Deed Of Distribution Virginia

Description

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Whether for business purposes or for personal matters, everybody has to manage legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with selecting the appropriate form template. For example, when you choose a wrong version of a Deed Of Distribution Virginia, it will be turned down when you submit it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you have to get a Deed Of Distribution Virginia template, follow these easy steps:

- Find the template you need by using the search field or catalog navigation.

- Check out the form’s information to ensure it fits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to locate the Deed Of Distribution Virginia sample you need.

- Get the file if it meets your requirements.

- If you already have a US Legal Forms profile, just click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Deed Of Distribution Virginia.

- After it is saved, you are able to fill out the form with the help of editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time seeking for the right template across the internet. Take advantage of the library’s straightforward navigation to get the correct form for any situation.

Form popularity

FAQ

EFFECTIVE IMMEDIATELY: All deeds recorded in the City of Norfolk MUST comply with the new provisions of Virginia Code Section 17.1-223. All deeds must be prepared by the owner of the property or by an attorney licensed to practice in Virginia.

Every deed and corrected or amended deed may be made in the following form, or to the same effect: "This deed, made the ______ day of ______, in the year ____, between (here insert names of parties as grantors or grantees), witnesseth: that in consideration of (here state the consideration, nominal or actual), the said ...

Deeds of gift are exempt from recordation taxes under Va. Code 58.1-811(D).

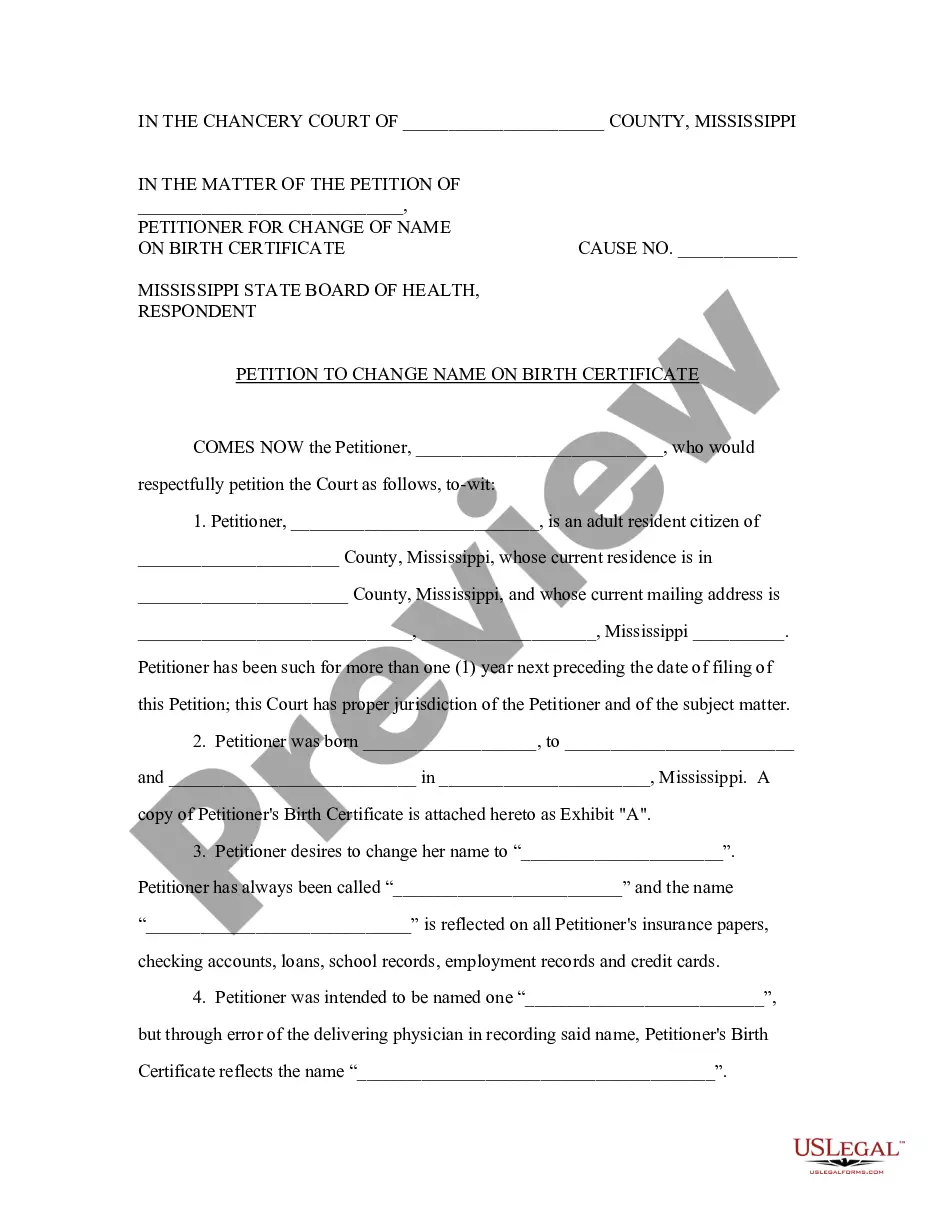

As used in this subsection, "deed of distribution" means a deed conveying property from an estate or trust (i) to the original beneficiaries of a trust from the trustees holding title under a deed in trust; (ii) the purpose of which is to comply with a devise or bequest in the decedent's will or to transfer title to ...

The deed proves that the transfer is actually a gift and does not require any conditions or form of compensation. For a gift deed to be legally valid, it must meet the necessary requirements: The grantor intends to make a gift of the property. The grantor must deliver the property to the grantee.