Limited Liability Company For Dummies

Description

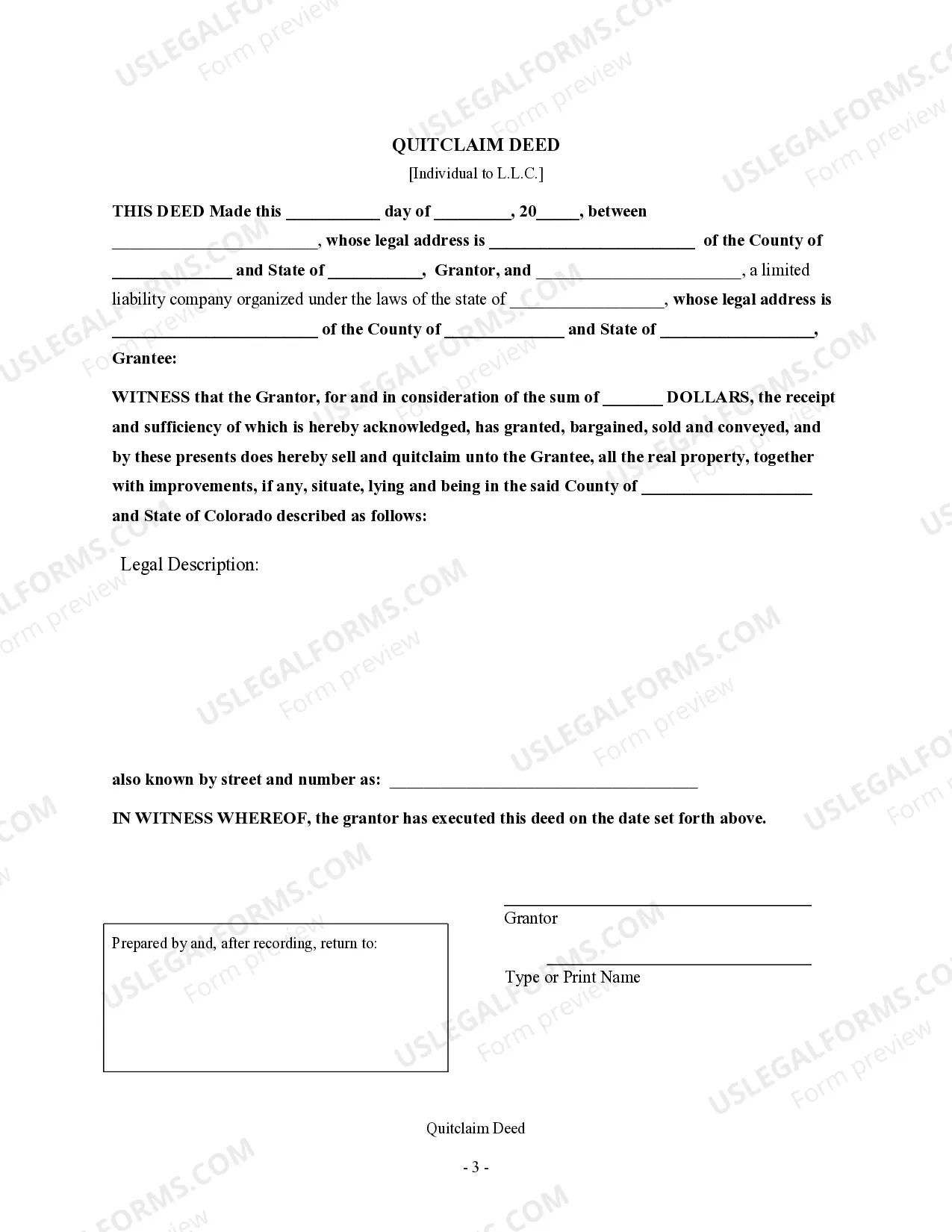

How to fill out Colorado Quitclaim Deed - Individual To Limited Liability Company?

- Log into your US Legal Forms account if you have one. Ensure your subscription is current; if it needs renewing, do so per your plan.

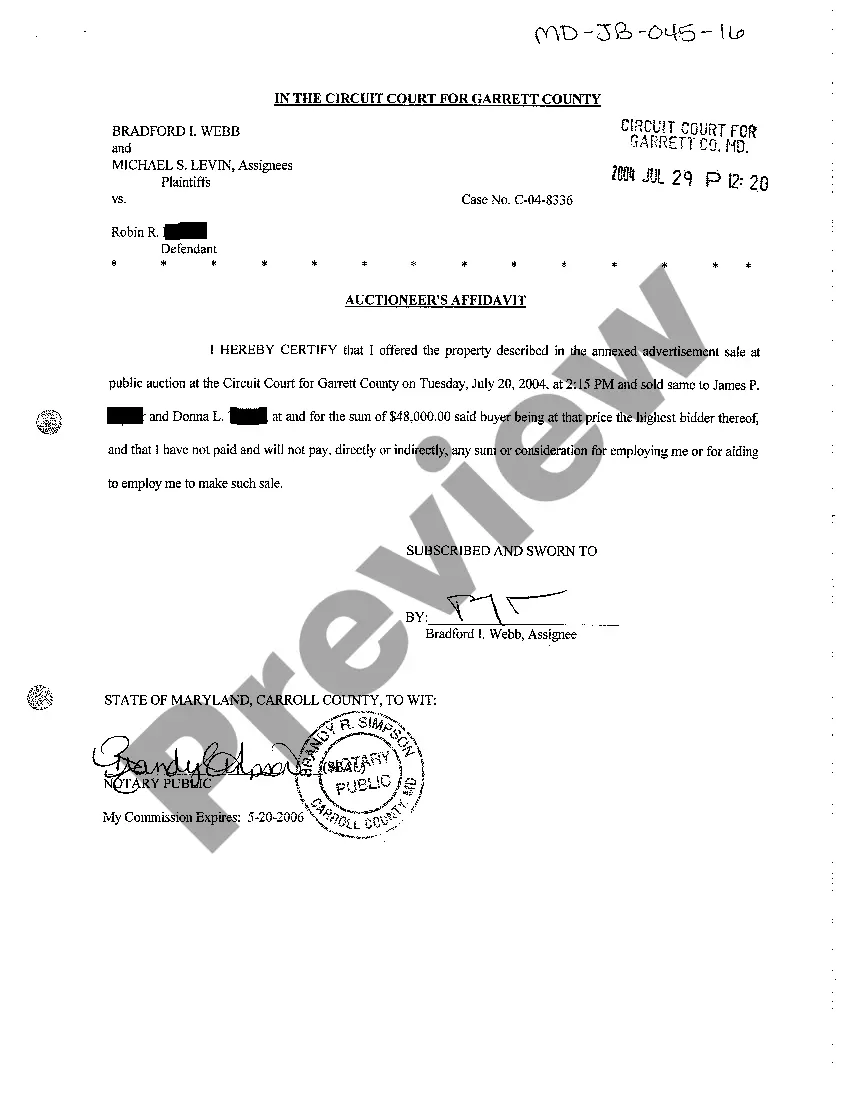

- In Preview mode, assess the form options available. Confirm that the template meets your specific LLC requirements and adheres to your local laws.

- If you need an alternative template, utilize the Search tab to find other options. Select the appropriate form that best fits your situation.

- Proceed to purchase the document by clicking the Buy Now button. Choose the subscription that suits your needs and create an account for full access.

- Complete your payment process, providing your credit card details or using PayPal as an alternative.

- Once payment is processed, download your LLC form directly to your device. Access it later in the My Forms section of your profile for easy reference.

By following these steps, you can quickly establish an LLC using US Legal Forms' user-friendly platform. This service is designed to empower both legal professionals and individuals to generate accurate and timely legal documents.

Start building your LLC today with confidence. Visit US Legal Forms now to explore their vast library of legal documents!

Form popularity

FAQ

To fill out an LLC application, begin by providing your chosen business name, followed by designating members and management structure. Next, include details such as your business address and registered agent. For those unfamiliar with the process, platforms like US Legal Forms can guide you step-by-step, making it easier to navigate the world of limited liability companies for dummies.

Writing an LLC example involves starting with a clear business name, like 'Tech Solutions LLC.' Following the name with 'LLC' signals that it operates under this business structure. This method is especially useful for those new to the concept, such as individuals learning about limited liability companies for dummies.

In simple terms, an LLC, or limited liability company, is a business structure that protects your personal assets. It separates your personal finances from your business investments, offering you peace of mind. Think of it as a safe harbor for entrepreneurs who want to minimize risk while maximizing potential, which aligns perfectly with the idea of limited liability companies for dummies.

Writing LLC correctly involves using uppercase letters and ensuring that it follows the business name clearly. For instance, 'Your Business Name LLC' clearly indicates that your enterprise is a limited liability company. Emphasizing this format helps reinforce understanding for anyone attempting to learn about limited liability companies for dummies.

To create an LLC example, start with a business name, such as 'ABC Consulting LLC.' Write the full name followed by 'LLC' to clarify its legal structure, making it recognizable as a limited liability company. This straightforward approach is beneficial for individuals who are new to the concept of a limited liability company for dummies.

When writing LLC, it should always be capitalized, as it represents a legal entity. The term 'LLC' stands for limited liability company, and using the correct form is important in official documents. To help you better grasp this concept, think of it as a business structure intended to protect your personal assets while being easy to manage, especially for those learning about limited liability companies for dummies.

A typical example of an LLC name could be 'XYZ Innovations LLC.' In this case, 'XYZ Innovations' represents the business, and 'LLC' indicates the limited liability company structure. Remember, when naming your LLC, it’s crucial to ensure that the name is unique and complies with state naming rules. This guideline is particularly useful for those exploring the concept of a limited liability company for dummies.

Yes, you can file your Limited Liability Company by itself without the need for legal assistance. However, it is important to ensure all steps are completed correctly to avoid complications. Platforms like USLegalForms offer the tools and templates necessary for dummies to successfully file their LLC independently and confidently.

Understanding how LLCs are taxed can be straightforward once you grasp the basics. Typically, LLCs are considered pass-through entities, meaning profits and losses are reported on the owner's personal tax return. To simplify this process further, USLegalForms provides valuable resources specifically designed for dummies, helping you navigate your tax obligations with ease.

The best way to file taxes as a Limited Liability Company hinges on your chosen tax classification. You can either file personally or as a separate entity, which will influence your reporting process. Maximize your understanding of these options by checking out the guidance on USLegalForms, made for dummies seeking clarity on tax filings.