Grant Without You

Description

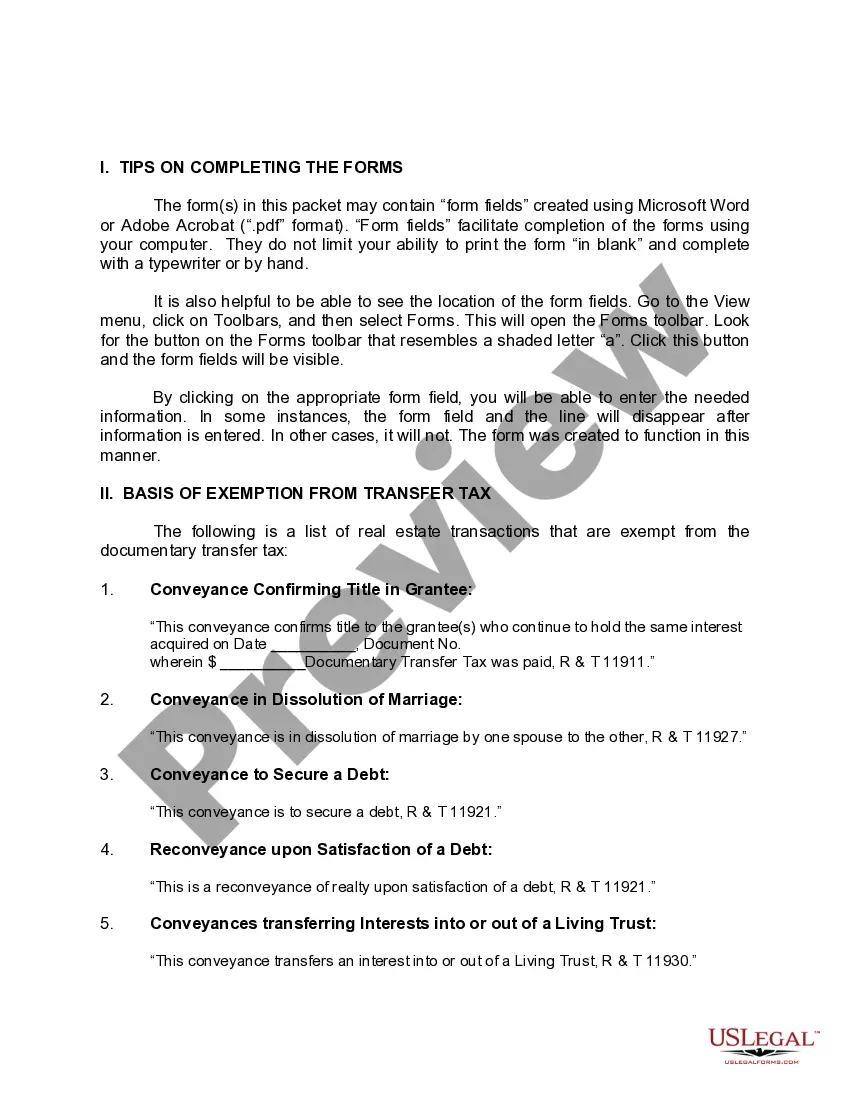

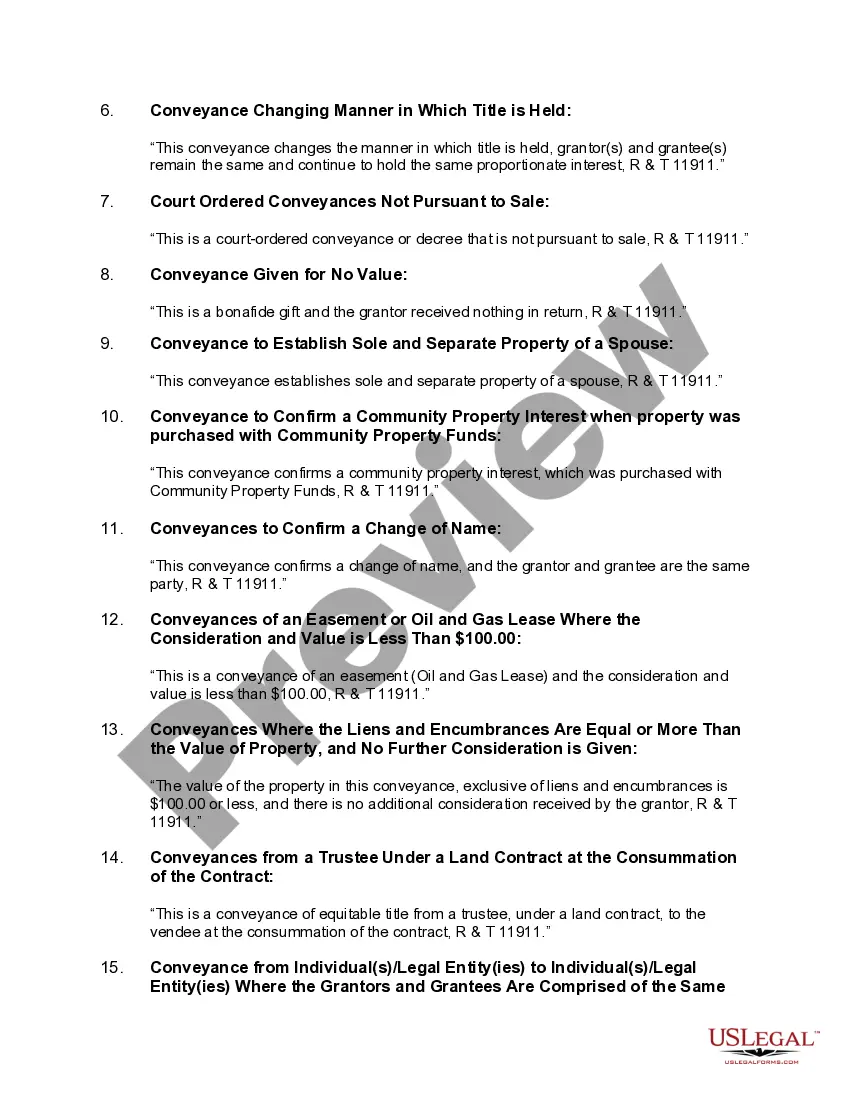

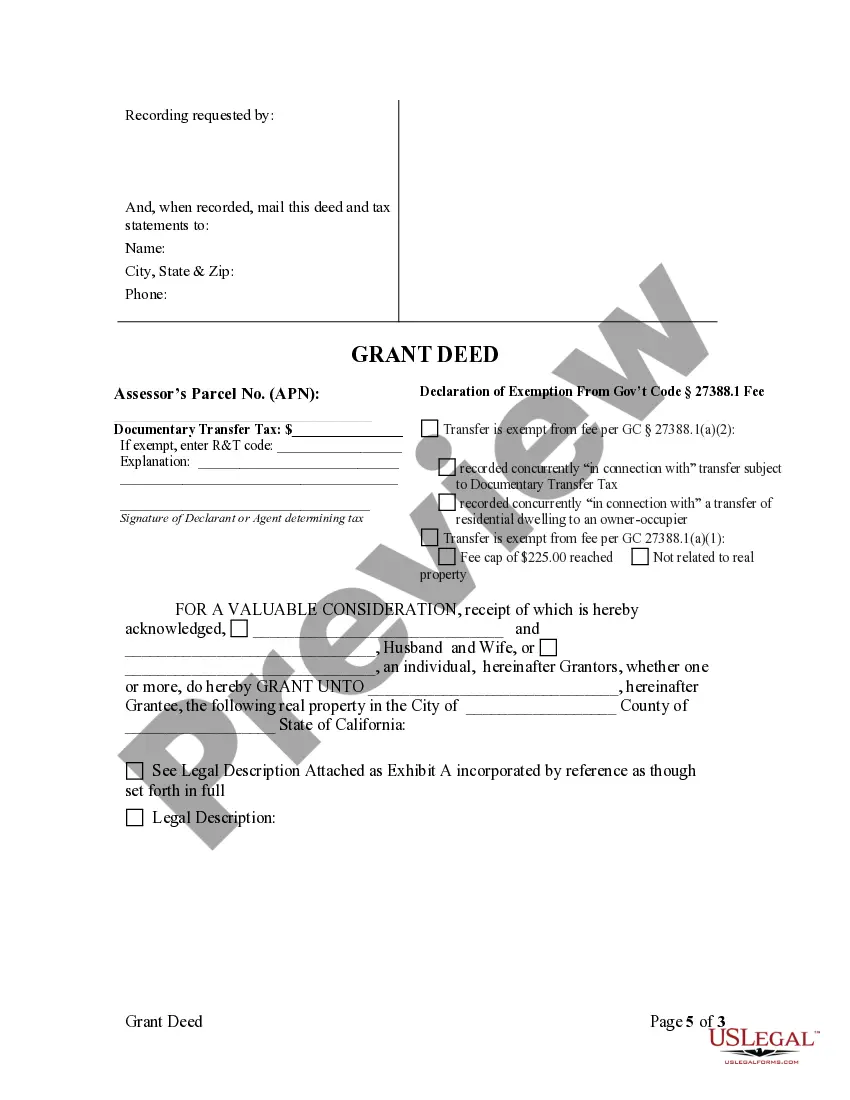

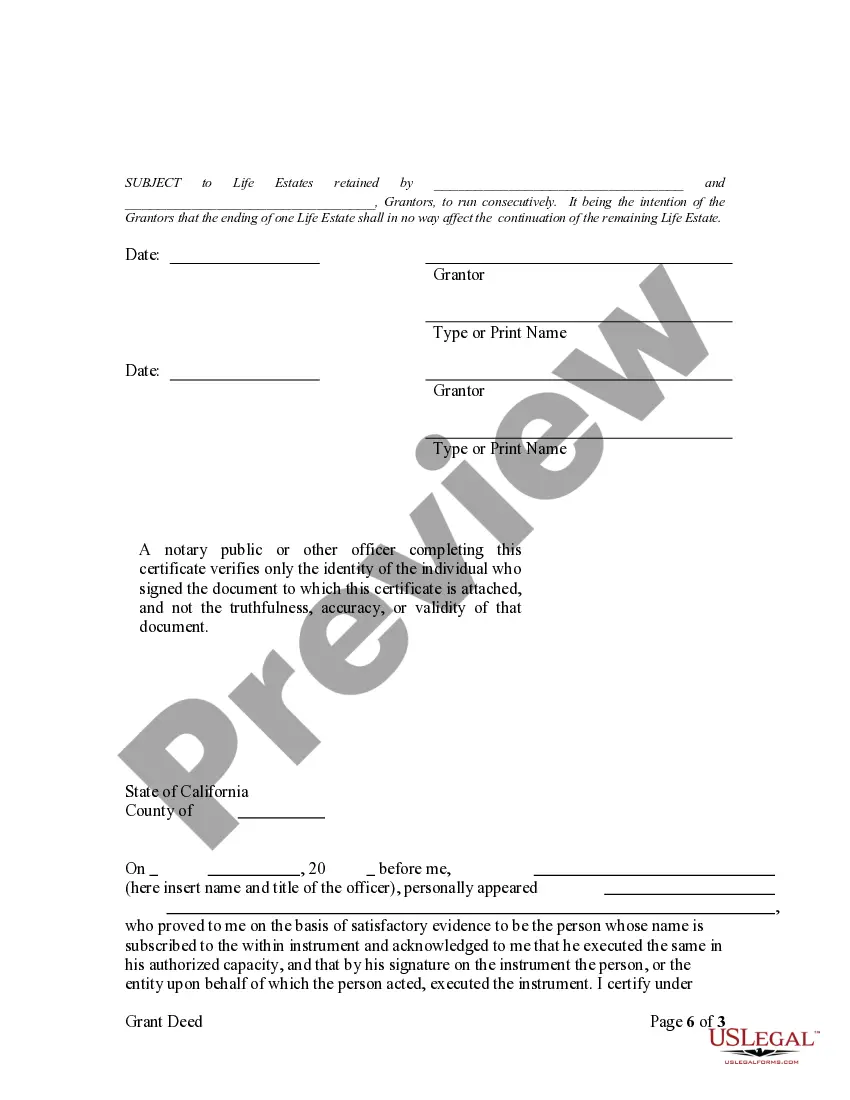

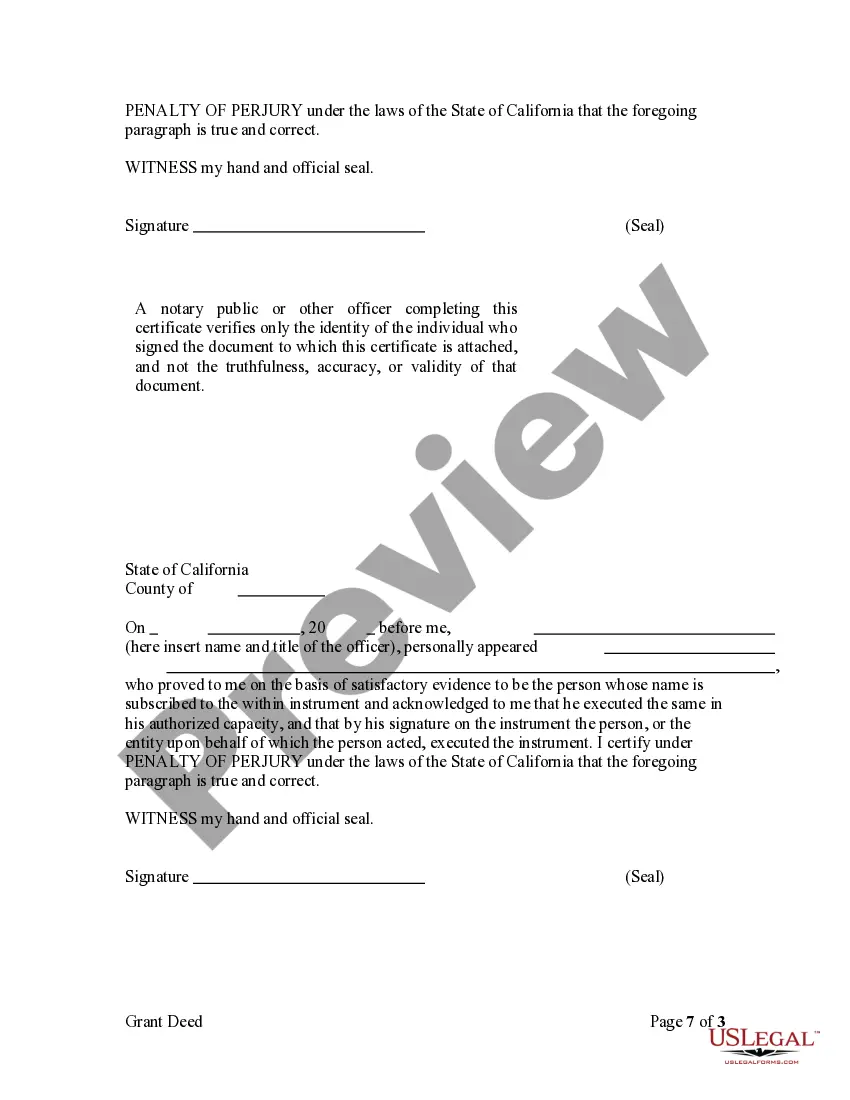

How to fill out California Grant Deed - Parents To Child With Reservation Of Life Estate?

- If you're a returning user, log in and ensure your subscription is active. Next, click the Download button to retrieve your form.

- For first-time users, start by browsing the extensive library of over 85,000 fillable and editable forms. Check the Preview mode and form descriptions to select the appropriate legal document.

- If your selected form doesn’t meet your needs, utilize the Search tab to find alternatives that align with your requirements and local jurisdiction.

- After choosing the right form, click the Buy Now button and select your desired subscription plan, which requires account registration for library access.

- Complete the purchase by providing your payment details, either through credit card or PayPal, to activate your subscription.

- Once the transaction is finalized, download your chosen legal form directly to your device for easy access and completion in the My Forms section.

In conclusion, US Legal Forms streamlines the process of obtaining legal documents, ensuring that users get high-quality forms tailored to their needs. With a robust form collection and access to premium experts, you can confidently manage your legal requirements.

Don't hesitate—start your journey with US Legal Forms today and experience the empowering benefits of quick and precise legal documentation!

Form popularity

FAQ

Yes, a normal person can apply for and receive grants, provided they meet the eligibility criteria set by specific grant programs. Securing a grant without you is entirely possible if you can present a compelling project plan or idea that aligns with the grant’s purpose. Many grants are aimed at supporting community projects, educational pursuits, or personal development initiatives, making them accessible to the average person. Always ensure your application is thorough, as this can make a positive impact.

Federal grants are available to various organizations, including nonprofits, educational institutions, and certain individuals. To qualify for a federal grant without you, applicants must provide detailed information about their objectives and how they plan to use the funding. The application process requires meeting specific guidelines and deadlines set forth by the federal agency offering the grant. Keep in mind, understanding these requirements can significantly increase your likelihood of success.

Eligibility for Minnesota grants varies by program, but generally, individuals, organizations, or entities can qualify based on specific criteria. To successfully secure a grant without you, applicants often need to demonstrate the intended impact of their projects. Many grants focus on community improvement, education, or economic development, so aligning your purpose with these missions enhances your chances. Always review the requirements outlined in each grant application to ensure you meet the qualifications.

Personal grants generally do not count as taxable income. However, there can be exceptions based on the grant's purpose and the stipulations attached to it. It's wise to consult a financial advisor or refer to resources available on platforms like US Legal Forms for detailed information on how to approach personal grants and their tax implications.

Eligibility for the Texas grant typically includes specific criteria like residency and enrollment in eligible educational programs. Various factors determine eligibility, such as financial need and demographic background. Researching these criteria on official platforms like US Legal Forms can help clarify your qualifications for a Texas grant.

You definitely can write a grant for yourself. It's about presenting your project clearly and outlining how the funding will make an impact. Many people successfully create grant applications independently, and US Legal Forms offers tools to streamline this process for you, making it more manageable.

Absolutely, individuals can apply for grants. Various grants are designed specifically to support individuals in their projects or needs. If you are seeking financial assistance, utilizing a service like US Legal Forms can simplify your application process and increase your chances of success.

Yes, you can write grants for yourself. However, it's important to understand the specific guidelines and requirements of the grant you are pursuing. Many individuals successfully apply for grants without assistance. Platforms like US Legal Forms can guide you through the application process with the necessary resources.

In most cases, grants are not recorded as income when used for their intended purpose. However, if that grant without you provides a benefit beyond qualifying expenses, it may be considered taxable income. Understanding how to properly categorize grants is key to avoiding potential tax issues. Platforms like uslegalforms can assist in understanding how to track and report your grant funds.

Generally, you do not have to count grants as income if used for qualified expenses. For instance, educational grants often do not need to be reported if applied toward tuition and materials. However, any grant without you that is used for personal gain could be considered taxable income. Always consult a tax professional for clarity on your specific situation.