Grant Deed For Living Trust

Description

How to fill out California Grant Deed - Living Trust To Living Trust?

How to locate professional legal documents that adhere to your state regulations and create the Grant Deed For Living Trust without hiring an attorney.

Numerous online services offer templates to address various legal scenarios and requirements. However, it can take time to discover which of the accessible samples meet both the intended purpose and legal specifications for you.

US Legal Forms is a reliable service that assists you in finding official documents crafted according to the latest state law revisions and helps you save on legal fees.

If you do not have an account with US Legal Forms, follow these instructions: Explore the webpage you have opened and ensure the form meets your requirements. Utilize the form description and preview options if available. Look for another template by entering your state in the header if needed. Click the Buy Now button after locating the correct document. Choose the most suitable pricing plan, then sign in or create an account. Select your preferred payment method (via credit card or PayPal). Choose the file format for your Grant Deed For Living Trust and click Download. The obtained templates remain yours: you can always revisit them in the My documents section of your account. Sign up for our library and prepare legal documents independently like a proficient legal professional!

- US Legal Forms is not just an ordinary online catalog.

- It is a compilation of over 85,000 authenticated templates for diverse business and personal circumstances.

- All documents are organized by field and state to expedite your search process and enhance convenience.

- Additionally, it integrates with powerful solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to effortlessly complete their paperwork online.

- It requires minimal effort and time to obtain the necessary documents.

- If you already possess an account, Log In and verify that your subscription is current.

- Download the Grant Deed For Living Trust by clicking the appropriate button next to the file name.

Form popularity

FAQ

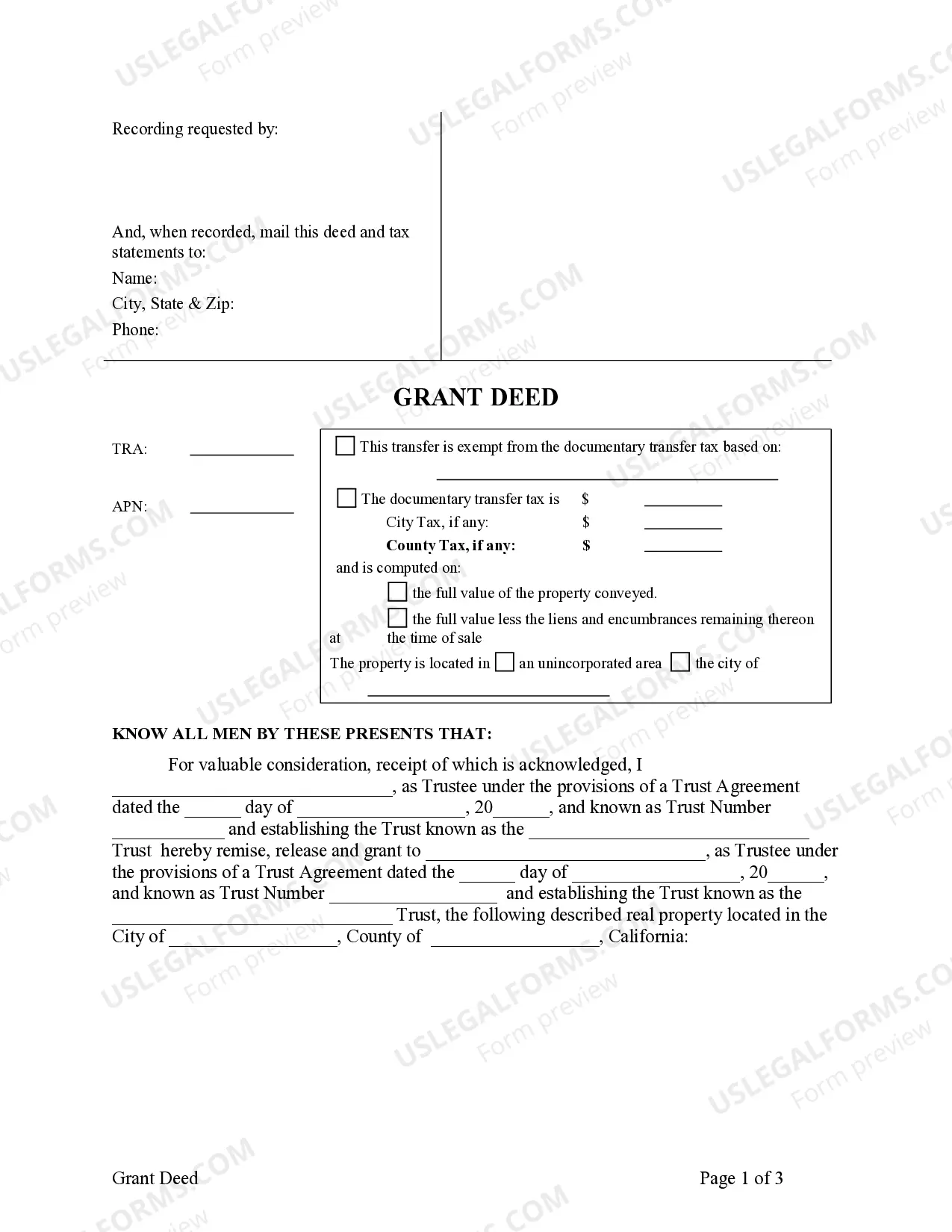

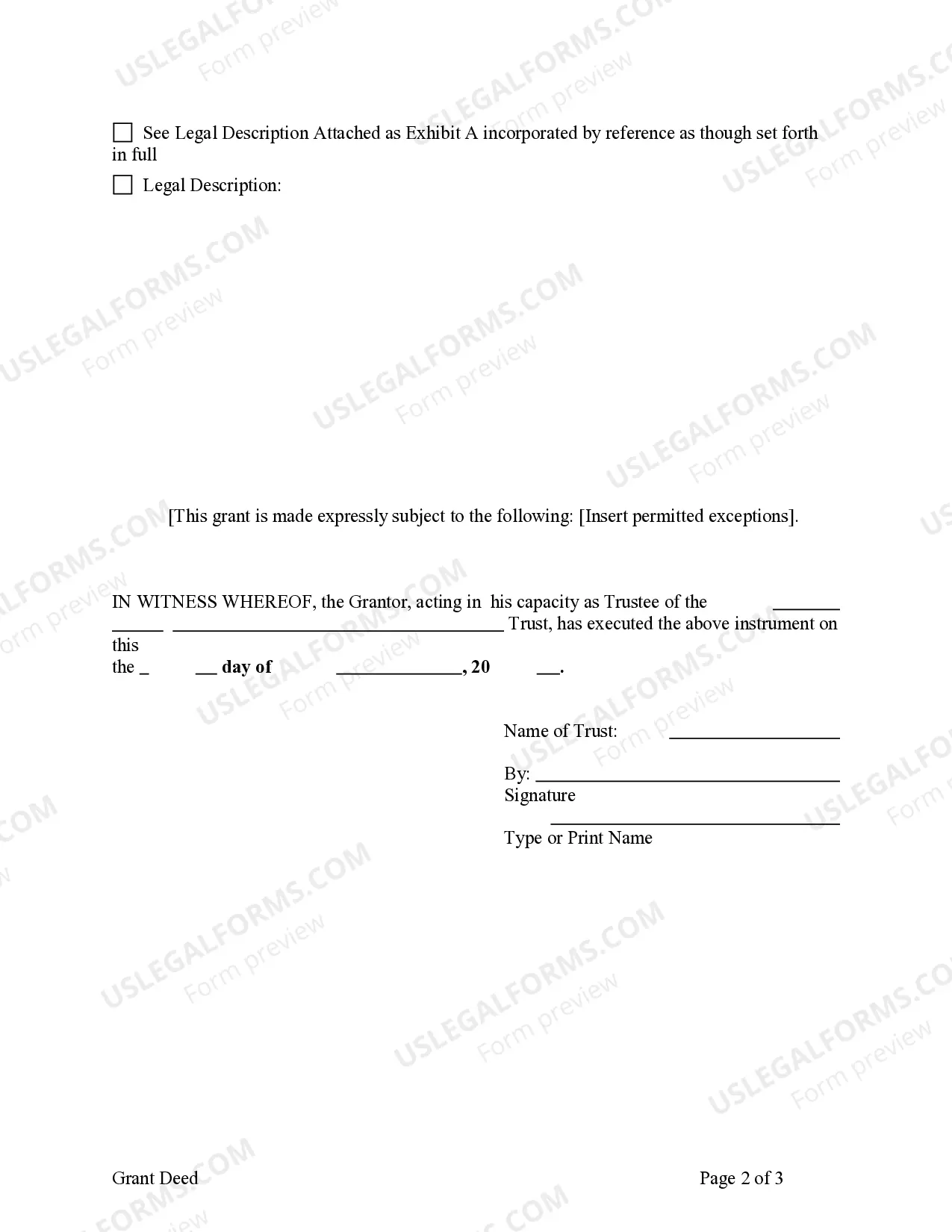

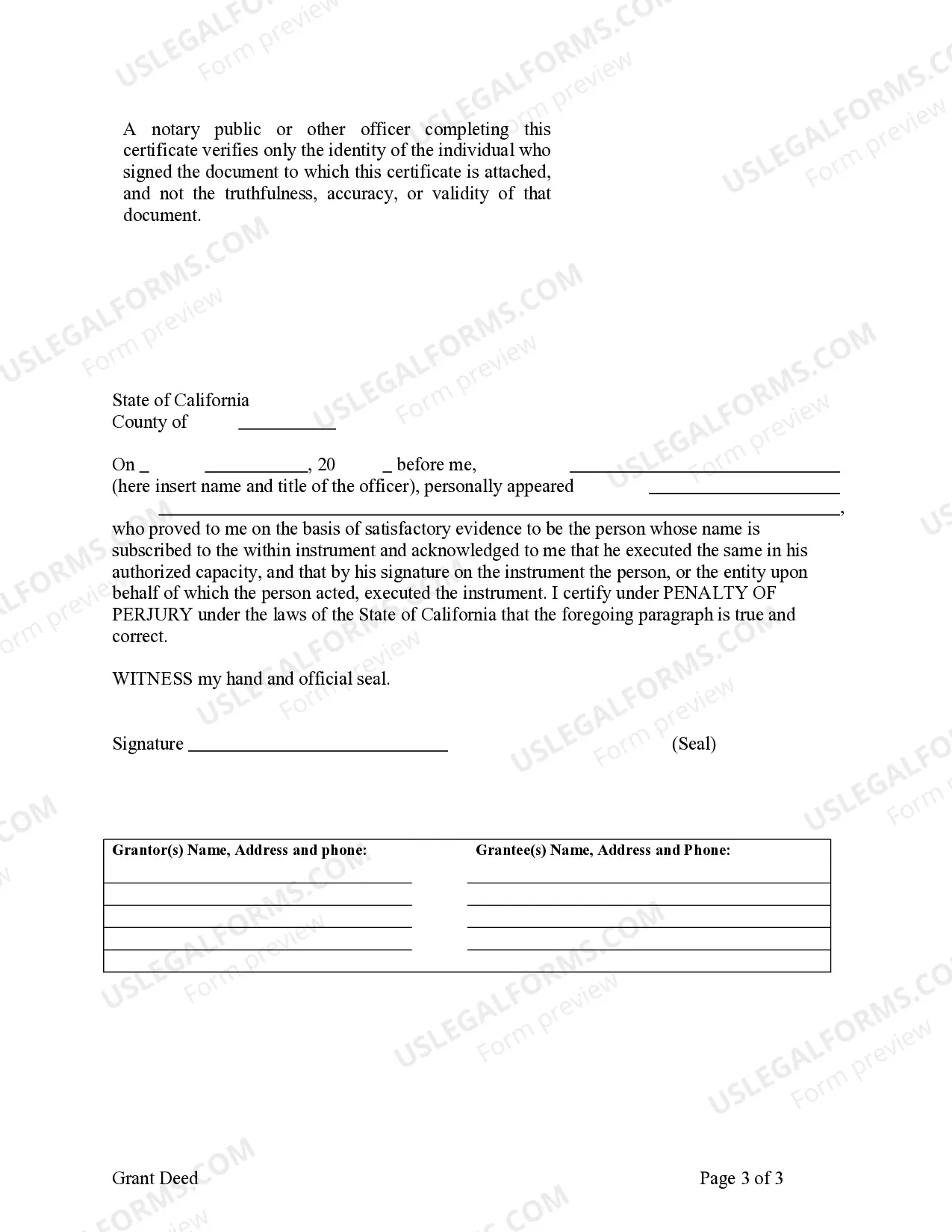

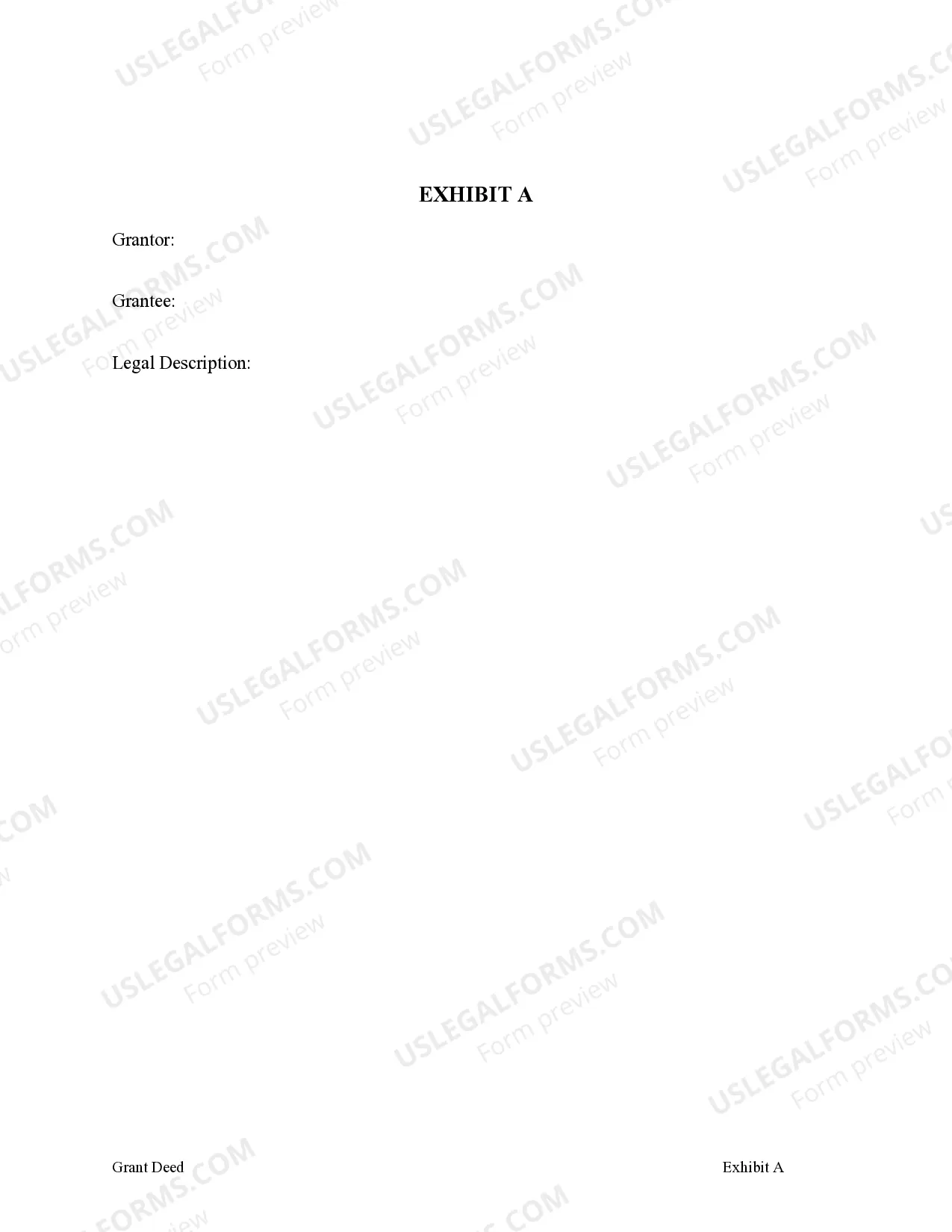

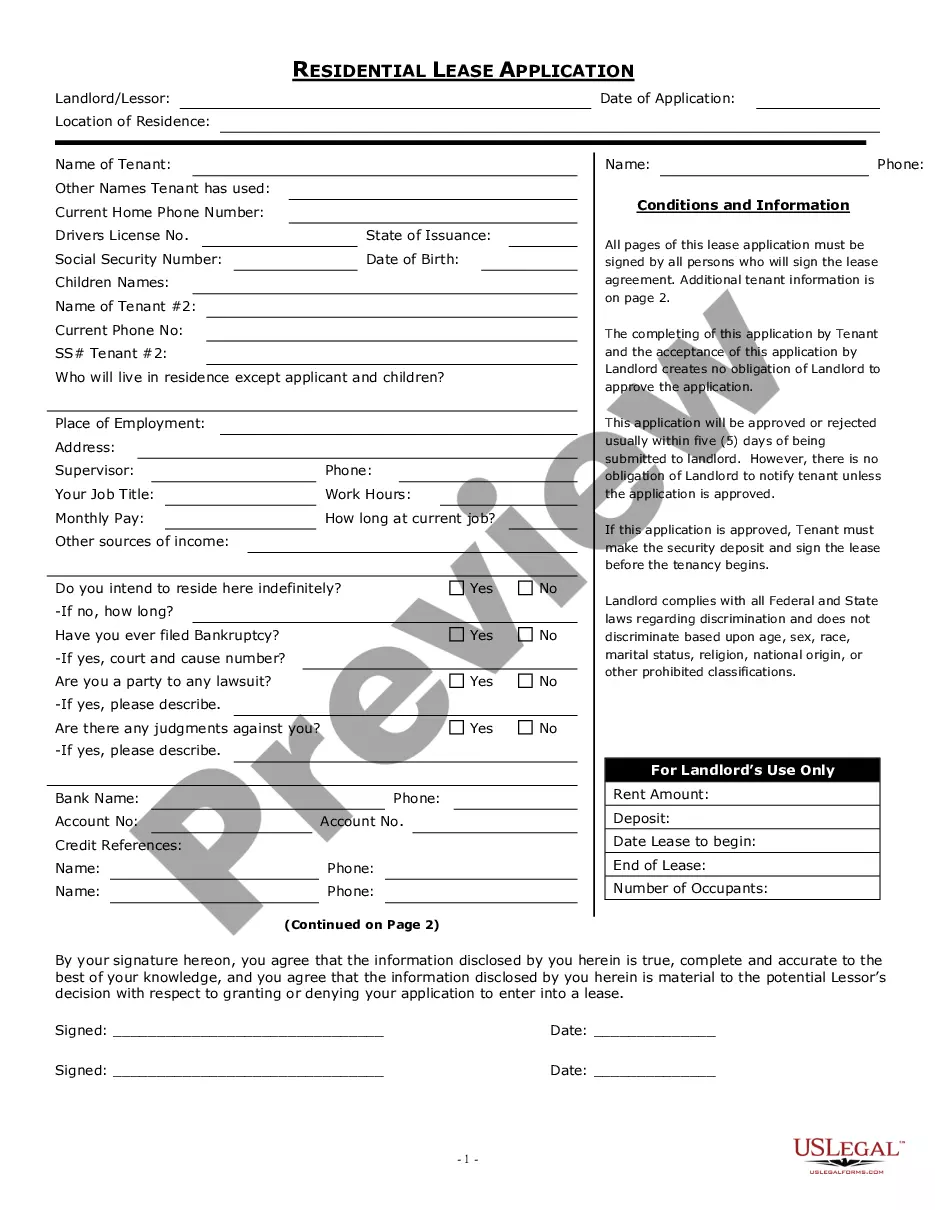

Filling out a grant deed in California involves a few essential steps. Start by gathering the details of your property and the name of the trust to which you are transferring it. Use a template for a grant deed for living trust, which includes spaces for the grantor, grantee, legal description of the property, and your trust's name. Once you complete the form and sign it before a notary, make sure to file it with the county recorder's office to ensure your deed is legally valid.

To transfer your home into a living trust, you need a grant deed for living trust. First, obtain the proper grant deed form, which can often be found on legal websites like USLegalForms. Next, fill out the form with your property details and the name of your trust. Finally, sign the deed in front of a notary public and record it with your local county office to finalize the transfer.

The objectives of a trust deed include facilitating property ownership transfers, securing loans, and establishing a legal framework for managing assets. A trust deed also allows property to remain within a trust, which can help in estate planning. By integrating a grant deed for living trust, you can align your property management goals with your long-term financial plans, safeguarding your legacy for future generations.

The best deed to transfer property depends on your specific situation, but a grant deed for living trust is often an excellent choice. This type of deed offers a straightforward way to transfer real estate into your trust, providing crucial benefits like avoiding probate. Furthermore, using a grant deed ensures that your property is managed according to your wishes, giving you peace of mind.