Deed Personal Representative With Trust

Description

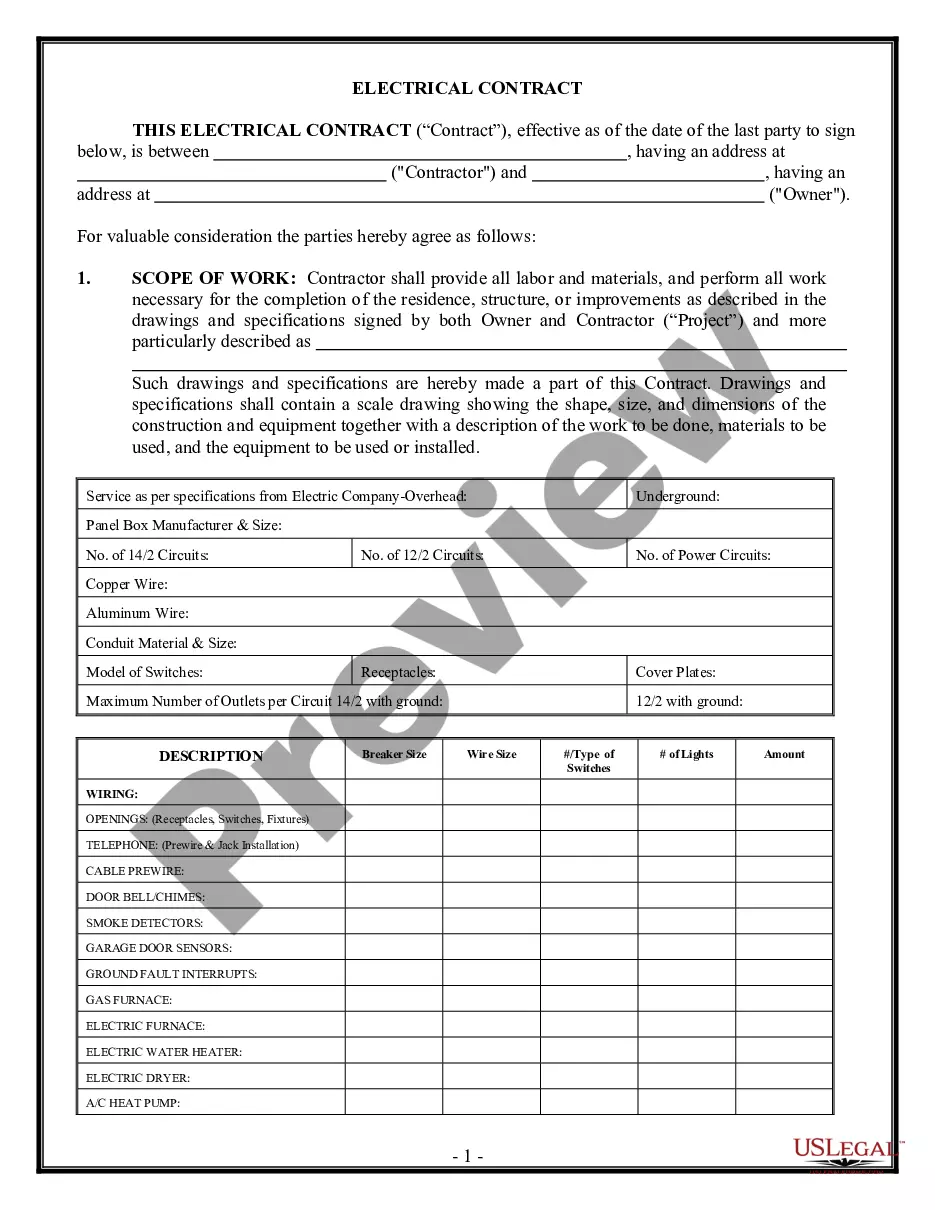

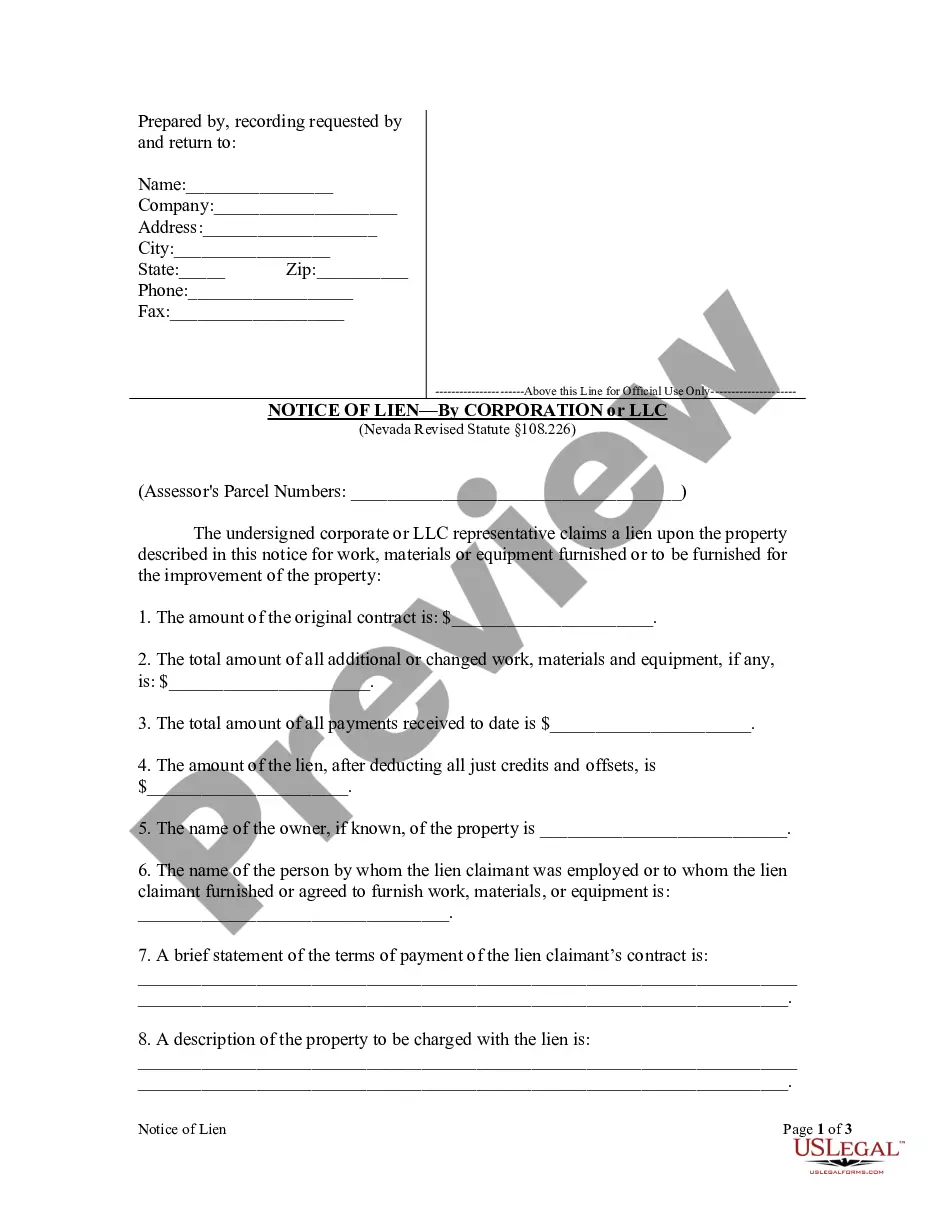

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Dealing with legal papers and procedures might be a time-consuming addition to the day. Deed Personal Representative With Trust and forms like it typically require that you look for them and navigate how to complete them properly. For that reason, whether you are taking care of financial, legal, or individual matters, having a comprehensive and practical web library of forms when you need it will help a lot.

US Legal Forms is the best web platform of legal templates, boasting more than 85,000 state-specific forms and a number of tools that will help you complete your papers quickly. Check out the library of appropriate papers available to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your papers management procedures by using a top-notch service that lets you prepare any form within minutes without having additional or hidden fees. Simply log in to the profile, find Deed Personal Representative With Trust and download it right away in the My Forms tab. You can also gain access to formerly saved forms.

Could it be your first time making use of US Legal Forms? Register and set up an account in a few minutes and you’ll get access to the form library and Deed Personal Representative With Trust. Then, follow the steps below to complete your form:

- Be sure you have discovered the proper form by using the Preview option and reading the form information.

- Select Buy Now as soon as ready, and choose the monthly subscription plan that fits your needs.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience helping users manage their legal papers. Find the form you want today and streamline any process without breaking a sweat.

Form popularity

FAQ

Generally, the person who oversees your estate is known as your ?personal representative.? California law also refers to a personal representative as an ?executor? or ?administrator.? All three terms describe the same function, although there is a legal distinction between their method of appointment.

Yes, it's quite common for the personal representative to also be the beneficiary. Oftentimes, that personal representative/beneficiary is a surviving spouse or immediate family member.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Basically, after your lifetime, a trustee is responsible for assets held in trust and a personal representative (sometimes also called an executor) is responsible for assets held in your individual name. You appoint these important agents of your estate plan with will or trust documents.

If you have a trust and funded it with most of your assets during your lifetime, your successor Trustee will have comparatively more power than your Executor. ?Attorney-in-Fact,? ?Executor? and ?Trustee? are designations for distinct roles in the estate planning process, each with specific powers and limitations.