Employee Hire Form With New

Description

How to fill out California Employment Hiring Process Package?

Locating a reliable source for obtaining the most up-to-date and suitable legal templates is part of the challenge of managing bureaucracy.

Selecting the correct legal documents requires accuracy and meticulousness, which highlights the necessity of sourcing the Employee Hire Form With New exclusively from dependable providers, such as US Legal Forms.

Eliminate the inconvenience related to your legal paperwork. Browse the extensive US Legal Forms catalog where you can discover legal templates, assess their relevance to your scenario, and download them instantly.

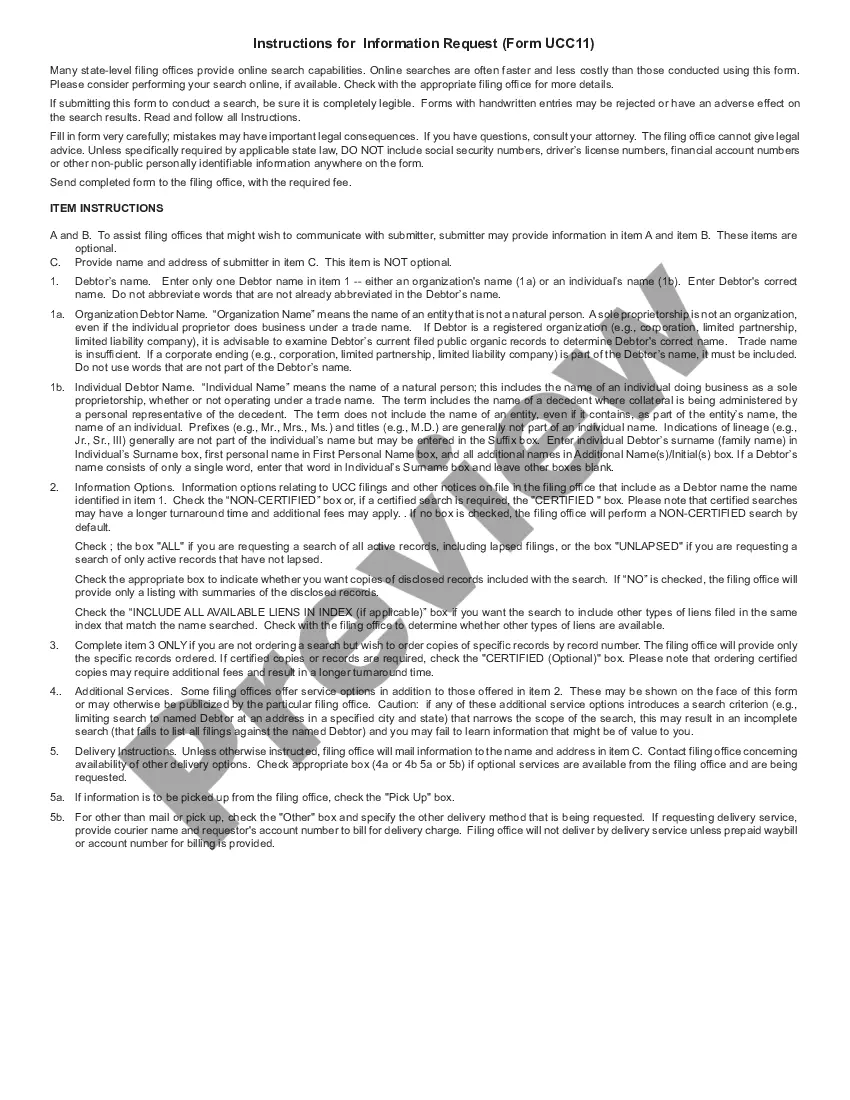

- Utilize the library navigation or search bar to locate your template.

- Access the form’s details to confirm if it aligns with the specifications of your state and locality.

- View the form preview, if available, to ensure the form is indeed the one you need.

- Return to the search and find the correct template if the Employee Hire Form With New does not fulfill your needs.

- Once you are certain about the form’s relevance, download it.

- If you are an existing customer, click Log in to verify your identity and access your chosen forms in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Select a pricing option that meets your requirements.

- Proceed with the registration to finalize your transaction.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Employee Hire Form With New.

- After downloading the form to your device, you can edit it with the editor or print it out and fill it in manually.

Form popularity

FAQ

A new hire typically needs to complete several important pieces of paperwork to start their job. At the core is the Employee hire form with new, which collects crucial information for payroll and tax purposes. Additionally, new hires often fill out identification verification forms, direct deposit authorization, and benefits enrollment documents. Completing these forms accurately helps streamline the onboarding process and supports compliance with legal requirements.

Filling in a new employee form, like the Employee hire form with new, involves providing accurate personal information and following the form's instructions closely. Start by clearly writing down your name, address, and Social Security number. Ensure that you understand each section, especially regarding tax withholdings. If you have questions, don't hesitate to ask your HR representative for guidance to avoid mistakes.

The form you fill out when starting a new job is commonly known as the Employee hire form with new. This form collects your essential information such as address, tax details, and any necessary documentation for payroll. Completing this form accurately ensures that your employer can process your hiring efficiently and without errors. Additionally, it lays the groundwork for a successful employment relationship.

Starting a new job requires several key documents to ensure compliance and accurate payroll processing. The Employee hire form with new is crucial, as it captures vital information like Social Security number and emergency contacts. You may also need to complete tax withholding forms and any consent documents for benefits. This paperwork helps the employer set up your employment file correctly and avoids any delays in your first paycheck.

When onboarding a new employee, they typically need to complete several important forms. The Employee hire form with new serves as a foundational document that includes personal details, tax information, and other essential data. Additionally, other forms might include benefit enrollment and direct deposit information. Having these forms properly filled out ensures a smooth start for both the employee and the employer.

New hires are required to complete several documents to ensure a smooth onboarding process. The crucial document is the employee hire form with new, which collects essential information. Additionally, new employees typically need to fill out tax forms, such as the W-4, and may also require an I-9 form for employment verification. It is important to gather these documents quickly and accurately to avoid any delays in the hiring process.

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.

All new employees must fill out two TD1 forms upon starting a new job. It is usually included in onboarding documents. A new hire must complete both the federal TD1 and the provincial TD1 if more than the basic personal amount is claimed.

Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States.

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form.