California Statutory Probate Code With The California

Description

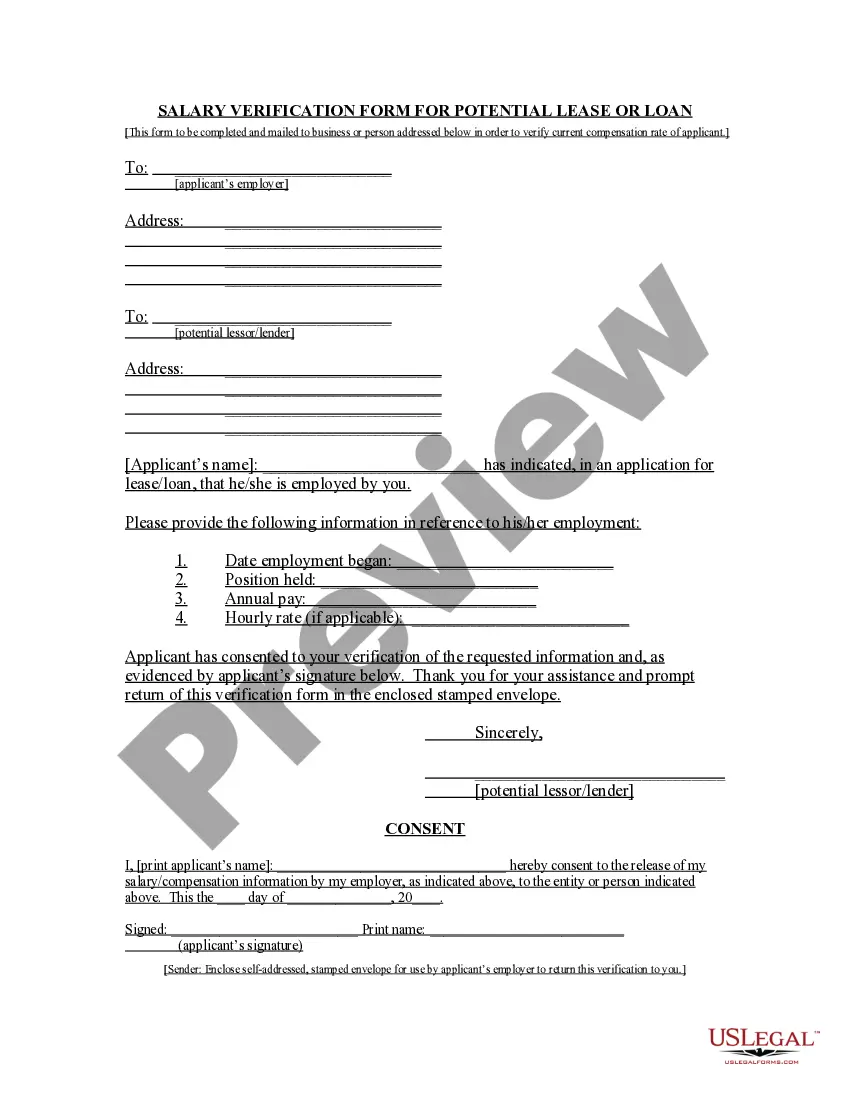

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

It’s obvious that you can’t become a law professional immediately, nor can you learn how to quickly draft California Statutory Probate Code With The California without the need of a specialized set of skills. Putting together legal forms is a long venture requiring a certain training and skills. So why not leave the preparation of the California Statutory Probate Code With The California to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court papers to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether California Statutory Probate Code With The California is what you’re looking for.

- Begin your search again if you need a different template.

- Set up a free account and select a subscription plan to buy the template.

- Choose Buy now. Once the transaction is complete, you can get the California Statutory Probate Code With The California, fill it out, print it, and send or send it by post to the designated individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Within 30 days of the decedent's death, go to the county probate clerk's office and file for probate. This is done by submitting the completed petition for probate form, the Will, and the decedent's death certificate. You must also pay the filing fee, which is currently $435.00 in California.

In California, probate settles a deceased person's estate and is required in California if the estate is worth more than $184,500. It typically occurs when the deceased person died without a will, but it can occur even if the deceased person did have a will if they owned real property that is subject to probate.

The California Statutory Will and the laws that give rise to it are provided in California Probate Code Sections 6200-6243. Under Probate Code Section 6220, any individual of sound mind and over the age of 18 may execute a California Statutory Will.

You can complete probate on your own, but an attorney can make the process easier.

How to probate a will in California Step 1: File the petition. ... Step 2: Publication of the notice of hearing. ... Step 3: First probate hearing. ... Step 4: Be prepared to post a bond. ... Step 5: Proving the will. ... Step 6: Collection of assets. ... Step 7: Designation of probate referee. ... Step 8: Payment to creditors.