California Termination Pay Requirements

Description

How to fill out California Employment Or Job Termination Package?

Finding a reliable source for acquiring the most recent and suitable legal templates is a significant part of navigating bureaucracy. Identifying the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of California Termination Pay Requirements solely from credible providers, like US Legal Forms. An incorrect template can squander your time and hinder the situation you are facing. With US Legal Forms, you have minimal concerns. You can access and verify all the specifics regarding the document’s applicability and significance for your situation and within your state or locality.

Consider the enumerated actions to finalize your California Termination Pay Requirements.

Once you have the form on your device, you can edit it with the editor or print it and fill it out manually. Eliminate the hassle associated with your legal documentation. Explore the extensive US Legal Forms catalog to discover legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Examine the form’s description to verify if it aligns with the regulations of your state and region.

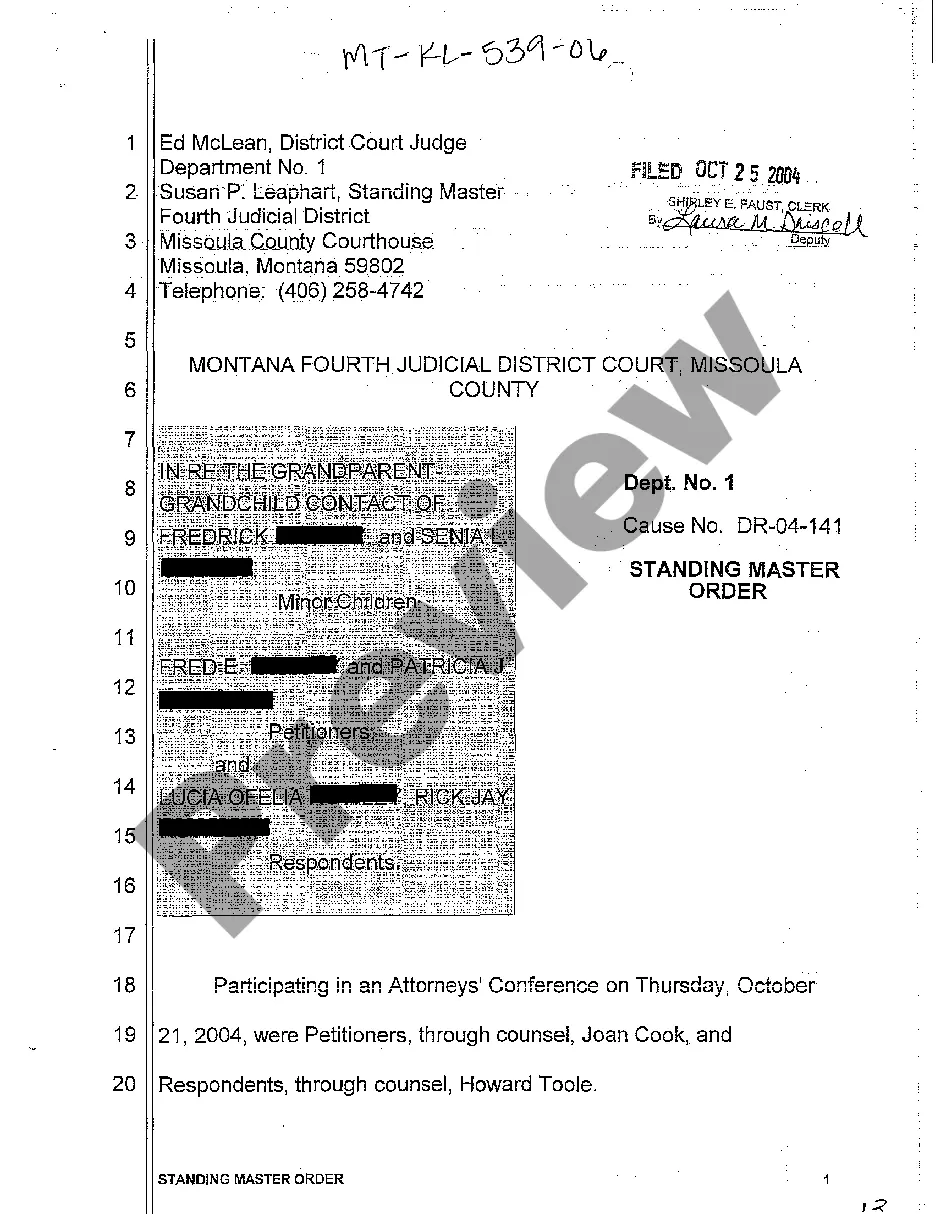

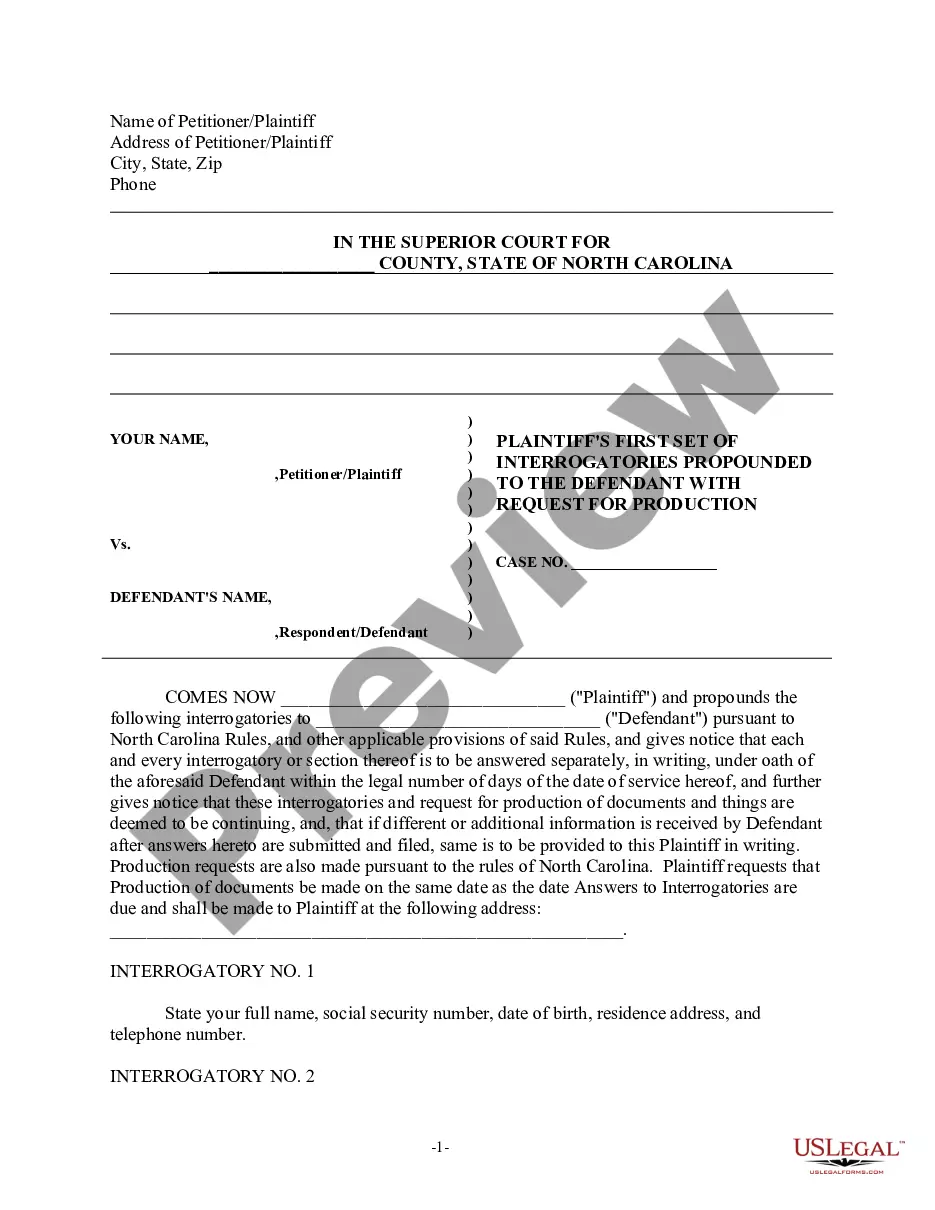

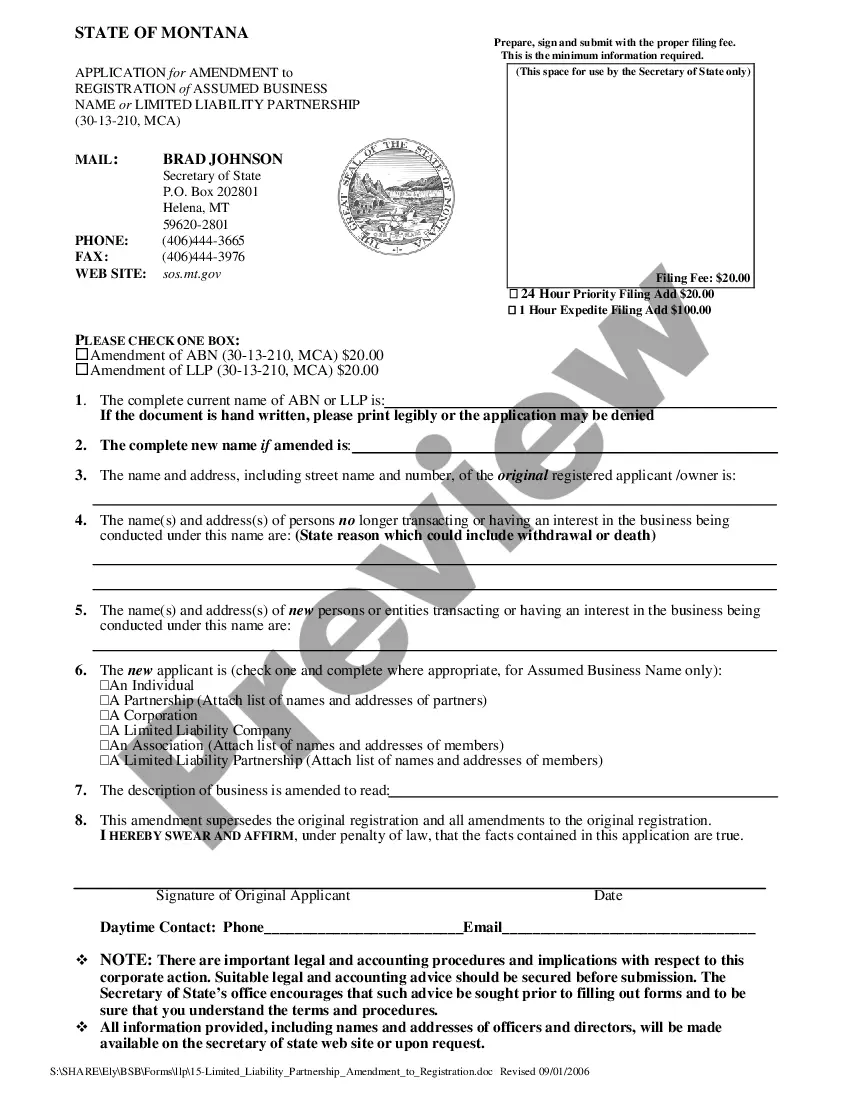

- View the form preview, if available, to confirm that the form is indeed the one you require.

- Return to the search and locate the appropriate template if the California Termination Pay Requirements does not meet your needs.

- If you are confident about the form’s applicability, download it.

- As an authorized user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing option that fits your needs.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading California Termination Pay Requirements.

Form popularity

FAQ

Be sure to include the following items as part of their final pay: overtime worked. penalty rates. long service (if applicable) loadings i.e. leave loading. monetary allowances. incentive-based payments and bonuses. any other separate identifiable amounts.

If an employee is fired or doesn't have a say in leaving their job, they must be paid their final paycheck on the same day as termination.

You are entitled to payment of your earned bonuses at the time you are fired, let go or quit your job. Employers are required to pay all unpaid wages including unpaid bonuses, within 72 hours of the employee's last day.

California Labor Code Section 2808(b) requires employers to provide to employees, upon termination, notification of all continuation, disability extension and conversion coverage options under any employer-sponsored coverage for which the employee may remain eligible after employment terminates.

Elements of a severance package that might be up for negotiation: Amount of severance pay. How severance is paid (installments or lump sum) Coverage of healthcare plan costs. Exact date of termination. Vesting in a retirement plan or stock options. Outplacement or job-training services.