Attorney Property Probate Without

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Obtaining a reliable source to access the latest and pertinent legal templates is a significant part of navigating bureaucracy. Identifying the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Attorney Property Probate Without exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns. You can access and review all the details regarding the document's applicability and significance for your case and in your jurisdiction.

Follow these steps to complete your Attorney Property Probate Without.

Once you have the form on your device, you can modify it with the editor or print it out and fill it in by hand. Eliminate the stress associated with your legal documentation. Browse the extensive US Legal Forms catalog where you can discover legal templates, verify their relevance to your case, and download them immediately.

- Utilize the catalog navigation or search bar to find your template.

- Examine the form’s description to determine if it meets the standards of your jurisdiction.

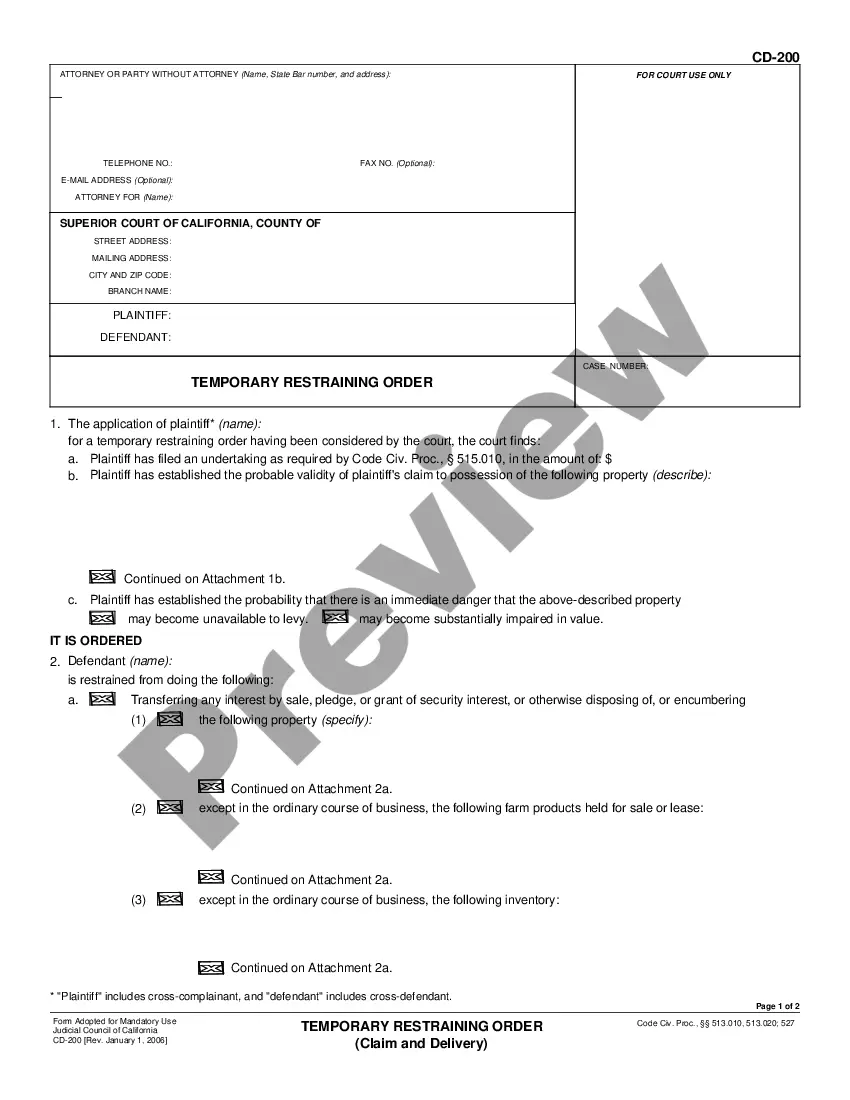

- View the form preview, if available, to confirm that the form is what you are looking for.

- Continue searching and locate the correct template if the Attorney Property Probate Without does not meet your specifications.

- Once you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing option that aligns with your needs.

- Proceed to the registration to complete your order.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Attorney Property Probate Without.

Form popularity

FAQ

The Probate Process in South Carolina Deliver the will at death. ... Personal representative is appointed. ... Notice to intestate heirs is sent. ... Inventory and appraisement of the estate. ... Final accounting. ... Disbursements. ... Close the estate.

In Texas, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate, General Forms Agreement as to the Advisability of Independent Administration (DOCX) Complete Small Estate Affidavit (PDF) Motion and Order for Release of Funds from Registry (PDF) Muniment of Title - Additional Requirements (PDF) Order Appointing Attorney Ad Litem (PDF)

Independent administration: This is the most common type of probate administration in Texas. Compared to dependent administration, this process is much less expensive because the administrator does not need to go to court very often, nor does he or she usually have to post a bond.

Every state sets the priority ing to which claims must be paid. The estate's beneficiaries only get paid once all the creditor claims have been satisfied. Usually, estate administration fees, funeral expenses, support payments, and taxes have priority over other claims.