Llc Limited Life

Description

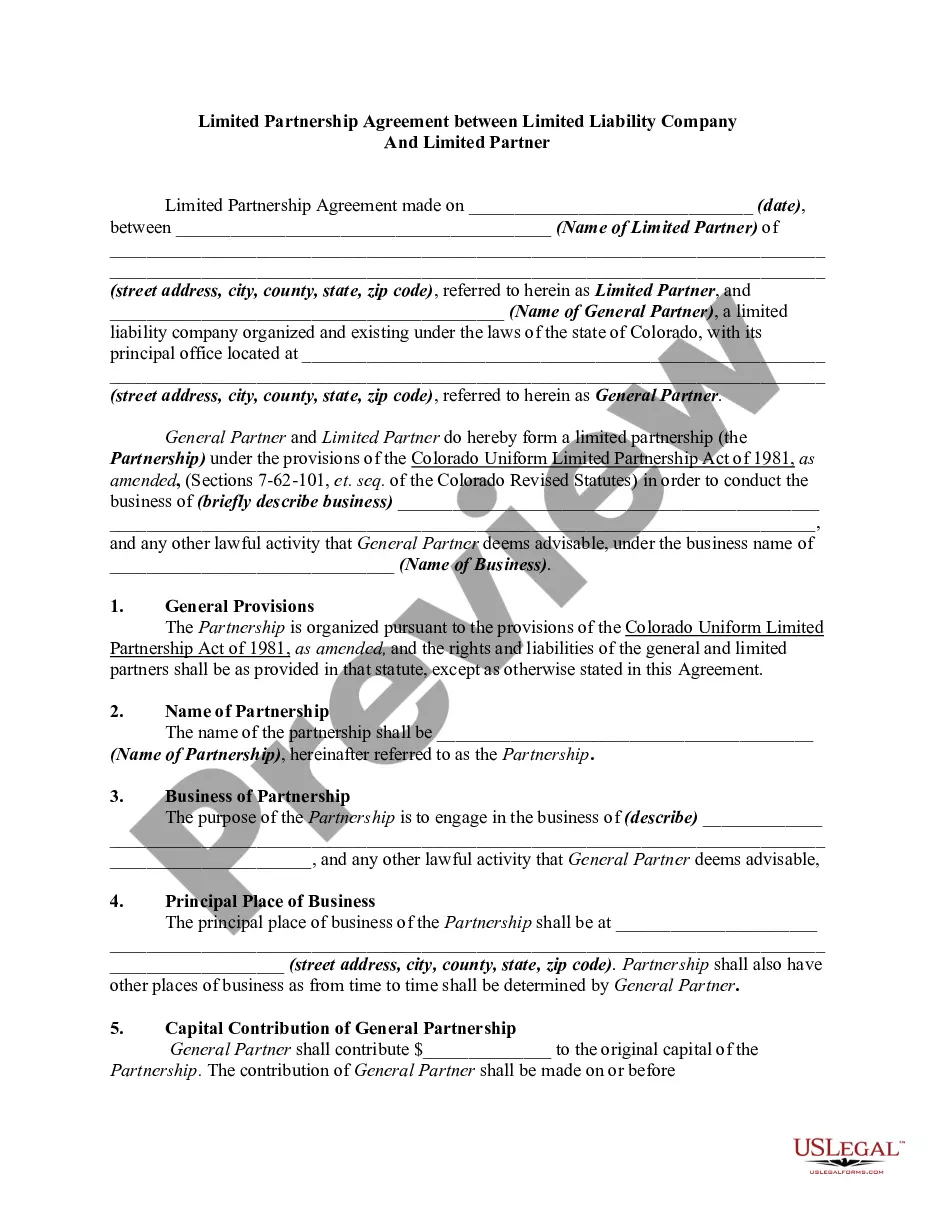

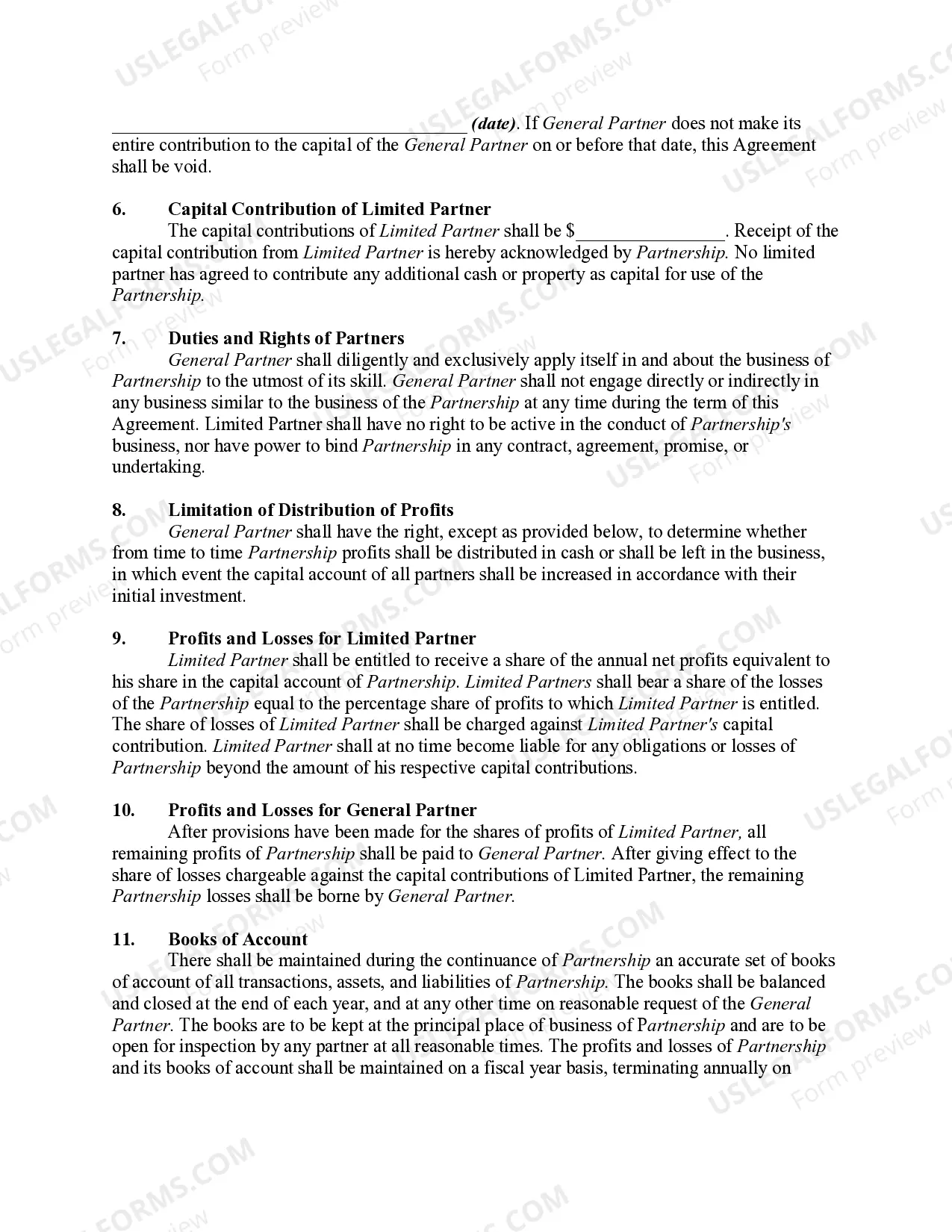

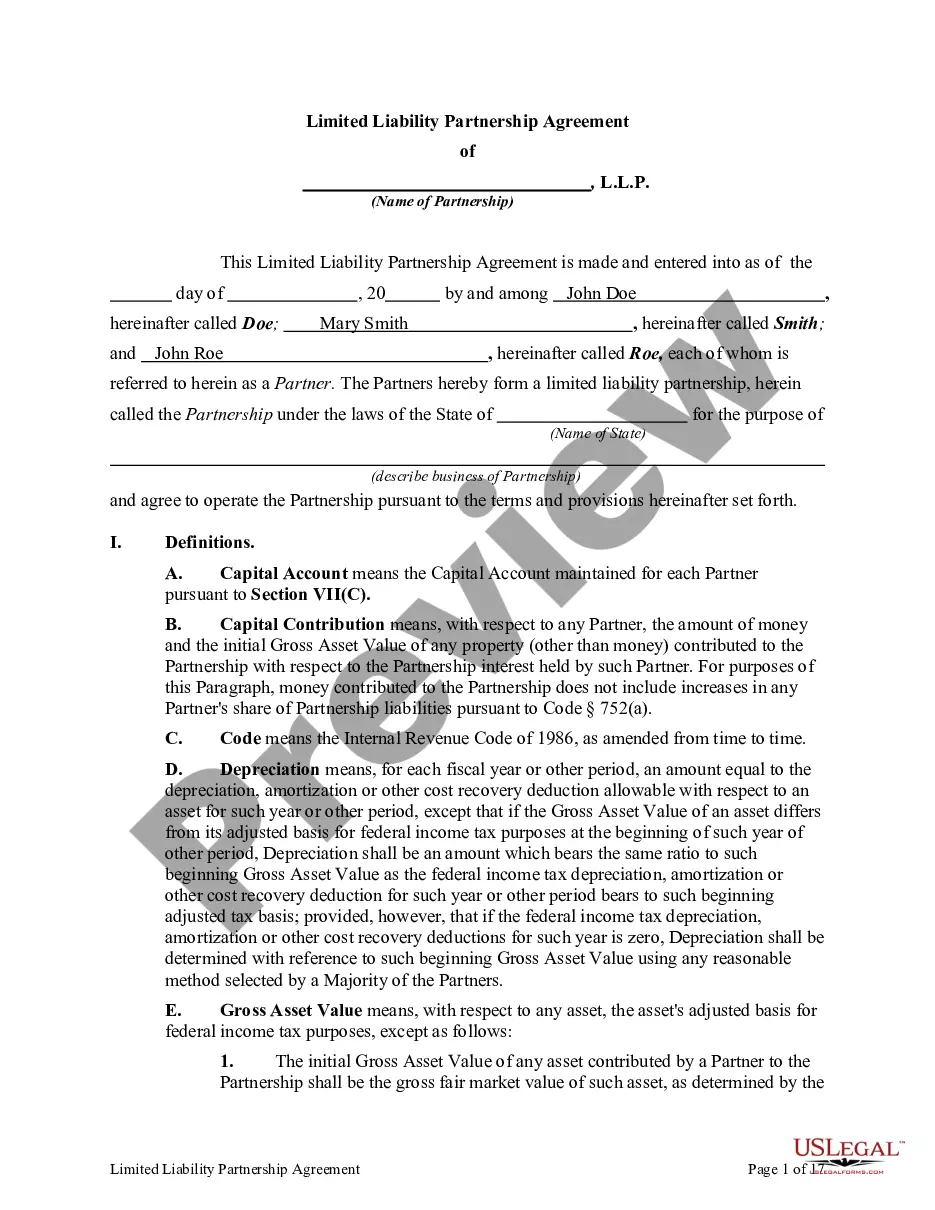

How to fill out Colorado Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

- If you're a returning user, log into your account and click the Download button next to your desired form. Ensure your subscription is current; if not, renew it based on your payment plan.

- For new users, start by checking the Preview mode and form description. This ensures you select the correct LLC limited life form that meets your specific jurisdictional requirements.

- If the form isn't suitable, utilize the Search tab above to find another template that fits your needs.

- Once you've selected the right document, proceed to purchase by clicking the Buy Now button and choosing the subscription plan that best works for you. Create an account to access all library resources.

- Complete your purchase by entering your credit card details or using your PayPal account for subscription payment.

- Finally, download your form and save it on your device for future reference. You can also access it anytime in the My Forms section of your profile.

By leveraging US Legal Forms, you empower yourself with easy access to a vast selection of legal documents tailored to your needs.

Start your journey toward legal documentation today and secure peace of mind with reliable forms. Visit US Legal Forms now!

Form popularity

FAQ

It’s recommended that LLCs set aside about 25% to 30% of their profits for taxes. This amount helps cover federal, state, and self-employment taxes, ensuring you avoid surprises during tax season. Planning for taxes plays a crucial role in managing your LLC limited life effectively. Using tools from platforms like US Legal Forms can assist you in estimating your tax liabilities accurately.

There is no income cap for LLCs, which gives you significant growth potential. Your LLC can earn as much as the market allows, without any restrictions on revenue. This flexibility aligns well with an LLC's limited life, as it enables you to focus on increasing profitability. Monitoring your growth and utilizing platforms like US Legal Forms helps you stay compliant with tax obligations.

While LLCs can deduct many business expenses, there are limits to certain types of deductions, especially for meals and entertainment. However, the overall business expenses incurred can usually be written off to reduce taxable income. This allows you to optimize your finances and stay within the guidelines for your LLC limited life. Using resources like US Legal Forms can clarify the rules and help you navigate these limits.

Yes, you can write off LLC startup costs. When you form your LLC, expenses like legal fees, registration costs, and market research can qualify as startup costs. These expenses can be deducted in the first year your LLC starts operating or amortized over 15 years. This benefit helps you manage your LLC limited life more efficiently.

The duration of an LLC varies based on its formation documents. While some LLCs have a designated limited life, others can exist indefinitely if they meet ongoing state requirements. To maintain your LLC’s longevity, regularly fulfill compliance duties, such as filing reports and paying fees, which can be seamlessly managed using platforms like USLegalForms.

The renewal frequency for an LLC typically depends on the state in which it is registered. Most states require annual or biennial reports and fees to keep your LLC in good standing. Staying organized and on top of these requirements is essential to avoid any lapse in your LLC's existence, particularly concerning its LLC limited life.

Yes, an LLC can expire if it has a limited life specified in its Articles of Organization. This limited life indicates that the LLC will cease to exist after a designated period, unless you take steps to renew it. Regular renewals and compliance with state laws can help ensure your LLC remains active and viable.

Running your life through an LLC can simplify your personal affairs, but it is essential to understand the concept of LLC limited life. An LLC primarily protects your personal assets from business liabilities. You can manage personal assets within the LLC, but ensure that you maintain clear boundaries between personal and business finances to preserve that protection.

An example of the purpose of a business could be 'To create innovative technology solutions that simplify everyday tasks.' This purpose communicates the goal and direction of the company, aligning with the concept of LLC limited life in terms of operational timeline.

When specifying the duration of your LLC, you can indicate whether it is perpetual or limited. If you choose a limited duration, you could say 'This LLC will operate for ten years from the date of its establishment.' This helps define the timeline of your LLC's limited life.