Property Finances Probate Without A Will

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Whether for commercial intentions or for personal issues, everyone must navigate legal matters at some point in their lives.

Filling out legal documents demands meticulous focus, starting with selecting the appropriate form template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms catalog available, you will never need to waste time searching for the right document online. Take advantage of the library’s user-friendly navigation to find the correct form for any situation.

- Locate the sample you require using the search bar or catalog browsing.

- Review the form’s details to verify it aligns with your situation, state, and county.

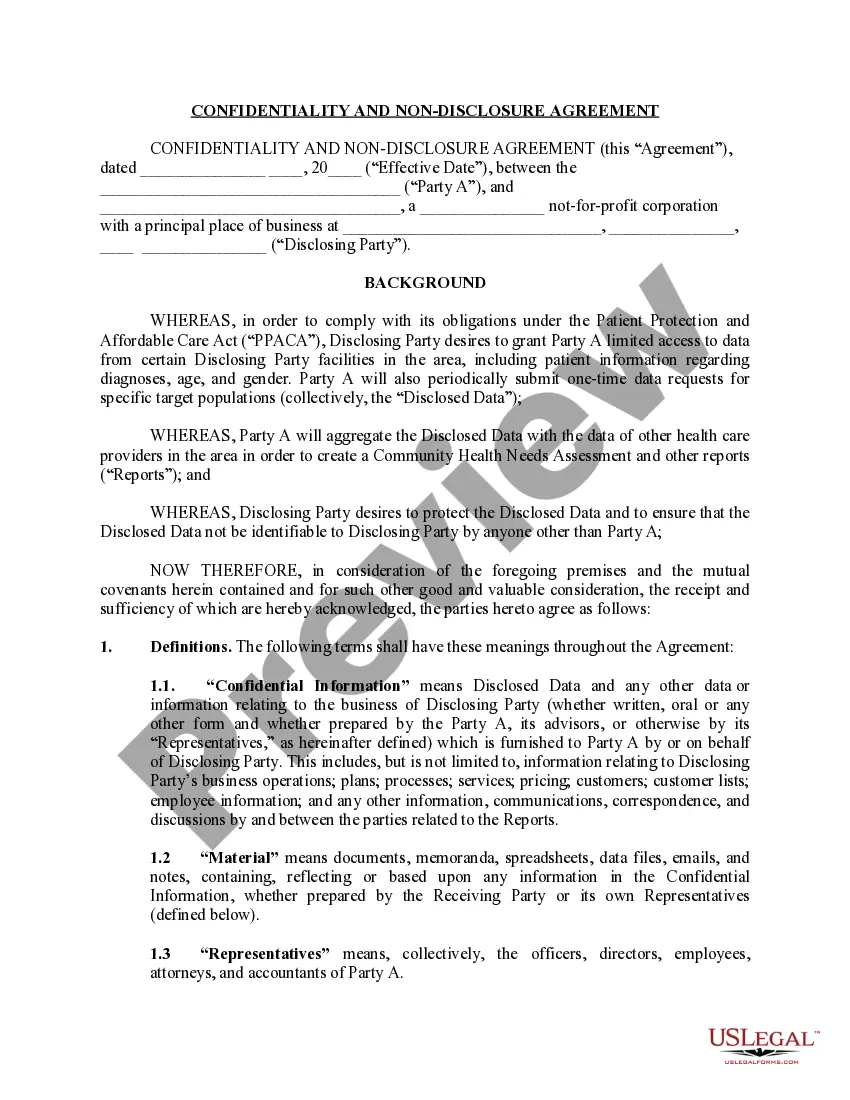

- Select the form’s preview to inspect it.

- If it is the incorrect document, return to the search option to find the Property Finances Probate Without A Will template you need.

- Download the template once it fits your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you haven’t created an account yet, you can acquire the document by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Pick your payment method: you can utilize a credit card or PayPal account.

- Choose the file format you desire and download the Property Finances Probate Without A Will.

Form popularity

FAQ

This depends on whether they had the right documents and how the property and debt are categorized. Probate may still be necessary depending on the estate's size and type of property and debt.

Non-probate assets are assets owned jointly with others or have some type of post-death designation in place. Examples of non-probate assets are: jointly-owned property (car, home, bank accounts, etc.), 401(k)s, life insurance, Transfer on Death accounts, and life estate properties.

Typical Intestate Succession Rules Generally, a surviving spouse receives the largest share of a decedent's property, followed by the decedent's children. Children commonly include adopted children but not step-children or foster children.

This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary. The proceeds are paid out directly to your named beneficiary when you pass away without having to pass through probate.

Any assets that are titled in the decedent's sole name, not jointly owned, not payable-on-death, don't have any beneficiary designations, or are left out of a Living Trust are subject to probate. Such assets can include: Bank or investment accounts. Stocks and bonds.