State Of Colorado Operating Agreement For Corporation

Description

How to fill out Colorado Limited Liability Company LLC Operating Agreement?

Regardless of whether it is for professional aims or personal issues, everyone must deal with legal circumstances at some time in their life.

Completing legal documents requires meticulous care, starting with selecting the appropriate form template.

With an extensive US Legal Forms library available, you do not have to waste time searching for the correct template on the internet. Utilize the library's simple navigation to find the right form for any occasion.

- Locate the template you require by using the search bar or catalog navigation.

- Review the form's description to ensure it suits your circumstances, state, and county.

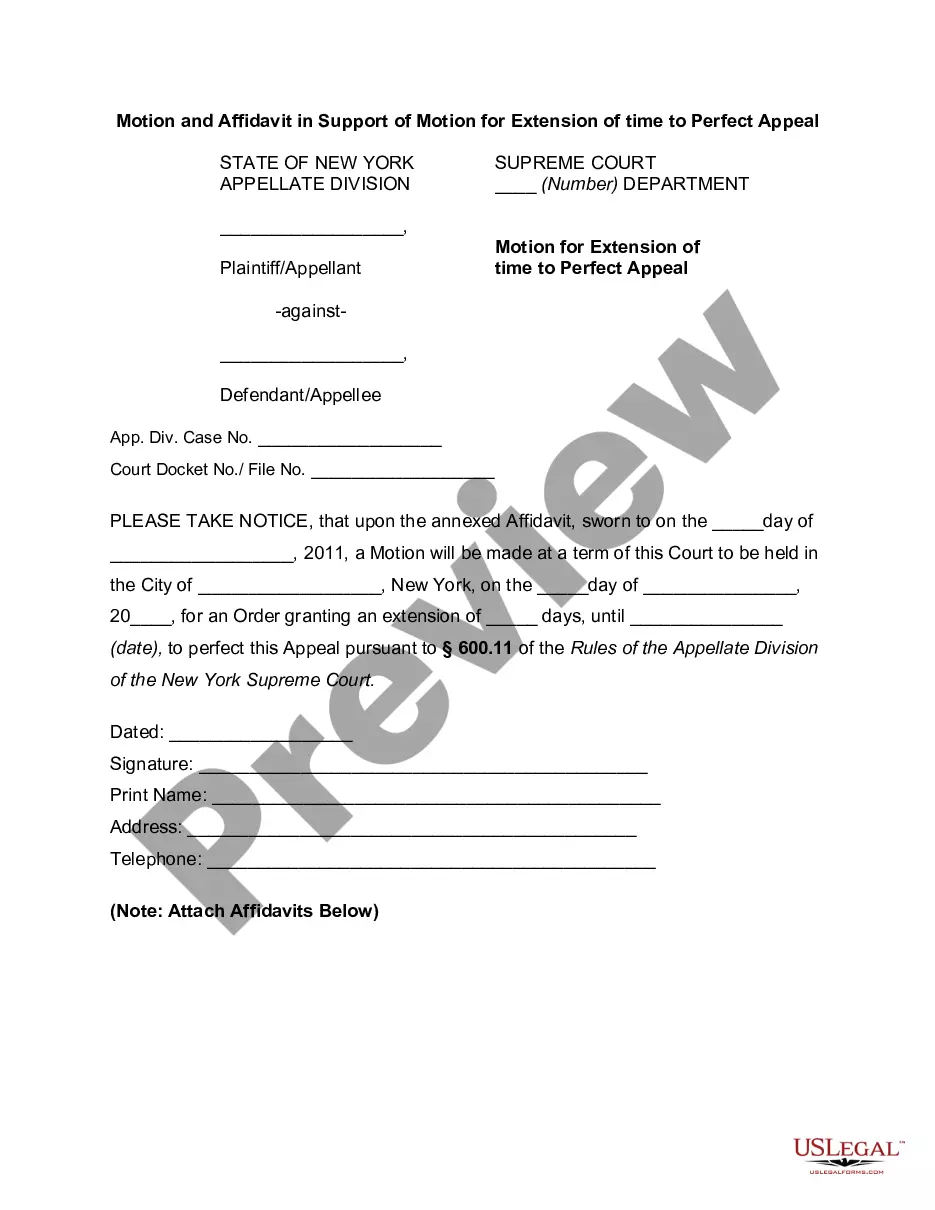

- Click on the form's preview to view it.

- If it is the incorrect document, return to the search function to find the State Of Colorado Operating Agreement For Corporation sample you need.

- Obtain the file when it meets your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate payment option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the State Of Colorado Operating Agreement For Corporation.

- Once saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

In Colorado, an operating agreement is not legally required for LLCs, but it is highly advisable. An operating agreement for an LLC in Colorado sets clear rules for ownership and management, which can help avert future conflicts. Using a comprehensive State of Colorado operating agreement for corporation or LLC can define roles, responsibilities, and operations, providing clarity and security for all members involved. Consider leveraging platforms like US Legal Forms to simplify the creation of your LLC operating agreement.

Operating agreement requirements vary by state. States like Delaware and California do not mandate corporation operating agreements, but having one is advisable. On the other hand, many states, including Wyoming and New Jersey, prefer that businesses have a formal operating agreement in place. For detailed guidance on state-specific requirements, consider using resources from platforms like US Legal Forms.

While Colorado does not legally require corporations to have an operating agreement, it is highly recommended. An operating agreement enhances your corporation's credibility and outlines its structure and governing rules. Furthermore, having a clear operating agreement protects your interests and helps prevent disputes. Therefore, investing time in creating a State of Colorado operating agreement for your corporation can be beneficial.

Yes, you can draft your own operating agreement for your corporation. However, it's important to ensure that it meets the legal requirements of the State of Colorado. A well-structured operating agreement can clarify the management and operational procedures of your corporation. If you're uncertain, consider using resources like US Legal Forms for a guided approach.

Yes, you can create your own State of Colorado operating agreement for corporation. Start by researching the essential components that need to be included, such as roles, responsibilities, and operational procedures. However, writing an agreement can be complex; using a service like US Legal Forms can provide you with reliable templates and legal guidance to ensure your document is complete and valid.

Yes, having a State of Colorado operating agreement for corporation is highly recommended, even if it is not legally required. This document clarifies the management structure and outlines member responsibilities, helping prevent misunderstandings down the line. It serves as a foundational tool for internal governance and can be essential in legal proceedings. Consider using a platform like US Legal Forms to create a comprehensive agreement.

Writing a simple operating agreement for a State of Colorado corporation involves several key steps. Begin with an introduction that states the purpose of the agreement, followed by defining the roles and responsibilities of each member. Include essential elements such as voting rights and the process for resolving disputes. For a streamlined approach, consider using US Legal Forms which provides easy-to-follow templates.

To fill out a State of Colorado operating agreement for corporation, start by gathering necessary business details, including the corporation's name, address, and purpose. Clearly outline the roles of the members and the management structure. Be sure to include provisions about ownership percentages, decision-making processes, and how profits will be distributed. You can use US Legal Forms for templates and guidance to simplify this process.

To find a company's operating agreement, you should start by contacting the business directly, as they may provide you with a copy upon request. If you are a shareholder or member, you typically have the right to access this document. Alternatively, you can visit the Secretary of State's website for Colorado, where some corporation documents may be available for public viewing. Remember, accessing the operating agreement is key to understanding the State of Colorado operating agreement for corporation and how it governs the entity.

In the State of Colorado, a corporation is not legally required to have an operating agreement, but having one is highly beneficial. An operating agreement outlines the management structure and operational procedures of your corporation. This document can help prevent future disputes among shareholders by clearly defining roles and responsibilities. Thus, while not mandatory, a Colorado operating agreement for a corporation can significantly enhance the organization and governance of your business.