California Probate Code 13100 To 13116

Description

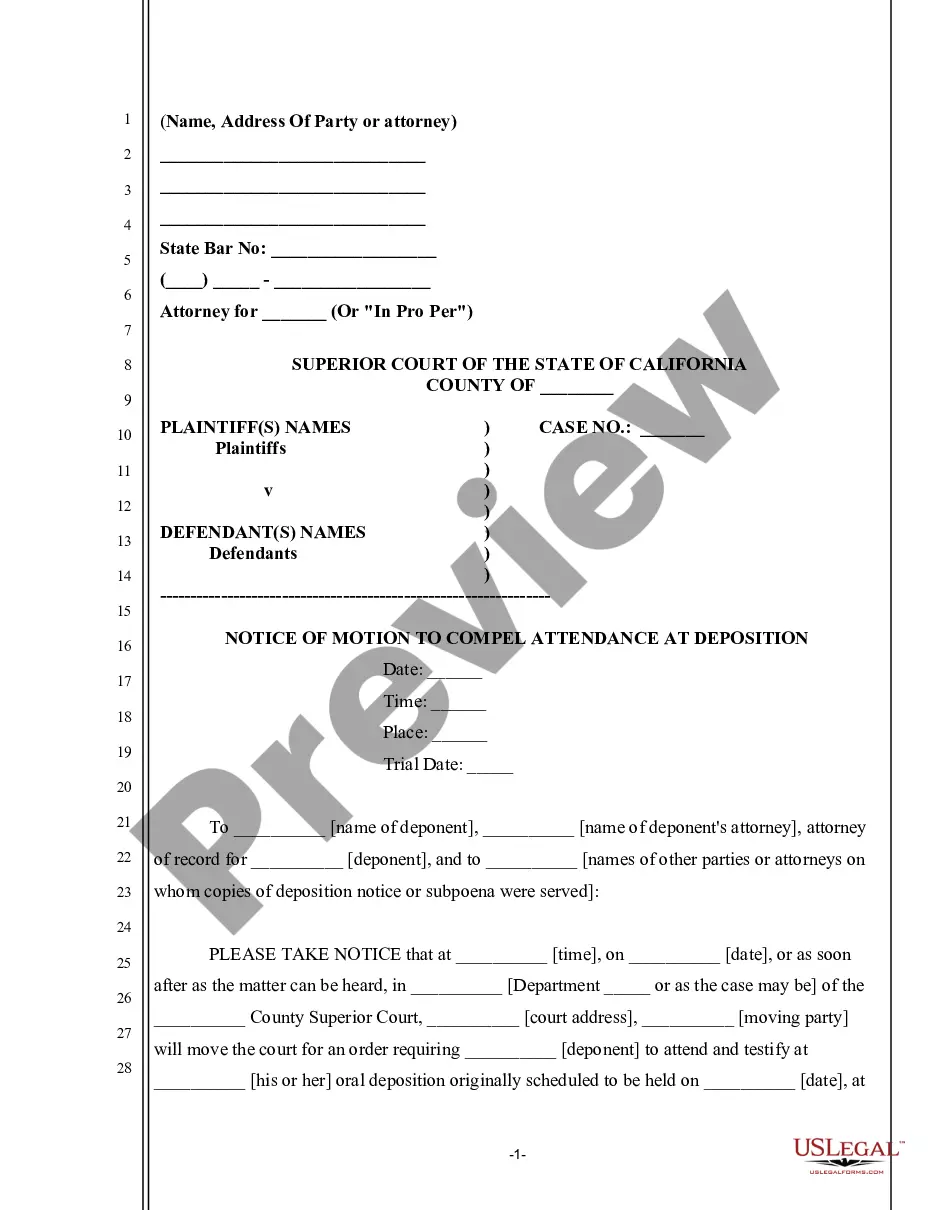

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Managing legal documents can be daunting, even for the most seasoned professionals.

When seeking the California Probate Code 13100 To 13116 and lacking the time to dedicate to finding the right and current version, the process can become anxious.

US Legal Forms meets all your requirements—from personal to business documents—all in one place.

Utilize extensive tools to complete and manage your California Probate Code 13100 To 13116.

Here are the steps to follow after finding the required form: Verify that it is the correct form by previewing it and examining its details. Ensure the template is admissible in your state or county. Click Buy Now when ready. Select a monthly subscription option. Choose your preferred file format, then Download, complete, eSign, print, and send your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your document management process effortlessly today.

- Access an informative library of articles, guides, and resources relevant to your situation and needs.

- Save time and energy searching for the documents you require, and leverage US Legal Forms’ superior search and Review feature to locate California Probate Code 13100 To 13116 and download it.

- If you hold a subscription, Log In to your US Legal Forms account, search for the desired form, and download it.

- Check your My documents tab to see the documents you've saved previously and manage your folders as you prefer.

- If this is your first experience with US Legal Forms, create an account to gain unlimited access to the platform’s advantages.

- A robust online form repository can significantly improve the efficiency for those handling these matters.

- US Legal Forms is a frontrunner in digital legal documents, offering over 85,000 state-specific legal templates available at all times.

- With US Legal Forms, users can access a multitude of local or state-specific legal and business forms.

Form popularity

FAQ

The California probate code sections 13100 to 13116 govern the simplified procedures for transferring small estates without formal probate. These codes allow beneficiaries to claim assets valued under a specific limit directly, simplifying the estate settlement process. Understanding these regulations is vital for anyone dealing with the estate of a deceased person. You can find helpful resources and guidance on how to navigate these codes at USLegalForms, which provides templates and legal forms suited for your needs.

A declaration under California probate Code 13100 to 13116 is a legal document that allows heirs to claim personal property without formal probate. This declaration simplifies the process for families dealing with the loss of a loved one. By utilizing this framework, you can minimize delays in asset distribution, ensuring a smoother transition of personal property.

The declaration under California probate Code 13100 to 13116 serves as a formal statement regarding the disposition of personal property. It allows individuals to declare heirship without going through a lengthy probate process. This can simplify the transition of assets after someone's passing, making it more efficient and less burdensome for families.

Section 13116. 13116. The procedure provided in this chapter is in addition to and supplemental to any other procedure for (1) collecting money due to a decedent, (2) receiving tangible personal property of a decedent, or (3) having evidence of ownership of property of a decedent transferred.

13006. "Successor of the decedent" means: (a) If the decedent died leaving a will, the sole beneficiary or all of the beneficiaries who succeeded to a particular item of property of the decedent under the decedent's will.

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

Probate Code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will.