Beneficiary Deed Colorado Tax Implications

Description

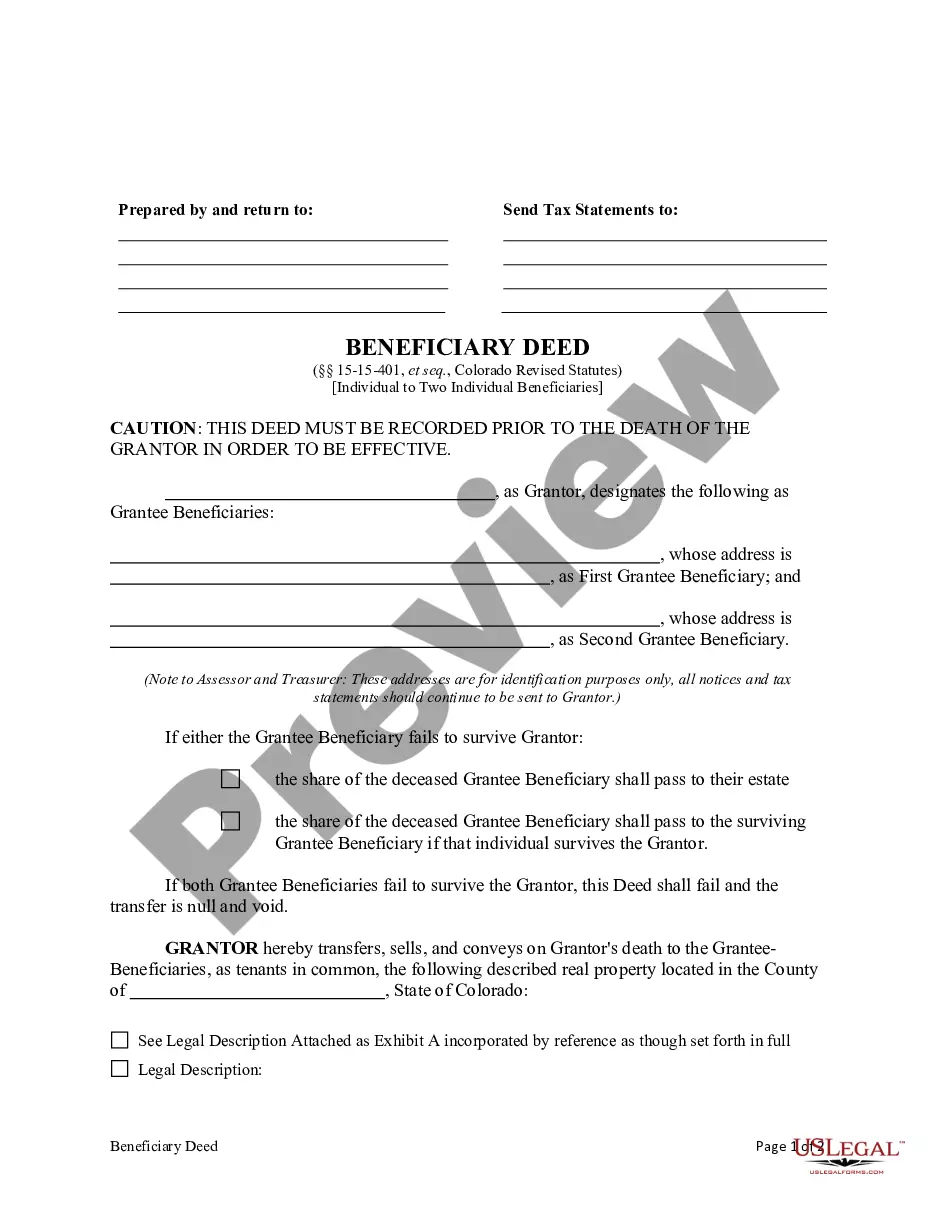

How to fill out Colorado Beneficiary Deed - Individual To Two Individuals Without Successor Beneficiaries?

Engaging with legal documents and processes can be a tedious addition to your daily routine.

Beneficiary Deed Colorado Tax Consequences and similar forms typically necessitate that you search for them and comprehend how to finalize them correctly.

Therefore, regardless of whether you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms will be significantly beneficial.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific documents and many resources to assist you in completing your paperwork effortlessly.

Is it your first time using US Legal Forms? Create an account and set it up in a few minutes to gain access to the form library and Beneficiary Deed Colorado Tax Consequences. Then, follow these steps to complete your form.

- Browse the collection of relevant documents accessible to you with a single click.

- US Legal Forms grants you access to state- and county-specific forms available for download at any time.

- Streamline your document management processes using a superior service that allows you to assemble any form in just a few minutes without hidden fees.

- Simply Log In to your account, find Beneficiary Deed Colorado Tax Consequences, and download it instantly within the My documents section.

- You can also retrieve forms that were downloaded previously.

Form popularity

FAQ

A beneficiary is generally not taxed on the assets received through a beneficiary deed in Colorado. Instead, the focus is on the estate's value and any income derived from those assets. While the beneficiary does not face a tax obligation at the time of inheritance, future tax responsibilities may arise if the property generates income or appreciates in value. To fully understand how beneficiary deed Colorado tax implications may affect you, seeking guidance from a tax expert can provide clarity and ensure compliance with current regulations.

A Colorado quitclaim deed* transfers property from the current owner (the Grantor) to a new owner (the Grantee).

Real Estate and TOD in Colorado In Colorado, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed.

To get title to the property after your death, the beneficiary must record an affidavit (sworn statement) and certified copy of the death certificate in the county clerk and recorder's office. No probate is necessary.

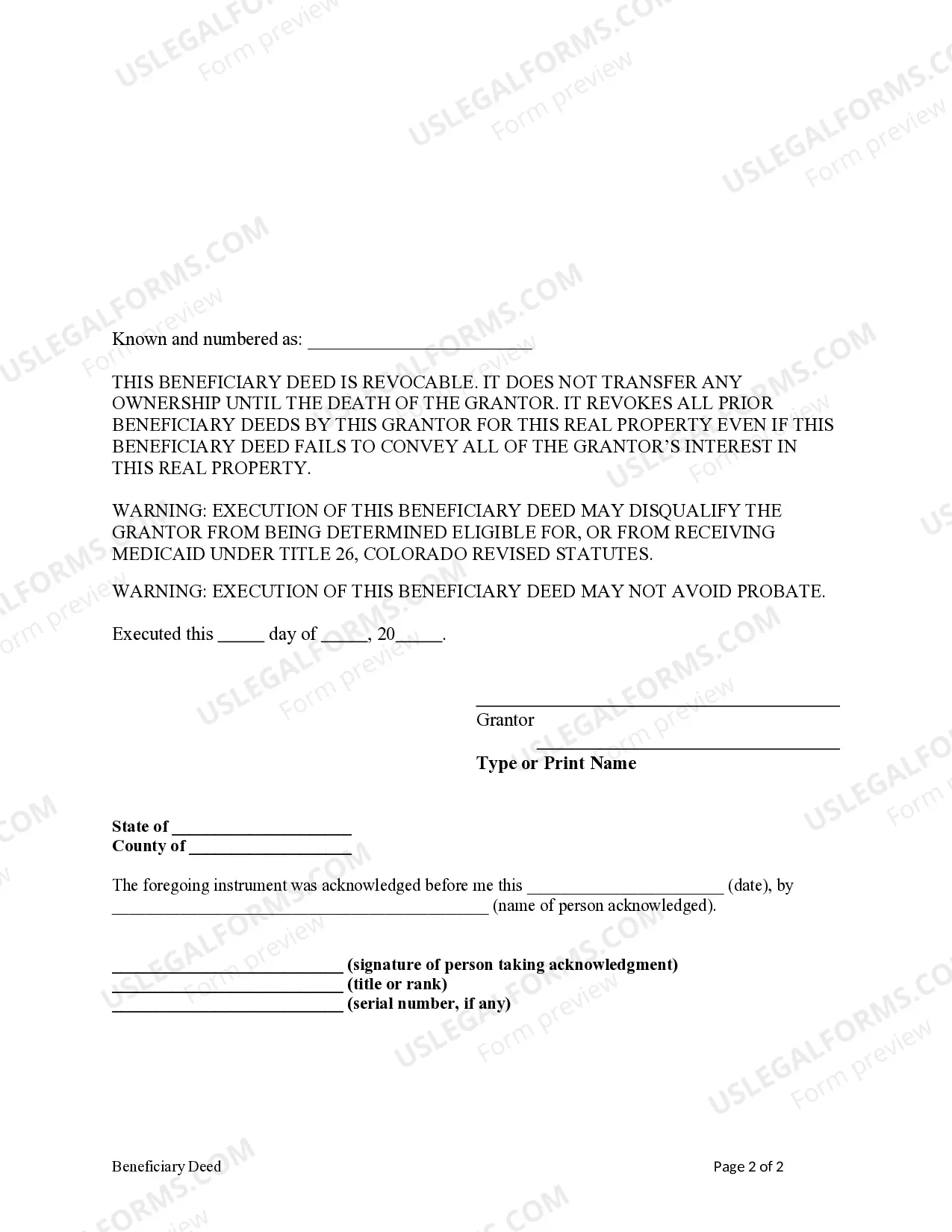

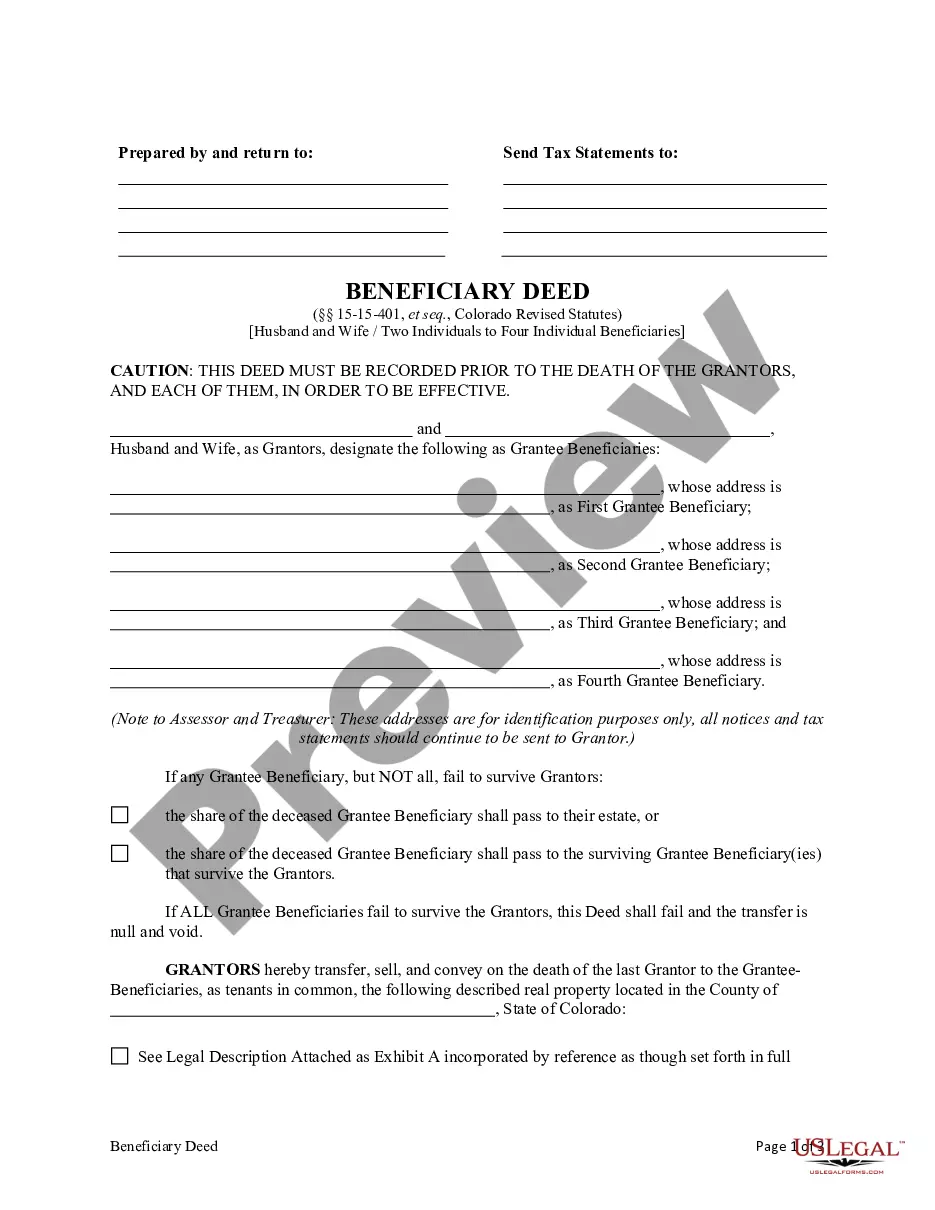

A beneficiary deed must be recorded in the county recorder's office where the property is located. For the document to be valid, it must be recorded prior to the property owner's death (§ 15-15-404). Fees: Recording fees vary by county.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk and recorder's office before your death. Otherwise, it won't be valid.