Transfer on Death Deed or TOD - Beneficiary Deed for Grantor to Five Grantee Beneficiaries

Colorado Statutes

TITLE 15 PROBATE, TRUSTS, AND FIDUCIARIES

COLORADO PROBATE CODE

ARTICLE 15 Nonprobate Transfers on Death

PART 4 TRANSFER OF REAL PROPERTY EFFECTIVE ON DEATH

15-15-402. Real property - beneficiary deed.

(1) In addition to any method allowed by law to effect a transfer at

death, title to an interest in real property may be transferred on the

death of the owner by recording, prior to the owner's death, a beneficiary

deed signed by the owner of such interest, as grantor, designating a

grantee-beneficiary of the interest. The transfer by a beneficiary deed

shall be effective only upon the death of the owner. A beneficiary deed

need not be supported by consideration.

(2) The joinder, signature, consent, or agreement of, or notice to, a

grantee-beneficiary of a beneficiary deed prior to the death of the grantor

shall not be required. Subject to the right of the grantee-beneficiary to

disclaim or refuse to accept the property, the conveyance shall be

effective upon the death of the owner.

(3) During the lifetime of the owner, the grantee-beneficiary shall have

no right, title, or interest in or to the property, and the owner shall

retain the full power and authority with respect to the property without

the joinder, signature, consent, or agreement of, or notice to, the

grantee-beneficiary for any purpose.

Source: L. 2004: Entire part added, p. 728, § 1, effective August 4.

15-15-403. Medicaid eligibility exclusion.

No person who is an applicant for or recipient of medical assistance

for which it would be permissible for the department of health care

policy and financing to assert a claim pursuant to section 25.5-4-301 or

25.5-4-302, C.R.S., shall be entitled to such medical assistance if the

person has in effect a beneficiary deed. Notwithstanding the provisions of

section 15-15-402(1), the execution of a beneficiary deed by an applicant

for or recipient of medical assistance as described in this section shall

cause the property to be considered a countable resource in accordance

with section 25.5-4-302(6), C.R.S., and applicable rules.

Source: L. 2004: Entire part added, p. 728, § 1, effective August 4.

L. 2006: Entire section amended, p. 2004, § 55, effective July 1.

15-15-404. Form of beneficiary deed - recording.

(1) An owner may transfer an interest in real property effective on the

death of the owner by executing a beneficiary deed that contains the words

"conveys on death" or "transfers on death" or otherwise indicates the

transfer is to be effective on the death of the owner and recording the

beneficiary deed prior to the death of the owner in the office of the clerk

and recorder in the county where the real property is located. A

beneficiary deed may be in substantially the following form:

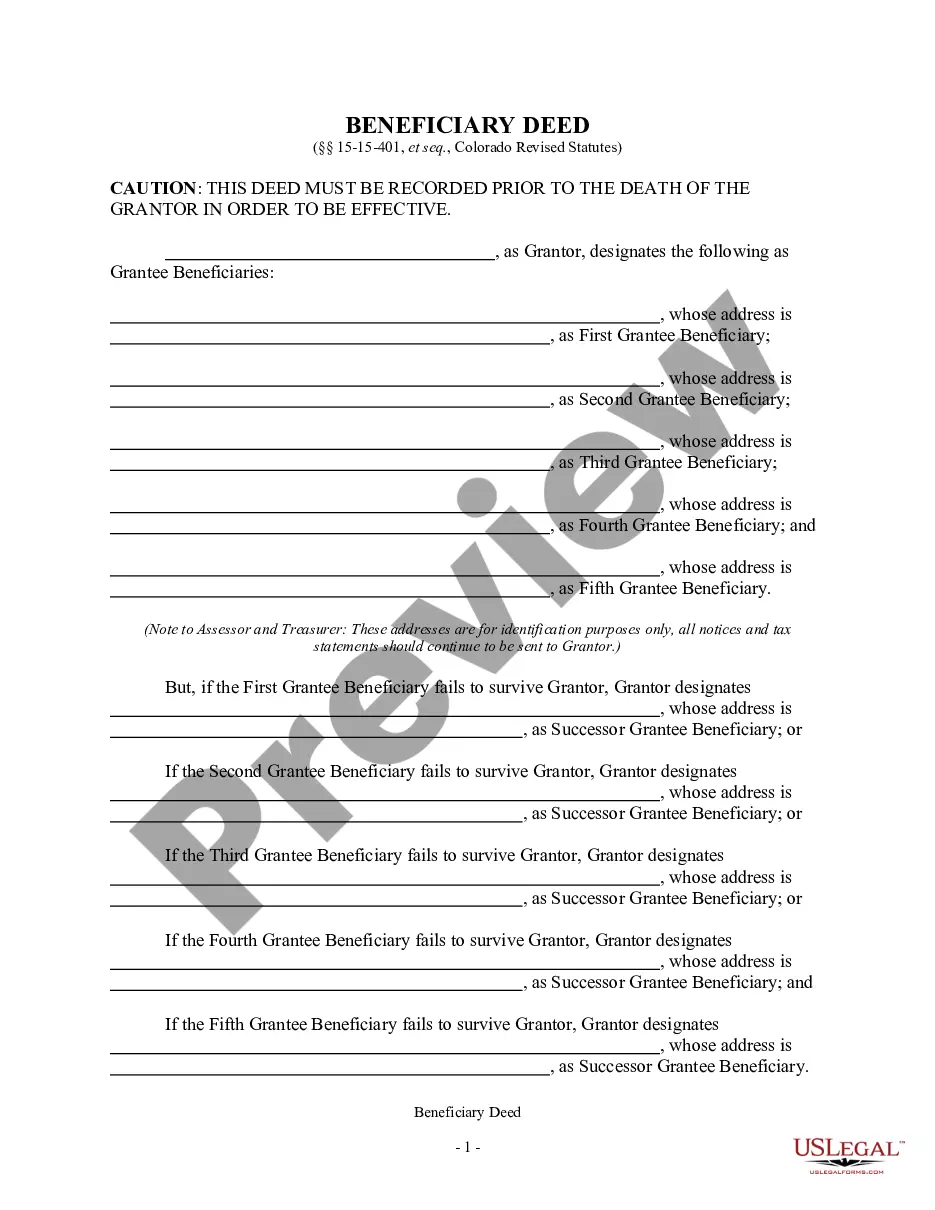

BENEFICIARY DEED

(§§ 15-15-401 et seq., Colorado Revised Statutes)

CAUTION: THIS DEED MUST BE RECORDED PRIOR TO THE DEATH OF THE GRANTOR

IN ORDER TO BE EFFECTIVE.

___, as grantor,

(Name of grantor)

designates____________________________________ as

(Name of grantee-beneficiary)

grantee-beneficiary whose address is ___ (Note to Assessor and

Treasurer: This address is for identification purposes only, all notices

and tax statements should continue to be sent to grantor.)

(Optional)[or if grantee-beneficiary fails to survive grantor, grantor

designates ___, as

(Name of successor grantee-beneficiary)

successor grantee-beneficiary whose address is ________________________

_____________________]

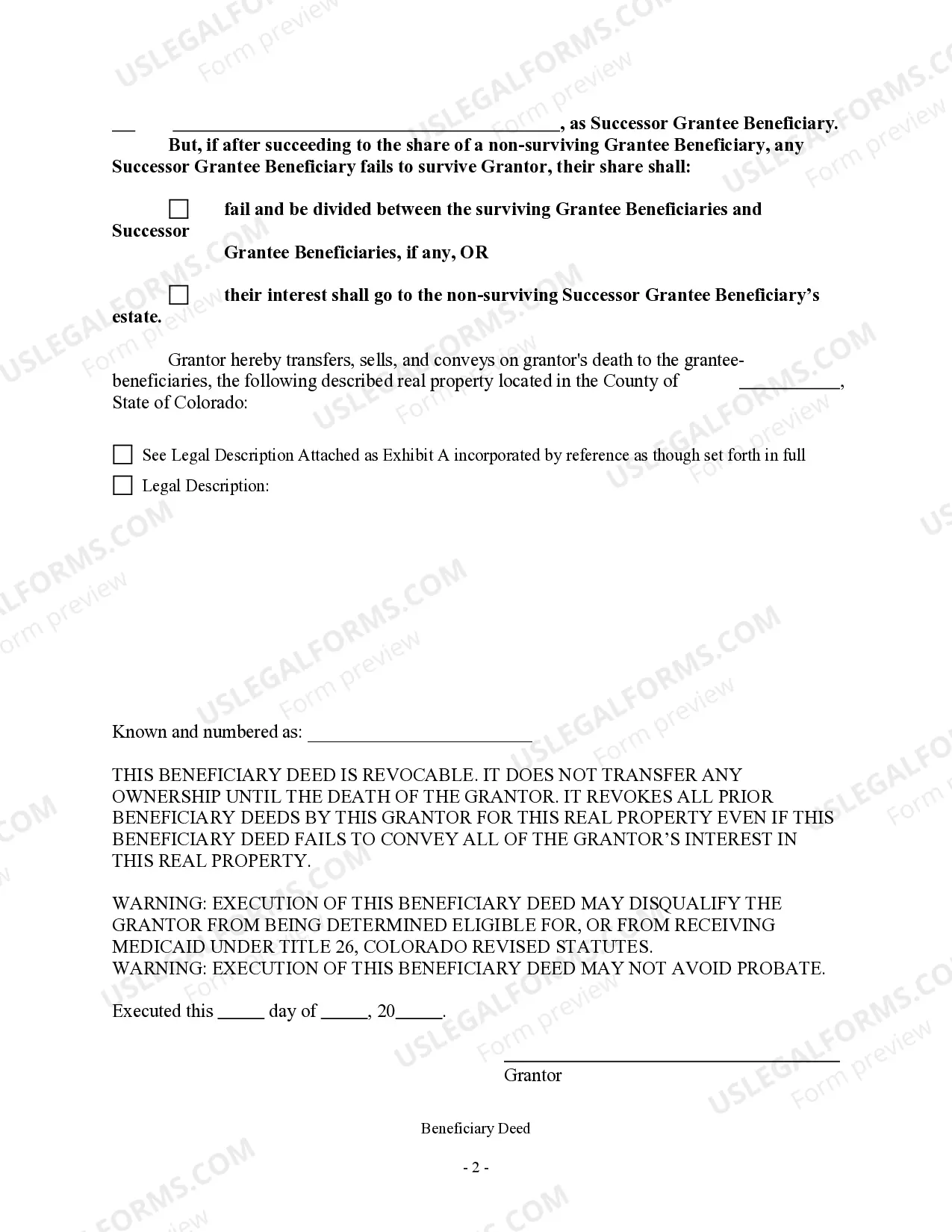

and grantor transfers, sells, and conveys on grantor's death to the

grantee-beneficiary, the following described real property located in the

County of ___, State of Colorado:

(insert legal description here)

Known and numbered as _______________

THIS BENEFICIARY DEED IS REVOCABLE. IT DOES NOT TRANSFER ANY OWNERSHIP UNTIL THE DEATH OF THE GRANTOR. IT REVOKES ALL PRIOR BENEFICIARY DEEDS BY THIS GRANTOR FOR THIS REAL PROPERTY EVEN IF THIS BENEFICIARY DEED FAILS TO CONVEY ALL OF THE GRANTOR'S INTEREST IN THIS REAL PROPERTY.

WARNING: EXECUTION OF THIS BENEFICIARY DEED MAY DISQUALIFY THE GRANTOR FROM BEING DETERMINED ELIGIBLE FOR, OR FROM RECEIVING, MEDICAID UNDER TITLE 26, COLORADO REVISED STATUTES.

WARNING: EXECUTION OF THIS BENEFICIARY DEED MAY NOT AVOID PROBATE.

Executed this______________.

(Date)

_________________________________

(Grantor)

(2) Unless the owner designates otherwise in a beneficiary deed, a

beneficiary deed shall not be deemed to contain any warranties of title and

shall have the same force and effect as a conveyance made using a bargain

and sale deed.

Source: L. 2004: Entire part added, p. 728, § 1, effective August 4.

15-15-405. Revocation � change � revocation by will prohibited.

(1) An owner may revoke a beneficiary deed by executing an instrument

that describes the real property affected, that revokes the deed, and

that is recorded prior to the death of the owner in the office of the

clerk and recorder in the county where the real property is located. The

joinder, signature, consent, agreement of, or notice to, the

grantee-beneficiary is not required for the revocation to be effective. A

revocation may be in substantially the following form:

REVOCATION OF BENEFICIARY DEED

(§§ 15-15-401 et seq., Colorado Revised Statutes)

CAUTION: THIS REVOCATION MUST BE RECORDED PRIOR TO THE DEATH OF THE GRANTOR IN ORDER TO BE EFFECTIVE.

___, as grantor, hereby

(Name of grantor)

REVOKES all beneficiary deeds concerning the following described real property located in the County of

___, State of Colorado:

(insert legal description here)

Known and numbered as _______________

Executed this ___.

(Date)

_________________________________

(Grantor)

(2) A subsequent beneficiary deed revokes all prior grantee-beneficiary designations by the owner for the described real property in their entirety even if the subsequent beneficiary deed fails to convey all of the owner's interest in the described real property. The joinder, signature, consent, or agreement of, or notice to, either the original or new grantee-beneficiary is not required for the change to be effective.

(3) The most recently executed beneficiary deed or revocation of all beneficiary deeds or revocations that have been recorded prior to the owner's death shall control regardless of the order of recording.

(4) A beneficiary deed that complies with the requirements of this part 4 may not be revoked, altered, or amended by the provisions of the will of the owner.

Source: L. 2004: Entire part added, p. 729, § 1, effective August 4.

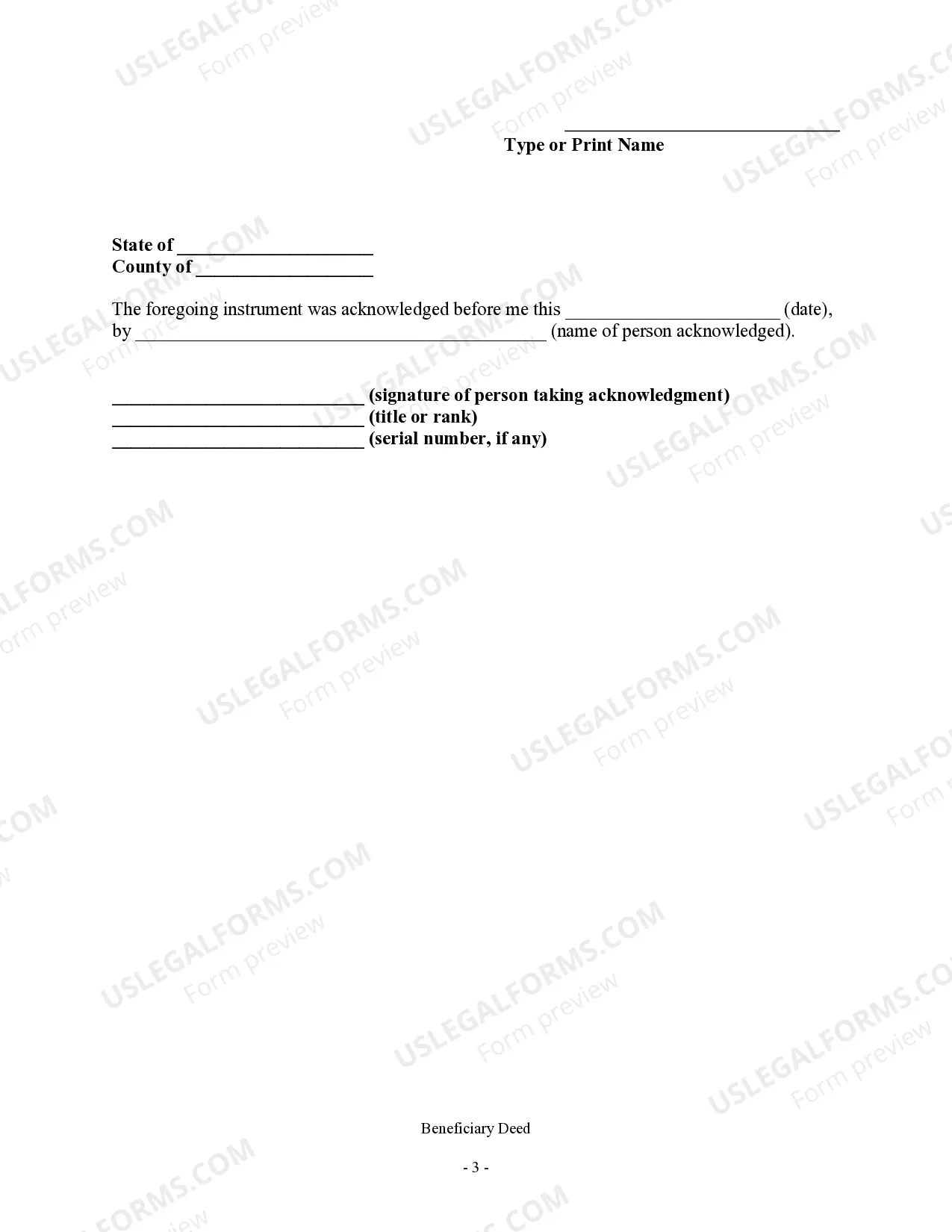

15-15-406. Acknowledgment.

A beneficiary deed or revocation of a beneficiary deed shall be subject to the requirements of section 38-35-109(2), C.R.S., and may be

acknowledged in accordance with section 38-35-101, C.R.S.

Source: L. 2004: Entire part added, p. 730, § 1, effective August 4.

15-15-407. Vesting of ownership in grantee-beneficiary.

(1) Title to the interest in real property transferred by a beneficiary deed shall vest in the designated grantee-beneficiary only on the death of the owner.

(2) A grantee-beneficiary of a beneficiary deed takes title to the owner's interest in the real property conveyed by the beneficiary deed at the death of the owner subject to all conveyances, encumbrances, assignments, contracts, mortgages, liens, and other interests, affecting title to the property, whether created before or after the recording of the beneficiary deed, or to which the owner was subject during the owner's lifetime including, but not limited to, any executory contract of sale, option to purchase, lease, license, easement, mortgage, deed of trust, or other lien. The grantee-beneficiary also takes title subject to any interest in the property of which the grantee-beneficiary has either actual or constructive notice.

(3)(a) A person having an interest described in subsection (2) of this section whose interest is not recorded in the records of the office of the clerk and recorder of the county in which the property is located at the time of the death of the owner, shall record evidence or a notice of the interest in the property not later than four months after the death of the owner. The notice shall name the person asserting the interest, describe the real property, and describe the nature of the interest asserted.

(b) Failure to record evidence or notice of interest in the property described in subsection (2) of this section within four months after the death of the owner shall forever bar the person from asserting an interest in the property as against all persons who do not have notice of the interest. A person who, without notice, obtains an interest in the property acquired by the grantee-beneficiary shall take the interest free from all persons who have not recorded their notice of interest in the property or evidence of their interest prior to the expiration of the four-month period.

(4) The interest of the grantee-beneficiary shall be subject to any claim of the department of health care policy and financing for recovery of medical assistance payments pursuant to section 25.5-4-301 or 25.5-4-302, C.R.S., which shall be enforced in accordance with section 15-15-103.

(5) The provisions of any anti-lapse statute shall not apply to beneficiary deeds. If one of multiple grantee-beneficiaries fails to survive the owner, and no provision for such contingency is made in the beneficiary deed, the share of the deceased grantee-beneficiary shall be proportionately added to, and pass as a part of, the shares of the surviving grantee-beneficiaries.

Source: L. 2004: Entire part added, p. 730, § 1, effective August 4.

L. 2006: (4) amended, p. 2004, § 56, effective July 1. L. 2007: (4)

amended, p. 2028, § 31, effective June 1.

15-15-408. Joint tenancy � definitions.

(1) A joint tenant of an interest in real property may use the procedures described in this part 4 to transfer his or her interest effective upon the death of such joint tenant. However, title to the interest shall vest in the designated grantee-beneficiary only if the joint tenant-grantor is the last to die of all of the joint tenants of such interest. If a joint tenant-grantor is not the last joint tenant to die, the beneficiary deed shall not be effective, and the beneficiary deed shall not make the grantee-beneficiary an owner in joint tenancy with the surviving joint tenant or tenants. A beneficiary deed shall not sever a joint tenancy.

(2) As used in this section, "joint tenant" means a person who owns an interest in real property as a joint tenant with right of survivorship.

Source: L. 2004: Entire part added, p. 731, § 1, effective August 4.

15-15-409. Rights of creditors and others. (Repealed)

15-15-410. Purchaser from grantee-beneficiary protected.

(1) Subject to the rights of claimants under section 15-15-407(2), if the property acquired by a grantee-beneficiary or a security interest therein is acquired for value and without notice by a purchaser from, or lender to, a grantee-beneficiary, the purchaser or lender shall take title free of rights of an interested person in the deceased owner's estate and shall not incur personal liability to the estate or to any interested person.

(2) For purposes of this section, any recorded instrument evidencing a transfer to a purchaser from, or lender to, a grantee-beneficiary on which a state documentary fee is noted pursuant to section 39-13-103, C.R.S., shall be prima facie evidence that the transfer was made for value. Any such sale or loan by the grantee-beneficiary shall not relieve the grantee-beneficiary of the obligation to the personal representative of the deceased owner's estate under section 15-15-103.

Source: L. 2004: Entire part added, p. 732, § 1, effective August 4.

L. 2007: (2) amended, p. 2028, § 32, effective June 1.

15-15-411. Limitations on actions and proceedings against

grantee-beneficiaries.

(1) Unless previously adjudicated or otherwise barred, the claim of a claimant to recover from a grantee-beneficiary who is liable to pay the claim, and the right of an heir or devisee or of a personal representative acting on behalf of an heir or devisee, to recover property from a grantee-beneficiary or the value thereof from a grantee-beneficiary is forever barred as follows:

(a) A claim by a creditor of the owner is forever barred at one year

after the owner's death.

(b) Any other claimant or an heir or devisee is forever barred at the

earlier of the following:

(I) Three years after the owner's death; or

(II) One year after the time of recording the proof of death of the owner in the office of the clerk and recorder in the county in which the legal property is located.

(2) Nothing in this section shall be construed to bar an action to recover property or value received as the result of fraud.

Source: L. 2004: Entire part added, p. 733, § 1, effective August 4.

15-15-412. Nontestamentary disposition.

A beneficiary deed shall not be construed to be a testamentary

disposition and shall not be invalidated due to nonconformity with the

provisions of the "Colorado Probate Code" governing wills.

Source: L. 2004: Entire part added, p. 733, § 1, effective August 4.

15-15-413. Proof of death.

Proof of the death of the owner or a grantee-beneficiary shall be

established in the same manner as for proving the death of a joint tenant.

Source: L. 2004: Entire part added, p. 733, § 1, effective August 4.

15-15-414. Disclaimer.

A grantee-beneficiary may refuse to accept all or any part of the real property interest described in a beneficiary deed. A grantee-beneficiary may disclaim all or any part of the real property interest described in a beneficiary deed by any method provided by law. If a grantee-beneficiary refuses to accept or disclaims any real property interest, the grantee-beneficiary shall have no liability by reason of being designated as a grantee-beneficiary under this part 4.

Source: L. 2004: Entire part added, p. 733, § 1, effective August 4.

15-15-415. Applicability.

The provisions of this part 4 shall apply to beneficiary deeds executed by owners who die on or after August 4, 2004.

Source: L. 2004: Entire part added, p. 733, § 1, effective August 4.