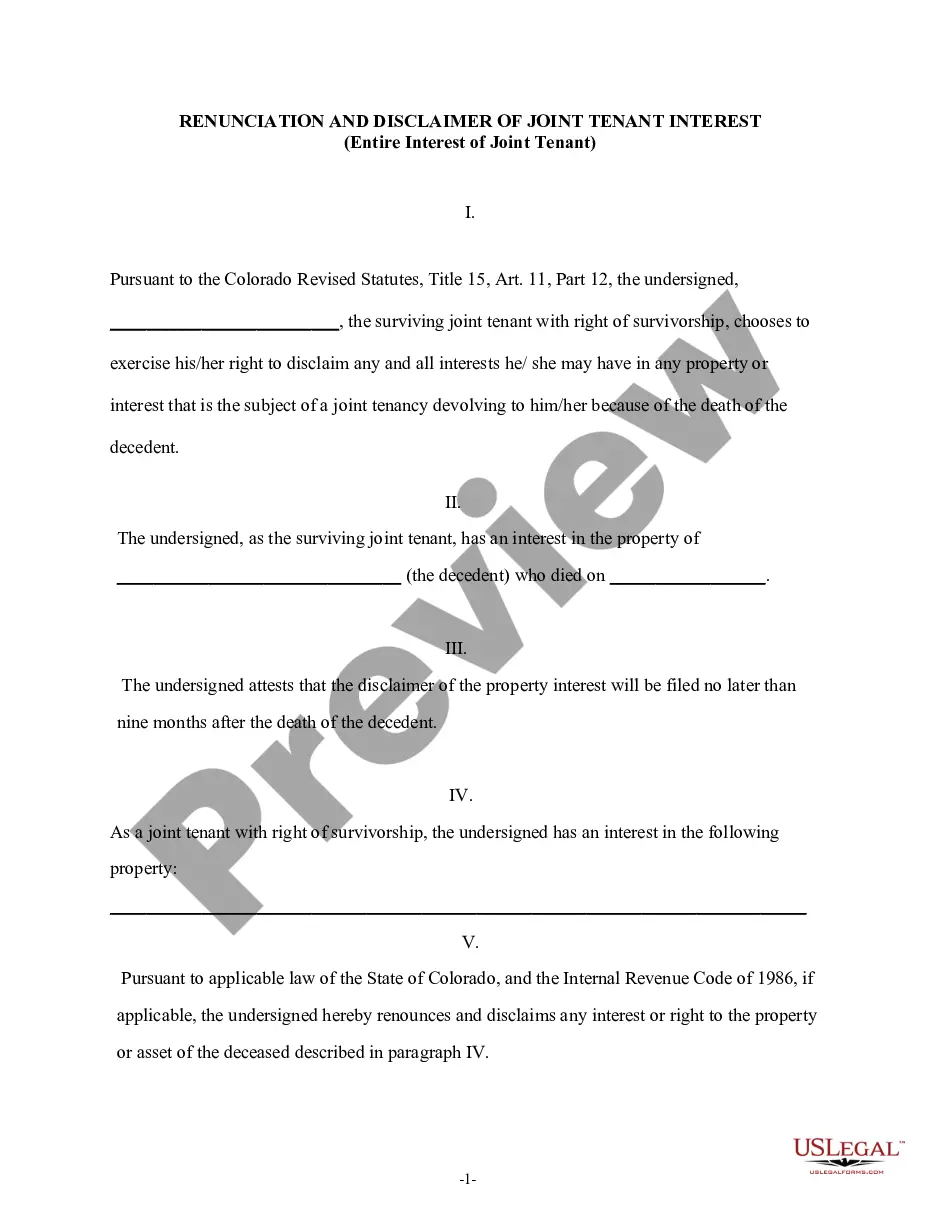

How to fill out Colorado Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- If you're a returning user, log in to your account. Make sure your subscription is active, or renew it if necessary.

- Review the form preview and description to confirm it suits your needs and is compliant with local laws.

- If modifications are needed, use the Search tab at the top to locate alternative forms that match your requirements.

- Select the form you need, then click the Buy Now button, and choose your preferred subscription plan.

- Proceed with the payment by entering your credit card information or using your PayPal account.

- Download the completed document to your device and access it anytime through the My Forms section.

By following these steps, you will have the necessary documents for joint tenancy with right of survivorship ready for your needs.

Start your legal documentation journey today with US Legal Forms, where our extensive library and expert assistance ensure your peace of mind.

Form popularity

FAQ

Joint tenancy with right of survivorship indeed overrides a will. This arrangement guarantees that when one joint tenant dies, their share automatically transfers to the surviving tenant, effectively bypassing any stipulations in a will. As such, individuals should carefully consider how they structure their assets to ensure their wishes align with how they want to manage ownership after death. Consulting platforms like US Legal Forms can provide valuable guidance on structuring these arrangements properly.

Yes, right of survivorship supersedes a will in joint tenancy arrangements. The law dictates that upon the death of one joint tenant, the survivor automatically inherits the deceased's interest in the property. This essential feature of joint tenancy ensures that the surviving owner retains full ownership, regardless of the instructions detailed in a will. Thus, it is crucial to comprehend how this aspect may affect your estate planning.

While joint tenancy with right of survivorship offers benefits like avoiding probate, it has some disadvantages to consider. For instance, if one owner has debts, creditors may place claims on the shared property. Additionally, both parties must agree on any decisions regarding the property, which can lead to conflicts. Furthermore, upon the death of one joint tenant, the surviving tenant may face tax implications.

The phrase 'jointly with right of survivorship' refers to an ownership structure where two or more individuals own property together, and rights automatically transfer to the surviving owner upon death. This arrangement makes it easy for the remaining tenant to retain complete control of the asset. It effectively bypasses the probate process, making inheritance straightforward and efficient. This term is primarily associated with property and financial accounts.

Joint tenants with right of survivorship can apply to various financial accounts, such as bank accounts, brokerage accounts, and real estate. This account type allows both parties to have equal access and rights over the assets. When one party passes away, their share goes directly to the surviving tenant without going through probate. It's a popular choice for couples and family members who want to ensure a smooth transition of assets.

In the context of joint tenancy with right of survivorship, a will does not override this arrangement. When one joint tenant passes away, ownership automatically transfers to the surviving tenant, regardless of the instructions in the will. This feature can be beneficial, as it simplifies the transfer of property. However, it's essential to plan carefully to ensure your wishes are followed.

While joint tenancy with rights of survivorship has clear benefits, it also carries certain disadvantages. For instance, if one tenant incurs debts, creditors may claim against the property, affecting all owners. Additionally, both tenants must agree on major decisions about the property, which can lead to conflicts. Ultimately, it is important to weigh these potential drawbacks, and consulting resources like US Legal Forms can provide valuable insights tailored to your situation.

The step-up basis for joint tenancy with right of survivorship refers to the adjustment of the property's value for tax purposes when one joint tenant passes away. In this case, the surviving tenant receives the deceased owner's half of the property at its current market value. This step-up reduces potential capital gains taxes when the surviving tenant sells the property. Understanding this concept is essential for effective estate planning and can help you maximize the financial benefits of joint tenancy.

To set up joint tenancy with the right of survivorship, start by determining the property you wish to hold jointly. Next, draft a deed that indicates your intention to establish this type of ownership. It is advisable to include language that explicitly grants rights of survivorship to all tenants. Finally, have the deed signed and notarized before filing it with the relevant local authorities, ensuring it meets your state's legal requirements. US Legal Forms can assist you in creating the necessary documentation.

Creating joint tenancy with rights of survivorship involves drafting a deed that clearly states the intention of establishing joint ownership. The deed must include the names of all joint tenants and specify the rights of survivorship. It is crucial to file this deed with your local government office to ensure that it is legally recognized. Using a platform like US Legal Forms can help you navigate this process efficiently.