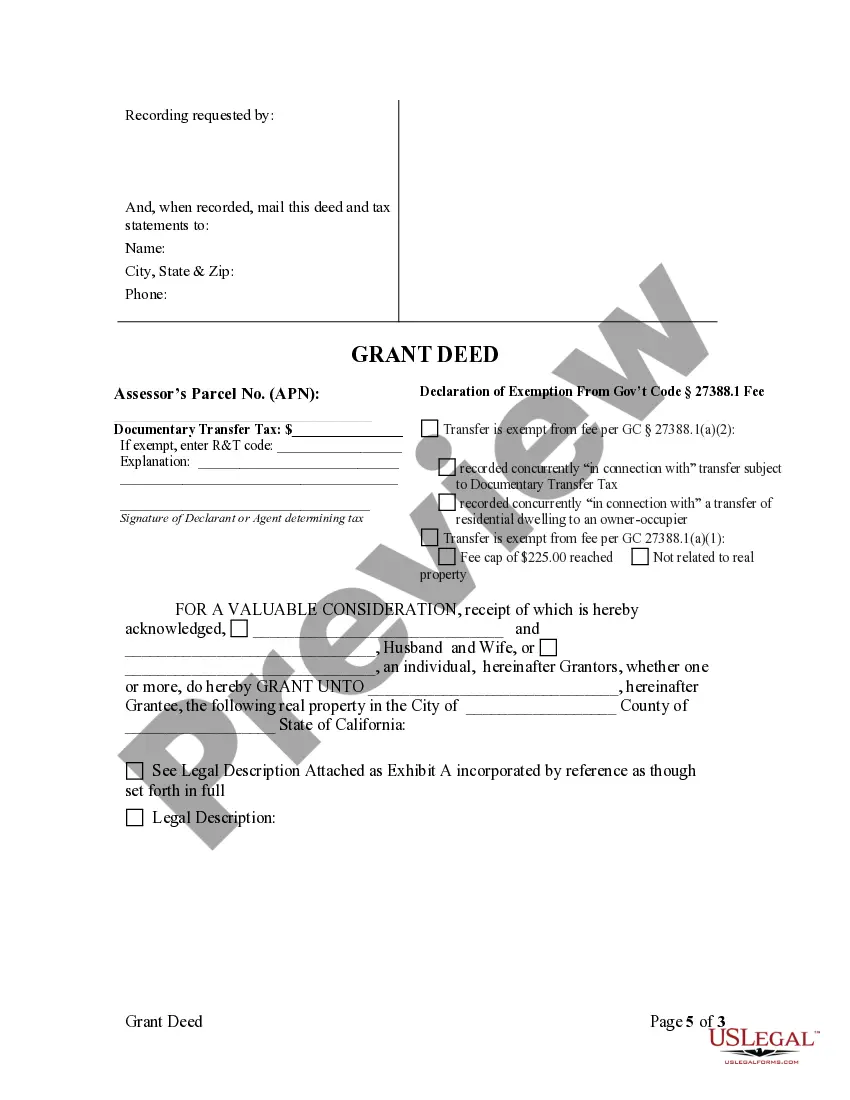

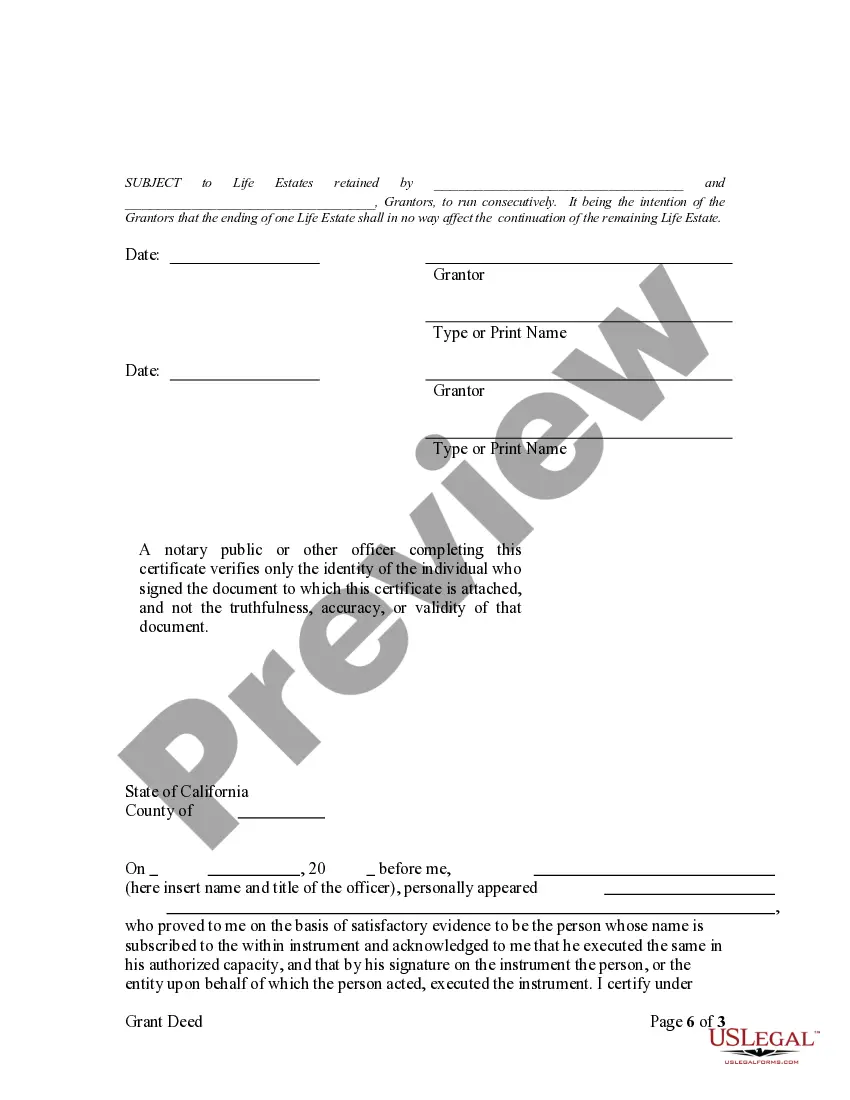

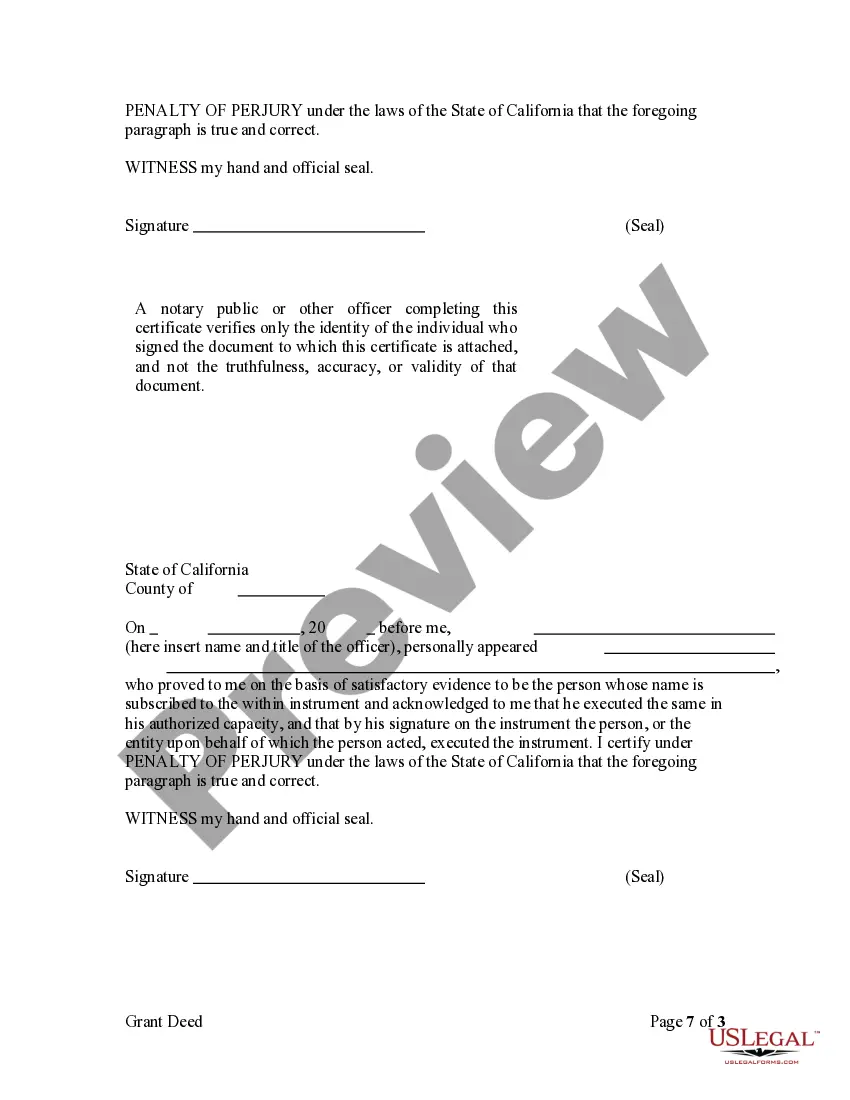

This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

A grant deed without trust is a legal document used in real estate transactions to transfer ownership rights of a property from one party (granter) to another party (grantee). It is typically used when the transfer is made without the involvement of a trust. This type of deed serves as evidence and a guarantee that the granter holds clear title to the property and has the authority to transfer it. Keywords: Grant deed, without trust, real estate, ownership rights, transfer, property, granter, grantee, clear title, authority. There are two different types of grant deeds without trust: general grant deeds and special grant deeds. 1. General Grant Deed Without Trust: A general grant deed without trust is the most common and widely used type of grant deed. It transfers ownership rights from the granter to the grantee with certain warranties and guarantees. By signing this deed, the granter implies that they have not sold or transferred any portion of the property to any other party, and that there are no undisclosed liens or encumbrances on the property. 2. Special Grant Deed Without Trust: A special grant deed without trust is used when the transfer of ownership rights is made with specific conditions or limitations. By signing this deed, the granter conveys a particular interest in the property, rather than the entire ownership. This type of deed is often used in cases where the granter intends to transfer only a portion of the property, or when certain rights or restrictions are attached to the transfer. In both types of grant deeds without trust, it is essential to execute the document properly and record it with the appropriate government entity, such as the county recorder's office. This ensures that the transfer of ownership is legally binding and properly documented. In conclusion, a grant deed without trust is a legal instrument used to transfer ownership rights of a property from a granter to a grantee, without the involvement of a trust. The two main types of grant deeds without trust are the general grant deed and the special grant deed. The general grant deed transfers full ownership rights with warranties, while the special grant deed transfers a specific interest or portion of the property. It is crucial to complete the execution and recording process accurately to secure a valid transfer of ownership.