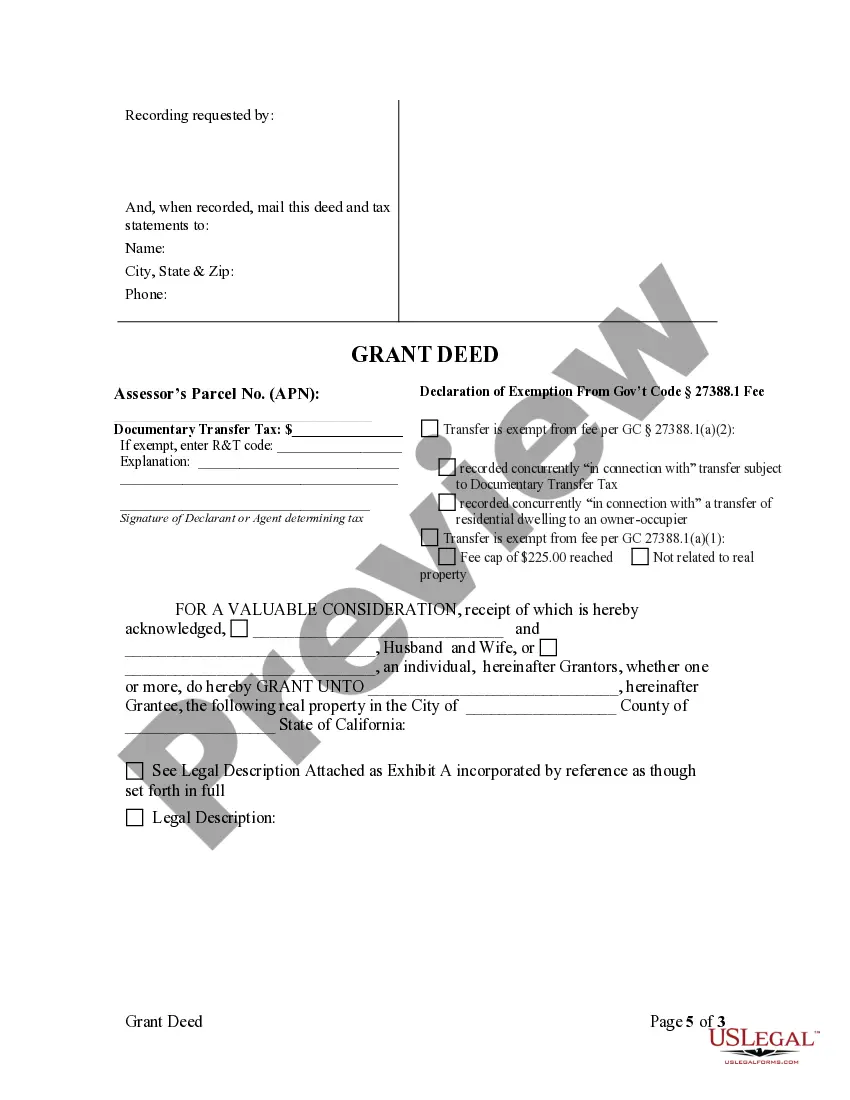

This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

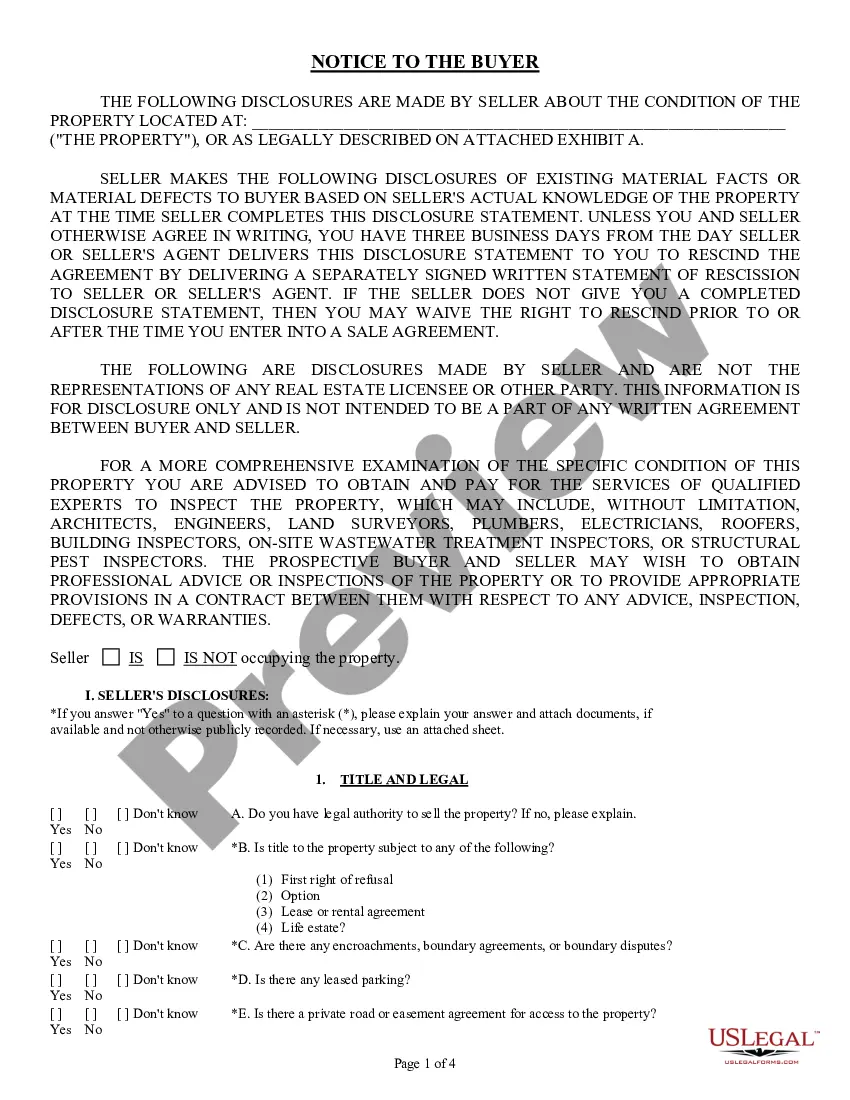

A grant deed with withdrawal, also known as a grant deed subject to defiance, is a legal document used in real estate transactions to convey ownership rights. This type of deed includes a provision that allows the granter (seller) to reclaim ownership of the property under specific circumstances. A grant deed with withdrawal offers an added layer of protection to the granter, providing a means to regain ownership if certain conditions are not met. These conditions are typically outlined in the deed itself and can vary based on the agreement between the parties involved. There are several types of grant deeds with withdrawal, each with its own set of conditions and terms: 1. Grant Deed with Withdrawal Condition: This type of grant deed allows the granter to withdraw ownership rights if the grantee (buyer) fails to fulfill specific obligations mentioned in the deed. For example, if the grantee fails to make the agreed-upon payments or maintain the property as per the terms of the agreement, the granter has the option to reclaim ownership. 2. Grant Deed with Partial Withdrawal: In some cases, a granter may want the option to withdraw only a portion of the property rights conveyed through the deed. This allows them to retain partial ownership and secure their interests in certain aspects of the property, such as mineral rights or easements. 3. Grant Deed with Conditional Withdrawal: This type of grant deed includes specific conditions that must be met within a designated timeframe for the granter to exercise their right of withdrawal. These conditions can vary widely and may include factors like payments made on time, specific improvements to the property, or other contractual obligations. 4. Grant Deed with Limited Withdrawal: In a grant deed with limited withdrawal, the granter has the option to withdraw ownership rights within a specific period or under certain circumstances. Once this predetermined timeframe or condition is met, the granter's ability to withdraw ownership rights expires. In summary, a grant deed with withdrawal provides an additional safeguard for the granter, granting them the right to withdraw ownership of the property if specific conditions outlined in the deed are not fulfilled. Different types of grant deeds with withdrawal exist to accommodate the varying needs and preferences of the parties involved in a real estate transaction.