Colorado Llc Operating Agreement With Units

Description

How to fill out Colorado Limited Liability Company LLC Operating Agreement?

The Colorado Llc Operating Agreement With Units displayed here is a reusable official template created by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has been supplying individuals, businesses, and legal professionals with more than 85,000 authenticated, state-specific documents for various business and personal scenarios.

Register with US Legal Forms to have authenticated legal templates for all of life’s situations at your fingertips.

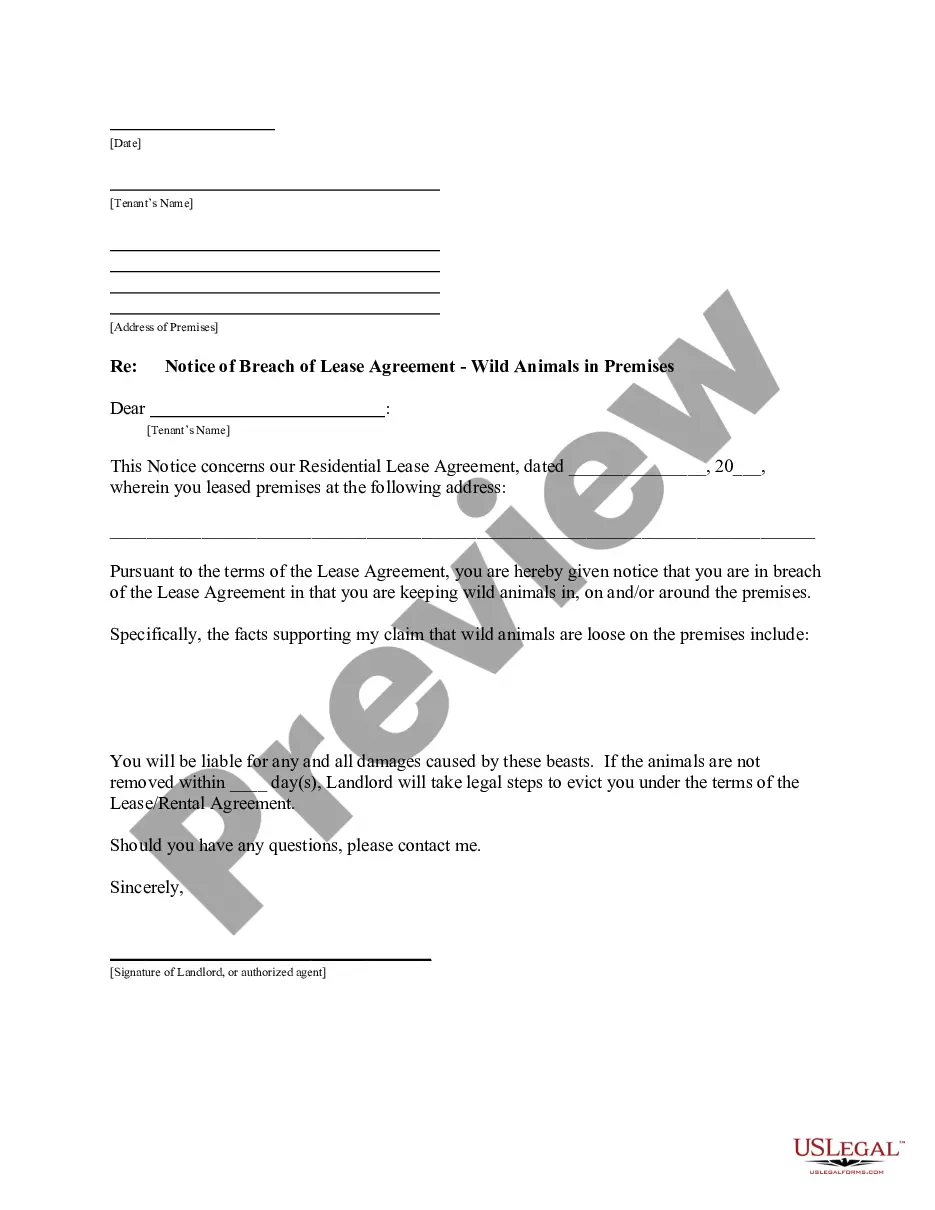

- Search for the document you require and review it.

- Browse through the file you found and preview it or review the form description to confirm it meets your needs. If not, use the search feature to locate the appropriate one. Click Buy Now once you have located the necessary template.

- Choose a subscription plan that fits you and create an account.

- Select PayPal or a credit card to make a speedy payment. If you already possess an account, Log In and check your subscription to proceed.

- Choose the format you prefer for your Colorado Llc Operating Agreement With Units (PDF, DOCX, RTF) and download the template onto your device.

Form popularity

FAQ

member LLC operating agreement is a binding document between the members of a company that includes terms related to ownership (%), management, and operations. The agreement should be created when forming the company as an understanding of how the organization will run.

In order to complete your Operating Agreement, you will need some basic information. The formation date of your LLC. The name and address of the Registered Office and Registered Agent. The general business purpose of the LLC. Member(s) percentages of ownership. Names of the Members and their addresses.

LLCs can also create different classes of membership units, just like corporations can with their stocks. (Think common stock verses preferred stock). But unlike corporations, LLCs can also be formed to express ownership as a percentage basis like a partnership.

Here, Class A would be business-founding members with complete voting rights. Class B would also be founders, but perhaps they played a minor role and are thus given less voting power. Class C would be investors, which aren't given any voting power.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.