California Assets With Social Security Number

Description

How to fill out California Organizing Your Personal Assets Package?

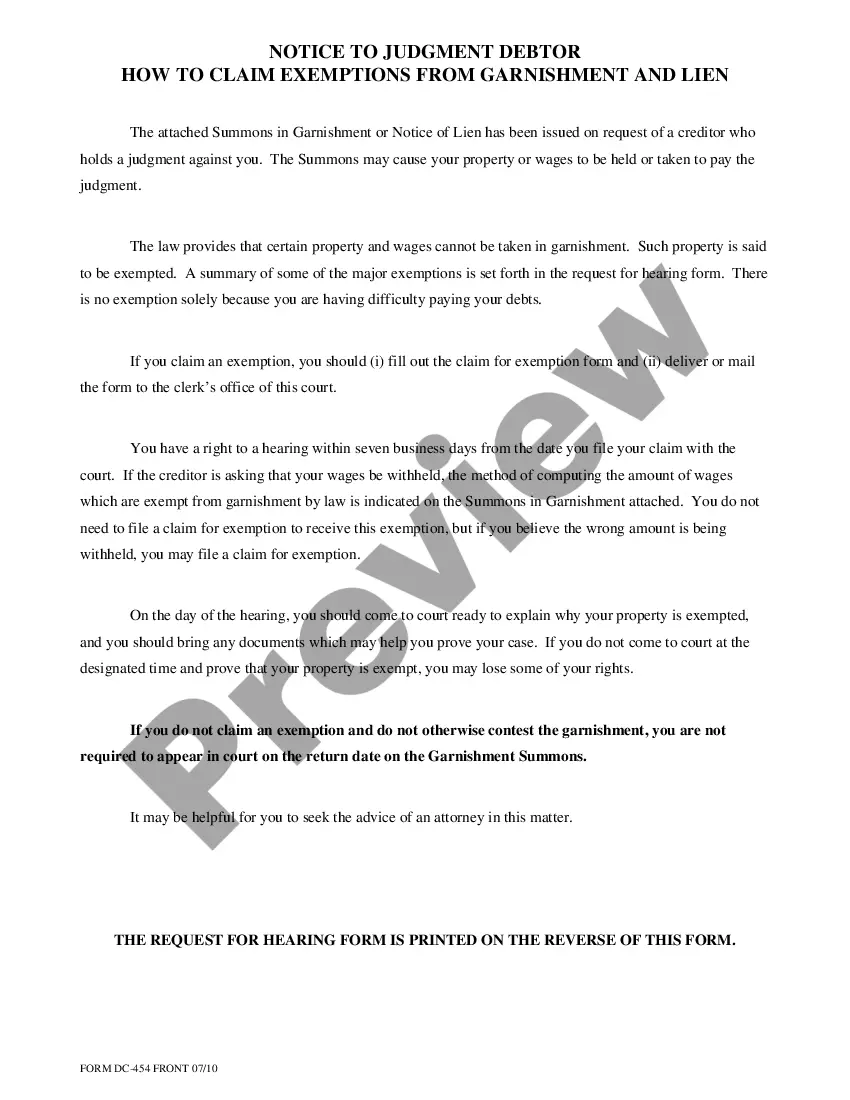

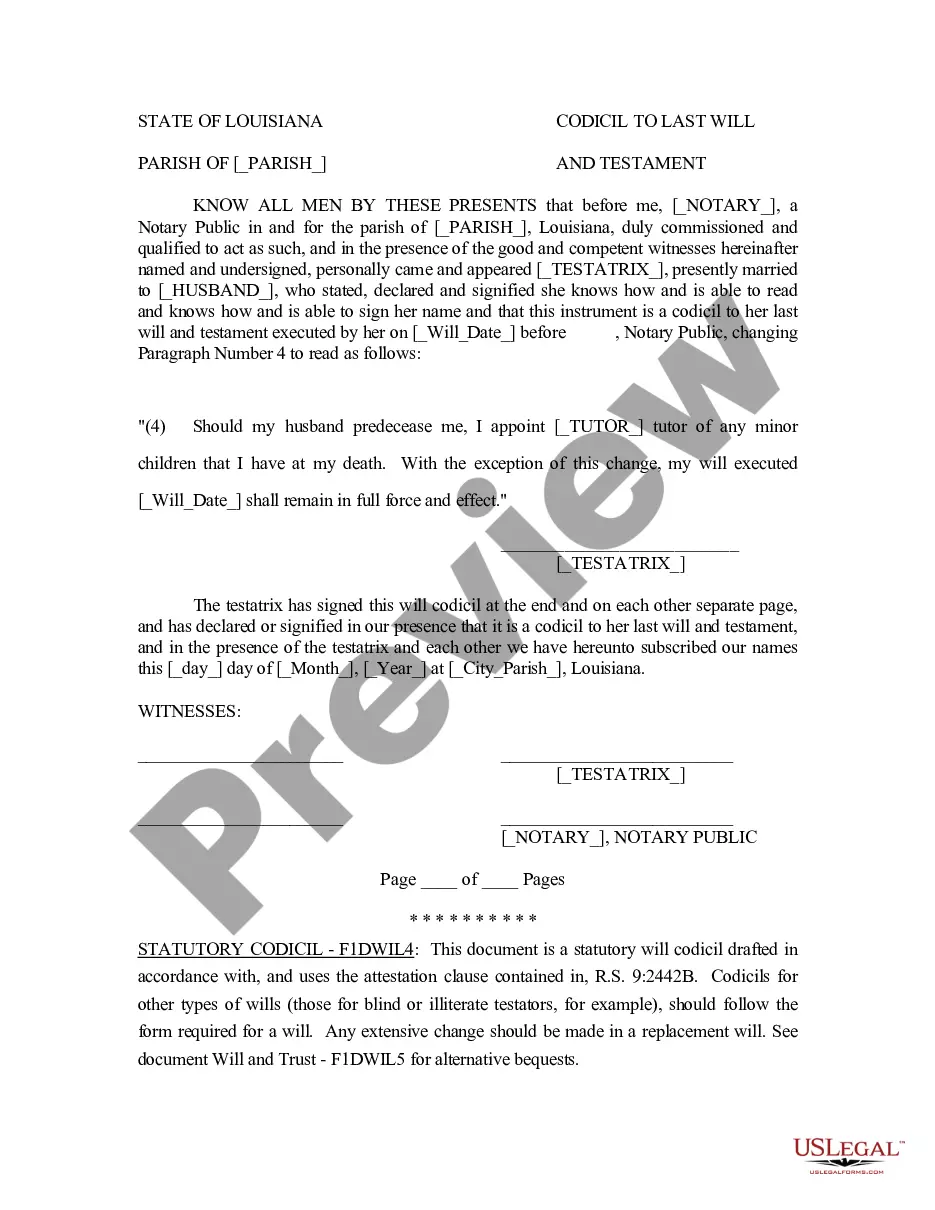

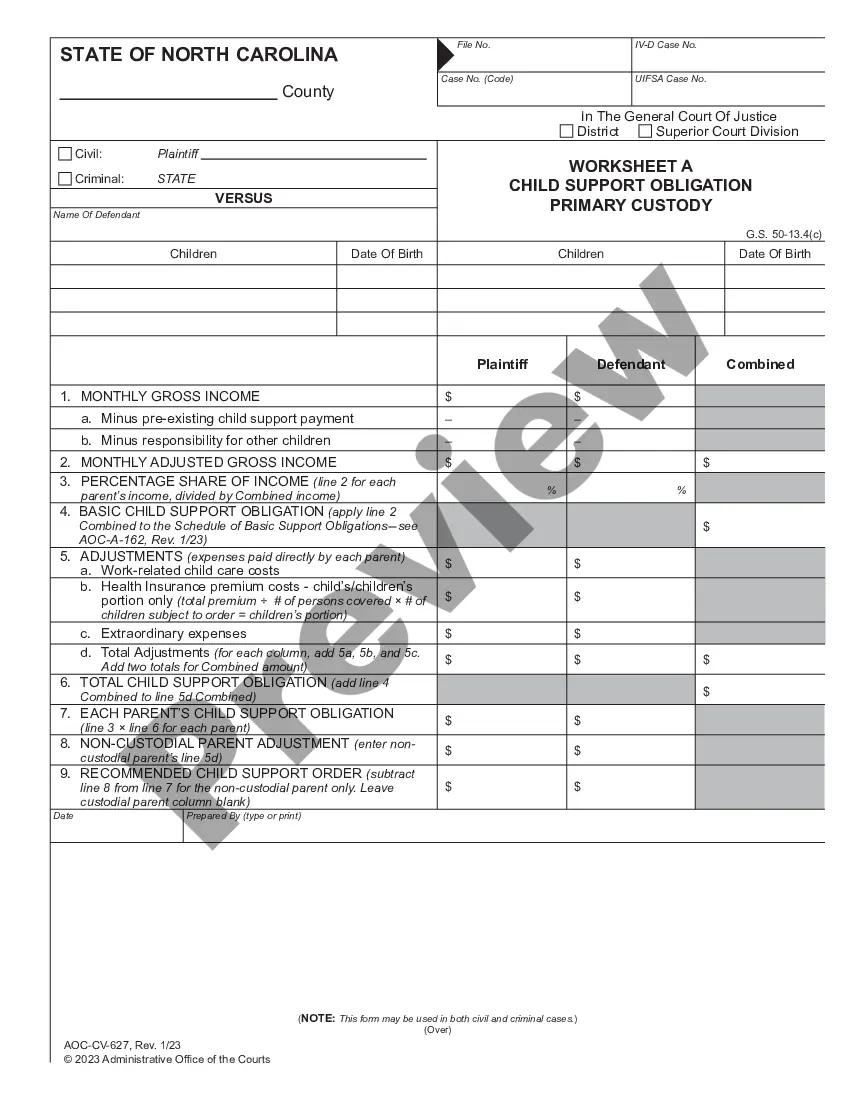

The California Assets With Social Security Number displayed on this page is a versatile legal template created by qualified attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal circumstances. It’s the quickest, simplest, and most reliable method to acquire the papers you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Select the format you prefer for your California Assets With Social Security Number (PDF, DOCX, RTF) and store the sample on your device.

- Search for the document you require and examine it.

- Look through the file you searched and view it or review the form description to confirm it meets your needs. If it doesn’t, use the search bar to locate the appropriate one. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Choose the pricing option that fits you and set up an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

Unclaimed property is generally defined as any financial asset left inactive by its owner for a period of time, typically three years. California unclaimed property law does not include real estate. The most common types of unclaimed property are: Bank accounts and safe deposit box contents.

Owners can search and claim their property for free but will need to verify their ownership. People can call 800-992-4647 with questions. People can also call the same number if they think the state has their property but they can't see it listed on the website.

Unclaimed Property is generally defined as any financial asset that has been left inactive by the owner for a period of time specified in the law, generally three (3) years.

Remitting Unclaimed Property Holders must transfer or remit unclaimed property to the State Controller when they submit the Remit Report. For remittance amounts totaling $2,000 and over, register with the State Controller's EFT Help Desk, preferably by April 30, and remit property via Electronic Funds Transfer.