Deed Personal Representative Without Will

Description

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Whether for business purposes or for personal matters, everybody has to manage legal situations sooner or later in their life. Completing legal paperwork demands careful attention, beginning from picking the appropriate form template. For instance, when you choose a wrong edition of the Deed Personal Representative Without Will, it will be rejected when you submit it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you need to obtain a Deed Personal Representative Without Will template, follow these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s description to make sure it suits your case, state, and county.

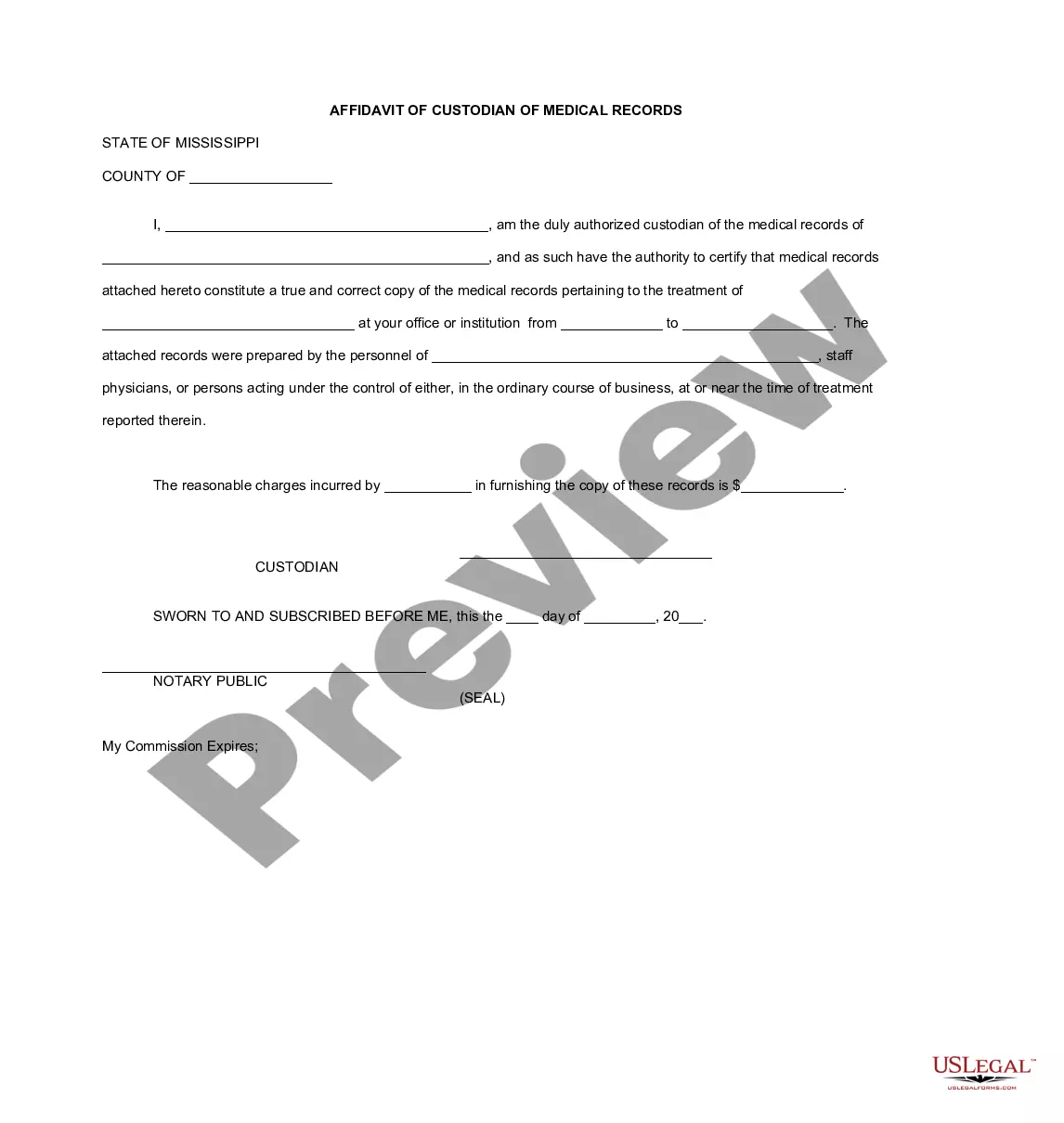

- Click on the form’s preview to examine it.

- If it is the wrong document, get back to the search function to find the Deed Personal Representative Without Will sample you require.

- Get the file when it meets your requirements.

- If you have a US Legal Forms account, just click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Select your payment method: you can use a bank card or PayPal account.

- Choose the file format you want and download the Deed Personal Representative Without Will.

- When it is saved, you are able to complete the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never have to spend time looking for the right sample across the internet. Use the library’s simple navigation to find the appropriate form for any occasion.

Form popularity

FAQ

This depends on whether they had the right documents and how the property and debt are categorized. Probate may still be necessary depending on the estate's size and type of property and debt.

How to transfer property of the deceased in Texas without a will Identifying the heirs based on Texas intestate succession laws. ... Submitting the Affidavit of Heirship to the County Clerk. ... Drafting and Recording a New Deed. ... Example: Transferring a Family Home to the Surviving Spouse and Children.

When a Texas resident dies without a will, their estate is said to be ?intestate.? If the decedent is married, the surviving spouse typically inherits all of the deceased's community property. If the decedent was not married, their intestate estate generally passes to their children or other close relatives.

In Colorado, if someone passes away without a spouse, but has children, the children inherit all eligible assets. If someone passes away without children, but has a spouse, the spouse inherits all eligible assets.

If you have no spouse or children, your property will be split among your parents and/or siblings, depending on who survives you: If both parents are still living, ½ goes to Mother and ½ goes to Father. If one parent and siblings (or siblings' descendants) are still living, ½ goes to surviving parent and ½ to siblings.