Co Deed Form For Florida

Description

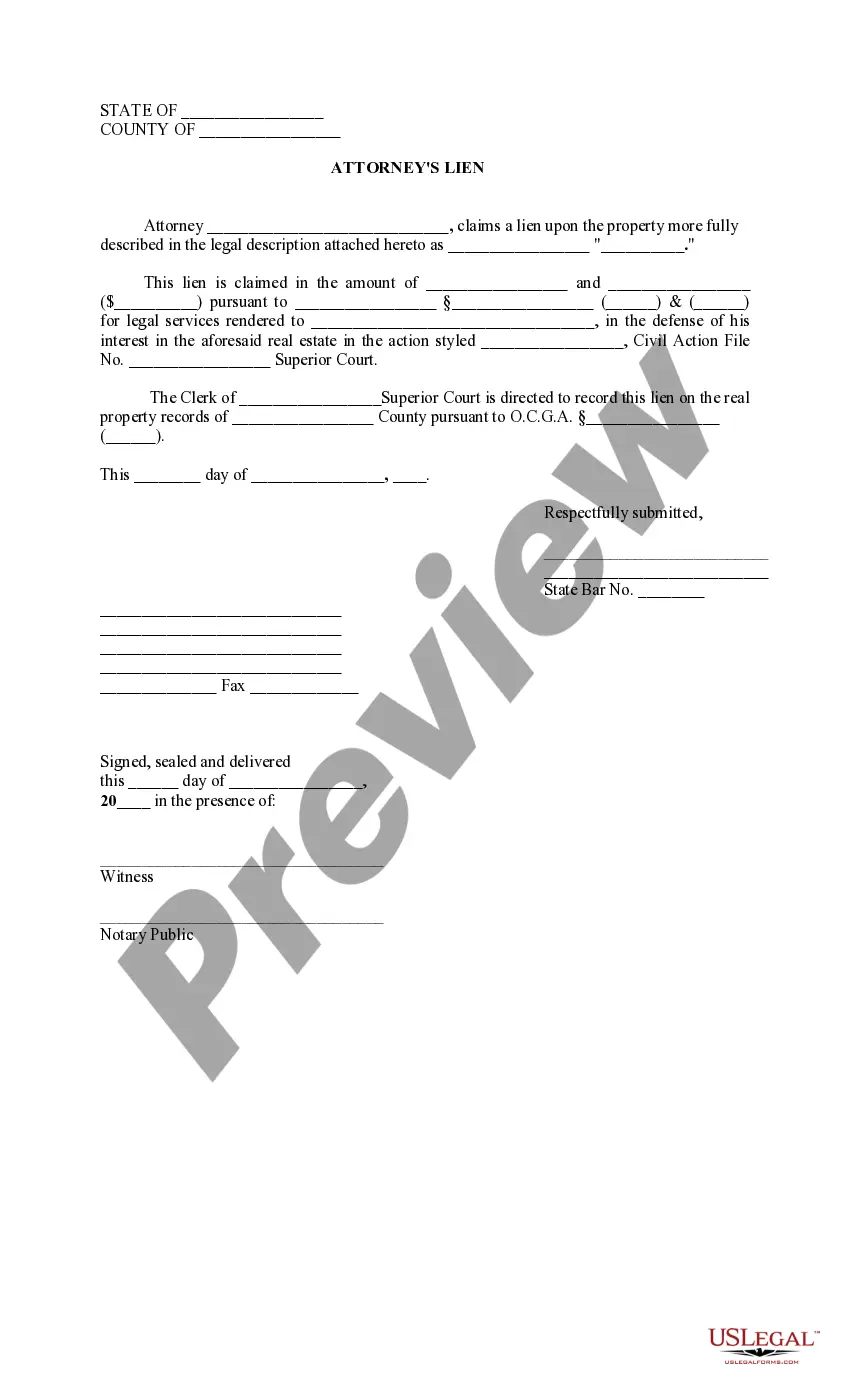

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Legal documents handling can be daunting, even for the most seasoned professionals.

If you are seeking a Co Deed Form For Florida and lack the time to search for the appropriate and current version, the tasks may be challenging.

Access state- or county-specific legal and business documents.

US Legal Forms accommodates any needs you might have, from personal to business documents, all in a single place.

If this is your first experience with US Legal Forms, create an account and enjoy unlimited access to all the features of the platform. Below are the steps to follow after downloading the form you need: Validate that this is the correct form by previewing it and reviewing its description. Ensure that the sample is authorized in your state or county. Click Buy Now when you are ready. Choose a monthly subscription plan. Locate the file format you require, and Download, fill out, sign, print, and send your document. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your daily document management into a seamless and user-friendly process today.

- Utilize advanced tools to complete and manage your Co Deed Form For Florida.

- Access a resource pool of articles, guides, and manuals relevant to your situation and needs.

- Save time and effort searching for the documents you require, and make use of US Legal Forms’ advanced search and Preview feature to find Co Deed Form For Florida and obtain it.

- If you have a subscription, Log In to the US Legal Forms account, search for the form, and retrieve it.

- Check the My documents tab to view the documents you have previously saved and manage your folders as you wish.

- A comprehensive online form repository could be a significant improvement for anyone aiming to handle these circumstances effectively.

- US Legal Forms is a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible to you anytime.

- With US Legal Forms, you can.

Form popularity

FAQ

Yes, you can complete a quitclaim deed yourself using the Co deed form for Florida. The process involves filling out the form, notarizing it, and filing it with the county. Many find it straightforward, but ensure you have all the correct details before submission. If you need guidance, platforms like US Legal Forms offer resources to help you navigate the process easily.

You do not necessarily need a lawyer to complete a quitclaim deed in Florida, but having one can help clarify the process. With the Co deed form for Florida readily available, many individuals choose to do it themselves. However, if you have doubts or specific legal concerns, consulting an attorney can provide peace of mind.

The primary downside of a quitclaim deed is that it offers no guarantees about the title. If there are any liens or title issues, the grantee takes on those risks. Additionally, a quitclaim deed does not provide any warranty, which may lead to complications in the future. It's essential to understand these factors when using the Co deed form for Florida.

While you do not need a lawyer for a quitclaim deed in Florida, consulting one can be beneficial, especially for complex situations. A lawyer can help ensure you fill out the Co deed form for Florida correctly and understand any potential implications of the transfer. Ultimately, the decision depends on your comfort level with the process.

Yes, you can file your own quitclaim deed in Florida without any legal representation. Begin by completing the Co deed form for Florida with accurate information. After notarization, you can file the deed at your county's Clerk of Court office, ensuring you follow any specific local filing requirements.

To prepare a quitclaim deed in Florida, start by obtaining a Co deed form for Florida. Fill in the necessary details, including the grantor's and grantee's names, property description, and any other required information. It's essential to have the document notarized to ensure its legality. Once ready, submit it to the appropriate county office to finalize the process.

The best way to execute a quitclaim deed is to complete the Co deed form for Florida accurately. Ensure you have the correct property description and the names of all parties involved. After filling out the form, sign it in front of a notary public to validate the transfer. Finally, file the completed deed with your county's Clerk of Court for it to take effect.